The Search

Your Search Results

News from us

Newest Symbols

Newest Industries

Click to expand

Advertising

See Stocks

Automotive

See Stocks

E-Commerce

See Stocks

E-Learning

See Stocks

Electricity

See Stocks

Engineering

See Stocks

FlexShopper Inc.

Bullish

Bullish

Tattooed Chef Inc.

Neutral

Neutral

Hellofresh SE

Bullish

Bullish

Build-a-Bear Workshop Inc.

Outperform

Outperform

Stamps.com Inc.

Bullish

Bullish

Redfin Corporation

Bullish

Bullish

Perion Network Ltd.

Outperform

Outperform

Upwork Inc.

Bullish

Bullish

Chegg Inc.

Bullish

Bullish

Pinterest Inc.

Bullish

Bullish

Bluelinx Holdings Inc

Bullish

Bullish

Momentus Inc.

Neutral

Neutral

Mynaric AG

Neutral

Neutral

Virgin Galactic Holdings Inc.

Neutral

Neutral

Maxar Technologies Inc.

Neutral

Neutral

Sunrun Inc.

Bullish

Bullish

Steico SE

Neutral

Neutral

Alfen N.V.

Neutral

Neutral

Research

Content Cards

Swipe

Our Article

Wingstop Inc. - Article

Big Game Hunt: Papa John's Pizza, Texas Roadhouse, The One Group Hospitality, Wendy's & Wingstop - What's More Tasty?

Table of Content:

- Author’s Opinion

- Papa John’s Pizza

- Texas Roadhouse

- The One Group Hospitality

- Wendy’s

- Wingstop

- Conclusion

Author’s Opinion

US Americans love their well-known casual dining restaurants where they spend their evenings with their families and empty their pints. But what they love even more are generously filled pizzas or chicken wings for Sunday night football. The people who can afford it go to innovative and hip steakhouses and party there. The American food trend is very popular and usually doesn’t just stay in the home market, but often spreads to other countries and continents.

Restaurant stocks and franchise companies are highly exciting for us investors and should definitely be represented in every portfolio. The reason for this are some obvious arguments.

Business Model

The business model is relatively easy to understand and everyone can easily comprehend. A company that runs the restaurants itself has high revenues, but also high expenses for personnel, rent and other costs. If the company uses a franchise system, the restaurant company is basically a real estate management company and receives royalties from the restaurant sales. Franchise companies usually achieve significantly lower sales, but also have significantly lower expenses and a higher quality of sales and margins. Another advantage of franchising is that one can expand efficiently with little capital, since the capital expenditures are on the franchisee. Franchising does not only offer advantages but also carries risks, for example, one hands over parts of the entrepreneurial skills into foreign hands. Likewise, franchisees can damage the company by not acting in the interest of the company or by using the concept and the locations for their own business.

But what many investors don’t consider nowadays is the fact that restaurant and fast food companies are more tech stocks with an edible product in the background than a traditional restaurant. Most of these companies invest heavily in delivery services, own apps and mobile payment. A promising company and investment in the restaurant business should therefore have a good digital strategy. This is especially evident during the Covid-19 pandemic.

Growth

Restaurant chains have the possibility to grow for many years, even decades without any problems. In the USA there are thousands of cities, large and small, that are potential locations for restaurant chains. A chain can thus slowly expand from one side of the country in a concentrated manner towards the other side of the country. At the same time, the neighboring countries offer much more growth potential.

However, restaurant chains do not only grow through more locations, but also by increasing sales from existing locations. So if a chain expands with their number of locations, it should also have a growth in sales of the individual locations, otherwise the growth is not really sustainable.

Competition

Have you ever thought about opening your own restaurant, but quickly rejected the idea because you thought it already existed and isn’t very innovative? Exactly this argument could also be used with a lot of restaurant stocks – I am not investing in this burger chain, because there are 20 competitors. There is nothing wrong with this argument, but it can be easily disarmed. A chain of ice-cream parlors that currently specializes in the East Coast will not be disturbed by a chain of ice-cream parlors on the West Coast for the time being. Both chains can expand in peace and meet in the middle and only then do they have to worry about competition. However, this process takes several years and offers the company the opportunity to prepare itself fully for this.

If there are several competing chains in the same segment, it is not the size but the geographic footprint that matters.

KPIs

One of the most important KPIs for restaurants is the “Same-Store Sales” KPI.

Same-store sales is a business term that refers to the difference in revenue generated by a retail chain’s existing outlets over a certain period (often a fiscal quarter or a particular shopping season), compared to an identical period in the past, usually in the previous year. By comparing sales data from existing outlets (that is, by excluding new outlets or outlets which have since closed), the comparison is like-to-like, and avoids comparing data that are fundamentally incomparable. This financial and operational metric is expressed as a percentage.

Same-store sales are also known as comparable store sales, identical store sales or like-store sales.

Source: Wikipedia

Simply said, they show if a restaurant chain can sell more in the “same” or “likely” restaurant, than in the period before. It is very important that a chain is increasing their revenue not only by new restaurant openings, but also from increasing their sales in existing restaurants, which is reflected by the “Same-Store Sales”.

Another important KPI is the “Net Openings” KPI. This KPI referes to the total restaurant count. “Net Openings” are all restaurant openings during a certain period minus all closings during this period. An positive “Net Opening” is an indicator for a growing business, because it shows, that the chain is growing and expanding their footprint.

Marketing & Reputation

Since Restaurants are directly operating for customers, a good markteting-strategy and corporate-image is essentially. As an potential investor, you always should check out their marketing strategy, corporate-image and reputation and ask yourself: Would you go their and eat there? Or are they currently involved in a hygiene scandal or are in the media due to bad reporting? As a restaurant chain, a good reputation is crucial for further growth and “Same-Store Sales”.

Tips and Tricks

Restaurant chains offer their products for everybody – so if have the ability to test their product and go to one of their restaurants, then DO IT. You can observe those Restaurants at diffrent timeframes and check out, how much traffic is there – is it trending or is the restaurant most of the time empty? If you don’t have the ability, to check them out, use social media and other portals like Yelp or TripAdvisor. Read local news about those chains and get informed about them and about their potential pro and cons. You can also watch Youtube food-reviews about their food and can hear the opinion of some of their customers.

Papa John’s Pizza

Source:

https://upload.wikimedia.org/wikipedia/ commons/6/6a/Papa_johns.jpg

Quick Info

Papa John’s International, Inc. (NASDAQ: PZZA) opened its doors in 1984 with one goal in mind: BETTER INGREDIENTS. BETTER PIZZA.® Papa John’s believes that using high quality ingredients leads to superior-quality pizzas. Its original dough is made of only six ingredients and is fresh, never frozen. Papa John’s tops its pizzas with real cheese made from mozzarella, pizza sauce made with vine-ripened tomatoes that go from vine to can in the same day, and meat free of fillers. It was the first national pizza delivery chain to announce the removal of artificial flavors and synthetic colors from its entire food menu. Papa John’s is headquartered in Louisville, Ky. and is the world’s third largest pizza delivery company with more than 5,300 restaurants in 49 countries and territories as of April 30, 2020. For more information about the Company or to order pizza online, visit www.PapaJohns.com or download the Papa John’s mobile app for iOS or Android.

Source: Papa John’s

Business Modell

So Papa John’s business model is very easy to understand: They have company and franchise owned restaurants and are specialized on pizza deliveries. They also sell some other pizza related food like bread or wraps. Most of there operations takes place in the USA, the rest is spreaded to europe and Russia. Since they are a delivery chain, they have a advanced digital channels and sells. Their CEO called their business “pandemic-proof” in the second quarter financial call – and thats true: Since the start of the pandemic, Papa John’s enjoyed an incredible “Same-Store Sales” growth of about 25% for the last two quarters. The people are tending to order more pizza during practicing social distancing and closed restaurants. On the other hand, some restaurants were forced to close, due to local restrictions.

What makes them special?

Papa John’s regularly introduces new food products for a limited time. So for example, they have recently launched new variants of their “Papadias”, which is a pizzalike kind of filled taco. They also have introduced the “Jack-o-Lantern” Pizza for Halloween.

Source: https://hips.hearstapps.com/hmg-prod.s3.amazonaws.com/images/jol-pizza-1572280620.jpg?crop=1.00xw:0.848xh;0,0.0833xh&resize=480:*

Papa John’s is also good known for their social commitment at their local communities – they support workers with scholoarships, created a lot of new workingplaces during the pandemic and donate for several organizations.

What should not remain unmentioned is that the founder and former CEO of Papa John’s had to leave the company in 2018 due to racist statements and excesses. This has led to a sharp drop in the share price and a lengthy image review. In the meantime, however, the damage has been repaired and Papa John’s is in good shape again. John Schnatter, the founder of Papa John’s, has been publicly agitating against the company and trying to unsettle investors ever since. He still owns a very considerable part of his shares and sells them regularly.

Numbers and News

Papa John’s was able to rebound their business during the pandemic. They have delivered solid numbers and performed incredible. They have managed to increase their “Same-Store Sales” about 24% in the third quarter of 2020. Assuming that they can keep those double digit growth rates for the next couple quartes, then Papa John’s should be a very good pandemic play with a lot of upside potential. Additionaly, their CEO recently said, that Papa John’s will focus on increasing their USA footprint extremly in 2021.

For additional informations, please have a look at their latest earnings news.

Texas Roadhouse

Source: https://www.texasroadhouse.com/ images/og-image.jpg

Quick Info

Texas Roadhouse is a casual dining concept that first opened in 1993 and today has grown to over 610 restaurants system-wide in 49 states and ten foreign countries. For more information, please visit the Web site at www.texasroadhouse.com.

Source: Texas Roadhouse

Business Modell

Texas Roadhouse has also an easy to understand business model. They chain operates a casual dining restaurant with an focus on texas style food and meat. They do not franchise their restaurants, so their revenues and expenses are higher in relation, compared to a franchise business. Due to the Covid-19 pandemic, people were force to practice social distancing. Therefore, many restaurants were temporary closed and less to no revenue has been made. Today, many restaurants have reopened with limited sitting capacitys. Curbside-pickup and delivery options have been implemented. Due to the business model and purpose of their restaurants – casual dining – their business and sales suffered a lot. Same-store-sales were down 46,7% in April, 41,9% in May, 14,1% in June, 13% in July, 6,6% in August and 0,5% in September. However in October, they have increased about 1%. The recovery over the past months shows, that their take-away options and the reinvented business model is gaining momentum, which is definetly a possitive sign. They have also an own app, which features those takeaway options, too.

What makes them special?

Texas Roadhouse is slowly but constantly growing. Their concept is one of the better quality casual dining restaurants in the US market. They focus on good and premium quality of their meat. Due to their low restaurant count of only 610, they have plenty of growthpotential.

Source: https://i.insider.com/5d029fb96fc92003275acbb4?width=1136&format=jpeg

Numbers and News

Texas Roadhouse is currently very high valued. They have a EPS-ratio of 92 for the current year, which is very high. On the other hand, the stockholders are paying a high premium for the incredible rebound ability of the company and their business model, as also to the ability to adopt their model to the current circumstances. Their quartlery dividend has been suspended due to the crisis. Before the crisis, the company has increased their dividend with a fast pace: From 0.25$ in March 2018 to 0.36$ in March 2020 – that makes incredible 45%.

Texas Roadhouse also announced new expansion and a net count of at least 20 new restraurant openings for the fiscal year 2020, which shows the willingness of expanding, even during a pandemic.

For additional informations, please have a look at their latest earnings news.

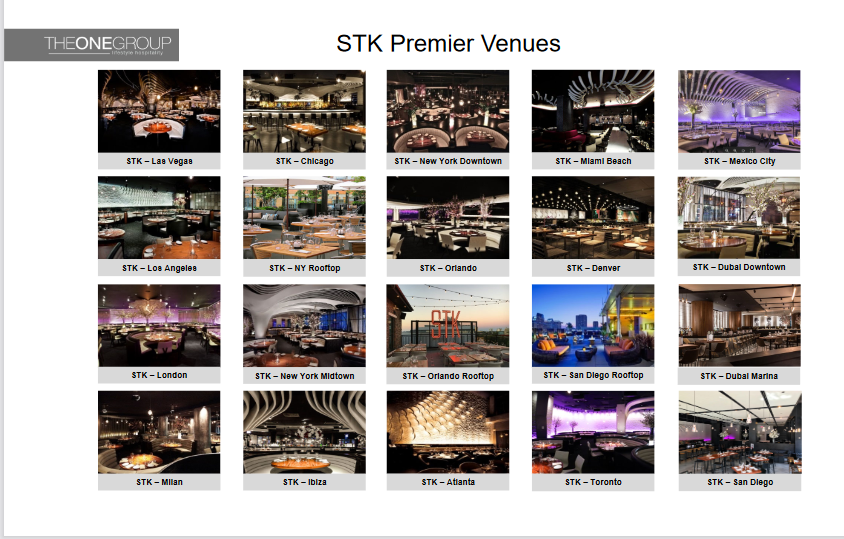

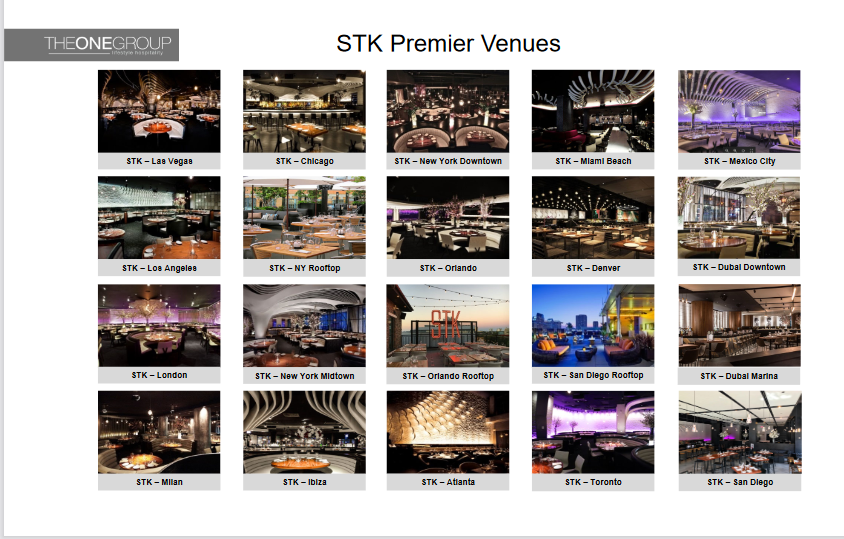

The One Group Hospitality

Quick Info

The ONE Group Hospitality, Inc. (Nasdaq: STKS) is a global hospitality company that develops and operates upscale and polished casual, high-energy restaurants and lounges and provides hospitality management services for hotels, casinos and other high-end venues both nationally and internationally. The ONE Group’s focus is to be the global leader in Vibe Dining, and its primary restaurant brands are:

- STK, a modern twist on the American steakhouse concept with 20 restaurants in major metropolitan cities in the U.S., Europe and the Middle East; and,

- Kona Grill, a polished casual, bar-centric grill brand with 24 restaurants in the U.S., features American favorites, award-winning sushi, and specialty cocktails in an upscale casual atmosphere.

ONE Hospitality, The ONE Group’s food and beverage hospitality services business, develops, manages and operates premier restaurants and turnkey food and beverage services within high-end hotels and casinos. Additional information about The ONE Group can be found at www.togrp.com.

Source: The One Group Hospitality

Business Modell

“The One-Group Hospitality” (TOGRP) operates mainly 2 restaurant concepts. One is the STK Steakhouse and Kona Grill, a kind of fusion cooking of Asian / Sushi and high quality American Dining. They also run some hospitality services for high class event locations like hotels and casinos all over the world. The majority of their restaurants are run by themselves, the restaurants located abroad are operated by franchisees. The STK Steakhouse is a concept that was developed and built directly by TOGRP. Kona Grill was itself a listed company, but had to file for bankruptcy. TOGRP picked out the best 24 of these restaurants and successfully restructured them.

Source: TOGRP Investor Deck

Kona Grill is exclusively represented in the USA, STK Steakhouse is mainly in the USA, but there are also some international locations. All these restaurants are mainly located in big cities with many wealthy people, as both concepts definitely appeal to a more upscale and affluent target group. Every visit should be entertaining and something special.

TOGRP generates most of its revenue from direct restaurant sales and a small portion through licensing and franchise fees. Since you run the majority of the restaurants yourself, you have a high turnover, but also associated high expenses for the operation of these restaurants.

TOGRP has suffered very much from corona. Since the restaurant concepts are not only focused on food, but also on entertainment, party, i.e. “vibe dining”, the business model was completely destroyed by the Covid-19 pandemic. Adaptations such as pickup orders or deliveries, reopenings with a limited number of seats or a meat online store could only cushion the business slump to a limited extent. This is also confirmed by the following numbers: “Same-Store Sales” decreased 90% in April, 70% in May and 40% in June. Reveneue for the thrid quarter decreased about 30%.

What makes them special?

If one of the stocks presented here has something very special, it is definitely TOGRP. With their invention or rather the celebration of the vibe-dining, you have revolutionized the otherwise rather boring, stuffy and stale steakhouse. Premium food, top drinks, loud music and a comfortable ambience are only a part of the vibe dining concept. An ingenious marketing concept, as well as a strong presence in high-income cities and experience-oriented neighborhoods complement the concept, which has led to almost double-digit “Same-Store Sales” before Corona. With their cherry-picking strategy in the acquisition of Kona Grill in 2019, they have also achieved something similar. They bought the best-running locations, migrated them to the vibe dining concept, and things are already going very well here too.

The acquisition of Kona Grill has probably saved TOGRP’s life in the meantime, because of Kona Grill’s sushi focus, the “Same Store Sales” has not collapsed as much, as people are more likely to have sushi delivered to their homes instead of steaks.

Numbers and News

The current valuation of TOGRP is justified by the current weakness and the strong uncertainty about the further course of the pandemic. If you look at the current valuation with the level before Corona, we have a strong undervaluation which makes the story more exciting again. Should the pandemic come to an end and old habits return, the stock is definitely very exciting and one of the most innovative and strongest candidates – but until then it remains rather speculative about the company. Soon the figures for the past third quarter will be published – these figures should definitely be observed.

For additional informations, please have a look at their latest earnings news.

Wendy’s

Source: https://www.irwendys.com/home/default.aspx

Quick Info

Wendy’s®was founded in 1969 by Dave Thomas in Columbus, Ohio. Dave built his business on the premise, “Quality is our Recipe®,” which remains the guidepost of the Wendy’s system.Wendy’s is best known for its made-to-order square hamburgers, using fresh, never frozen beef*, freshly-prepared salads, and other signature items like chili, baked potatoes and the Frosty®dessert.The Wendy’s Company (Nasdaq: WEN) is committed to doing the right thing and making a positive difference in the lives of others.This is mostvisible through the Company’s support of the Dave Thomas Foundation for Adoption®and its signature Wendy’s Wonderful Kids®program, which seeks to find every child in the North American foster care system a loving, forever home.Today, Wendy’s and its franchisees employ hundreds of thousands of people across more than 6,800 restaurants worldwide with a vision of becoming the world’s most thriving and beloved restaurant brand. For details on franchising, connect with us at www.wendys.com/franchising.

Source: Wendy’s

Business Modell

Wendy’s is a burger fast food chain like McDonald’s or Burger King. They focus heavily on franchise – therefore they have a lower revenue, but also lower costs. Since the pandemic has started, they could improve their “Same-store Sales”, espically in the US. The numbers for the US are: a decrease of 14% in April and 1,9% in May, but an increase of 5,1% in June and 8,2% in July.

What makes them special?

Wendy’s is also focused on pick-up or delivery orders and has a modern app with an good digital strategy. They are currently focusing on breakfast options, to attract a bigger customer segment.

Numbers and News

Wendy’s has got an PE-Ratio of about 46 and a annual dividend yield of 0,92%. The PE Ratio is too high for their last and current growth numbers. On the other hand, if they can manage to keep their “Same-Store Sales” number as high as in the last months, there should be some more upside potential.

For additional informations, please have a look at their latest earnings news.

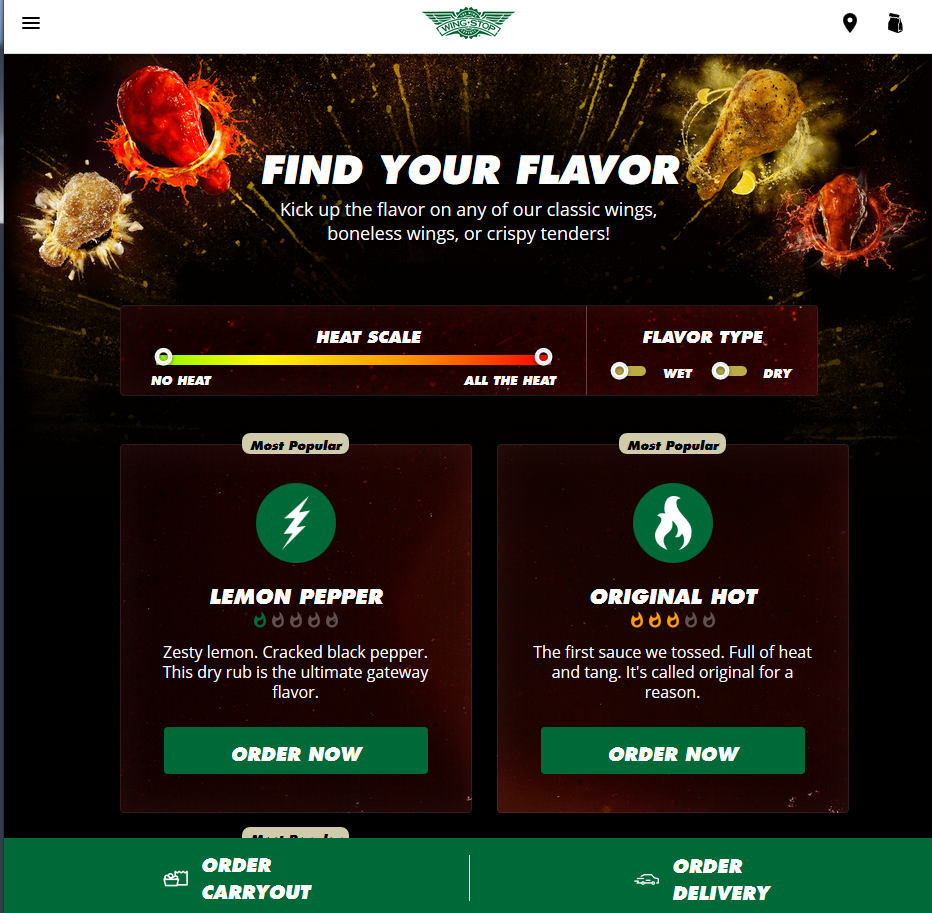

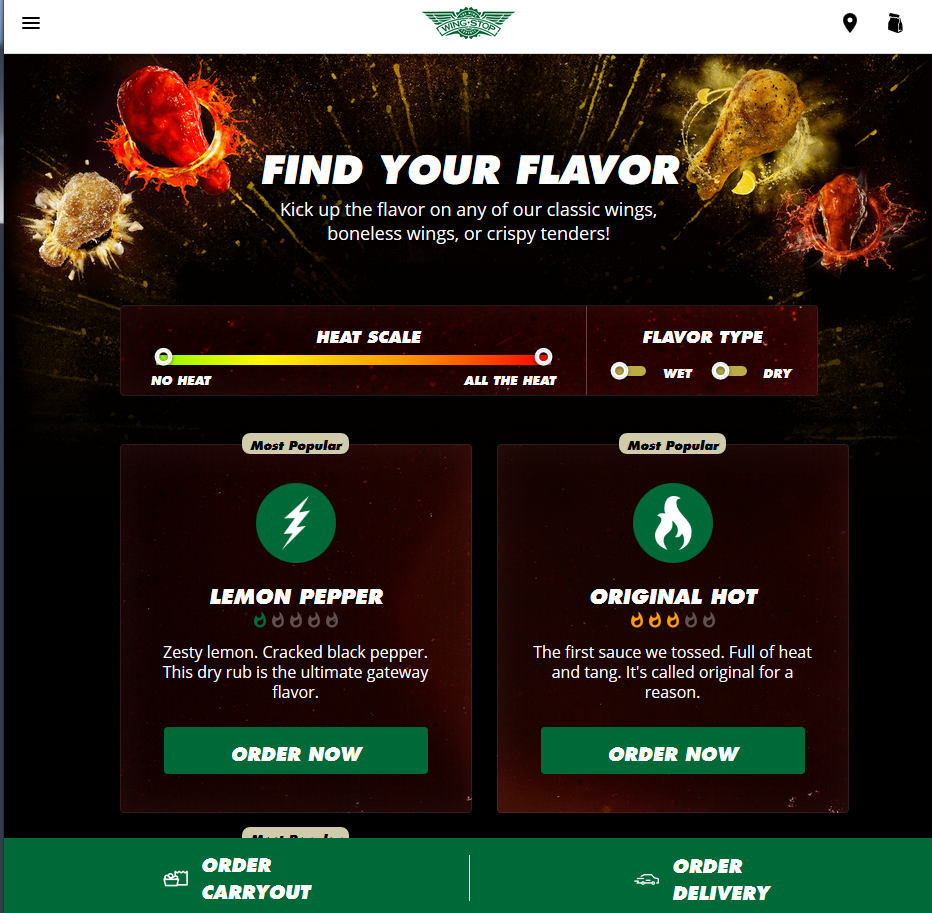

Wingstop

Source: https://i.pinimg.com/originals/1c/1e/75/ 1c1e755d0feaa7cf62c77a9b8801ddc5.jpg

Quick Info

Founded in 1994 and headquartered in Dallas, TX, Wingstop Inc. (NASDAQ: WING) operates and franchises over 1,450 locations worldwide. The Wing Experts are dedicated to Serving the World Flavor through an unparalleled guest experience and offering of classic wings, boneless wings and tenders, always cooked to order and hand-sauced-and-tossed in fans’ choice of 11 bold, distinctive flavors. Wingstop’s menu also features signature sides including fresh-cut, seasoned fries and freshly-made ranch and bleu cheese dips.

In 2019, Wingstop’s system-wide sales increased 20.1% year-over-year to $1.5 billion, marking the 16th consecutive year of same store sales growth, and Wingstop achieved over 400% shareholder return since its 2015 initial public offering. With a vision of becoming a Top 10 Global Restaurant Brand, its system is comprised of independent franchisees, or brand partners, who account for more than 98% of Wingstop’s total restaurant count of 1,479 as of September 26, 2020. In February 2019, the Company launched its new tagline and creative campaign “Where Flavor Gets Its Wings” and continued the rollout of national delivery. During the fiscal quarter ended September 26, 2020, Wingstop generated 62.0% of sales via digital channels including Wingstop.com and the Wingstop app. The Company has been ranked on Franchise Business Review’s “Top 30 Food and Beverage Franchises” (2019), Fast Casual’s “Movers & Shakers” (2019), QSR Magazine’s “The Industry’s 9 Best Franchise Deals” (2019) and “The QSR Top 50” (2019) for limited-service restaurants in the U.S.

Source: Wingstop

Business Modell

Wingstop is a rapidly growing restaurant chain in the USA and parts of Europe. They are specialized in chicken wings and matching side dishes.

Wingstop works almost exclusively with franchisees, which is why their revenues are relatively low. Despite this, they have been able to show continuous profits and pay a small dividend of 0,14$ per Share for years. They have had consistently positive “Same-Store Sales” for 16 years and in the last 3 years you have had an average growth of 16% at this measure.

Wingstop is more a tech company than a restaurant company. They focus very much on deliveries and digital sales. This focus has given them a further boost in the Corona Pandemic, which has resulted in the following figures: Increase in “Same-Store Sales” by 31.9% in Q2 and by 25,4% in Q3 2020. They were also able to achieve 43 “Net-Openings” in Q3 2020. They now count 1479 Restaurants, of which are 1277 are franchised and 1308 are in the US.

What makes them special?

As mentioned above, Wingstop is extremely focused on their digital model, which pays off. Despite fewer live sport events, wingstop has managed to grow further. They are also starting to try out the concept of ghost-kitchens, i.e. Wingstops that are only for delivery service and no longer offer restaurant options. A look at the homepage shows best why wingstop is so successful and how good the digital platform is there.

Note: Wingstops Delivery Platform

Numbers and News

Wingstop has always had and still has a relatively high valuation, in some cases a three-digit PE ratio. This valuation was and always has been maintained by very successful figures and a very dynamic business development. Looking back, Wingstop is one of the most successful franchises of the last few years. In addition, their incredibly good figures during the pandemic have shown that Wingstop and their digital strategy fit very well into the current times and that there is still a lot of potential for the future.

With the release of the Q3 figures for 2020, potential investors should have a better understanding of how strongly Wingstop can grow in the near future.

For additional informations, please have a look at their latest earnings news.

Conclusion

Due to the current crisis and the associated uncertainty as to when it will end and what people’s behavior will be like afterwards, I would prefer current restaurant models that work well. These definitely include delivery service models like Wingstop or Papa John’s. Texas Roadhouse is also very exciting, which has shown impressive comeback potential despite a business model that is rather unfavorable for Corona. The One Group Hospitality is very speculative and definitely too early to draw any precise conclusions for its futur. Wendy’s is an more boring but good working modell with normal to high growth potential for the future.

Use the current market weakness and look for cheap entry points for the restaurant stocks you like. Think about, if the current sell off or high price of the stock you are watching reflects the strength or weakness of the companys business model in relation to the Covid-19 pandemic.

General Warning

Due to the marketcap and the float (the amount of shares circling around and traded, which are not held by major investors) of shares, there are certain risks and an medium volatility.

Disclaimer & Conflict of interest

The author currently holds a position in one or more of the mentioned stocks (Papa John’s Pizza, Wingstop) and may sell his entire holdings shortly after the release of this article. The mentioned companies do NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Wingstop Inc. - Article

Big Game Hunt: Papa John's Pizza, Texas Roadhouse, The One Group Hospitality, Wendy's & Wingstop - What's More Tasty?

Table of Content:

- Author's Opinion

- Papa John's Pizza

- Texas Roadhouse

- The One Group Hospitality

- Wendy's

- Wingstop

- Conclusion

Author's Opinion

US Americans love their well-known casual dining restaurants where they spend their evenings with their families and empty their pints. But what they love even more are generously filled pizzas or chicken wings for Sunday night football. The people who can afford it go to innovative and hip steakhouses and party there. The American food trend is very popular and usually doesn't just stay in the home market, but often spreads to other countries and continents.

Restaurant stocks and franchise companies are highly exciting for us investors and should definitely be represented in every portfolio. The reason for this are some obvious arguments.

Business Model

The business model is relatively easy to understand and everyone can easily comprehend. A company that runs the restaurants itself has high revenues, but also high expenses for personnel, rent and other costs. If the company uses a franchise system, the restaurant company is basically a real estate management company and receives royalties from the restaurant sales. Franchise companies usually achieve significantly lower sales, but also have significantly lower expenses and a higher quality of sales and margins. Another advantage of franchising is that one can expand efficiently with little capital, since the capital expenditures are on the franchisee. Franchising does not only offer advantages but also carries risks, for example, one hands over parts of the entrepreneurial skills into foreign hands. Likewise, franchisees can damage the company by not acting in the interest of the company or by using the concept and the locations for their own business.

But what many investors don't consider nowadays is the fact that restaurant and fast food companies are more tech stocks with an edible product in the background than a traditional restaurant. Most of these companies invest heavily in delivery services, own apps and mobile payment. A promising company and investment in the restaurant business should therefore have a good digital strategy. This is especially evident during the Covid-19 pandemic.

Growth

Restaurant chains have the possibility to grow for many years, even decades without any problems. In the USA there are thousands of cities, large and small, that are potential locations for restaurant chains. A chain can thus slowly expand from one side of the country in a concentrated manner towards the other side of the country. At the same time, the neighboring countries offer much more growth potential.

However, restaurant chains do not only grow through more locations, but also by increasing sales from existing locations. So if a chain expands with their number of locations, it should also have a growth in sales of the individual locations, otherwise the growth is not really sustainable.

Competition

Have you ever thought about opening your own restaurant, but quickly rejected the idea because you thought it already existed and isn't very innovative? Exactly this argument could also be used with a lot of restaurant stocks - I am not investing in this burger chain, because there are 20 competitors. There is nothing wrong with this argument, but it can be easily disarmed. A chain of ice-cream parlors that currently specializes in the East Coast will not be disturbed by a chain of ice-cream parlors on the West Coast for the time being. Both chains can expand in peace and meet in the middle and only then do they have to worry about competition. However, this process takes several years and offers the company the opportunity to prepare itself fully for this.

If there are several competing chains in the same segment, it is not the size but the geographic footprint that matters.

KPIs

One of the most important KPIs for restaurants is the "Same-Store Sales" KPI.

Same-store sales is a business term that refers to the difference in revenue generated by a retail chain's existing outlets over a certain period (often a fiscal quarter or a particular shopping season), compared to an identical period in the past, usually in the previous year. By comparing sales data from existing outlets (that is, by excluding new outlets or outlets which have since closed), the comparison is like-to-like, and avoids comparing data that are fundamentally incomparable. This financial and operational metric is expressed as a percentage.

Same-store sales are also known as comparable store sales, identical store sales or like-store sales.

Source: Wikipedia

Simply said, they show if a restaurant chain can sell more in the "same" or "likely" restaurant, than in the period before. It is very important that a chain is increasing their revenue not only by new restaurant openings, but also from increasing their sales in existing restaurants, which is reflected by the "Same-Store Sales".

Another important KPI is the "Net Openings" KPI. This KPI referes to the total restaurant count. "Net Openings" are all restaurant openings during a certain period minus all closings during this period. An positive "Net Opening" is an indicator for a growing business, because it shows, that the chain is growing and expanding their footprint.

Marketing & Reputation

Since Restaurants are directly operating for customers, a good markteting-strategy and corporate-image is essentially. As an potential investor, you always should check out their marketing strategy, corporate-image and reputation and ask yourself: Would you go their and eat there? Or are they currently involved in a hygiene scandal or are in the media due to bad reporting? As a restaurant chain, a good reputation is crucial for further growth and "Same-Store Sales".

Tips and Tricks

Restaurant chains offer their products for everybody - so if have the ability to test their product and go to one of their restaurants, then DO IT. You can observe those Restaurants at diffrent timeframes and check out, how much traffic is there - is it trending or is the restaurant most of the time empty? If you don't have the ability, to check them out, use social media and other portals like Yelp or TripAdvisor. Read local news about those chains and get informed about them and about their potential pro and cons. You can also watch Youtube food-reviews about their food and can hear the opinion of some of their customers.

Papa John's Pizza

Source:

https://upload.wikimedia.org/wikipedia/ commons/6/6a/Papa_johns.jpg

Quick Info

Papa John’s International, Inc. (NASDAQ: PZZA) opened its doors in 1984 with one goal in mind: BETTER INGREDIENTS. BETTER PIZZA.® Papa John’s believes that using high quality ingredients leads to superior-quality pizzas. Its original dough is made of only six ingredients and is fresh, never frozen. Papa John’s tops its pizzas with real cheese made from mozzarella, pizza sauce made with vine-ripened tomatoes that go from vine to can in the same day, and meat free of fillers. It was the first national pizza delivery chain to announce the removal of artificial flavors and synthetic colors from its entire food menu. Papa John’s is headquartered in Louisville, Ky. and is the world’s third largest pizza delivery company with more than 5,300 restaurants in 49 countries and territories as of April 30, 2020. For more information about the Company or to order pizza online, visit www.PapaJohns.com or download the Papa John’s mobile app for iOS or Android.

Source: Papa John's

Business Modell

So Papa John's business model is very easy to understand: They have company and franchise owned restaurants and are specialized on pizza deliveries. They also sell some other pizza related food like bread or wraps. Most of there operations takes place in the USA, the rest is spreaded to europe and Russia. Since they are a delivery chain, they have a advanced digital channels and sells. Their CEO called their business "pandemic-proof" in the second quarter financial call - and thats true: Since the start of the pandemic, Papa John's enjoyed an incredible "Same-Store Sales" growth of about 25% for the last two quarters. The people are tending to order more pizza during practicing social distancing and closed restaurants. On the other hand, some restaurants were forced to close, due to local restrictions.

What makes them special?

Papa John's regularly introduces new food products for a limited time. So for example, they have recently launched new variants of their "Papadias", which is a pizzalike kind of filled taco. They also have introduced the "Jack-o-Lantern" Pizza for Halloween.

Source: https://hips.hearstapps.com/hmg-prod.s3.amazonaws.com/images/jol-pizza-1572280620.jpg?crop=1.00xw:0.848xh;0,0.0833xh&resize=480:*

Papa John's is also good known for their social commitment at their local communities - they support workers with scholoarships, created a lot of new workingplaces during the pandemic and donate for several organizations.

What should not remain unmentioned is that the founder and former CEO of Papa John's had to leave the company in 2018 due to racist statements and excesses. This has led to a sharp drop in the share price and a lengthy image review. In the meantime, however, the damage has been repaired and Papa John's is in good shape again. John Schnatter, the founder of Papa John's, has been publicly agitating against the company and trying to unsettle investors ever since. He still owns a very considerable part of his shares and sells them regularly.

Numbers and News

Papa John's was able to rebound their business during the pandemic. They have delivered solid numbers and performed incredible. They have managed to increase their "Same-Store Sales" about 24% in the third quarter of 2020. Assuming that they can keep those double digit growth rates for the next couple quartes, then Papa John's should be a very good pandemic play with a lot of upside potential. Additionaly, their CEO recently said, that Papa John's will focus on increasing their USA footprint extremly in 2021.

For additional informations, please have a look at their latest earnings news.

Texas Roadhouse

Source: https://www.texasroadhouse.com/ images/og-image.jpg

Quick Info

Texas Roadhouse is a casual dining concept that first opened in 1993 and today has grown to over 610 restaurants system-wide in 49 states and ten foreign countries. For more information, please visit the Web site at www.texasroadhouse.com.

Source: Texas Roadhouse

Business Modell

Texas Roadhouse has also an easy to understand business model. They chain operates a casual dining restaurant with an focus on texas style food and meat. They do not franchise their restaurants, so their revenues and expenses are higher in relation, compared to a franchise business. Due to the Covid-19 pandemic, people were force to practice social distancing. Therefore, many restaurants were temporary closed and less to no revenue has been made. Today, many restaurants have reopened with limited sitting capacitys. Curbside-pickup and delivery options have been implemented. Due to the business model and purpose of their restaurants - casual dining - their business and sales suffered a lot. Same-store-sales were down 46,7% in April, 41,9% in May, 14,1% in June, 13% in July, 6,6% in August and 0,5% in September. However in October, they have increased about 1%. The recovery over the past months shows, that their take-away options and the reinvented business model is gaining momentum, which is definetly a possitive sign. They have also an own app, which features those takeaway options, too.

What makes them special?

Texas Roadhouse is slowly but constantly growing. Their concept is one of the better quality casual dining restaurants in the US market. They focus on good and premium quality of their meat. Due to their low restaurant count of only 610, they have plenty of growthpotential.

Source: https://i.insider.com/5d029fb96fc92003275acbb4?width=1136&format=jpeg

Numbers and News

Texas Roadhouse is currently very high valued. They have a EPS-ratio of 92 for the current year, which is very high. On the other hand, the stockholders are paying a high premium for the incredible rebound ability of the company and their business model, as also to the ability to adopt their model to the current circumstances. Their quartlery dividend has been suspended due to the crisis. Before the crisis, the company has increased their dividend with a fast pace: From 0.25$ in March 2018 to 0.36$ in March 2020 - that makes incredible 45%.

Texas Roadhouse also announced new expansion and a net count of at least 20 new restraurant openings for the fiscal year 2020, which shows the willingness of expanding, even during a pandemic.

For additional informations, please have a look at their latest earnings news.

The One Group Hospitality

Quick Info

The ONE Group Hospitality, Inc. (Nasdaq: STKS) is a global hospitality company that develops and operates upscale and polished casual, high-energy restaurants and lounges and provides hospitality management services for hotels, casinos and other high-end venues both nationally and internationally. The ONE Group’s focus is to be the global leader in Vibe Dining, and its primary restaurant brands are:

- STK, a modern twist on the American steakhouse concept with 20 restaurants in major metropolitan cities in the U.S., Europe and the Middle East; and,

- Kona Grill, a polished casual, bar-centric grill brand with 24 restaurants in the U.S., features American favorites, award-winning sushi, and specialty cocktails in an upscale casual atmosphere.

ONE Hospitality, The ONE Group’s food and beverage hospitality services business, develops, manages and operates premier restaurants and turnkey food and beverage services within high-end hotels and casinos. Additional information about The ONE Group can be found at www.togrp.com.

Source: The One Group Hospitality

Business Modell

"The One-Group Hospitality" (TOGRP) operates mainly 2 restaurant concepts. One is the STK Steakhouse and Kona Grill, a kind of fusion cooking of Asian / Sushi and high quality American Dining. They also run some hospitality services for high class event locations like hotels and casinos all over the world. The majority of their restaurants are run by themselves, the restaurants located abroad are operated by franchisees. The STK Steakhouse is a concept that was developed and built directly by TOGRP. Kona Grill was itself a listed company, but had to file for bankruptcy. TOGRP picked out the best 24 of these restaurants and successfully restructured them.

Source: TOGRP Investor Deck

Kona Grill is exclusively represented in the USA, STK Steakhouse is mainly in the USA, but there are also some international locations. All these restaurants are mainly located in big cities with many wealthy people, as both concepts definitely appeal to a more upscale and affluent target group. Every visit should be entertaining and something special.

TOGRP generates most of its revenue from direct restaurant sales and a small portion through licensing and franchise fees. Since you run the majority of the restaurants yourself, you have a high turnover, but also associated high expenses for the operation of these restaurants.

TOGRP has suffered very much from corona. Since the restaurant concepts are not only focused on food, but also on entertainment, party, i.e. "vibe dining", the business model was completely destroyed by the Covid-19 pandemic. Adaptations such as pickup orders or deliveries, reopenings with a limited number of seats or a meat online store could only cushion the business slump to a limited extent. This is also confirmed by the following numbers: "Same-Store Sales" decreased 90% in April, 70% in May and 40% in June. Reveneue for the thrid quarter decreased about 30%.

What makes them special?

If one of the stocks presented here has something very special, it is definitely TOGRP. With their invention or rather the celebration of the vibe-dining, you have revolutionized the otherwise rather boring, stuffy and stale steakhouse. Premium food, top drinks, loud music and a comfortable ambience are only a part of the vibe dining concept. An ingenious marketing concept, as well as a strong presence in high-income cities and experience-oriented neighborhoods complement the concept, which has led to almost double-digit "Same-Store Sales" before Corona. With their cherry-picking strategy in the acquisition of Kona Grill in 2019, they have also achieved something similar. They bought the best-running locations, migrated them to the vibe dining concept, and things are already going very well here too.

The acquisition of Kona Grill has probably saved TOGRP's life in the meantime, because of Kona Grill's sushi focus, the "Same Store Sales" has not collapsed as much, as people are more likely to have sushi delivered to their homes instead of steaks.

Numbers and News

The current valuation of TOGRP is justified by the current weakness and the strong uncertainty about the further course of the pandemic. If you look at the current valuation with the level before Corona, we have a strong undervaluation which makes the story more exciting again. Should the pandemic come to an end and old habits return, the stock is definitely very exciting and one of the most innovative and strongest candidates - but until then it remains rather speculative about the company. Soon the figures for the past third quarter will be published - these figures should definitely be observed.

For additional informations, please have a look at their latest earnings news.

Wendy's

Source: https://www.irwendys.com/home/default.aspx

Quick Info

Wendy's®was founded in 1969 by Dave Thomas in Columbus, Ohio. Dave built his business on the premise, “Quality is our Recipe®,” which remains the guidepost of the Wendy’s system.Wendy’s is best known for its made-to-order square hamburgers, using fresh, never frozen beef*, freshly-prepared salads, and other signature items like chili, baked potatoes and the Frosty®dessert.The Wendy’s Company (Nasdaq: WEN) is committed to doing the right thing and making a positive difference in the lives of others.This is mostvisible through the Company’s support of the Dave Thomas Foundation for Adoption®and its signature Wendy’s Wonderful Kids®program, which seeks to find every child in the North American foster care system a loving, forever home.Today, Wendy’s and its franchisees employ hundreds of thousands of people across more than 6,800 restaurants worldwide with a vision of becoming the world’s most thriving and beloved restaurant brand. For details on franchising, connect with us at www.wendys.com/franchising.

Source: Wendy's

Business Modell

Wendy's is a burger fast food chain like McDonald's or Burger King. They focus heavily on franchise - therefore they have a lower revenue, but also lower costs. Since the pandemic has started, they could improve their "Same-store Sales", espically in the US. The numbers for the US are: a decrease of 14% in April and 1,9% in May, but an increase of 5,1% in June and 8,2% in July.

What makes them special?

Wendy's is also focused on pick-up or delivery orders and has a modern app with an good digital strategy. They are currently focusing on breakfast options, to attract a bigger customer segment.

Numbers and News

Wendy's has got an PE-Ratio of about 46 and a annual dividend yield of 0,92%. The PE Ratio is too high for their last and current growth numbers. On the other hand, if they can manage to keep their "Same-Store Sales" number as high as in the last months, there should be some more upside potential.

For additional informations, please have a look at their latest earnings news.

Wingstop

Source: https://i.pinimg.com/originals/1c/1e/75/ 1c1e755d0feaa7cf62c77a9b8801ddc5.jpg

Quick Info

Founded in 1994 and headquartered in Dallas, TX, Wingstop Inc. (NASDAQ: WING) operates and franchises over 1,450 locations worldwide. The Wing Experts are dedicated to Serving the World Flavor through an unparalleled guest experience and offering of classic wings, boneless wings and tenders, always cooked to order and hand-sauced-and-tossed in fans' choice of 11 bold, distinctive flavors. Wingstop's menu also features signature sides including fresh-cut, seasoned fries and freshly-made ranch and bleu cheese dips.

In 2019, Wingstop's system-wide sales increased 20.1% year-over-year to $1.5 billion, marking the 16th consecutive year of same store sales growth, and Wingstop achieved over 400% shareholder return since its 2015 initial public offering. With a vision of becoming a Top 10 Global Restaurant Brand, its system is comprised of independent franchisees, or brand partners, who account for more than 98% of Wingstop's total restaurant count of 1,479 as of September 26, 2020. In February 2019, the Company launched its new tagline and creative campaign "Where Flavor Gets Its Wings" and continued the rollout of national delivery. During the fiscal quarter ended September 26, 2020, Wingstop generated 62.0% of sales via digital channels including Wingstop.com and the Wingstop app. The Company has been ranked on Franchise Business Review's "Top 30 Food and Beverage Franchises" (2019), Fast Casual's "Movers & Shakers" (2019), QSR Magazine's "The Industry's 9 Best Franchise Deals" (2019) and "The QSR Top 50" (2019) for limited-service restaurants in the U.S.

Source: Wingstop

Business Modell

Wingstop is a rapidly growing restaurant chain in the USA and parts of Europe. They are specialized in chicken wings and matching side dishes.

Wingstop works almost exclusively with franchisees, which is why their revenues are relatively low. Despite this, they have been able to show continuous profits and pay a small dividend of 0,14$ per Share for years. They have had consistently positive "Same-Store Sales" for 16 years and in the last 3 years you have had an average growth of 16% at this measure.

Wingstop is more a tech company than a restaurant company. They focus very much on deliveries and digital sales. This focus has given them a further boost in the Corona Pandemic, which has resulted in the following figures: Increase in "Same-Store Sales" by 31.9% in Q2 and by 25,4% in Q3 2020. They were also able to achieve 43 "Net-Openings" in Q3 2020. They now count 1479 Restaurants, of which are 1277 are franchised and 1308 are in the US.

What makes them special?

As mentioned above, Wingstop is extremely focused on their digital model, which pays off. Despite fewer live sport events, wingstop has managed to grow further. They are also starting to try out the concept of ghost-kitchens, i.e. Wingstops that are only for delivery service and no longer offer restaurant options. A look at the homepage shows best why wingstop is so successful and how good the digital platform is there.

Note: Wingstops Delivery Platform

Numbers and News

Wingstop has always had and still has a relatively high valuation, in some cases a three-digit PE ratio. This valuation was and always has been maintained by very successful figures and a very dynamic business development. Looking back, Wingstop is one of the most successful franchises of the last few years. In addition, their incredibly good figures during the pandemic have shown that Wingstop and their digital strategy fit very well into the current times and that there is still a lot of potential for the future.

With the release of the Q3 figures for 2020, potential investors should have a better understanding of how strongly Wingstop can grow in the near future.

For additional informations, please have a look at their latest earnings news.

Conclusion

Due to the current crisis and the associated uncertainty as to when it will end and what people's behavior will be like afterwards, I would prefer current restaurant models that work well. These definitely include delivery service models like Wingstop or Papa John's. Texas Roadhouse is also very exciting, which has shown impressive comeback potential despite a business model that is rather unfavorable for Corona. The One Group Hospitality is very speculative and definitely too early to draw any precise conclusions for its futur. Wendy's is an more boring but good working modell with normal to high growth potential for the future.

Use the current market weakness and look for cheap entry points for the restaurant stocks you like. Think about, if the current sell off or high price of the stock you are watching reflects the strength or weakness of the companys business model in relation to the Covid-19 pandemic.

General Warning

Due to the marketcap and the float (the amount of shares circling around and traded, which are not held by major investors) of shares, there are certain risks and an medium volatility.

Disclaimer & Conflict of interest

The author currently holds a position in one or more of the mentioned stocks (Papa John's Pizza, Wingstop) and may sell his entire holdings shortly after the release of this article. The mentioned companies do NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Peers

All the Peers

Hellofresh SE

Bullish

The Wendy´s Company

Neutral

Papa John´s International Inc.

Bullish

The One Hospitality Group Inc.

Bullish