The Search

Your Search Results

News from us

Newest Symbols

Newest Industries

Click to expand

Advertising

See Stocks

Automotive

See Stocks

E-Commerce

See Stocks

E-Learning

See Stocks

Electricity

See Stocks

Engineering

See Stocks

FlexShopper Inc.

Bullish

Bullish

Tattooed Chef Inc.

Neutral

Neutral

Hellofresh SE

Bullish

Bullish

Build-a-Bear Workshop Inc.

Outperform

Outperform

Stamps.com Inc.

Bullish

Bullish

Redfin Corporation

Bullish

Bullish

Perion Network Ltd.

Outperform

Outperform

Upwork Inc.

Bullish

Bullish

Chegg Inc.

Bullish

Bullish

Pinterest Inc.

Bullish

Bullish

Bluelinx Holdings Inc

Bullish

Bullish

Momentus Inc.

Neutral

Neutral

Mynaric AG

Neutral

Neutral

Virgin Galactic Holdings Inc.

Neutral

Neutral

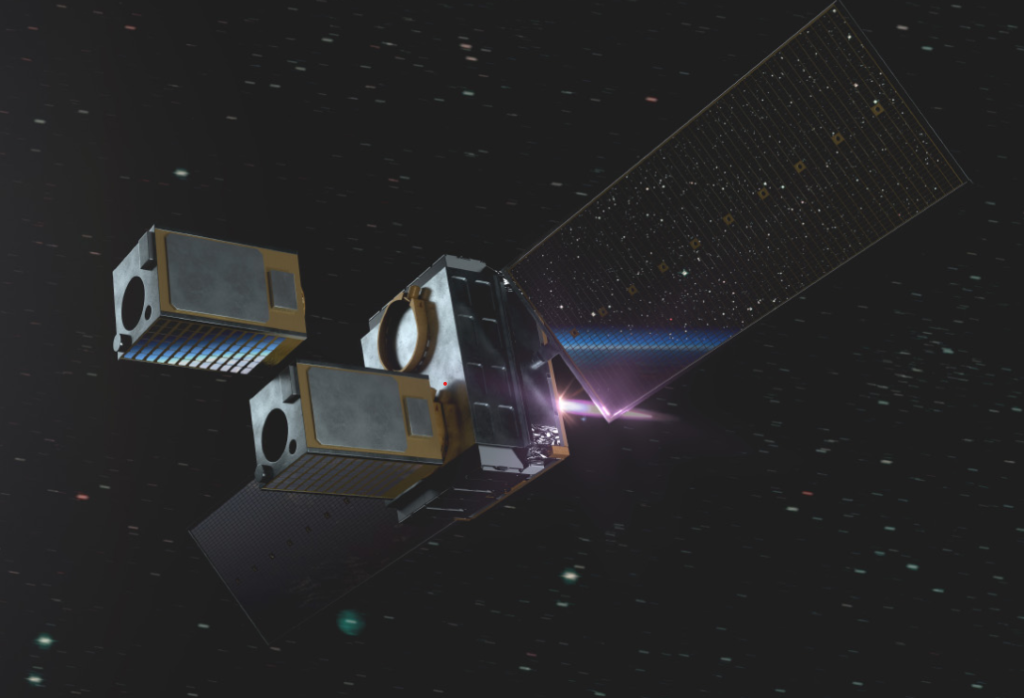

Maxar Technologies Inc.

Neutral

Neutral

Sunrun Inc.

Bullish

Bullish

Steico SE

Neutral

Neutral

Alfen N.V.

Neutral

Neutral

Research

Content Cards

Swipe

Our Article

Mynaric AG - Article

Big Game Hunt: Space Edition - Maxar, Mynaric, Momentus & Virgin Galactic

Table of Content:

- Introduction

- Maxar

- Mynaric

- Momentus

- Virgin Galactic

- Conclusion

Market situation

The highflyers of the space industry, like SpaceX or BlueOrigin are not directly investible. But there are lots of smaller companies that supply features for space faring, that try to develop business models in the lower orbit or that lay the ground works for further developments in space. The overall global space industry is expected to grow at least 5% for the next 25 years. This is not a lot, but markets are just being created with the first private companies trying to conquer space. The mentioned growth only provides a baseline which is mostly fueled by US military spending. This spending is even held or increased during recessions and in 2019 the Space budget was the biggest driver of the total US military spending. With the creation of the Space Force one could argue that this was just the starting point and many other western countries or even the European Union itself might drag along. But also, private markets will emerge and futuristic dreams of space stations or asteroid mining will become an opportunity. A handful of companies, some hopefully mentioned in this hunt, might win big and profit from the space race.

There’s the chance to profit from the dramatic efficiency gains that SpaceX has gifted the market with its tremendous disruption. SpaceX’s Starship will shrink the cost of transporting a kilogram into space by 15 times from its smaller sister the Falcon 9. That’s more than a 97% price reduction from the 1966 Soyuz 2.1. This disruption will triple the Small sat TAM in the next 4 years. With more than 1000 satellite launches in 2024.

Competition

Competition is fierce with old industry giants like Boeing, Northrup Grumman or Lockheed Martin take big shares of the space investment budget. But the smaller more specialized companies are conquering parts decisively and rapidly. Especially these companies are interesting to invest in because they provide a pure play entry point into a megatrend.

MAXAR

The first company that operates in Earth’s orbits and reaches to the star is the planet data and space infrastructure platform provider Maxar.

Maxar is a trusted partner and innovator in Earth Intelligence and Space Infrastructure. We deliver disruptive value to government and commercial customers to help them monitor, understand, and navigate our changing planet; deliver global broadband communications; and explore and advance the use of space. Our unique approach combines decades of deep mission understanding and a proven commercial and defense foundation to deploy solutions and deliver insights with speed, scale, and cost-effectiveness. Maxar’s 4,000 team members in more than 20 global locations are inspired to harness the potential of space to help our customers create a better world.

Source: Maxar

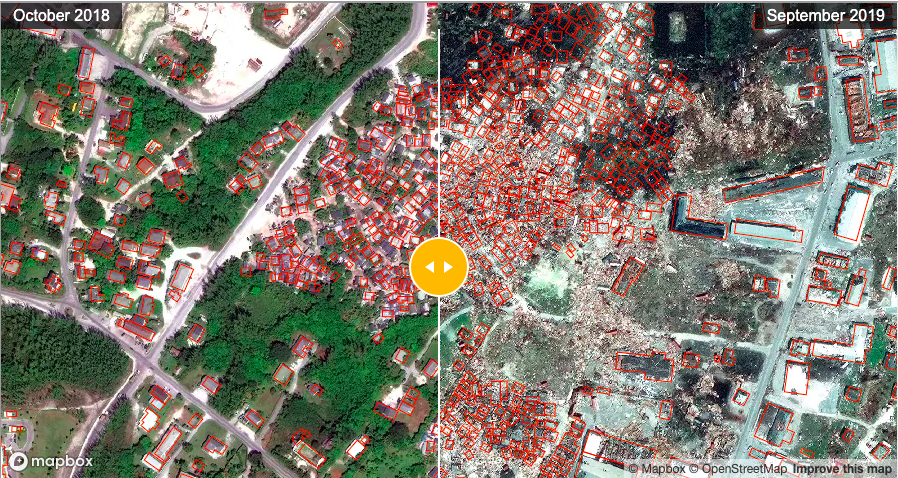

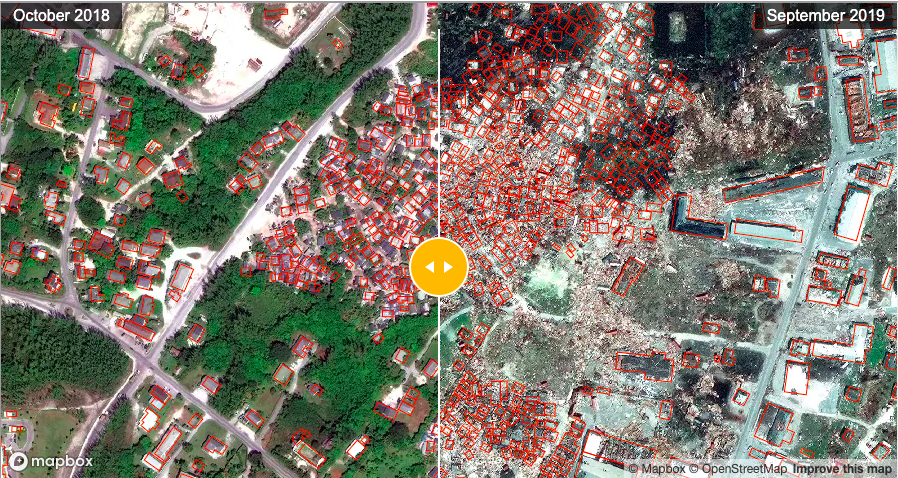

Maxar’s engagement in Earth Intelligence is partly a data analytics platform and partly a data generation service. These recurring multiyear contracts provide the customer with a big data platform with tools to analyze satellite pictures. Special high-resolution imagery for real time geospatial insights can be generated for special use cases. Aggregating multiple data sources—including satellite imagery, weather data, human geography information and more—into a single view can help get a more complete picture and make decisions with the best possible information This is a cost-effective way of gaining instant information about for example the impact of natural disasters. It allows first responders, by efficiently and quickly mapping passable routes, to deliver critical services in a matter of hours.

Another example is the modern approach to monitoring, preventing, and predicting outbreaks at scale. Satellite imagery can help researchers understand our travel patterns and the economic effects of a pandemic. Applied to infectious disease models, geospatial data analysis can help determine which locations need support now as well as predict where the next outbreaks may occur.

A new set of satellites, the “Legion Worldview satellites”, is being deployed over the next years. Satellites normally have a lifetime of 5-7 years, after this they are deorbited and replace by a new one which is technologically a lot more advanced. The huge upfront infrastructure investments (comparable to a telecommunications company) should pay themselves back in the next years, through the better service they provide and new feature they enable.

The other part, which delivers about 40% of the revenue, are the infrastructure contract solutions. Maxar for example advises NASA in question of space exploration, on orbit satellite servicing and robotics for ongoing space operation and exploration. They for example are developing a propulsion drive system with NASA to help reach the moon easier. So Maxar is on the spearhead of the US Artemis program to bring humans back to the moon. The other big part of the infrastructure solutions is delivering connectivity. From high-speed internet and real-time access to satellites orbiting the Earth to critical spacecraft communications, Maxar can help developers to connect what matters.

The company’s aim is to reduce leverage which has hit a painful high in 2019, luckily the attempts in the last quarters help to lower liabilities dramatically. But a ratio of 4.2x is still too much to acknowledge Maxar as a safe investment.

Growth in the Q3 was mostly flat with some market share gain in the space infrastructure. If the remeasurement of the M&A actions is adjusted, the net income melts away to zero.

Maxar is a company worth to watch because its engagement in the space industry might prove beneficial is some years. But for that growth must come back and the balance sheet must better itself so that M&A activities are on the plate again.

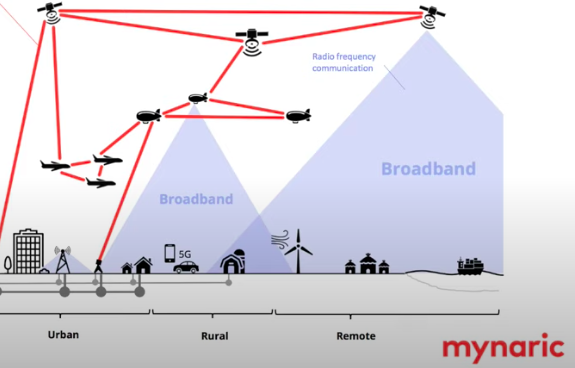

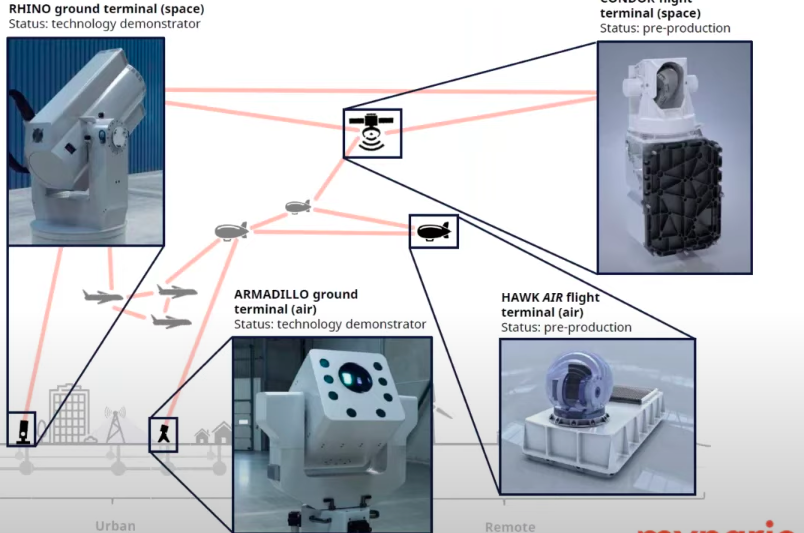

MYNARIC

With the spread of civilization throughout the Milky Way communications are a vital component of building up space station or even colonies. Copper cables or fiber optic networks are old tech and do not work in space. But the light aspect of glass fiber cable can use without the conducting part in the shape of lasers. A European company that pioneers this space is the company Mynaric headquartered in Munich Germany.

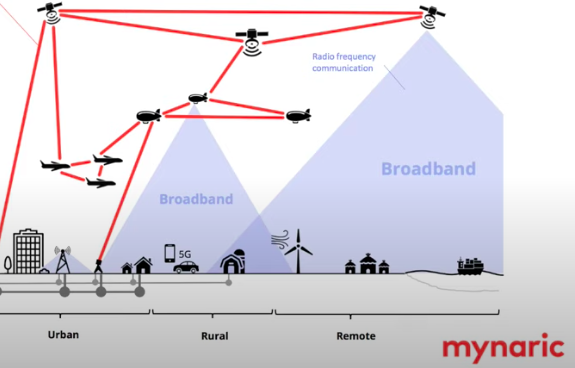

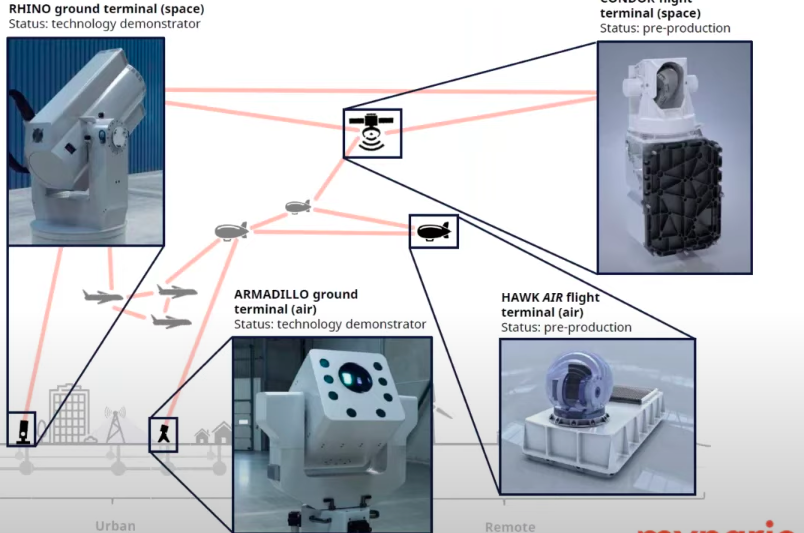

“Mynaric is a manufacturer of laser communication technologies used to enable communication and surveillance applications in air and space. Its laser data transmission products include ground and flight terminals, which allow large quantities of data to be sent wirelessly and securely over long distances between aircraft, autonomous drones, high-altitude platforms, satellites and the ground.”

“Globally, the need for fast and secure connectivity is advancing inexorably. Data networks are today largely based on infrastructure on the ground, which cannot be expanded arbitrarily for legal, economic, or practical reasons. The future therefore calls for an expansion of the existing network infrastructure into air and space. With its laser data transmission products Mynaric is positioned as a pioneer in this growth market.”

Source: Mynaric

Today the connectivity landscape is incomplete and expensive. Laying glass fiber cables in rural areas is only possible if it is heavily subsidized. On the open ocean satellite communication is the only way to go, but satellites are not interlinked yet and fly in high altitudes – providing a low bandwidth with high latency. Still, satellites are a subpar support for moving vehicles. Another usage of old radio frequency communication is in airborne means of transport. On passenger flights the internet connecting always gives a bad experience. These systems are prone to be hacked, can be interrupted or jammed and are easily detectable.

Mynaric’s solution for that is a laser interconnected system.

In the first step the developer of such a network will have to replace old connections with laser and these systems are planned to grow organic from that point on. Different systems of communication will morph together like it is seen in internet networks

Products for different use cases are sold by Mynaric. The satellite and plane laser have already hit the market and their function is being validated with several customers in air and space. If successful production will be scaled up in the next years. Ground terminals are still in development. The 2020 production target is a minimum of 30 lasers.

On the market side the potential for lasers on plane and satellites seems huge because they need to be equipped with one for every direction. The most dominant force SpaceX, with their own Starlink satellite network, has vertical integration written in their DNA. This means they will certainly either develop their own product or buy a company in that arena. To illustrate that: to automate the model 3 production Elon has bought the German automation company Grohmann, which was a supplier for German car brands, but now fully works for Tesla. Even if SpaceX does not choose Mynaric as a 1st tier supplier they still can act as 2nd supplier. So, laser networks won’t be built with only one supplier – the risk of not having diverse supply chains is too big.

Mynaric is of national importance for the German government so Mynaric is for example forbidden to work with the Chinese, because of its technological significance. This enables them special reimbursements. Luckily they are allowed on the American market and already work as well on American military contracts.

The management is very experienced in the field of space, especially the CEO Bulent Altan was one of the first employees at SpaceX, handpicked by Elon Musk.

Mynaric is a bet on the company, its products and the laser communication market. But it is still a bit early to make out the right winner on this turf, so an investment is extremely risky.

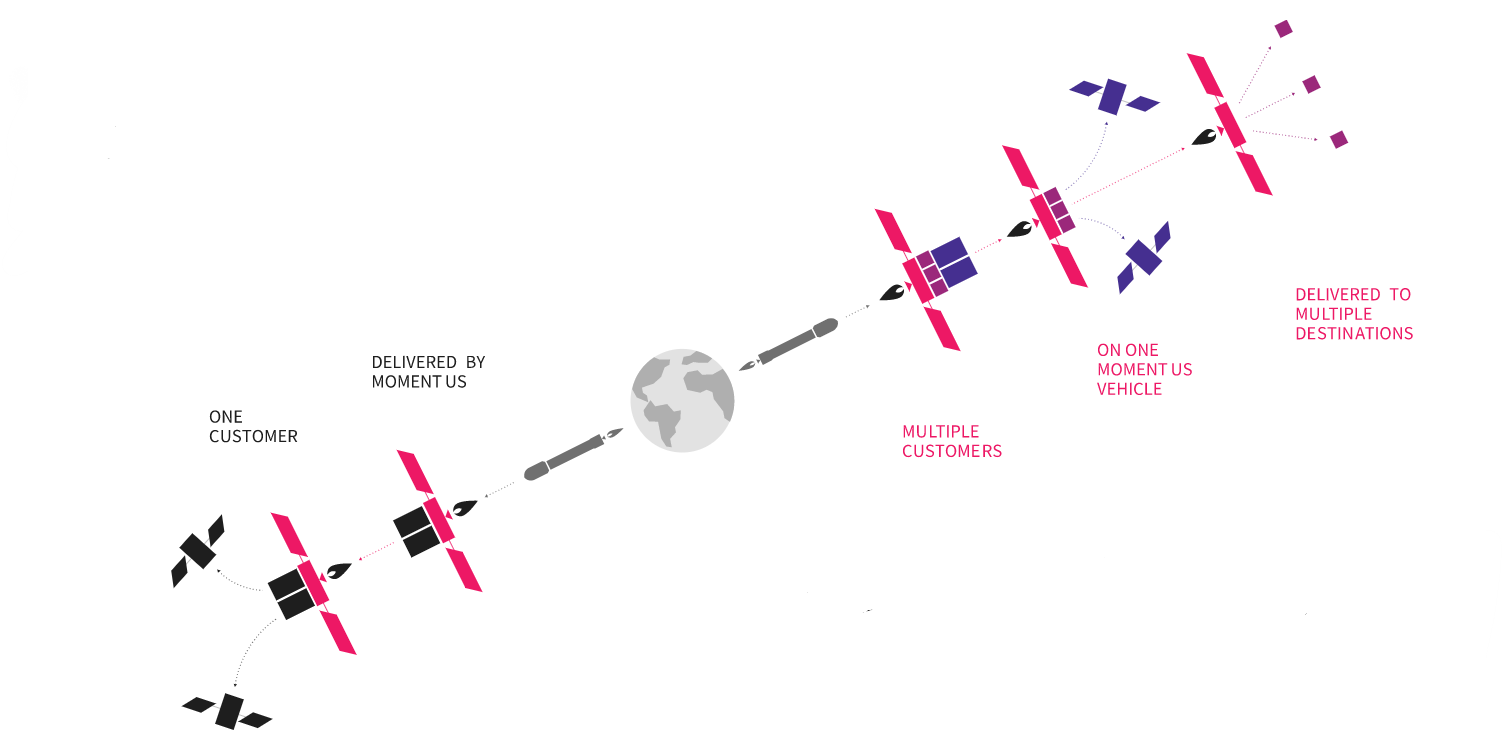

MOMENTUS

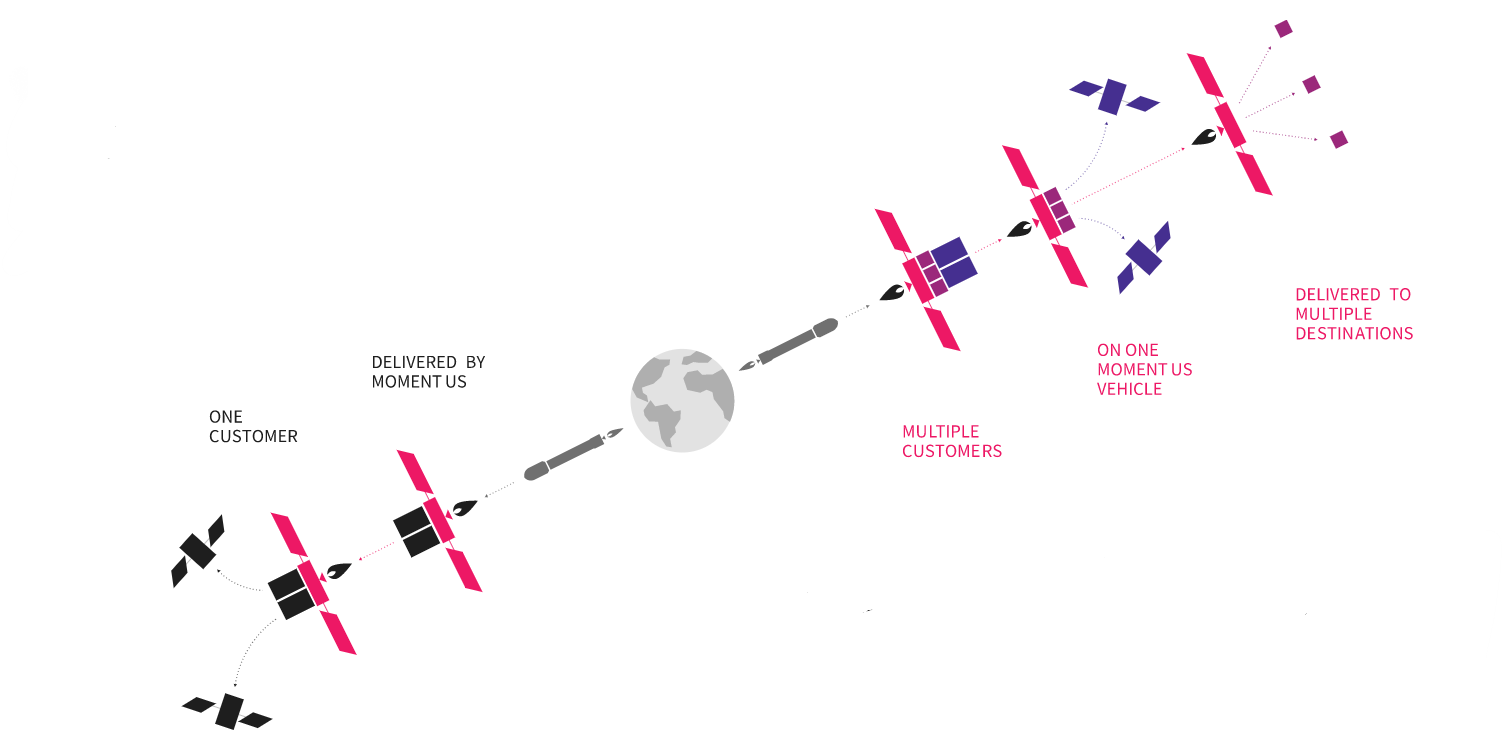

On the vanguard of the new space economy is a space transportation and infrastructure company. It tries to conquer space as the railway companies once did with the race in the young USA. The young but extremely ambitious company is called Momentus. Having proven itself as a first mover and with technological breakthroughs, it was able to already sign deals with the most prestigious names in the space field (SpaceX, Lockheed Martin, NASA)

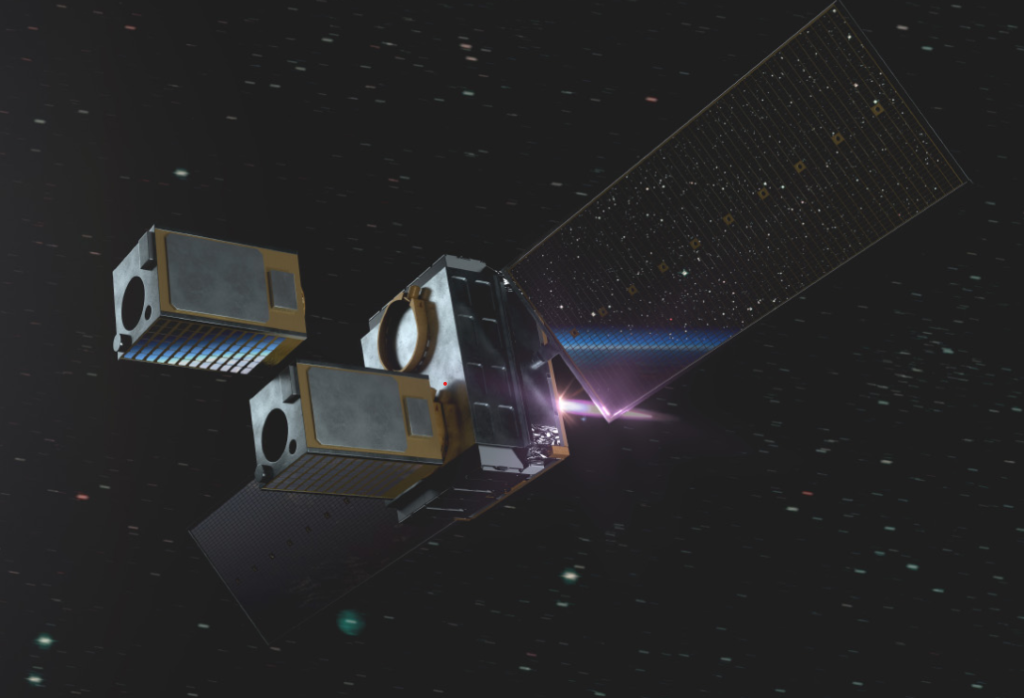

The company’s flagship space transportation vehicle is the Vigoride. It comes to fruition once the customer’s satellite and Momentus transfer vehicle is transported by the carrier (e.g. SpaceX’s Falcon 9) into the orbit. After the transfer vehicle breaks away from the rocket it brings the satellites to the definitive place. The vehicle returns to its resting spot thereafter and can be reused.

The hub and spoke model is used by airline transportation services to facilitate its logistics. Momentus uses this system instead of a point to point structure (which is used right now). Efficiency gains will drive the company’s moat. Transporting and delivering large quantities of smaller satellites is about three times a cheaper than equipping each small satellite with its own propulsion.

When on course Vigoride will reposition, refuel, repair, or deorbit satellites.

The Company plans to launch its first Vigoride vehicle in December 2020 with commercial customers and four to five Vigorides in 2021. The Company is developing two larger, more capable vehicles in its development plans: Ardoride in 2022 and Fervoride in 2024 with the goal of serving all orbits up to Geosynchronous Orbit and even Lunar Orbit and handling payloads of up to 4,000 kg. To extend the capabilities of gigantic rockets like SpaceX’s Starship and Blue Origin’s New Glenn, the Company is building its largest vehicle to date – Fervoride, which the Company expects to be capable of delivering up to 20 tons of cargo anywhere from Low Earth Orbit to Geosynchronous Orbit and into deep space. Fervoride is expected to be a pathfinder for the prospecting and use of space resources such as water from the Moon and asteroids and a technology enabler for the largest moonshot opportunities like solar energy generation in space.

Source: Momentus

Moonshot long term growth opportunity plans are: in-space renewable energy generation or asteroid mining for water and resources. This will be powered by a team and technologies that have already proven themselves in Earth’s orbit.

The CEO has an interesting track record of founding companies like a merchandise retail store in Russia and leading other companies to success (Llim Timber, Yehnoshika) The dream of space came to him in his midlife crisis (you might also compare him to a Russian Elon Musk in that case.)

The company is going public via a SPAC. The merging company is Stable Road acquisition Corporation that is found on NASDAQ:SRAC. In early 2021 the newborn company become listed on NASDAQ:MNTS. The transaction will provide approximately $310 million in cash on the balance sheet

Momentus could morph to the Uber+ in the still tiny space industry. But as long they have not delivered on their Vigoride platform, everything they promise must be taken with a grain of salt.

VIRGIN GALACTIC

Aside from the public sector being the driving force behind building the space market Virgin Galactic aims at the luxury entertainment private sector.

Virgin Galactic Holdings, Inc. is a vertically integrated aerospace and space travel company, pioneering human spaceflight for private individuals and researchers, as well as a manufacturer of advanced air and space vehicles. Using its proprietary and reusable technologies and supported by a distinctive, Virgin-branded customer experience, it is developing a spaceflight system designed to offer customers a unique, multi-day, transformative experience. This culminates in a spaceflight that includes views of Earth from space and several minutes of weightlessness that will launch from Spaceport America, New Mexico. Virgin Galactic and The Spaceship Company believe that one of the most exciting and significant opportunities of our time lies in the commercial exploration of space and the development of technology that will change the way we travel across the globe in the future. Together we are opening access to space to change the world for good.

Source: Virgin Galactic

The company recently successfully completed their test flight program from their own Spaceport “America”. They are now in the progress of gaining the license to perform spaceflights for paying customers. Almost all the steps the FAA (Federal Aviation Administration) has demanded were fulfilled for the special Launch License. Virgin Galactic’s Safety Management System is already approved. On the timeline the last test flights were delayed due to COVID-19 restrictions that dictate a minimal operational footprint at its facilities in New Mexico. As a result of that, the company’s flight that was planned to occur at the end of November has been rescheduled.

Virgin Galactic already pre-sells tickets for their spaceflight, and they market the trip with an AR (augmented reality) app that mimics the spaceship cabin. A special feature inside the cabin are the 16 internal cameras and the externally mounted one that generated a high definition output for social media or an edited personal movie. Before taking the trip, a training is arranged at their Spaceport resort. For the full Disney experience, they have onboarded Disney veteran Michael Colglazier as the new CEO in July. At Disney, he was developing and growing consumer-oriented multi-billion-dollar businesses strategically, commercially, and operationally.

Famous SPAC investor Chamath Palihapitiya and business magnate Richard Branson the hold a huge portion of the stock and provide the company with their knowledge.

George Whitesides, the CEO before that, will assume the role of Chief Space Officer, focused on developing the Company’s future business opportunities, including point-to-point hypersonic travel and orbital space travel. The company dreams noticeably big and has already a deal with Rolls-Royce to facilitate further collaboration on the development of sustainable, cutting-edge propulsion systems for this type of aircraft. They have previously entered into a Space Act Agreement with NASA to enable the development of sustainable high-speed technologies over the coming years. The parameters of the initial high-speed aircraft design include a Targeted Mach 3 certified delta wing aircraft and the capacity for 9 to 19 people at an altitude above 60,000 feet.

If these ambitions are to create shareholder value is yet to be proven. The only thing Virgin Galactic has come out with is a shiny render of the plane and bold roadmap. The bear case with that is the fate of Nikola.

Collusion, Conclusion and Speculation

All the mentions companies still have a long way to go but at this early stage of the space market the risk is extremely high. For example, if Virgin Galactic never achieves to follow along its proposed road map the stock will be worth close to nothing. But it is also extremely important to watch the talked about stocks because they are on the forefront of humanity expanding into space and the first mover always has a certain bonus. Once milestones, laid out by the managements, are hit, stated risks might melt away. At this point revisiting the stocks’ valuations could bear fruit and warrant an investment.

The best strategy right now is to dream big and observe carefully.

General Warning

Due to the market cap and the float (the amount of shares circling around and traded, which are not held by major investors) of shares, there are certain risks and a medium volatility.

Disclaimer & Conflict of interest

The author currently does NOT hold a position in one or more of the mentioned stocks. The mentioned companies do NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Mynaric AG - Article

Big Game Hunt: Space Edition - Maxar, Mynaric, Momentus & Virgin Galactic

Table of Content:

- Introduction

- Maxar

- Mynaric

- Momentus

- Virgin Galactic

- Conclusion

Market situation

The highflyers of the space industry, like SpaceX or BlueOrigin are not directly investible. But there are lots of smaller companies that supply features for space faring, that try to develop business models in the lower orbit or that lay the ground works for further developments in space. The overall global space industry is expected to grow at least 5% for the next 25 years. This is not a lot, but markets are just being created with the first private companies trying to conquer space. The mentioned growth only provides a baseline which is mostly fueled by US military spending. This spending is even held or increased during recessions and in 2019 the Space budget was the biggest driver of the total US military spending. With the creation of the Space Force one could argue that this was just the starting point and many other western countries or even the European Union itself might drag along. But also, private markets will emerge and futuristic dreams of space stations or asteroid mining will become an opportunity. A handful of companies, some hopefully mentioned in this hunt, might win big and profit from the space race.

There’s the chance to profit from the dramatic efficiency gains that SpaceX has gifted the market with its tremendous disruption. SpaceX’s Starship will shrink the cost of transporting a kilogram into space by 15 times from its smaller sister the Falcon 9. That’s more than a 97% price reduction from the 1966 Soyuz 2.1. This disruption will triple the Small sat TAM in the next 4 years. With more than 1000 satellite launches in 2024.

Competition

Competition is fierce with old industry giants like Boeing, Northrup Grumman or Lockheed Martin take big shares of the space investment budget. But the smaller more specialized companies are conquering parts decisively and rapidly. Especially these companies are interesting to invest in because they provide a pure play entry point into a megatrend.

MAXAR

The first company that operates in Earth’s orbits and reaches to the star is the planet data and space infrastructure platform provider Maxar.

Maxar is a trusted partner and innovator in Earth Intelligence and Space Infrastructure. We deliver disruptive value to government and commercial customers to help them monitor, understand, and navigate our changing planet; deliver global broadband communications; and explore and advance the use of space. Our unique approach combines decades of deep mission understanding and a proven commercial and defense foundation to deploy solutions and deliver insights with speed, scale, and cost-effectiveness. Maxar’s 4,000 team members in more than 20 global locations are inspired to harness the potential of space to help our customers create a better world.

Source: Maxar

Maxar’s engagement in Earth Intelligence is partly a data analytics platform and partly a data generation service. These recurring multiyear contracts provide the customer with a big data platform with tools to analyze satellite pictures. Special high-resolution imagery for real time geospatial insights can be generated for special use cases. Aggregating multiple data sources—including satellite imagery, weather data, human geography information and more—into a single view can help get a more complete picture and make decisions with the best possible information This is a cost-effective way of gaining instant information about for example the impact of natural disasters. It allows first responders, by efficiently and quickly mapping passable routes, to deliver critical services in a matter of hours.

Another example is the modern approach to monitoring, preventing, and predicting outbreaks at scale. Satellite imagery can help researchers understand our travel patterns and the economic effects of a pandemic. Applied to infectious disease models, geospatial data analysis can help determine which locations need support now as well as predict where the next outbreaks may occur.

A new set of satellites, the “Legion Worldview satellites”, is being deployed over the next years. Satellites normally have a lifetime of 5-7 years, after this they are deorbited and replace by a new one which is technologically a lot more advanced. The huge upfront infrastructure investments (comparable to a telecommunications company) should pay themselves back in the next years, through the better service they provide and new feature they enable.

The other part, which delivers about 40% of the revenue, are the infrastructure contract solutions. Maxar for example advises NASA in question of space exploration, on orbit satellite servicing and robotics for ongoing space operation and exploration. They for example are developing a propulsion drive system with NASA to help reach the moon easier. So Maxar is on the spearhead of the US Artemis program to bring humans back to the moon. The other big part of the infrastructure solutions is delivering connectivity. From high-speed internet and real-time access to satellites orbiting the Earth to critical spacecraft communications, Maxar can help developers to connect what matters.

The company’s aim is to reduce leverage which has hit a painful high in 2019, luckily the attempts in the last quarters help to lower liabilities dramatically. But a ratio of 4.2x is still too much to acknowledge Maxar as a safe investment.

Growth in the Q3 was mostly flat with some market share gain in the space infrastructure. If the remeasurement of the M&A actions is adjusted, the net income melts away to zero.

Maxar is a company worth to watch because its engagement in the space industry might prove beneficial is some years. But for that growth must come back and the balance sheet must better itself so that M&A activities are on the plate again.

MYNARIC

With the spread of civilization throughout the Milky Way communications are a vital component of building up space station or even colonies. Copper cables or fiber optic networks are old tech and do not work in space. But the light aspect of glass fiber cable can use without the conducting part in the shape of lasers. A European company that pioneers this space is the company Mynaric headquartered in Munich Germany.

"Mynaric is a manufacturer of laser communication technologies used to enable communication and surveillance applications in air and space. Its laser data transmission products include ground and flight terminals, which allow large quantities of data to be sent wirelessly and securely over long distances between aircraft, autonomous drones, high-altitude platforms, satellites and the ground."

"Globally, the need for fast and secure connectivity is advancing inexorably. Data networks are today largely based on infrastructure on the ground, which cannot be expanded arbitrarily for legal, economic, or practical reasons. The future therefore calls for an expansion of the existing network infrastructure into air and space. With its laser data transmission products Mynaric is positioned as a pioneer in this growth market."

Source: Mynaric

Today the connectivity landscape is incomplete and expensive. Laying glass fiber cables in rural areas is only possible if it is heavily subsidized. On the open ocean satellite communication is the only way to go, but satellites are not interlinked yet and fly in high altitudes - providing a low bandwidth with high latency. Still, satellites are a subpar support for moving vehicles. Another usage of old radio frequency communication is in airborne means of transport. On passenger flights the internet connecting always gives a bad experience. These systems are prone to be hacked, can be interrupted or jammed and are easily detectable.

Mynaric’s solution for that is a laser interconnected system.

In the first step the developer of such a network will have to replace old connections with laser and these systems are planned to grow organic from that point on. Different systems of communication will morph together like it is seen in internet networks

Products for different use cases are sold by Mynaric. The satellite and plane laser have already hit the market and their function is being validated with several customers in air and space. If successful production will be scaled up in the next years. Ground terminals are still in development. The 2020 production target is a minimum of 30 lasers.

On the market side the potential for lasers on plane and satellites seems huge because they need to be equipped with one for every direction. The most dominant force SpaceX, with their own Starlink satellite network, has vertical integration written in their DNA. This means they will certainly either develop their own product or buy a company in that arena. To illustrate that: to automate the model 3 production Elon has bought the German automation company Grohmann, which was a supplier for German car brands, but now fully works for Tesla. Even if SpaceX does not choose Mynaric as a 1st tier supplier they still can act as 2nd supplier. So, laser networks won’t be built with only one supplier - the risk of not having diverse supply chains is too big.

Mynaric is of national importance for the German government so Mynaric is for example forbidden to work with the Chinese, because of its technological significance. This enables them special reimbursements. Luckily they are allowed on the American market and already work as well on American military contracts.

The management is very experienced in the field of space, especially the CEO Bulent Altan was one of the first employees at SpaceX, handpicked by Elon Musk.

Mynaric is a bet on the company, its products and the laser communication market. But it is still a bit early to make out the right winner on this turf, so an investment is extremely risky.

MOMENTUS

On the vanguard of the new space economy is a space transportation and infrastructure company. It tries to conquer space as the railway companies once did with the race in the young USA. The young but extremely ambitious company is called Momentus. Having proven itself as a first mover and with technological breakthroughs, it was able to already sign deals with the most prestigious names in the space field (SpaceX, Lockheed Martin, NASA)

The company’s flagship space transportation vehicle is the Vigoride. It comes to fruition once the customer’s satellite and Momentus transfer vehicle is transported by the carrier (e.g. SpaceX’s Falcon 9) into the orbit. After the transfer vehicle breaks away from the rocket it brings the satellites to the definitive place. The vehicle returns to its resting spot thereafter and can be reused.

The hub and spoke model is used by airline transportation services to facilitate its logistics. Momentus uses this system instead of a point to point structure (which is used right now). Efficiency gains will drive the company's moat. Transporting and delivering large quantities of smaller satellites is about three times a cheaper than equipping each small satellite with its own propulsion.

When on course Vigoride will reposition, refuel, repair, or deorbit satellites.

The Company plans to launch its first Vigoride vehicle in December 2020 with commercial customers and four to five Vigorides in 2021. The Company is developing two larger, more capable vehicles in its development plans: Ardoride in 2022 and Fervoride in 2024 with the goal of serving all orbits up to Geosynchronous Orbit and even Lunar Orbit and handling payloads of up to 4,000 kg. To extend the capabilities of gigantic rockets like SpaceX’s Starship and Blue Origin’s New Glenn, the Company is building its largest vehicle to date – Fervoride, which the Company expects to be capable of delivering up to 20 tons of cargo anywhere from Low Earth Orbit to Geosynchronous Orbit and into deep space. Fervoride is expected to be a pathfinder for the prospecting and use of space resources such as water from the Moon and asteroids and a technology enabler for the largest moonshot opportunities like solar energy generation in space.

Source: Momentus

Moonshot long term growth opportunity plans are: in-space renewable energy generation or asteroid mining for water and resources. This will be powered by a team and technologies that have already proven themselves in Earth’s orbit.

The CEO has an interesting track record of founding companies like a merchandise retail store in Russia and leading other companies to success (Llim Timber, Yehnoshika) The dream of space came to him in his midlife crisis (you might also compare him to a Russian Elon Musk in that case.)

The company is going public via a SPAC. The merging company is Stable Road acquisition Corporation that is found on NASDAQ:SRAC. In early 2021 the newborn company become listed on NASDAQ:MNTS. The transaction will provide approximately $310 million in cash on the balance sheet

Momentus could morph to the Uber+ in the still tiny space industry. But as long they have not delivered on their Vigoride platform, everything they promise must be taken with a grain of salt.

VIRGIN GALACTIC

Aside from the public sector being the driving force behind building the space market Virgin Galactic aims at the luxury entertainment private sector.

Virgin Galactic Holdings, Inc. is a vertically integrated aerospace and space travel company, pioneering human spaceflight for private individuals and researchers, as well as a manufacturer of advanced air and space vehicles. Using its proprietary and reusable technologies and supported by a distinctive, Virgin-branded customer experience, it is developing a spaceflight system designed to offer customers a unique, multi-day, transformative experience. This culminates in a spaceflight that includes views of Earth from space and several minutes of weightlessness that will launch from Spaceport America, New Mexico. Virgin Galactic and The Spaceship Company believe that one of the most exciting and significant opportunities of our time lies in the commercial exploration of space and the development of technology that will change the way we travel across the globe in the future. Together we are opening access to space to change the world for good.

Source: Virgin Galactic

The company recently successfully completed their test flight program from their own Spaceport “America”. They are now in the progress of gaining the license to perform spaceflights for paying customers. Almost all the steps the FAA (Federal Aviation Administration) has demanded were fulfilled for the special Launch License. Virgin Galactic’s Safety Management System is already approved. On the timeline the last test flights were delayed due to COVID-19 restrictions that dictate a minimal operational footprint at its facilities in New Mexico. As a result of that, the company's flight that was planned to occur at the end of November has been rescheduled.

Virgin Galactic already pre-sells tickets for their spaceflight, and they market the trip with an AR (augmented reality) app that mimics the spaceship cabin. A special feature inside the cabin are the 16 internal cameras and the externally mounted one that generated a high definition output for social media or an edited personal movie. Before taking the trip, a training is arranged at their Spaceport resort. For the full Disney experience, they have onboarded Disney veteran Michael Colglazier as the new CEO in July. At Disney, he was developing and growing consumer-oriented multi-billion-dollar businesses strategically, commercially, and operationally.

Famous SPAC investor Chamath Palihapitiya and business magnate Richard Branson the hold a huge portion of the stock and provide the company with their knowledge.

George Whitesides, the CEO before that, will assume the role of Chief Space Officer, focused on developing the Company’s future business opportunities, including point-to-point hypersonic travel and orbital space travel. The company dreams noticeably big and has already a deal with Rolls-Royce to facilitate further collaboration on the development of sustainable, cutting-edge propulsion systems for this type of aircraft. They have previously entered into a Space Act Agreement with NASA to enable the development of sustainable high-speed technologies over the coming years. The parameters of the initial high-speed aircraft design include a Targeted Mach 3 certified delta wing aircraft and the capacity for 9 to 19 people at an altitude above 60,000 feet.

If these ambitions are to create shareholder value is yet to be proven. The only thing Virgin Galactic has come out with is a shiny render of the plane and bold roadmap. The bear case with that is the fate of Nikola.

Collusion, Conclusion and Speculation

All the mentions companies still have a long way to go but at this early stage of the space market the risk is extremely high. For example, if Virgin Galactic never achieves to follow along its proposed road map the stock will be worth close to nothing. But it is also extremely important to watch the talked about stocks because they are on the forefront of humanity expanding into space and the first mover always has a certain bonus. Once milestones, laid out by the managements, are hit, stated risks might melt away. At this point revisiting the stocks' valuations could bear fruit and warrant an investment.

The best strategy right now is to dream big and observe carefully.

General Warning

Due to the market cap and the float (the amount of shares circling around and traded, which are not held by major investors) of shares, there are certain risks and a medium volatility.

Disclaimer & Conflict of interest

The author currently does NOT hold a position in one or more of the mentioned stocks. The mentioned companies do NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Peers

All the Peers

Bluelinx Holdings Inc

Bullish

Momentus Inc.

Neutral

Virgin Galactic Holdings Inc.

Neutral

Maxar Technologies Inc.

Neutral

Sunrun Inc.

Bullish

Steico SE

Neutral