The Search

Your Search Results

News from us

Newest Symbols

Newest Industries

Click to expand

Advertising

See Stocks

Automotive

See Stocks

E-Commerce

See Stocks

E-Learning

See Stocks

Electricity

See Stocks

Engineering

See Stocks

FlexShopper Inc.

Bullish

Bullish

Tattooed Chef Inc.

Neutral

Neutral

Hellofresh SE

Bullish

Bullish

Build-a-Bear Workshop Inc.

Outperform

Outperform

Stamps.com Inc.

Bullish

Bullish

Redfin Corporation

Bullish

Bullish

Perion Network Ltd.

Outperform

Outperform

Upwork Inc.

Bullish

Bullish

Chegg Inc.

Bullish

Bullish

Pinterest Inc.

Bullish

Bullish

Bluelinx Holdings Inc

Bullish

Bullish

Momentus Inc.

Neutral

Neutral

Mynaric AG

Neutral

Neutral

Virgin Galactic Holdings Inc.

Neutral

Neutral

Maxar Technologies Inc.

Neutral

Neutral

Sunrun Inc.

Bullish

Bullish

Steico SE

Neutral

Neutral

Alfen N.V.

Neutral

Neutral

Research

Content Cards

Swipe

Our Article

Steico SE - Article

Big Game Hunt: Green-Edition - Alfen, Casella, Steico and Sunrun

Note: A Casella Bin / Source

Table of Content:

- Author’s Opinion

- Alfen

- Casella

- Steico

- Sunrun

- Conclusion

Author’s Opinion

With the next issue of Big Game Hunt we would like to present green and sustainable investment opportunities in the direction of sustainable building materials, electrification and waste management. Why all this? There are many reasons: For one thing, the stock exchange always trades the future and already prices much of the future into the present. So why invest in old and non-functioning business models or long obsolete raw materials or companies, when you can also invest in companies and areas that are only just emerging now and are far from reaching their peak point. So an investment in sustainability not only calms your conscience, but also ensures that we will still have a promising business model in ten years or more.

A further point is that environmental protection and sustainability is everyone’s business – so if we want to do something about it, we could do it on the stock market and invest at least a small amount in the environment and environmentally friendly technologies – so several people benefit from it. The last point is that just because a company focuses on green and sustainable technologies, it doesn’t have to be boring or unprofitable. These companies, whose products, services or technologies are popular and much sought after, often have strong growth figures, high profitability and a very high dynamic. So let’s take a look at a few interesting candidates from this segment – but before we do so, let’s first take a brief look at what might be relevant for these companies.

Business Model

Due to the large and varying number of business models, each of them will be outlined individually and briefly. Basically, however, it can be said that we have both business-to-customer and business-to-business models. Sometimes there are individual sales and services, sometimes there are long-term contracts, which provide for recurring revenues.

Due to the corona pandemic, some companies have suffered greater losses than others. A waste management company has probably suffered less than a building materials manufacturer, for example. Because due to the pandemic, some construction sites / construction projects had to be stopped or cancelled, while waste and its disposal always take place.

Growth

Both small and large companies are presented. Regardless of the size, the markets and geographical possibilities considered offer many years of potential growth. Not only the companies can grow, but also the markets. One example is waste management – here not only the annual amount of waste is growing, but there are also more households and companies that need fair disposal. In addition, segments such as recycling are becoming more and more important, offering additional growth opportunities. Moreover, from a geographical point of view, expansion offers much more growth potential. So we have a market that is growing very broadly and offers a lot of growth potential, as well as geographical opportunities. Laws and the increasingly important environmental protection offer additional opportunities and dynamics.

Competition

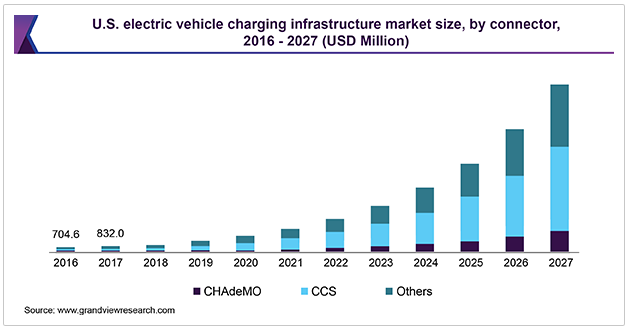

As in almost every business unit, there is a lot of competition and rivals in the business units presented later. However, for many business models, this should not directly affect anything. Here, too, the example of the ice cream parlor chain can be applied: A chain of ice-cream parlors that currently specializes in the East Coast will not be disturbed by a chain of ice-cream parlors on the West Coast for the time being. Both chains can expand in peace and meet in the middle and only then do they have to worry about competition. However, this process takes several years and offers the company the opportunity to prepare itself fully for this. In addition, sometimes an increasing density of services or clustering, like EV (“EV = Electrical vehicle”) loading stations is a big plus.

If there are several competing chains in the same segment, it is not the size but the geographic footprint, the clustering / density and the distribution-channels that matters.

Marketing & Reputation

Since the presented companies stand strongly for sustainability, innovation and a better environment, or want to achieve this themselves, they generally have a good reputation. This makes it all the more important that the companies actively live this and take it seriously, and do not build a “green” dummy facade to jump on the bandwagon.

Tips and Tricks

To get a better picture of the company, it can’t hurt to check out their rating portals or the social media channels. That way you won’t miss any new offers, technologies or services.

Alfen

Note: An Alfen EV loading station / Source

Quick Info

Netherlands-based Alfen is operating internationally in the heart of the energy transition, as a specialist in energy solutions for the future. With over 80-years’ history, Alfen has a unique combination of activities. Alfen designs, develops and produces smart grids, energy storage systems, and electric vehicle charging equipment and combines these in integrated solutions to address the electricity challenges of its clients. Alfen has a market leading position in the Netherlands and experiences fast international growth benefitting from its first mover advantage. For further information see Alfen’s website at: www.alfen.com

Source: Alfen

Business Modell

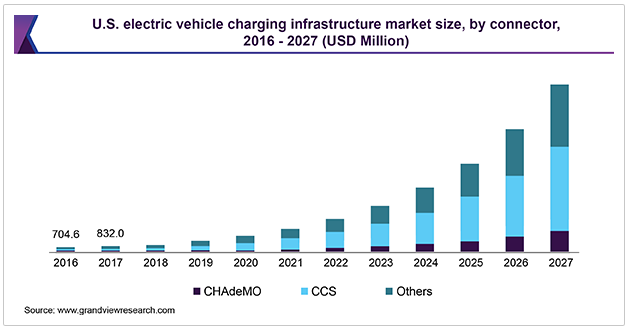

Alfens business model is a little more complex compared to that of simple restaurants. Alfen’s business is divided into three main businesses, namely smart grids, charging solutions for electric vehicles and energy storage systems. The Smart Grids business is the largest area of Alfen’s business in terms of sales, but also the area with the lowest percentage growth. Furthermore, charging solutions make up the 2nd largest segment and also deliver the 2nd highest percentage growth rates. The energy storage systems are still a very small business area, but achieve 3-digit percentage growth rates compared to the previous year. They are therefore the fastest growing business segment.

Alfen’s business has partly suffered from the Corona Pandemic, as especially large projects in the field of smart grids have been postponed or cancelled. Despite these postponements and cancellations, the business still grew very strongly and developed dynamically.

Alfen earns its money by developing and selling products, mostly in large projects and framework agreements, which ensure high scalability and recurring revenues. Additionally, they offer additional added value and potential through intelligent solutions and software.

What makes them special?

Alfens speciality is that we have here a mature “pure play” in the electrical transformation / evolution. Alfen writes positive figures, can show a very strong growth despite a corona pandemic and is operating in an extremely fast growing and state-subsidized market, which will not be saturated in 20 years.

Note: Alfen is busy in a high growth market / Source

With their more than strong foundation in smart grids, they can continue to drive other very strong growth drivers such as charging systems and energy storage.

Alfens management currently assumes that the electrification and thus also the growth of Alfen will accelerate even further.

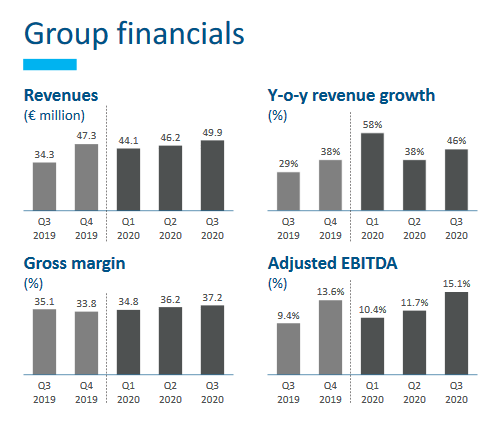

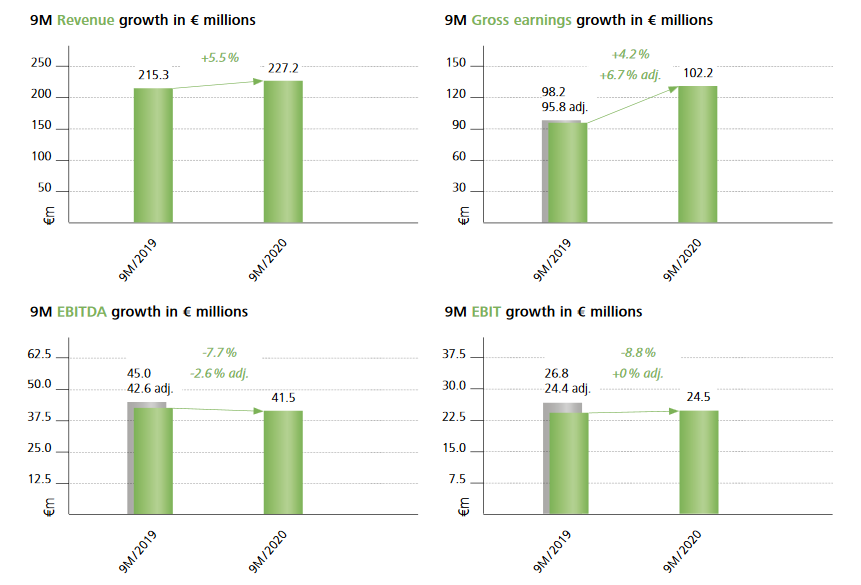

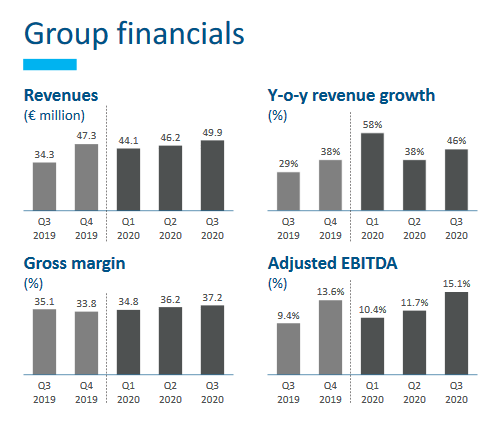

Note: Alfens impressive growth numbers – Alfen expects that their growth will further accelerate / Source

Numbers and News

Alfens was able to rebounce their business during the pandemic. They have delivered solid numbers and performed incredible. They have managed to increase their “Smart-Grid”-Sales about 23% in the third quarter of 2020. In addition, they were able to increase their “EV-Charging Solutions”-Sales about 72%. Finally, their “Energy-Storage”-Sales surged 488% Year-over-Year. Considering that Alfen has achieved such incredibly strong growth figures despite the pandemic and the cancellation of many projects, these figures are more than strong. Assuming that Alfen can maintain such growth figures and accelerate growth even more in the future, Alfen is a true green future play. Another bonus is the currently still profitable growth. Alfen has also reiterated their revenue outlook for 2020 with $180-200M.

For additional informations, please have a look at their latest earnings news.

Casella Waste Systems

Note: A Casella garbage truck / Source

Quick Info

Casella Waste Systems, Inc., headquartered in Rutland, Vermont, provides resource management expertise and services to residential, commercial, municipal and industrial customers, primarily in the areas of solid waste collection and disposal, transfer, recycling and organics services in the northeastern United States. For further information visit the Company’s website at http://www.casella.com.

Source: Casella

Business Modell

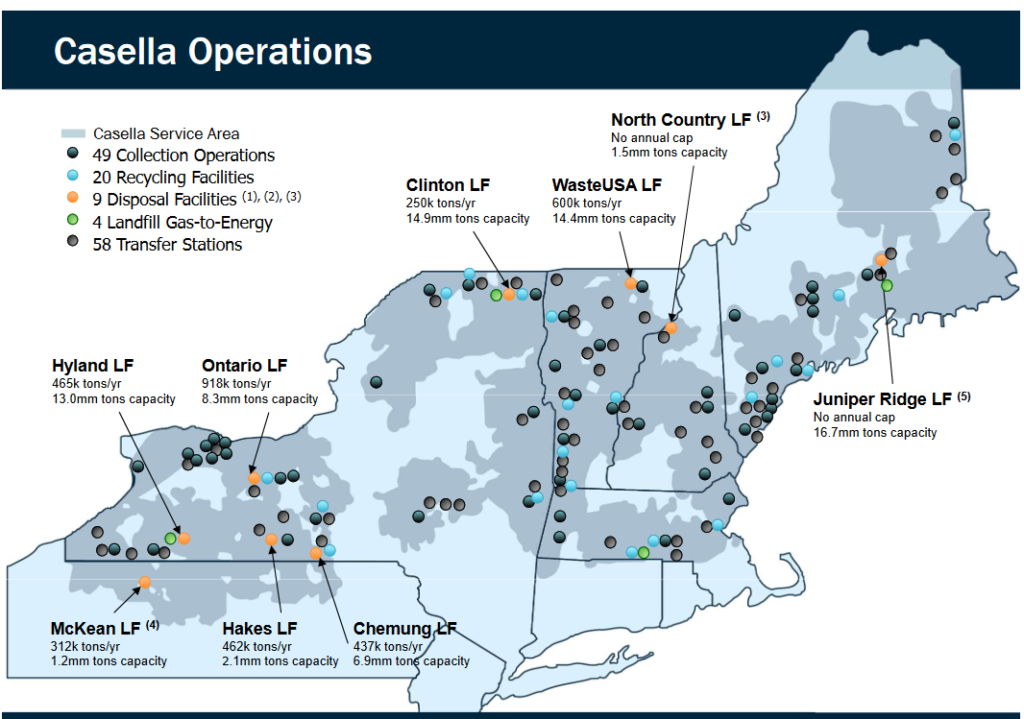

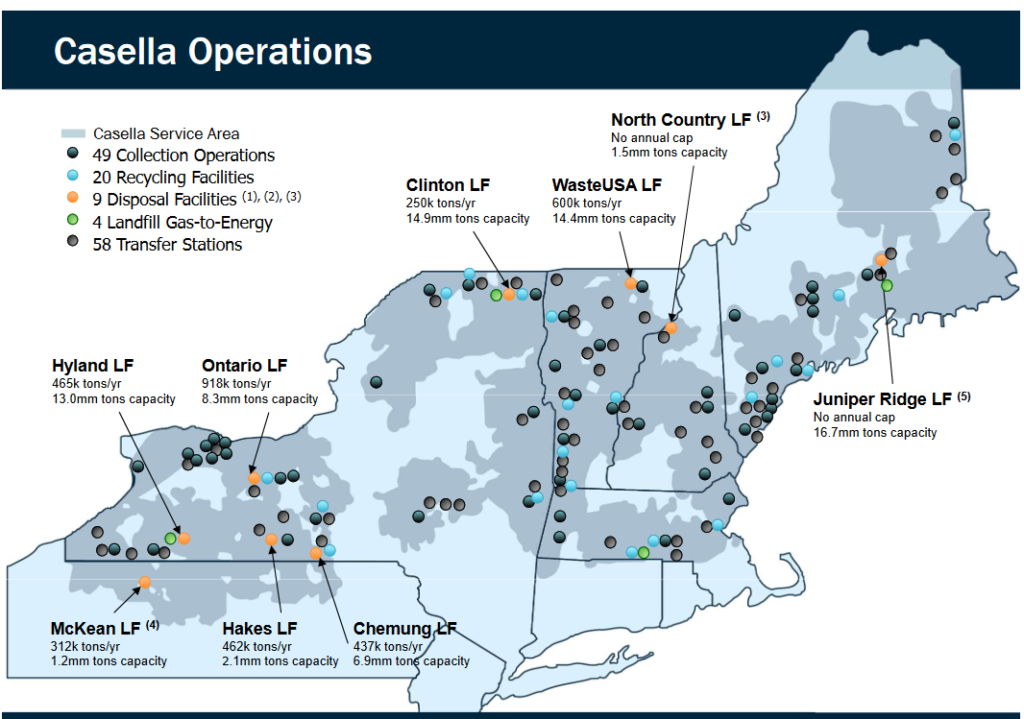

Casellla is a typical waste management company. Casella’s business is currently limited to a few states in the Northeastern United States, which makes it a rather small national company. Casella earns most of its money by recycling garbage, collecting garbage, disposing of garbage, transferring garbage and organically breaking down (gas) garbage. To achieve this, Casella has a whole armada of clustered sites to ensure efficiency and customer proximity. Casella serves normal households, communitys and businesses.

Approximately 75% of Casella’s turnover is generated with solid waste, i.e. the removal and disposal of waste. Casella generates the remaining 25% with services related to recycling. Solid Waste offers Casella’s highest-margin business. The current EBITDA margin (“EBITDA = Earning before interest, taxes, deprecation & amortization”) is around 27.4%.

Since Casella earns its money with the processing of garbage, rising garbage quantities are very decisive for the further development of the business, as well as an important characteristic number in the waste management.

Due to the corona pandemic, Casella had some revenue impacts, because the waste amount decreased. The reason for that was, that many business had to close or decreased production, which led to an decrease in waste-amounts, which resulted in a slight decrease in revenues for Casella.

Note: Casella’s clustered operations in the Northeast U.S. / Source

What makes them special?

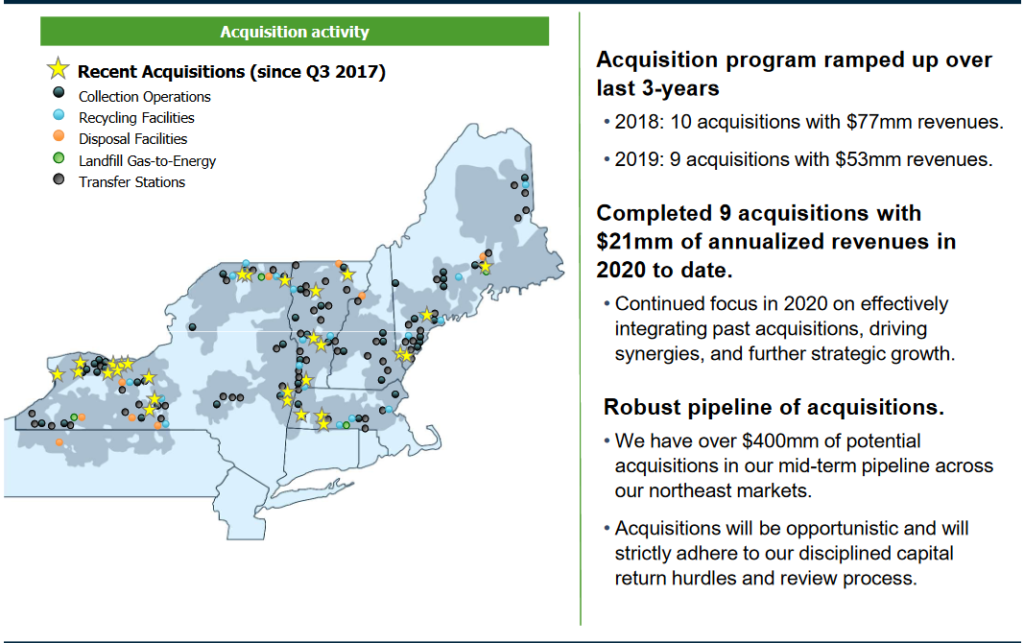

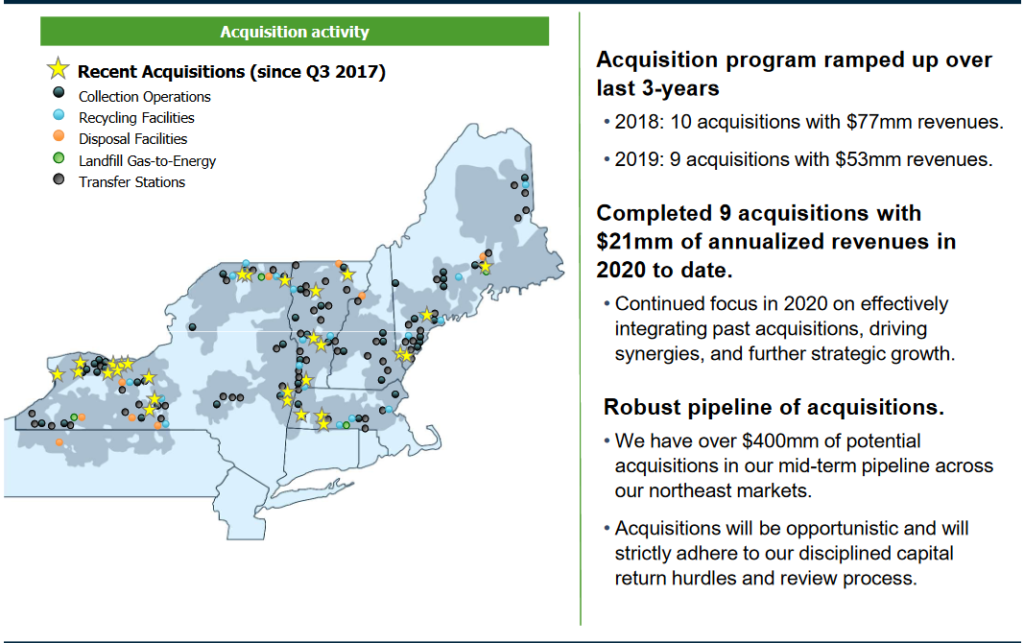

Casella is slowly but constantly growing. Due to the ever-increasing global consumption and the resulting increase in waste production, Casella is profiting optimally from this negative trend. Since services such as recycling are also becoming increasingly important in the USA, further growth is also to be seen here. Casella also has a potential acquisition pipeline of currently over $400M in sight. Acquisitions of this kind not only enable personnel cost reductions to be achieved, but also create synergies by clustering locations.

Casella is also looking to increase revenue through price increases in monopolistic offerings and services. Furthermore, they want to become more efficient by optimizing collection operations and using modern technologies. The focus and expansion of services such as recycling and acquisitions should bring further growth.

Note: Casella’s most recent acquisitions / Source

Despite Casella’s many expenditures for optimization, acquisitions and ongoing operations and innovations, Casella has managed to report significantly increased profits and cash flows in recent quarters. This is an impressive achievement.

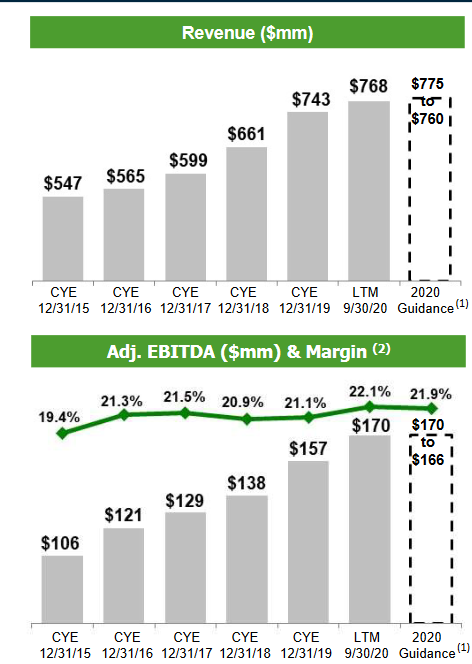

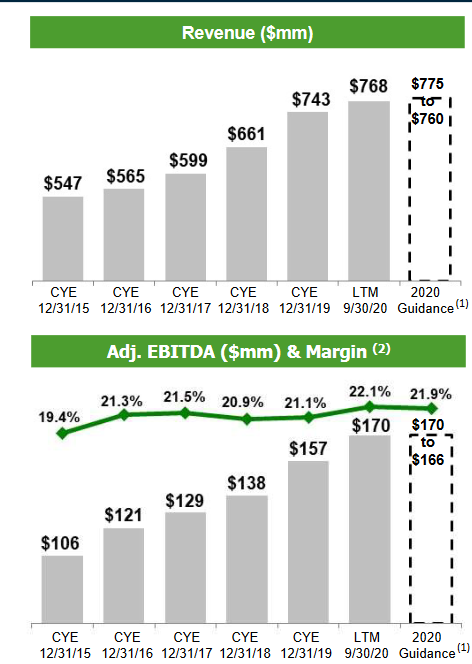

Numbers and News

Casella’s latest news were the quarterly figures. Due to the reduced waste volume caused by the Corona pandemic, sales increased by only 2% compared to the previous year. However, profits increased by 22% to approximately $15m. Due to improving conditions, the outlook for the current year was raised. Sales of up to $775M and a profit of up to $28 are now expected. What is very impressive, however, is the fact that profits have increased so much, even though the amount of solid wastes has decreased by about 8.5%. This clearly shows that the efforts of the management to improve the profitability and efficiency of operations are bearing fruit.

It was also announced that this year’s acquisitions will provide approximately $21m of additional revenue for Casella. This clearly shows that Casella is strongly interested in growth and investment despite the crisis.

Although Casella is already highly valued at present, the figures provided, the strong business development and also the broad view into the future speak for an investment in Casella.

Note: Casella’s strong growth / Source

For additional informations, please have a look at their latest earnings news.

Steico

Quick Info

STEICO develops, produces and markets ecological construction products made of renewable raw materials. STEICO is the European market leader for wood fiber insulation materials.

STEICO is positioned as a system provider for ecological residential construction and is the only manufacturer in the industry to offer an integrated wooden construction system in which insulation material and construction components supplement each other. These include flexible and stable wood fiber insulation panels, composite thermal insulation systems, insulation panels with a reinforcing effect, as well as cavity wall insulation made of wood fibers and cellulose.

The construction elements comprise I-joists and laminated veneer lumber. In addition, the STEICO group also produces hardboards (Natural Fibre Boards) and operates in the wood trade.

The Munich-based company’s products are used in new construction and when renovating roofs, walls, ceilings, floors and facades. STEICO’s products allow the construction of future-proof, healthy buildings with a particularly high quality of living and a healthy atmosphere. STEICO’s products offer reliable protection against cold, heat and also noise, and they permanently improve the building’s energy efficiency.

Source: Steico SE

Business Modell

Steico earns his money by selling sustainable high-performance building materials from Halz for house construction and expansion. The focus of the business is on B2B.

As expected, Steico’s business model has not been crisis-proof against the corona crisis. There was less growth due to delays at construction sites, lockdown measures and cancellation of projects. However, it was possible to iron out this kink in the course of the year. The trend towards sustainable building materials and the growing importance of wooden building materials underpinned this trend.

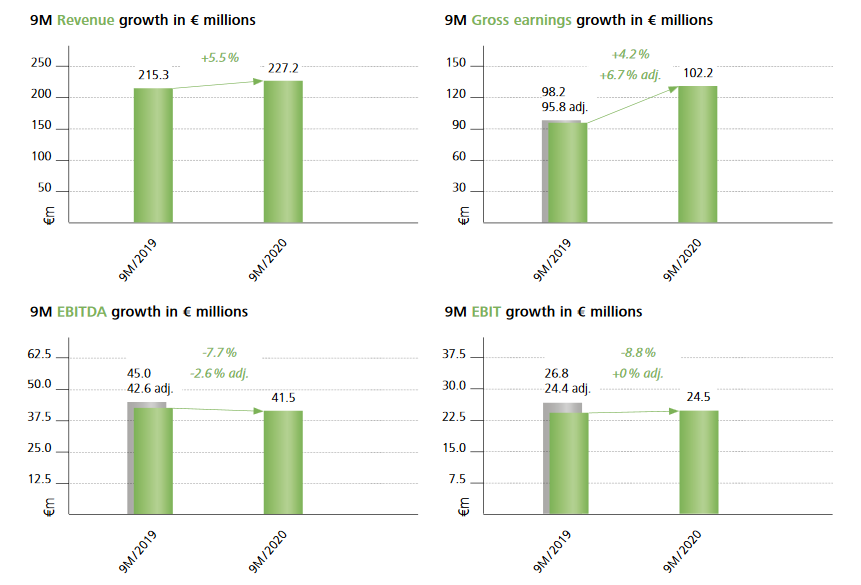

Steico is earning well despite the current crisis and can report an EBITDA margin of around 18.7%. On the sales side, overall growth of 5-7% is expected for 2020.

Note: Steico’s Q3 earnings / Source

What makes them special?

Steico’s special feature is that they are a small niche player and focus their business entirely on sustainable, high-performance building materials made of wood. This focus not only optimizes thei production costs and thus improves margins, but also allows them to achieve higher prices. At the same time, the trend towards sustainability and wooden building materials is increasing. So on the one hand we have a strong efficiency and cost discipline with a very boring product, and on the other hand a double growing market. Steico is also not missing out on these growth opportunities by investing in additional plants and locations in Europe. A new plant in Poland is being planned and should bring new growth in 2022.

Note: Steico’s CzarnaWoda facility / Source

Numbers and News

Despite Corona, Steico was able to increase its sales and also its EBITDA slightly compared to the previous year. Due to the additional investments and the growing market, Steico should be able to achieve double-digit growth rates in the coming years. The current valuation is already justified and Steico does not seem to be very favorable at this point. Nevertheless, Steico is a wonderfully managed company, with a clear focus that ensures good margins. Steico should therefore continue to grow in the coming years, and so should the share price.

For additional informations, please have a look at their latest earnings news.

Sunrun

Quick Info

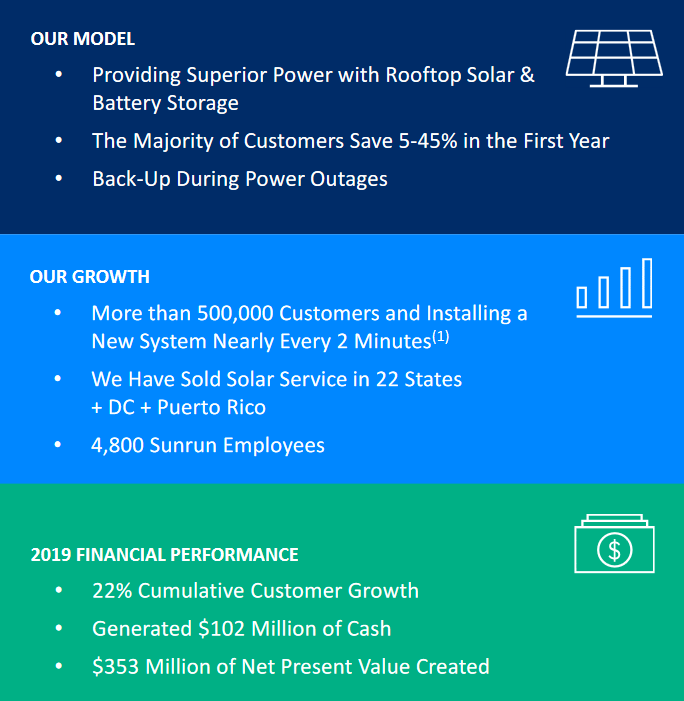

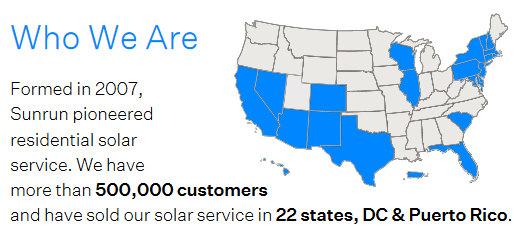

Sunrun Inc. (Nasdaq: RUN) is the nation’s leading home solar, battery storage, and energy services company. Founded in 2007, Sunrun pioneered home solar service plans to make local clean energy more accessible to everyone for little to no upfront cost. Sunrun’s innovative home battery solution, Brightbox, brings families affordable, resilient, and reliable energy. The company can also manage and share stored solar energy from the batteries to provide benefits to households, utilities, and the electric grid while reducing our reliance on polluting energy sources. For more information, please visit www.sunrun.com.

Source: Sunrun

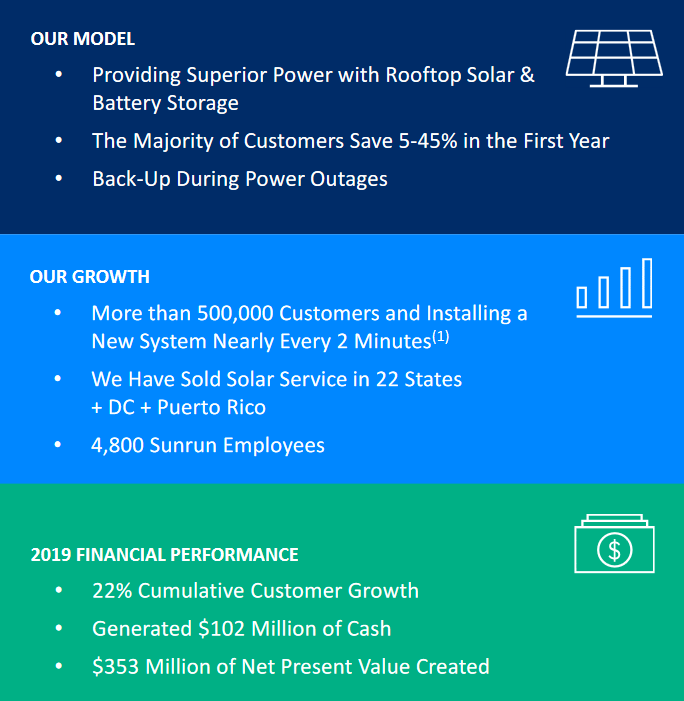

Business Modell

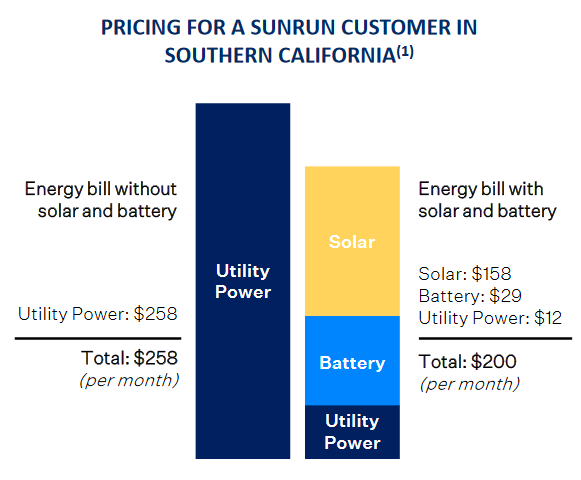

Sunrun has an ingenious, but also somewhat more complex business model. Sunrun works closely with small electrical companies that can install solar systems. Private customers, who are interested in a solar system, can purchase it from Sunrun and then have it installed by one of these smaller subcontractors. So far so simple. But Sunrun has built a sophisticated subscription model from the simple sale of the systems, which makes Sunrun a giant solar power producer. The high investment costs / acquisition costs of a solar plant deter many, not wealthy prospective customers. Here Sunrun takes this customer under the arm and finances the plant completely for the customers. In return, they pay off the system in the form of interest and payments for the solar power – on average, such a contract is for 20 years. This way, Sunrun has recurring revenues per customer over 20 years and profits from rising electricity prices, as it sells the electricity to its subscribers. At the same time, the cost of solar power systems decreases. Due to the close cooperation with subcontractors, the model is extremely scalable. Important key figures for Sunrun are the price per kwh, the amount of kwh produced and the number of its customers.

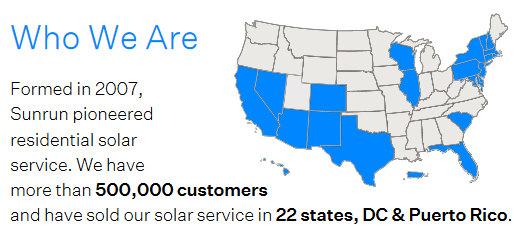

Note: Sunrun at a glance / Source

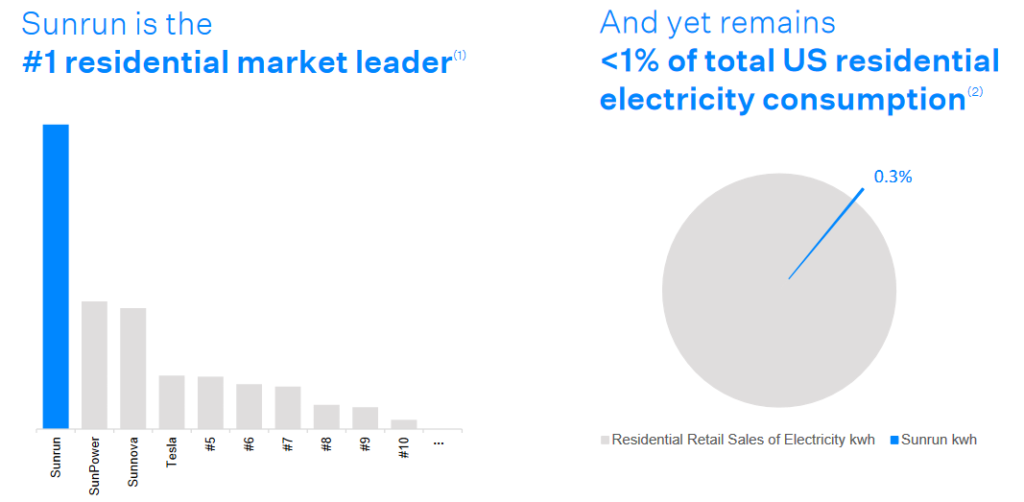

What makes them special?

Once you understand the ingenuity of the business model and its potential, you already have enough special features that speak for Sunrun. The costs for solar modules and energy storage are continuously decreasing, thanks to a high supply and cheaper suppliers. Furthermore, the price of electricity in the USA is rising – about 32% in the last 10 years alone. If Sunrun were to pass this price increase on to its customers, it would result in another nice increase in sales per customer. Through this ever-growing price range, Sunrun can increase its margins and achieve even better cash flows, as well as grow more strongly.

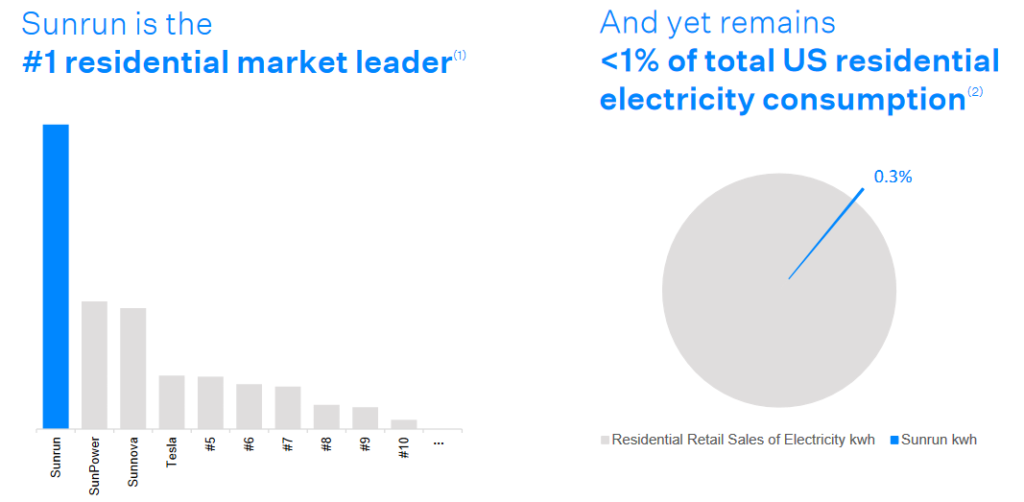

Note: Sunrun’s marketshare / Source

Sunrun currently has only 500,000 customers in 22 states and therefore still has extreme growth potential – Joe Biden’s focus on solar energy and its promotion should further accelerate this. In addition, Sunrun wants to continue to grow through aggressive acquisitions, such as the latest one from Vivint Solar. Vivint Solar is also a provider of solar energy systems and similar to Sunrun.

Other products besides solar systems such as energy storage systems promise further cross-selling opportunities and revenue, as well as subscription increases.

Note: Sunrun’s geographical footprint / Source

Numbers and News

Sunsrun’s latest news were the Q3 figures for the year 2020. Sunrun could not increase its sales compared to the previous year, but could increase its customers by 20% and the number of megawatts produced by 40%. Through cost efficiencies, however, the profit could be increased. The acquisition of Vivint Solar was also completed.

Sunrun is definitely very highly valued, but thanks to the contractual models, sales can be predicted very well – so good forecasts can be made. Because of the almost Corona Independent model, Sunrun can grow extremely strong in the next years. Sunrun is a clear candidate for purchase.

For additional informations, please have a look at their latest earnings news.

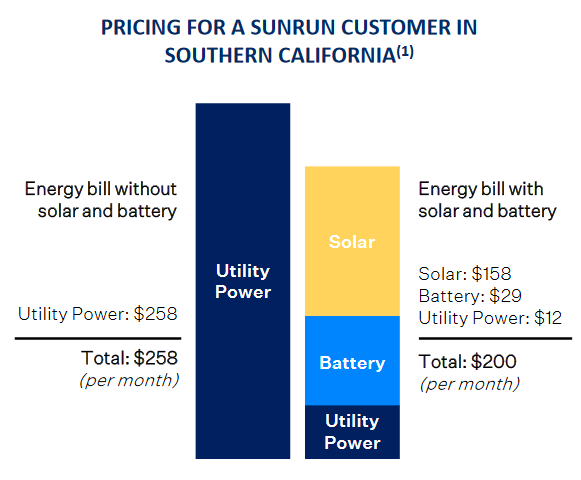

Note: Sunrun’s typical pricing / Source

Conclusion

The stocks presented in this article all had medium to small restrictions due to the current pandemic. Nevertheless, almost all companies have managed to grow further and continue their previous performance. All companies have one thing in common: they are operating in the megatrend of sustainability – which is why many of these shares seem to be highly valued at first glance. At second glance, however, the (guaranteed) potential behind these stocks and their business models is evident. All stocks in this article should experience strong further growth in the coming years to benefit from the sustainable trend and the continuous improvement of our environment. Every stock, whether a big company like Sunrun or a small one like Steico, makes a good addition to any portfolio and is a nice addition to the many tech stocks.

Use the current market weakness and look for cheap entry points for the green stocks you like. Think about, if the current sell off or high price of the stock you are watching reflects the strength or weakness of the companys business model in relation to the Covid-19 pandemic and the bright future it has to offer.

General Warning

Due to the marketcap and the float (the amount of shares circling around and traded, which are not held by major investors) of shares, there are certain risks and an medium volatility.

Disclaimer & Conflict of interest

The author currently does NOT hold a position in one or more of the mentioned stocks. The author intends to buy one or more of the above mentioned stocks short after the release of this article. The mentioned companies do NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Steico SE - Article

Big Game Hunt: Green-Edition - Alfen, Casella, Steico and Sunrun

Note: A Casella Bin / Source

Table of Content:

- Author's Opinion

- Alfen

- Casella

- Steico

- Sunrun

- Conclusion

Author's Opinion

With the next issue of Big Game Hunt we would like to present green and sustainable investment opportunities in the direction of sustainable building materials, electrification and waste management. Why all this? There are many reasons: For one thing, the stock exchange always trades the future and already prices much of the future into the present. So why invest in old and non-functioning business models or long obsolete raw materials or companies, when you can also invest in companies and areas that are only just emerging now and are far from reaching their peak point. So an investment in sustainability not only calms your conscience, but also ensures that we will still have a promising business model in ten years or more. A further point is that environmental protection and sustainability is everyone's business - so if we want to do something about it, we could do it on the stock market and invest at least a small amount in the environment and environmentally friendly technologies - so several people benefit from it. The last point is that just because a company focuses on green and sustainable technologies, it doesn't have to be boring or unprofitable. These companies, whose products, services or technologies are popular and much sought after, often have strong growth figures, high profitability and a very high dynamic. So let's take a look at a few interesting candidates from this segment - but before we do so, let's first take a brief look at what might be relevant for these companies.

Business Model

Due to the large and varying number of business models, each of them will be outlined individually and briefly. Basically, however, it can be said that we have both business-to-customer and business-to-business models. Sometimes there are individual sales and services, sometimes there are long-term contracts, which provide for recurring revenues.

Due to the corona pandemic, some companies have suffered greater losses than others. A waste management company has probably suffered less than a building materials manufacturer, for example. Because due to the pandemic, some construction sites / construction projects had to be stopped or cancelled, while waste and its disposal always take place.

Growth

Both small and large companies are presented. Regardless of the size, the markets and geographical possibilities considered offer many years of potential growth. Not only the companies can grow, but also the markets. One example is waste management - here not only the annual amount of waste is growing, but there are also more households and companies that need fair disposal. In addition, segments such as recycling are becoming more and more important, offering additional growth opportunities. Moreover, from a geographical point of view, expansion offers much more growth potential. So we have a market that is growing very broadly and offers a lot of growth potential, as well as geographical opportunities. Laws and the increasingly important environmental protection offer additional opportunities and dynamics.

Competition

As in almost every business unit, there is a lot of competition and rivals in the business units presented later. However, for many business models, this should not directly affect anything. Here, too, the example of the ice cream parlor chain can be applied: A chain of ice-cream parlors that currently specializes in the East Coast will not be disturbed by a chain of ice-cream parlors on the West Coast for the time being. Both chains can expand in peace and meet in the middle and only then do they have to worry about competition. However, this process takes several years and offers the company the opportunity to prepare itself fully for this. In addition, sometimes an increasing density of services or clustering, like EV ("EV = Electrical vehicle") loading stations is a big plus.

If there are several competing chains in the same segment, it is not the size but the geographic footprint, the clustering / density and the distribution-channels that matters.

Marketing & Reputation

Since the presented companies stand strongly for sustainability, innovation and a better environment, or want to achieve this themselves, they generally have a good reputation. This makes it all the more important that the companies actively live this and take it seriously, and do not build a "green" dummy facade to jump on the bandwagon.

Tips and Tricks

To get a better picture of the company, it can't hurt to check out their rating portals or the social media channels. That way you won't miss any new offers, technologies or services.

Alfen

Note: An Alfen EV loading station / Source

Quick Info

Netherlands-based Alfen is operating internationally in the heart of the energy transition, as a specialist in energy solutions for the future. With over 80-years’ history, Alfen has a unique combination of activities. Alfen designs, develops and produces smart grids, energy storage systems, and electric vehicle charging equipment and combines these in integrated solutions to address the electricity challenges of its clients. Alfen has a market leading position in the Netherlands and experiences fast international growth benefitting from its first mover advantage. For further information see Alfen’s website at: www.alfen.com

Source: Alfen

Business Modell

Alfens business model is a little more complex compared to that of simple restaurants. Alfen's business is divided into three main businesses, namely smart grids, charging solutions for electric vehicles and energy storage systems. The Smart Grids business is the largest area of Alfen's business in terms of sales, but also the area with the lowest percentage growth. Furthermore, charging solutions make up the 2nd largest segment and also deliver the 2nd highest percentage growth rates. The energy storage systems are still a very small business area, but achieve 3-digit percentage growth rates compared to the previous year. They are therefore the fastest growing business segment.

Alfen's business has partly suffered from the Corona Pandemic, as especially large projects in the field of smart grids have been postponed or cancelled. Despite these postponements and cancellations, the business still grew very strongly and developed dynamically.

Alfen earns its money by developing and selling products, mostly in large projects and framework agreements, which ensure high scalability and recurring revenues. Additionally, they offer additional added value and potential through intelligent solutions and software.

What makes them special?

Alfens speciality is that we have here a mature "pure play" in the electrical transformation / evolution. Alfen writes positive figures, can show a very strong growth despite a corona pandemic and is operating in an extremely fast growing and state-subsidized market, which will not be saturated in 20 years.

Note: Alfen is busy in a high growth market / Source

With their more than strong foundation in smart grids, they can continue to drive other very strong growth drivers such as charging systems and energy storage.

Alfens management currently assumes that the electrification and thus also the growth of Alfen will accelerate even further.

Note: Alfens impressive growth numbers - Alfen expects that their growth will further accelerate / Source

Numbers and News

Alfens was able to rebounce their business during the pandemic. They have delivered solid numbers and performed incredible. They have managed to increase their "Smart-Grid"-Sales about 23% in the third quarter of 2020. In addition, they were able to increase their "EV-Charging Solutions"-Sales about 72%. Finally, their "Energy-Storage"-Sales surged 488% Year-over-Year. Considering that Alfen has achieved such incredibly strong growth figures despite the pandemic and the cancellation of many projects, these figures are more than strong. Assuming that Alfen can maintain such growth figures and accelerate growth even more in the future, Alfen is a true green future play. Another bonus is the currently still profitable growth. Alfen has also reiterated their revenue outlook for 2020 with $180-200M.

For additional informations, please have a look at their latest earnings news.

Casella Waste Systems

Note: A Casella garbage truck / Source

Quick Info

Casella Waste Systems, Inc., headquartered in Rutland, Vermont, provides resource management expertise and services to residential, commercial, municipal and industrial customers, primarily in the areas of solid waste collection and disposal, transfer, recycling and organics services in the northeastern United States. For further information visit the Company’s website at http://www.casella.com.Source: Casella

Business Modell

Casellla is a typical waste management company. Casella's business is currently limited to a few states in the Northeastern United States, which makes it a rather small national company. Casella earns most of its money by recycling garbage, collecting garbage, disposing of garbage, transferring garbage and organically breaking down (gas) garbage. To achieve this, Casella has a whole armada of clustered sites to ensure efficiency and customer proximity. Casella serves normal households, communitys and businesses.

Approximately 75% of Casella's turnover is generated with solid waste, i.e. the removal and disposal of waste. Casella generates the remaining 25% with services related to recycling. Solid Waste offers Casella's highest-margin business. The current EBITDA margin ("EBITDA = Earning before interest, taxes, deprecation & amortization") is around 27.4%.

Since Casella earns its money with the processing of garbage, rising garbage quantities are very decisive for the further development of the business, as well as an important characteristic number in the waste management.

Due to the corona pandemic, Casella had some revenue impacts, because the waste amount decreased. The reason for that was, that many business had to close or decreased production, which led to an decrease in waste-amounts, which resulted in a slight decrease in revenues for Casella.

Note: Casella's clustered operations in the Northeast U.S. / Source

What makes them special?

Casella is slowly but constantly growing. Due to the ever-increasing global consumption and the resulting increase in waste production, Casella is profiting optimally from this negative trend. Since services such as recycling are also becoming increasingly important in the USA, further growth is also to be seen here. Casella also has a potential acquisition pipeline of currently over $400M in sight. Acquisitions of this kind not only enable personnel cost reductions to be achieved, but also create synergies by clustering locations.

Casella is also looking to increase revenue through price increases in monopolistic offerings and services. Furthermore, they want to become more efficient by optimizing collection operations and using modern technologies. The focus and expansion of services such as recycling and acquisitions should bring further growth.

Note: Casella's most recent acquisitions / Source

Despite Casella's many expenditures for optimization, acquisitions and ongoing operations and innovations, Casella has managed to report significantly increased profits and cash flows in recent quarters. This is an impressive achievement.

Numbers and News

Casella's latest news were the quarterly figures. Due to the reduced waste volume caused by the Corona pandemic, sales increased by only 2% compared to the previous year. However, profits increased by 22% to approximately $15m. Due to improving conditions, the outlook for the current year was raised. Sales of up to $775M and a profit of up to $28 are now expected. What is very impressive, however, is the fact that profits have increased so much, even though the amount of solid wastes has decreased by about 8.5%. This clearly shows that the efforts of the management to improve the profitability and efficiency of operations are bearing fruit.

It was also announced that this year's acquisitions will provide approximately $21m of additional revenue for Casella. This clearly shows that Casella is strongly interested in growth and investment despite the crisis.

Although Casella is already highly valued at present, the figures provided, the strong business development and also the broad view into the future speak for an investment in Casella.

Note: Casella's strong growth / Source

For additional informations, please have a look at their latest earnings news.

Steico

Quick Info

STEICO develops, produces and markets ecological construction products made of renewable raw materials. STEICO is the European market leader for wood fiber insulation materials.STEICO is positioned as a system provider for ecological residential construction and is the only manufacturer in the industry to offer an integrated wooden construction system in which insulation material and construction components supplement each other. These include flexible and stable wood fiber insulation panels, composite thermal insulation systems, insulation panels with a reinforcing effect, as well as cavity wall insulation made of wood fibers and cellulose.

The construction elements comprise I-joists and laminated veneer lumber. In addition, the STEICO group also produces hardboards (Natural Fibre Boards) and operates in the wood trade.

The Munich-based company’s products are used in new construction and when renovating roofs, walls, ceilings, floors and facades. STEICO’s products allow the construction of future-proof, healthy buildings with a particularly high quality of living and a healthy atmosphere. STEICO’s products offer reliable protection against cold, heat and also noise, and they permanently improve the building’s energy efficiency.

Source: Steico SE

Business Modell

Steico earns his money by selling sustainable high-performance building materials from Halz for house construction and expansion. The focus of the business is on B2B.

As expected, Steico's business model has not been crisis-proof against the corona crisis. There was less growth due to delays at construction sites, lockdown measures and cancellation of projects. However, it was possible to iron out this kink in the course of the year. The trend towards sustainable building materials and the growing importance of wooden building materials underpinned this trend.

Steico is earning well despite the current crisis and can report an EBITDA margin of around 18.7%. On the sales side, overall growth of 5-7% is expected for 2020.

Note: Steico's Q3 earnings / Source

What makes them special?

Steico's special feature is that they are a small niche player and focus their business entirely on sustainable, high-performance building materials made of wood. This focus not only optimizes thei production costs and thus improves margins, but also allows them to achieve higher prices. At the same time, the trend towards sustainability and wooden building materials is increasing. So on the one hand we have a strong efficiency and cost discipline with a very boring product, and on the other hand a double growing market. Steico is also not missing out on these growth opportunities by investing in additional plants and locations in Europe. A new plant in Poland is being planned and should bring new growth in 2022.

Note: Steico's CzarnaWoda facility / Source

Numbers and News

Despite Corona, Steico was able to increase its sales and also its EBITDA slightly compared to the previous year. Due to the additional investments and the growing market, Steico should be able to achieve double-digit growth rates in the coming years. The current valuation is already justified and Steico does not seem to be very favorable at this point. Nevertheless, Steico is a wonderfully managed company, with a clear focus that ensures good margins. Steico should therefore continue to grow in the coming years, and so should the share price.

For additional informations, please have a look at their latest earnings news.

Sunrun

Quick Info

Sunrun Inc. (Nasdaq: RUN) is the nation’s leading home solar, battery storage, and energy services company. Founded in 2007, Sunrun pioneered home solar service plans to make local clean energy more accessible to everyone for little to no upfront cost. Sunrun’s innovative home battery solution, Brightbox, brings families affordable, resilient, and reliable energy. The company can also manage and share stored solar energy from the batteries to provide benefits to households, utilities, and the electric grid while reducing our reliance on polluting energy sources. For more information, please visit www.sunrun.com. Source: Sunrun

Business Modell

Sunrun has an ingenious, but also somewhat more complex business model. Sunrun works closely with small electrical companies that can install solar systems. Private customers, who are interested in a solar system, can purchase it from Sunrun and then have it installed by one of these smaller subcontractors. So far so simple. But Sunrun has built a sophisticated subscription model from the simple sale of the systems, which makes Sunrun a giant solar power producer. The high investment costs / acquisition costs of a solar plant deter many, not wealthy prospective customers. Here Sunrun takes this customer under the arm and finances the plant completely for the customers. In return, they pay off the system in the form of interest and payments for the solar power - on average, such a contract is for 20 years. This way, Sunrun has recurring revenues per customer over 20 years and profits from rising electricity prices, as it sells the electricity to its subscribers. At the same time, the cost of solar power systems decreases. Due to the close cooperation with subcontractors, the model is extremely scalable. Important key figures for Sunrun are the price per kwh, the amount of kwh produced and the number of its customers.

Note: Sunrun at a glance / Source

What makes them special?

Once you understand the ingenuity of the business model and its potential, you already have enough special features that speak for Sunrun. The costs for solar modules and energy storage are continuously decreasing, thanks to a high supply and cheaper suppliers. Furthermore, the price of electricity in the USA is rising - about 32% in the last 10 years alone. If Sunrun were to pass this price increase on to its customers, it would result in another nice increase in sales per customer. Through this ever-growing price range, Sunrun can increase its margins and achieve even better cash flows, as well as grow more strongly.

Note: Sunrun's marketshare / Source

Sunrun currently has only 500,000 customers in 22 states and therefore still has extreme growth potential - Joe Biden's focus on solar energy and its promotion should further accelerate this. In addition, Sunrun wants to continue to grow through aggressive acquisitions, such as the latest one from Vivint Solar. Vivint Solar is also a provider of solar energy systems and similar to Sunrun.

Other products besides solar systems such as energy storage systems promise further cross-selling opportunities and revenue, as well as subscription increases.

Note: Sunrun's geographical footprint / Source

Numbers and News

Sunsrun's latest news were the Q3 figures for the year 2020. Sunrun could not increase its sales compared to the previous year, but could increase its customers by 20% and the number of megawatts produced by 40%. Through cost efficiencies, however, the profit could be increased. The acquisition of Vivint Solar was also completed.

Sunrun is definitely very highly valued, but thanks to the contractual models, sales can be predicted very well - so good forecasts can be made. Because of the almost Corona Independent model, Sunrun can grow extremely strong in the next years. Sunrun is a clear candidate for purchase.

For additional informations, please have a look at their latest earnings news.

Note: Sunrun's typical pricing / Source

Conclusion

The stocks presented in this article all had medium to small restrictions due to the current pandemic. Nevertheless, almost all companies have managed to grow further and continue their previous performance. All companies have one thing in common: they are operating in the megatrend of sustainability - which is why many of these shares seem to be highly valued at first glance. At second glance, however, the (guaranteed) potential behind these stocks and their business models is evident. All stocks in this article should experience strong further growth in the coming years to benefit from the sustainable trend and the continuous improvement of our environment. Every stock, whether a big company like Sunrun or a small one like Steico, makes a good addition to any portfolio and is a nice addition to the many tech stocks.

Use the current market weakness and look for cheap entry points for the green stocks you like. Think about, if the current sell off or high price of the stock you are watching reflects the strength or weakness of the companys business model in relation to the Covid-19 pandemic and the bright future it has to offer.

General Warning

Due to the marketcap and the float (the amount of shares circling around and traded, which are not held by major investors) of shares, there are certain risks and an medium volatility.

Disclaimer & Conflict of interest

The author currently does NOT hold a position in one or more of the mentioned stocks. The author intends to buy one or more of the above mentioned stocks short after the release of this article. The mentioned companies do NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Peers

All the Peers

Bluelinx Holdings Inc

Bullish

Momentus Inc.

Neutral

Mynaric AG

Neutral

Virgin Galactic Holdings Inc.

Neutral

Maxar Technologies Inc.

Neutral

Sunrun Inc.

Bullish

Alfen N.V.

Neutral