The Search

Your Search Results

News from us

Newest Symbols

Newest Industries

Click to expand

Advertising

See Stocks

Automotive

See Stocks

E-Commerce

See Stocks

E-Learning

See Stocks

Electricity

See Stocks

Engineering

See Stocks

FlexShopper Inc.

Bullish

Bullish

Tattooed Chef Inc.

Neutral

Neutral

Hellofresh SE

Bullish

Bullish

Build-a-Bear Workshop Inc.

Outperform

Outperform

Stamps.com Inc.

Bullish

Bullish

Redfin Corporation

Bullish

Bullish

Perion Network Ltd.

Outperform

Outperform

Upwork Inc.

Bullish

Bullish

Chegg Inc.

Bullish

Bullish

Pinterest Inc.

Bullish

Bullish

Bluelinx Holdings Inc

Bullish

Bullish

Momentus Inc.

Neutral

Neutral

Mynaric AG

Neutral

Neutral

Virgin Galactic Holdings Inc.

Neutral

Neutral

Maxar Technologies Inc.

Neutral

Neutral

Sunrun Inc.

Bullish

Bullish

Steico SE

Neutral

Neutral

Alfen N.V.

Neutral

Neutral

Research

Content Cards

Swipe

Our Article

Stamps.com Inc. - Article

Research: Stamps.com - The Unknown Shipping Package and Postal Profiteer

Note: Stamps.com / Source

Table of Content:

- Author’s Opinion

- Introduction to the Company

- What makes it so special?

- The Read between the lines

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author’s Opinion

Stamps.com offers interesting and well thought out shipping and packaging solutions in the form of software. It unifies many interfaces into one and offers many advantages for customers. In particular the competition is equipped by closed and badly thought out isolated solutions, which are not competitive. The ever-growing package trade on the Internet and the continuing globalization should push players in this unpenetrated market further. Little to no competition and market leadership, as well as an attractive valuation, are just a few reasons for choosing Stamps.com as an investment.

Introduction: Let the company introduce itself

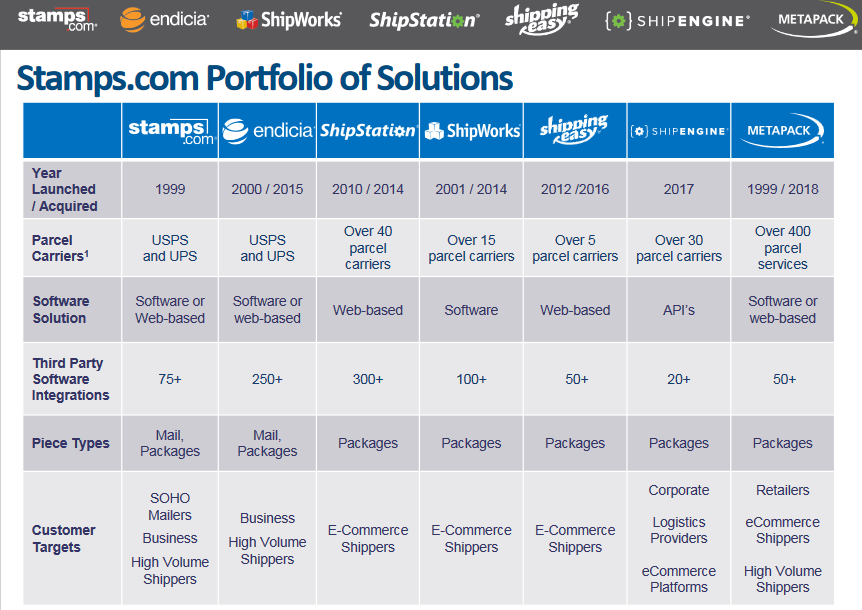

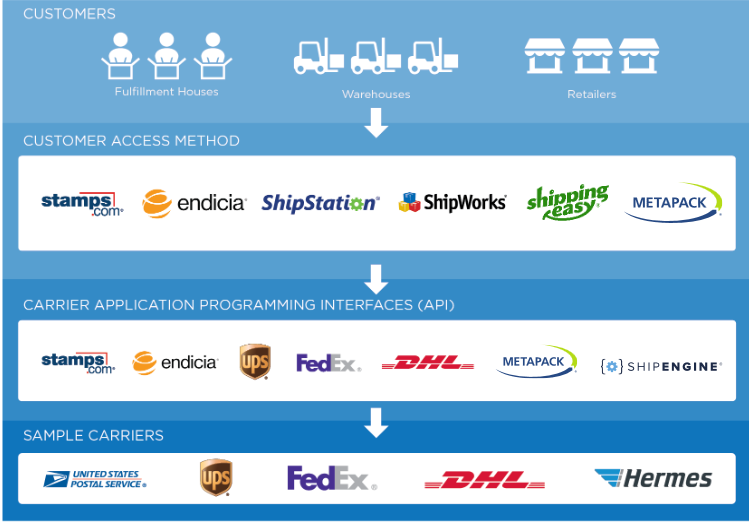

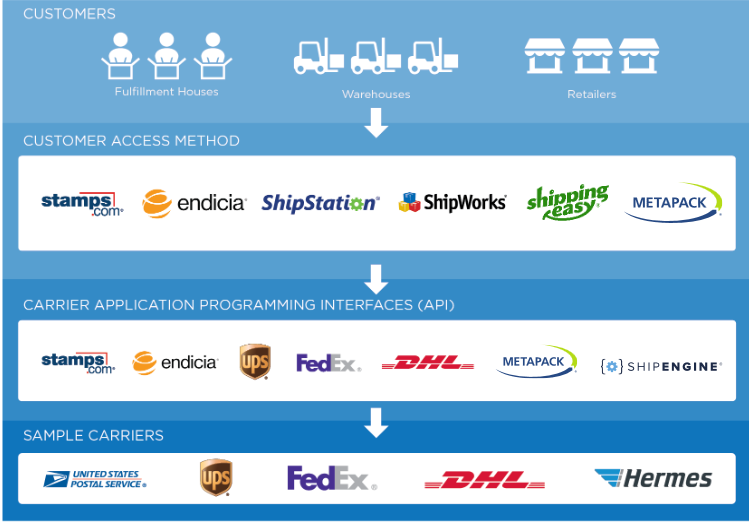

Stamps.com (NASDAQ: STMP) is the leading provider of postage online and shipping software solutions to customers including consumers, small businesses, e-commerce shippers, enterprises, and high volume shippers. Stamps.com offers solutions that help businesses run their shipping operations more smoothly and function more successfully under the brand names Stamps.com, Endicia®, ShipStation®, ShipEngine®, ShippingEasy®, ShipWorks®, GlobalPost and Metapack™. Stamps.com’s family of brands provides seamless access to mailing and shipping services through integrations with more than 500 unique partner applications.

Source: Stamps.com

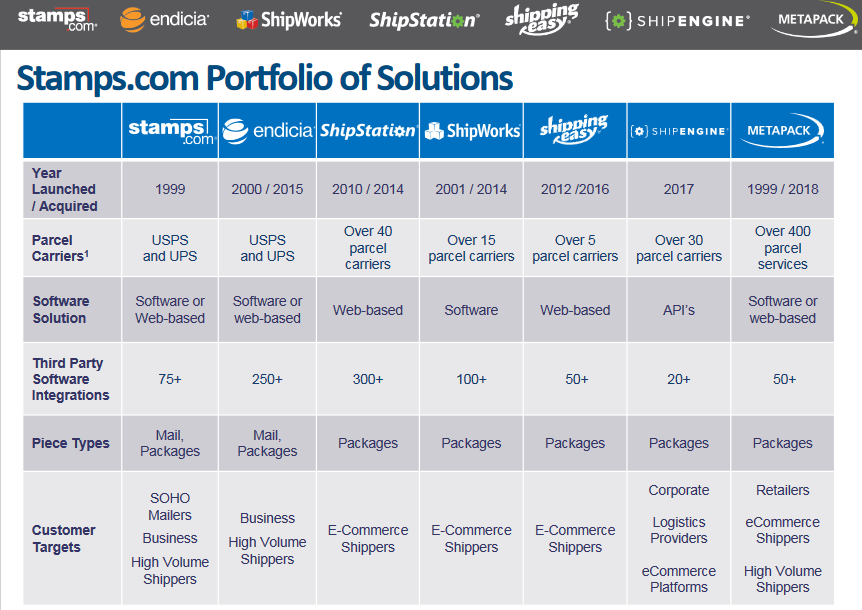

What makes Stamps.com so special?

8 Software Solutions

Note: Product overview of Stamps.com services / Source

Stamps.com

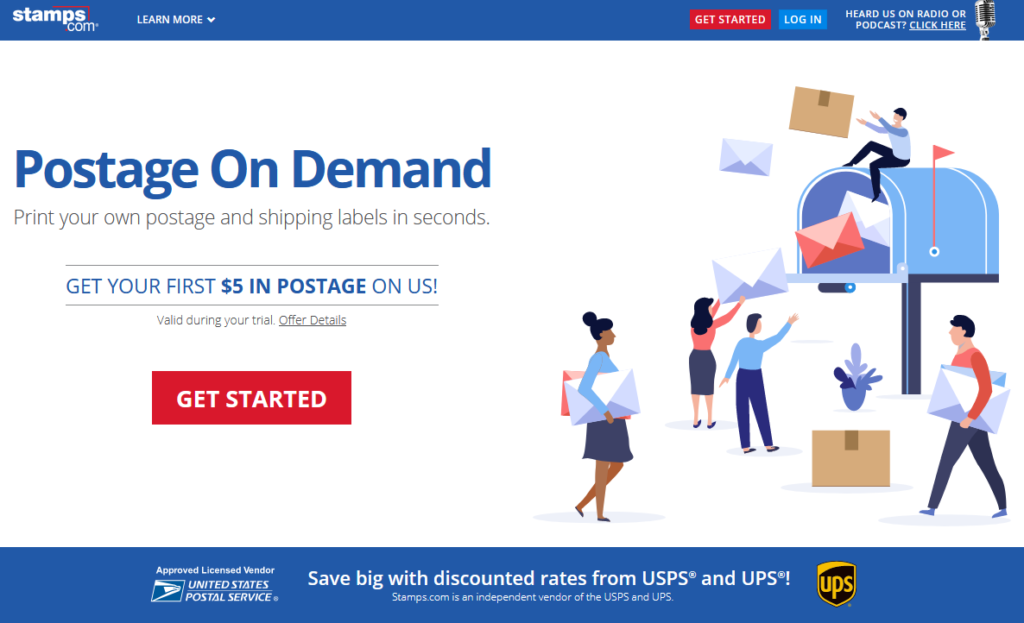

Stamps.com is an internet or desktop client service, that lets customers print USPS and UPS approved mailing and shipping labels.

Stamps.com is a monthly subcription service. That means, that the customers pays a certain amount monthly for the software and also pays in addition for the mails or packages he sends.

Therefore Stamps.com offers additional features, like marketplace integrations, batch-printing or “always the best price for your package”. Automatically take care of daily repetitive tasks (automatic emails, post back shipping details to marketplaces, pre-fill customs forms, etc.).

Note: Stamps.com software / Source

Endicia

Endicia, which is also a monthly subscription service, is mostly the same product like Stamps.com, but made for high volume USPS and UPS shipping, which makes it the ideal software for large retailers, warehouses & fulfillment centers.

Like Stamps.com, Endicia features also many integrated tools and has good connections with 3rd party services and solutions.

Note: Endicia.com software / Source

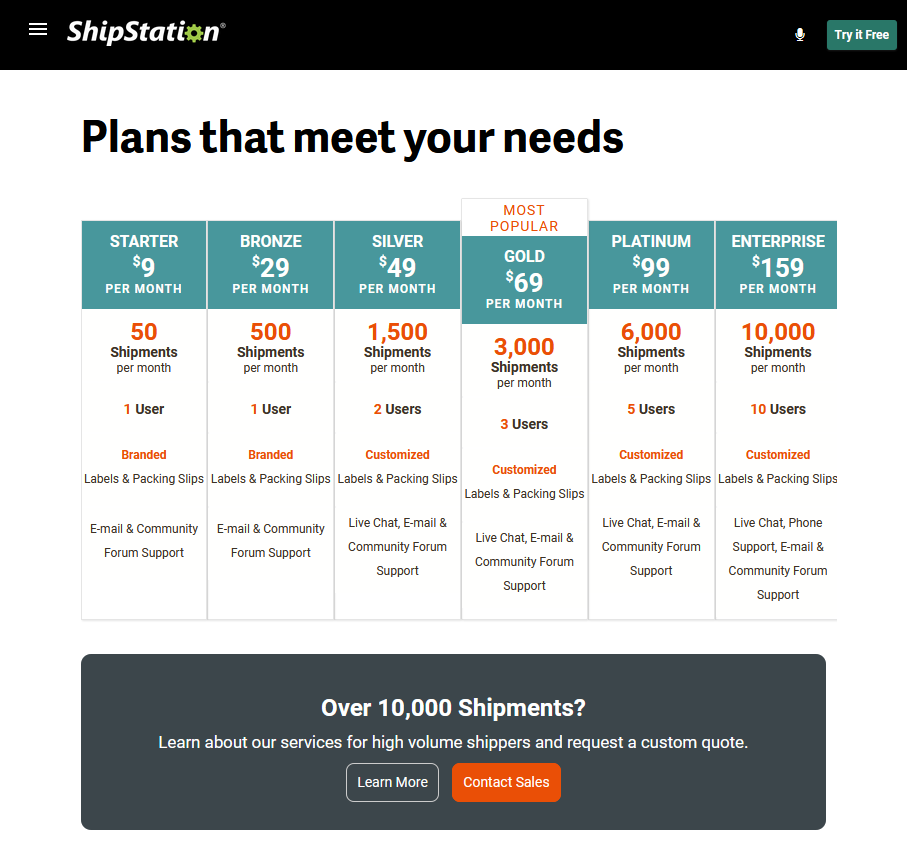

ShipStation

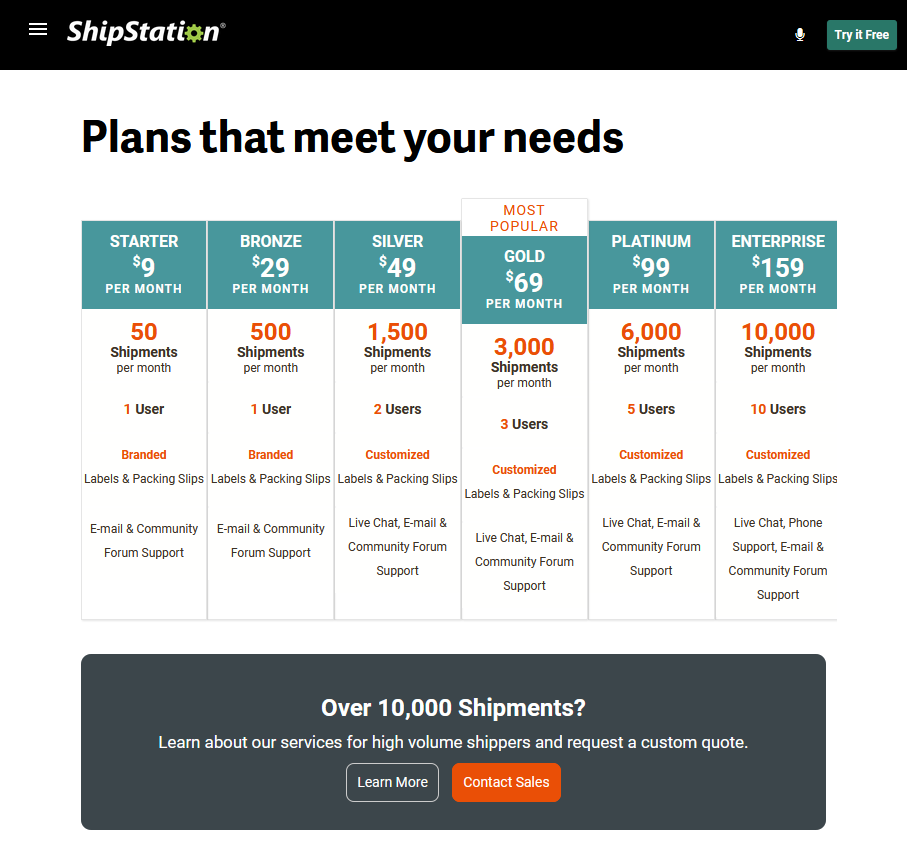

ShipStation is the leading, web-based only shipping solution, especially for e-commerce. It supports over 40 different carriers, like USPS, DHL, FedEx, Amazon Shipping, etc.

It offers about 300 partner integrations, in order to organize, fulfill and ship orders efficently. It also can handle multiple selling channels, batch printing and fraud or error detection. It features many other advantages.

ShipStation was acquired in mid of 2014, which was a really good acquisition for the company and a good addition to the product portfolio.

ShipStation is like the earlier mentiond services an subscription service, too. The customer pays for the software as a service (“SaaS”) and has to pay the shipments in addition to third party carriers.

Note: ShipStation.com software / Source

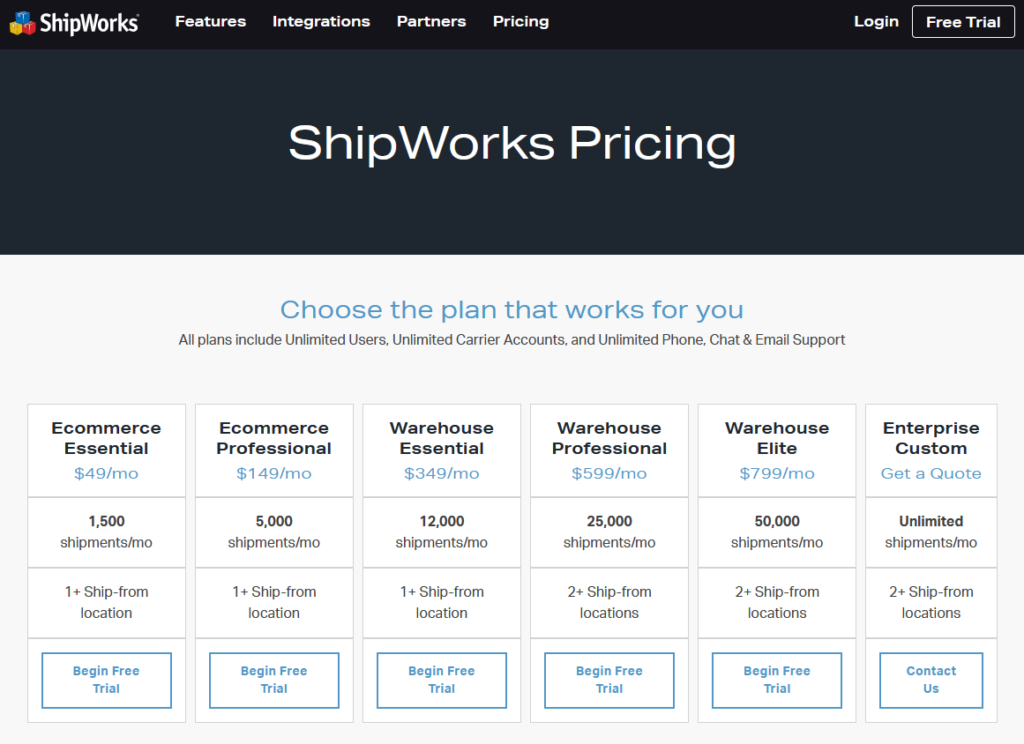

ShipWorks

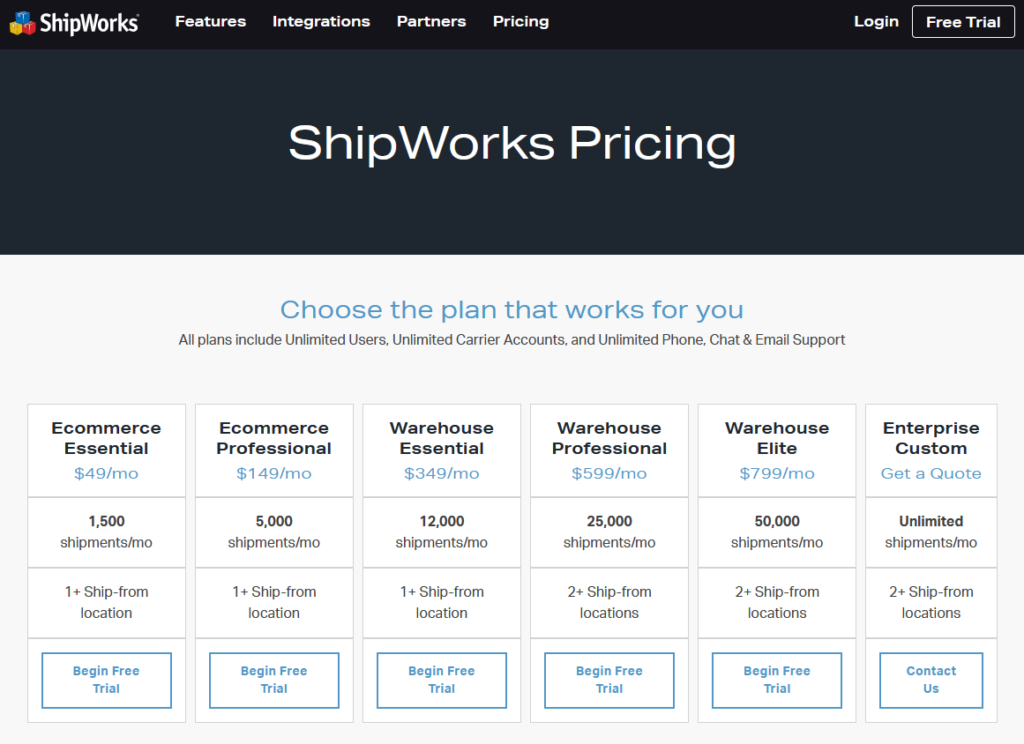

ShipWork is similar to ShipStation. It is made for big volume shipping from fullfilment centers or warehouses. It is the leading, client-based only shipping solution, especially for large retailers. It supports over 15 different carriers, like USPS, DHL, FedEx, etc.

It offers about 100 partner integrations, in order to organize, fulfill and ship orders efficently. It also can handle very complex and individual shipping forms and rules. It is also highly customizeable.

ShipWorks was also acquired in mid of 2014, which was a really good acquisition for the company and a good addition to the product portfolio.

ShipWorks is like the earlier mentiond services an subscription service, too. The customer pays for the software as a service (“SaaS”) and has to pay the shipments in addition to third party carriers.

Note: ShipWorks.com software / Source

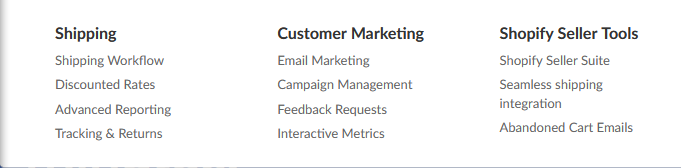

ShippingEasy

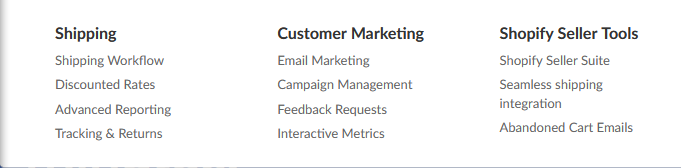

ShippingEasy has been acquired in mid 2016 and is more or less the same like ShipStation, with some extra features. It offers some extra offers / features for the “Shopify” marketplace.

Note: Shippingeasy.com software / Source

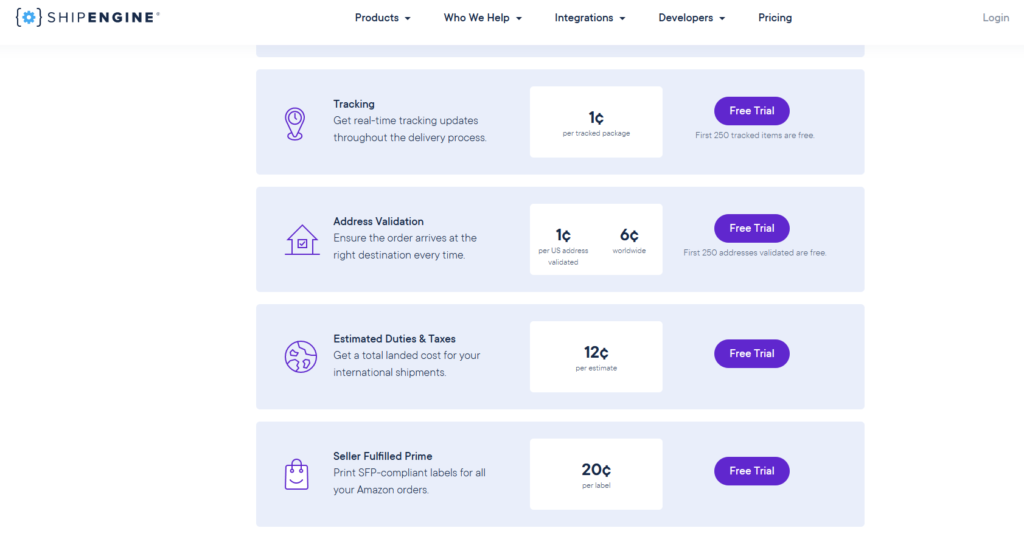

ShipEngine

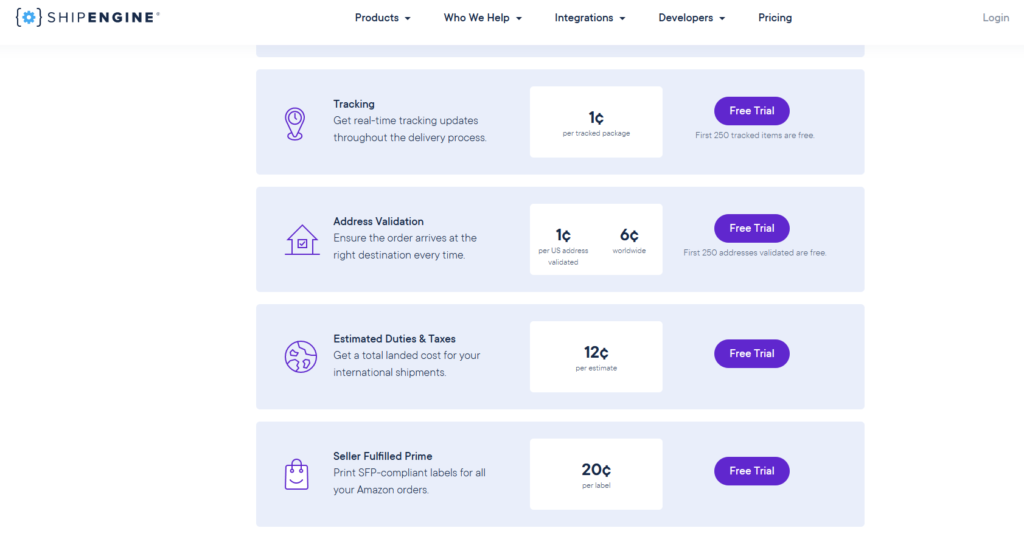

ShipEngine is the leading API solution for e-commerce shipping for software developers and a strong tool for building shipping tools or order tools.

Both the developer and the businesses are benefiting of ShipEngine:

- Leverage the same APIs Stamps.com’s affiliates use to power their shipping platforms

- Faster time to market for a user’s project offering the full breadth of services to its customers

- A world-class customer experience provided and backed by Stamps.com

And how does ShipEngine profit from that? ShipEngine earns a little amount per Action, which is generated over these APIs. For example an action can be a tracked package, a package rate quote or a label generation. For each action, which is executed or queried over the API, ShipEninge earns about 1 to 20$ cent. Imagine the revenue and scalability.

Note: ShipEngine.com software pricing / Source

GlobalPost

GlobalPost is a very simple and easy service made for international shipping. The customer can choose the cheapest rate for his package and then track it internationally.

GlobalPost offers a range of domestic and international shipping solutions that simplifies parcel shipping while saving you money. By combining our world-class customer service, easy-to-use technology and seamless integrations with the world’s top shipping platforms, we help e-commerce and warehouse sellers succeed domestically and around the world.

Source: GlobalPost.com

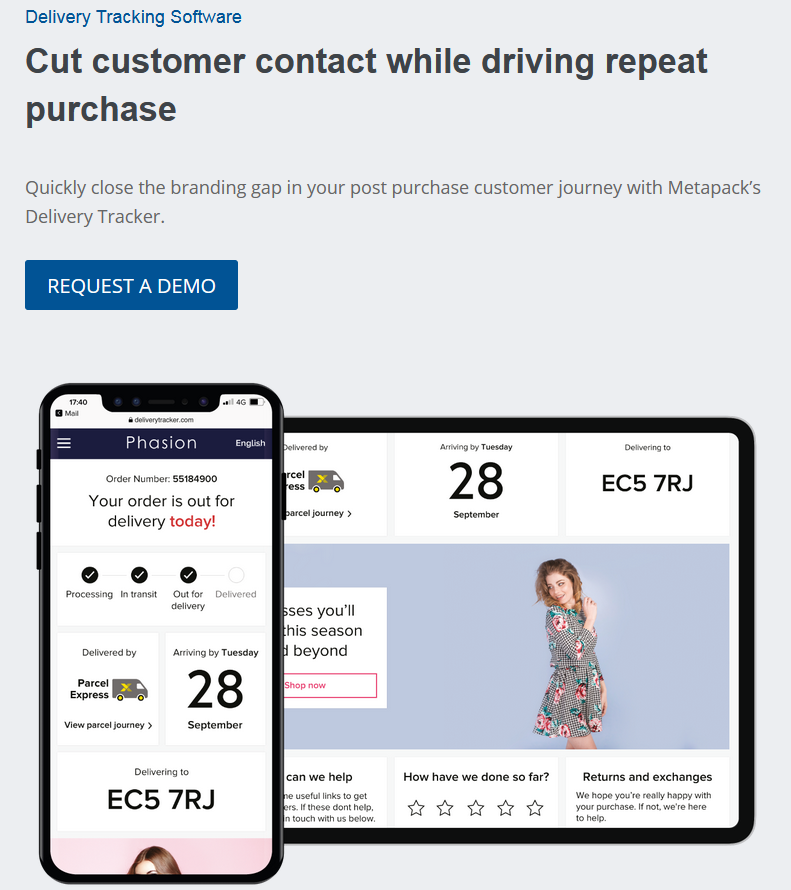

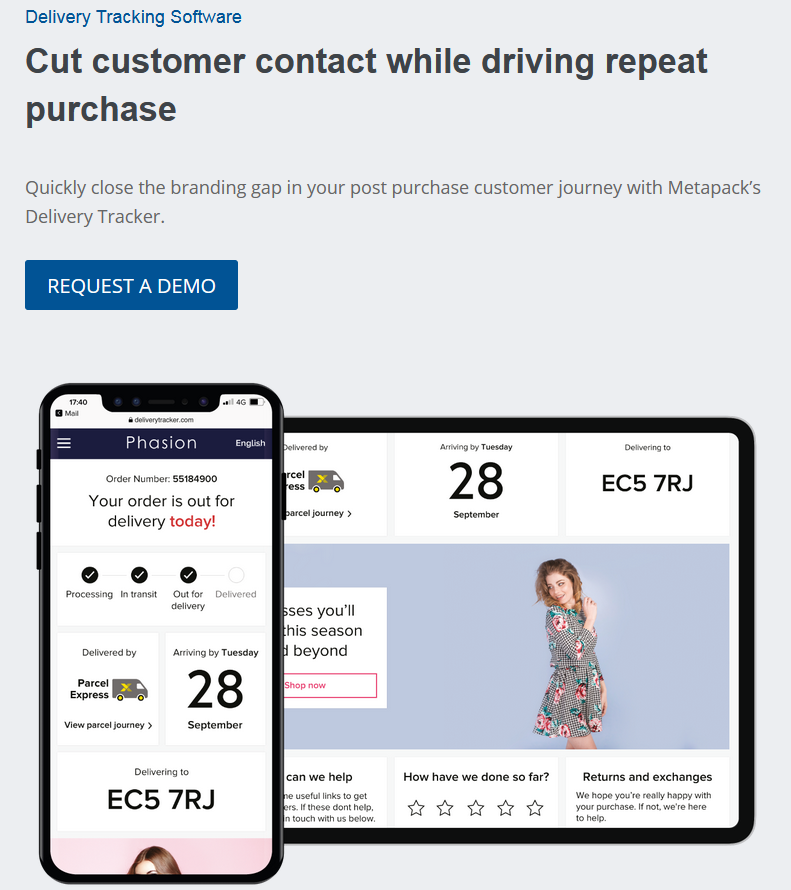

MetaPack

MetaPack was acquired by Stamps.com in mid 2018.

Metapack is the leading provider of eCommerce delivery management technology to enterprise retailers and brands. Our platform integrates over 400 carriers and 5,500 delivery services such as Next Day, Click and Collect, Locker Boxes, and International Delivery – ensuring that retailers and brands can offer delivery options and convenience for their customers.

For each and every order, Metapack is able to identify the most appropriate delivery service for that particular customer, providing a seamless and personalized delivery experience, whilst removing manual and time-consuming processes in the retailer’s warehouse.

Metapack’s delivery management platform enables retailers and brands worldwide to strengthen their delivery proposition, generate customer loyalty and website conversion, ensuring every customer has the best delivery experience.

Source: Metapack.com

In short, MetaPack provides different software solutions made for the shipping and ecommerce universe and offers them to e-commerce companys, retailers and high volume shippers.

Metapack has no public pricing list, it offers individual solutions.

Note: Metapack.com shipping tracking solution / Source

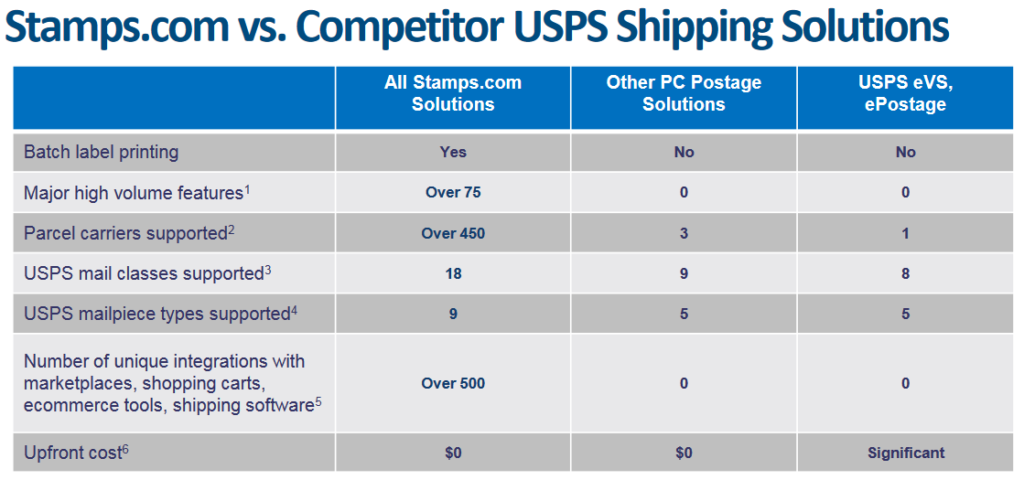

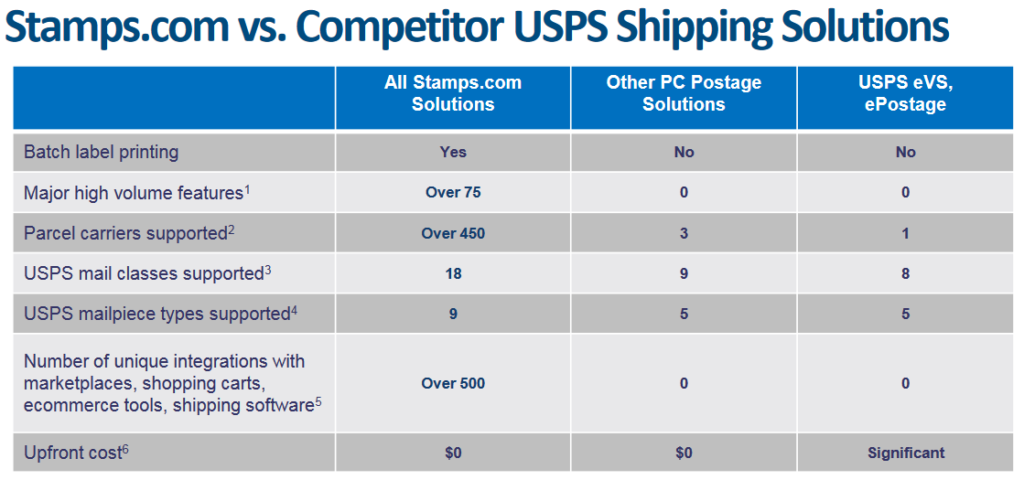

Integrated Platform vs. “Island Solutions”

One of the biggest advantages of Stamps.com and the company’s other related software tools is the open and integrated approach on which the software is based. Every software is strongly focused on the highest possible level of integration and usability. This means that the software supports as many parcel / postal services as possible, such as “DHL” or “UPS”, but also marketplaces like “Etsy”, “Amazon” or “Shopify”. Even small store systems like “Woocommerce” or “Wix” can be connected quite naturally to offer store operators of any size or professionalism a functioning software.

In contrast to that, there is no comparably good competition on the market. Many parcel / postal services rely on their own strongly limited isolated solutions, which cannot be integrated with other services or are difficult to integrate. This is a clear advantage for Stamps.com and the other software tools of Stamps.com. So Stamps.com is revolutionizing the old and not integrated software tools.

Note: Stamps.com vs. competitive software / Source

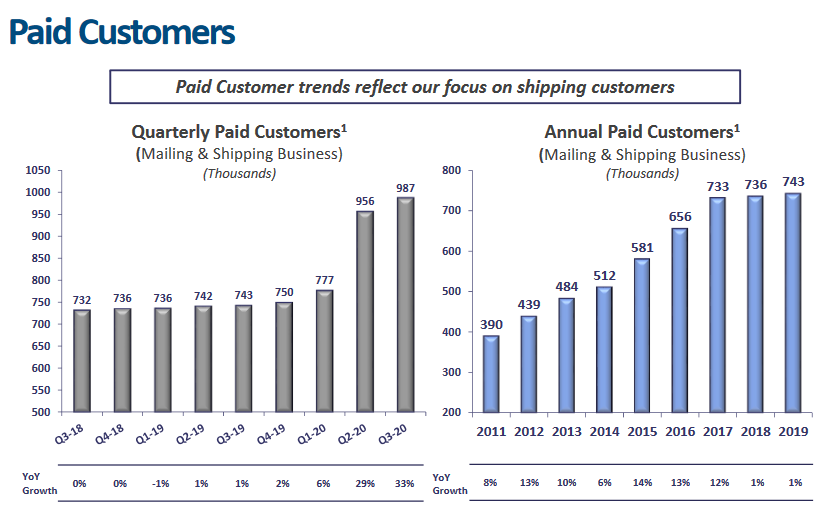

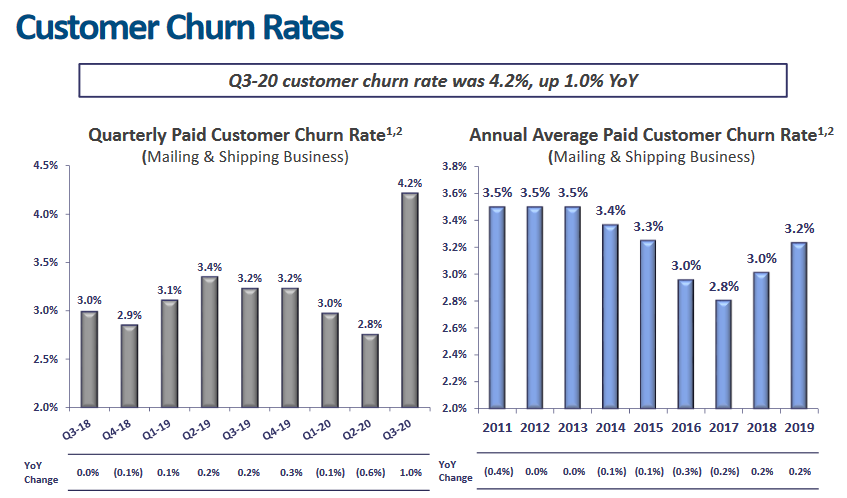

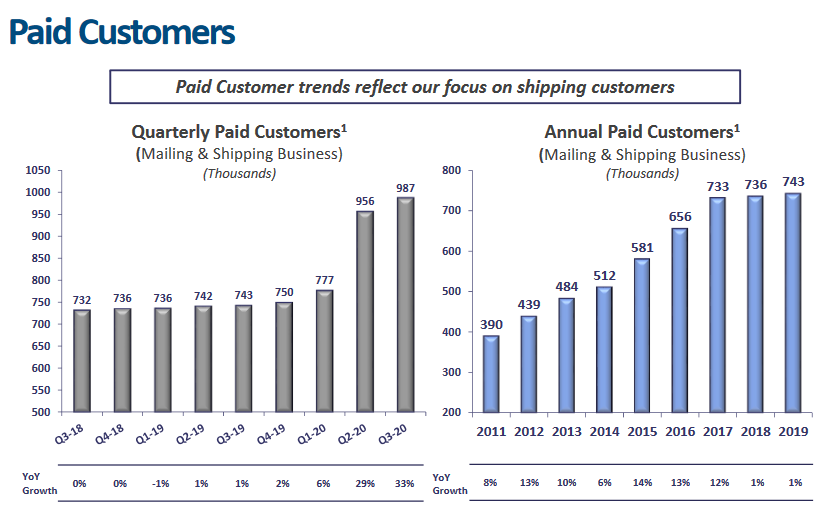

Loyal and qualitative good new customers

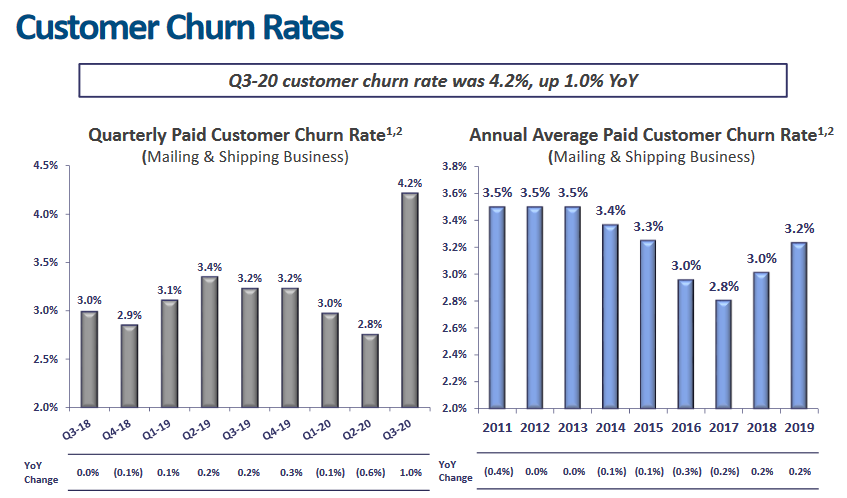

During the Codiv-19 pandemic, Stamps.com was able to acquire many new customers – an 33% increase Year-over-Year. However more interesting is the quality of those new customers and therefore the connected churn-rate of them. Q1 and Q2 2020 saw decreasing churn rates, but Q3 saw an 2% increase in churns. This increase was primarily driven by churns from the mailing segment, while churn rates in the much more important shipping segment further decreased. To conclude, Stamps.com was able to acquire many new very shipping focused customers with very low churn rates. On the other hand, mailing customers saw an increase in their churn rate. In the short term future, customer churn rates should further decrease, because of the good quality of the new shipping focused customers. In addition, more momentum in the customer growth should occure.

Note: Stamps.com’s paid customers / Source

Note: Stamps.com’s customer churn rate / Source

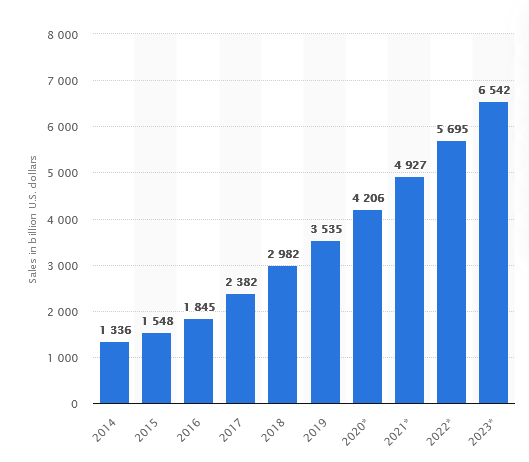

A strong growing market

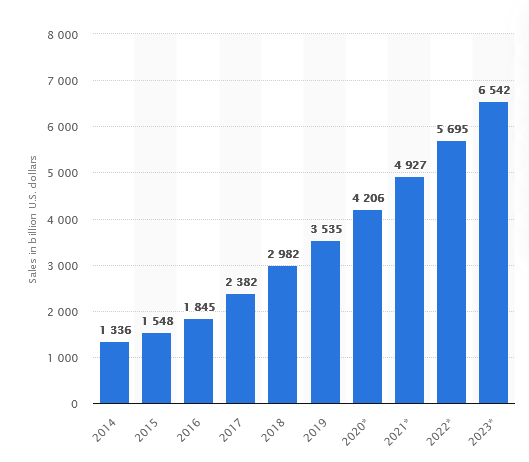

Stamps.com is acting in a high growth market, which was further fueled by the Covid-19 pandemic. Due to the virus, a critical shift to even more online shopping has happend, from which Stamps.com has also profited. With growing marketplaces and new shipping businesses funded, Stamps.com will grow also and profit from this trajectory in more packages send and the need for reliable and integrated solutions for mailing and shipping.

Note: Retail e-commerce sales worldwide from Statista / Source

Recent News and Updates

GlobalPost extends it product offering and improves services

GlobalPost has released several news over the last month, in which they announced new features and offerings for their customers.

-

GlobalPost Introduces GlobalPost Plus SmartSaver Service Allowing Shippers to Reduce Delivery Delays to Canada, UK and Mexico

-

GlobalPost Introduces USPS Canada DDP Service Allowing Shippers to Fast-Track Packages to Canadian Customers

-

GlobalPost Introduces USPS Canada DDP Service Allowing Shippers to Fast-Track Packages to Canadian Customers

In addition, other services from Stamps.com have also released new features and initatives.

In general all those news have no severe impact on the business directly, but bundled they show a nice progress and steady evolution in the product developement from Stamps.com and show that Stamps.com is pushing it’s services further ahead.

Read more.

The Release of the Results for the third Quarter 2020

Stamps.com has announced their latest earnings results on November 5th. Due to the dramatic acceleration in online mail order business, mainly due to the Covid-19 pandemic, Stamps.com has seen very strong sales and profits. Additional information from the earnings call reveals that the new customers won are of the same quality as those won before Corona. Therefore, strong growth should continue after Corona.

- Total Revenues increased 42% Year-over-Year to $193.9 Mio

- EPS (“EPS = Earnings per share”) increased 528% Year-over-Year to $3.30

- Non-GAAP adjusted EBITDA (“Earning Before Interest, Taxes, Deprecations and Amortization”) increased 107% to $71.2 Mio

Stamps.com has also raised its outlook for the rest of 2020. Particularly noteworthy is the almost doubling of the expected profit and the more than halving of the effective tax rate. Stamps.com now expects the following figures for Q4 2020:

- Revenues: Before: $650 – 725 Mio – Now: $705 – 735 Mio

- EPS: Before: $3.93 – 6.70 – Now: $7.30 – 8.27

- Effective Tax Rate: Before: $28% – Now: 12%

For additional informations, please have a look at their latest earnings release.

UPS Partnership for Stamps.com’s customers

UPS and Stamps.com (and all related software solutions) have announced a partnership. As UPS wants to further expand its rapidly growing business with smaller companies, UPS has initiated a special partnership with Stamps.com. Through the partnership, all Stamps.com customers will have smooth and seamless access to all UPS products at over 50% discount. Such attractive discount rates are normally only available to long term partners or large companies. The partnership is therefore a win-win-win situation for all parties involved. UPS receives more traffic and packages from the customers and users of Stamps.com. Stamps.com can offer its customers more service, more choice and better prices. The end customer benefits from lower prices, attractive tariffs and seamless software integration.

“UPS wants to make the shipping process seamless for small businesses, so they can focus on growing their business,” said Kevin Warren, UPS Chief Marketing Officer. “By collaborating with Stamps.com, their e-commerce customers will have easy access to UPS within the same familiar platform they’ve been using, offering them more choice and control over their shipping needs.”

“This new collaboration will allow us to bring the leading shipping solutions of UPS to our customer base in a simpler and more seamless fashion, and at very attractive new discounts,” said Ken McBride, Chairman and CEO of Stamps.com. “We want to empower our customers, and we know that delivery speeds and competitive rates are an important factor for small business success.”

Source: Press Release

This strategic move outlines the possible steps for Stamps.com to deliver strong benefits to customers, but also to initiate strong growth. In order to avoid a strong dependence on UPS, other similar partnerships should follow in order to diversify its business.

Read more.

The Read between the lines – Earnings Call

The aggregated information of the Q3 2020 earningscall can be seperated into three different categories, customers, product developement and growth & outlook:

- People looking for alternatives ways instead of the old brick and mortar way, to mail or ship an item. With the advantages Stamps.com offers the customers, e.g. $5 cent saving per USPS mail or an 62% discount for UPS daily rates, more customers are using Stamps.com The customer acquisition was up 90% Year-over-Year, while the total cost per acquisition was down by 30% Year-over-Year. This ended in an all time high of 987.000 paying customers. Those new customers are equal of quality to those that were acquired pre COVID. Shipping customers of the best quality and highest margins. This has led to an ARPU of $65.47 which was up 10% year-over-year driven primarily by growth in the shipping focused area of our business.

- UPS shipped packages increased 600% in Q2 2020 and about 50% in Q3 2020 sequentially. This shows and very good trajection for the newly UPS parnership. Products are further developed and improved by new partnerships, for example with SAP or Alibaba. This development make ShipStation the first US shipping solution to officially integrate with AliBaba.com. ShipStation also recently launched a new partnership with MercadoLibre which will open up the sizable Latin American market to ShipStation sellers and further enhances the advantages sellers have working with ShipStation.

- Growth will be achieved by launching into new countries with new languages. They are starting out with the French-speaking portions of Canada to get some experience with that solution first and then they expect to start to launch that in France during the fourth quarter and then they are wrapping up some final beta testing on that Spanish-language version of ShipStation. So that’s particularly exciting as well with some of the partnerships like MercadoLibre that was mentioned above, that allows Stamps.com to go after the big Latin American market. In addition, they expect a little revenue decline in Q4 2020, due to a transition from normal shopping behaviors from Q4 to Q3. They also noted, that there guidance is typically very conservative and low.

The deep Analysis

Financials

Operational History

If one looks at the company’s chart or at the key figures mentioned above, one sees a sharp drop in the share price in 2019 until the beginning of 2020. This is mainly due to a slight decline in growth in 2019. Due to a lack of growth drivers, the company managed to further expand its customer base, but not its sales. The reason for this glaring contrast was therefore a sharp drop in ARPU (“ARPU = Average Revenue per User”), triggered by poor margins and an unfavorable customer base.

In the years before, this was much more successful and the sales, but also the profit increased strongly. This is also reflected in the positive development of the share price until 2019.

Dividend

The company currently does not pay a dividend. However Stamps.com is currently buying back their own shares ($20 Mio remaining until Februar 2021) to drive additional shareholder value. This means, that the company is buying their own shares and then “destroys” them, to reduce the total outstanding shares. This reduces marketcap and increases all metrics per share, which is good.

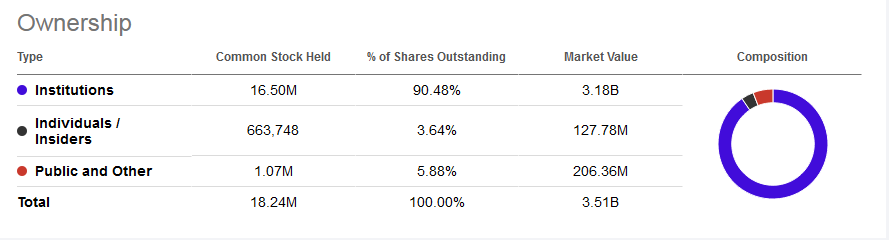

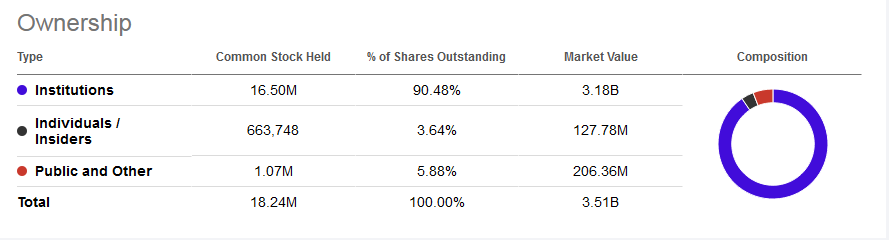

Share Structure

Stamps.com uses a one class share system. The current free-float to the public is very low compared to the institutions ownership.

Note: The share Structure of Stamps.com / Source

Insiders are holding approximately $130 Mio in shares, which is a good amount and shows that there is plenty of skin in the game for the insiders.

Chart

Valuation of the Stock

Stamps.com is currently low to fair valued. Stamps.com has got a one-year forward non-GAAP P/E-Ratio (“P/E-Ratio=Price to Earnings Ratio”) of approximately 18, which is a low valuation. If we look at the Price/Revenue-Ratio, we have also a normal value of 4.5 for 2020. So at a first look, Stamps.com looks pretty cheap. But if Stamps.com cannot delivery enough growth for the next years, this valuation is pretty fair to normal. But if Stamps.com can continue its success from this year and can repeat its large growth numbers from the last years, it is valued very cheap and attractive. An additional plus is the big net cash amount and the debt-free balance sheet, which offers plenty options for additional growth or shareholder value. For example, some additional share buybacks or a dividend could follow up or new acquisitions for new growth could follow.

Business Model

It is not so easy to explain the business model of Stamps.com, because different software solutions apply different models. But mainly a monthly or annual subscription is used, which makes the sales predictable. Since the sales are predictable, this also increases the quality of the sales. Other business models are primarily negligible. Stamps.com earns its money by offering its software solutions as a service to its customers. They pay a certain amount of money monthly, depending on the contract or usage. This model also offers a certain dependency of customers on Stamps.com, because customers who use the software for a longer period of time cannot simply stop using it, because they are more or less dependent on it. With the subscriptions, the number of customers is a very important indicator for the business model, as well as the rate of churn.

Note: Stamps.com business model / Source

Management

Stamps.com is run by it’s long time employees, which have built the business and the company and know it’s really good. They all have many year of knowledge and experience in their field of business.

- Ken McBrinde – CEO – Ken McBride was named Chairman and CEO of Stamps.com in January 2012. He has been President and CEO of Stamps.com from August 2001 to January 2012 and also served as the CFO from October 2000 to January 2004. Previously, Mr. McBride served as the Senior Director of Finance for the company from April 1999 to October 2000.

- Jeff Carberry – CFO – Jeff Carberry was named Chief Financial Officer of Stamps.com in August 2017. Mr. Carberry served the company as Vice President of Finance from April 2014 to August 2017, Sr. Director of Finance from April 2011 to April 2014, and Director of Finance from July 2008 to April 2011.

- John Clem – CSO – John Clem was named Chief Product & Strategy Officer of Stamps.com in January 2012. He has been Vice President, Product and Service Operations of Stamps.com from March 2006 to January 2012. Previously, Mr. Clem served as the Director of Corporate Strategy from March 2003 to February 2004 and as a Director of Marketing from March 2004 to February 2006 where he led the launch of Stamps.com’s Package Insurance and PhotoStamps products.

- Jonathan Bourgoine – CTO – Jonathan Bourgoine was named Chief Technology Officer of Stamps.com in February 2018. Prior to joining Stamps.com, Mr. Bourgoine held the position of Vice President and Chief Technology Officer for Mattel, Inc. from 2011 to 2018.

Source: Stamps.com

Insiders are holding approximately about $130 Mio in own shares.

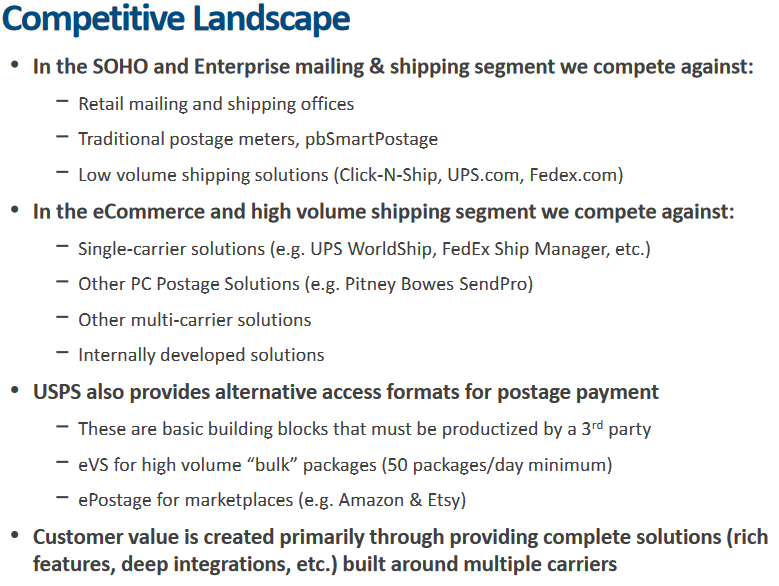

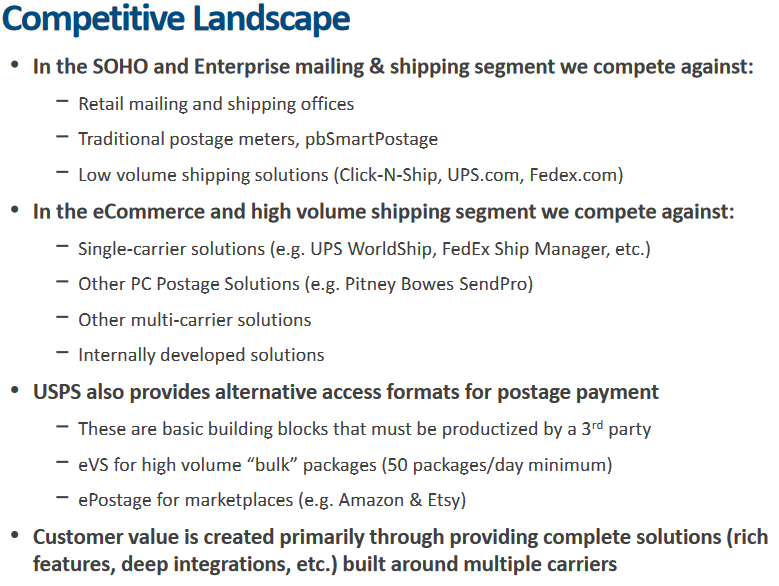

Competition

Stamps.com operates in a strong growth market, but still has few direct competitors. As Stamps.com itself writes, there are none to a few small competing products, most of which are old software or isolated solutions that cannot be integrated. Thus, Stamps.com really has no direct competition in the area of On the Move. But there are still many possible competitors, but also some dangers. Marketplace providers or store systems could, for example, reproduce and introduce products or features themselves and would thus make Stamps.com’s products partially superfluous. When I think about this, I think especially of the big providers like Amazon, Shopify or Alibaba. Nevertheless, it is precisely these vendors that enter into close cooperation with Stamps.com, which should limit this danger for the time being. Further possible dangers exist in the exclusive partnerships such as with UPS or USPS – if they terminate the partnership or discontinue products, this can lead to a serious drop in sales, as has already happened in the past. However, these partnerships also offer good diversification potential if further partnerships are entered into. But also here, package providers could include features or software ideas from Stamps.com in their own offers.

The bottom line is that Stamps.com has built a good moat through its many years of experience and good products, which is not endangered in the short term.

Note: Competition in the shipping game / Source

What to expect in the near future

Growth-Strategy

Stamps.com will continue to focus strongly on growth in the coming years and all tracks will follow this direction. This will mainly be achieved, as mentioned in the earnings call, through customer beneficial partnerships and expansion into non-English speaking countries. Higher margins on products and an increase in ARPU should further support the growth targets. Due to the very high net cash position in the balance sheet, large acquisitions, as they have happened in the past, are very likely.

One-Platform-Strategy

For me as the author of this research, it was initially very difficult and incomprehensible why there are so many almost identical individual software solutions at Stamps.com, which hardly differ in functions and target group. The one or other reader will probably feel very similar. I personally see a lot of potential here to go a similar way as Microsoft has done. Microsoft has bundled its entire product range under “MS Office” and no longer sells “Word” or “Excel” as a stand-alone product. I could imagine a similar approach for Stamps.com. That all products are bundled under one name, in order to build up a uniform brand name and to create a solid and unique product range that is not duplicated or tripled. The advantages would be a high recognition value of the software, avoidance of feature redundancies and a significant savings potential. Furthermore, this type of product differentiation also offers a very strong cross-selling potential.

Conclusion

Stamps.com is a very exciting and unknown company with a strong and broad product range. It operates in a rapidly growing market that will continue to grow and grow. The company’s growth in recent years clearly shows the trend and proves that companies are very interested in Stamps.com’s solutions. The extremely solid and clean balance sheet offers plenty of room for new acquisitions. The only drawbacks against Stamps.com are the weak year 2019 and the company’s development without the Covid-19 pandemic in 2020. Stamps.com offers a lot of upside potential with very little downside potential considering the above arguments. Imagining the different solutions as one big solution like described above, then this would be the next big beautiful software company with a very nice cloud product suite.

Currently we have a fair valuation for little to 0 growth. If the growth turns out to be slightly better or even continues at the earlier rates, the stock should rise strongly. In short, Stamps.com is a very exciting future game with a lot of upside potential with little to no downside.

Our recommendation: This stock is a buy. Use the current price for buying in or averaging up and use further price-falls to average up.

Disclaimer & Conflict of interest

The author currently holds a position in the mentioned stock. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Stamps.com Inc. - Article

Research: Stamps.com - The Unknown Shipping Package and Postal Profiteer

Note: Stamps.com / Source

Table of Content:

- Author's Opinion

- Introduction to the Company

- What makes it so special?

- The Read between the lines

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author's Opinion

Stamps.com offers interesting and well thought out shipping and packaging solutions in the form of software. It unifies many interfaces into one and offers many advantages for customers. In particular the competition is equipped by closed and badly thought out isolated solutions, which are not competitive. The ever-growing package trade on the Internet and the continuing globalization should push players in this unpenetrated market further. Little to no competition and market leadership, as well as an attractive valuation, are just a few reasons for choosing Stamps.com as an investment.

Introduction: Let the company introduce itself

Stamps.com (NASDAQ: STMP) is the leading provider of postage online and shipping software solutions to customers including consumers, small businesses, e-commerce shippers, enterprises, and high volume shippers. Stamps.com offers solutions that help businesses run their shipping operations more smoothly and function more successfully under the brand names Stamps.com, Endicia®, ShipStation®, ShipEngine®, ShippingEasy®, ShipWorks®, GlobalPost and Metapack™. Stamps.com’s family of brands provides seamless access to mailing and shipping services through integrations with more than 500 unique partner applications.

Source: Stamps.com

What makes Stamps.com so special?

8 Software Solutions

Note: Product overview of Stamps.com services / Source

Stamps.com

Stamps.com is an internet or desktop client service, that lets customers print USPS and UPS approved mailing and shipping labels.

Stamps.com is a monthly subcription service. That means, that the customers pays a certain amount monthly for the software and also pays in addition for the mails or packages he sends.

Therefore Stamps.com offers additional features, like marketplace integrations, batch-printing or "always the best price for your package". Automatically take care of daily repetitive tasks (automatic emails, post back shipping details to marketplaces, pre-fill customs forms, etc.).

Note: Stamps.com software / Source

Endicia

Endicia, which is also a monthly subscription service, is mostly the same product like Stamps.com, but made for high volume USPS and UPS shipping, which makes it the ideal software for large retailers, warehouses & fulfillment centers.

Like Stamps.com, Endicia features also many integrated tools and has good connections with 3rd party services and solutions.

Note: Endicia.com software / Source

ShipStation

ShipStation is the leading, web-based only shipping solution, especially for e-commerce. It supports over 40 different carriers, like USPS, DHL, FedEx, Amazon Shipping, etc.

It offers about 300 partner integrations, in order to organize, fulfill and ship orders efficently. It also can handle multiple selling channels, batch printing and fraud or error detection. It features many other advantages.

ShipStation was acquired in mid of 2014, which was a really good acquisition for the company and a good addition to the product portfolio.

ShipStation is like the earlier mentiond services an subscription service, too. The customer pays for the software as a service ("SaaS") and has to pay the shipments in addition to third party carriers.

Note: ShipStation.com software / Source

ShipWorks

ShipWork is similar to ShipStation. It is made for big volume shipping from fullfilment centers or warehouses. It is the leading, client-based only shipping solution, especially for large retailers. It supports over 15 different carriers, like USPS, DHL, FedEx, etc.

It offers about 100 partner integrations, in order to organize, fulfill and ship orders efficently. It also can handle very complex and individual shipping forms and rules. It is also highly customizeable.

ShipWorks was also acquired in mid of 2014, which was a really good acquisition for the company and a good addition to the product portfolio.

ShipWorks is like the earlier mentiond services an subscription service, too. The customer pays for the software as a service ("SaaS") and has to pay the shipments in addition to third party carriers.

Note: ShipWorks.com software / Source

ShippingEasy

ShippingEasy has been acquired in mid 2016 and is more or less the same like ShipStation, with some extra features. It offers some extra offers / features for the "Shopify" marketplace.

Note: Shippingeasy.com software / Source

ShipEngine

ShipEngine is the leading API solution for e-commerce shipping for software developers and a strong tool for building shipping tools or order tools.

Both the developer and the businesses are benefiting of ShipEngine:

- Leverage the same APIs Stamps.com’s affiliates use to power their shipping platforms

- Faster time to market for a user’s project offering the full breadth of services to its customers

- A world-class customer experience provided and backed by Stamps.com

And how does ShipEngine profit from that? ShipEngine earns a little amount per Action, which is generated over these APIs. For example an action can be a tracked package, a package rate quote or a label generation. For each action, which is executed or queried over the API, ShipEninge earns about 1 to 20$ cent. Imagine the revenue and scalability.

Note: ShipEngine.com software pricing / Source

GlobalPost

GlobalPost is a very simple and easy service made for international shipping. The customer can choose the cheapest rate for his package and then track it internationally.

GlobalPost offers a range of domestic and international shipping solutions that simplifies parcel shipping while saving you money. By combining our world-class customer service, easy-to-use technology and seamless integrations with the world’s top shipping platforms, we help e-commerce and warehouse sellers succeed domestically and around the world.

Source: GlobalPost.com

MetaPack

MetaPack was acquired by Stamps.com in mid 2018.

Metapack is the leading provider of eCommerce delivery management technology to enterprise retailers and brands. Our platform integrates over 400 carriers and 5,500 delivery services such as Next Day, Click and Collect, Locker Boxes, and International Delivery – ensuring that retailers and brands can offer delivery options and convenience for their customers.

For each and every order, Metapack is able to identify the most appropriate delivery service for that particular customer, providing a seamless and personalized delivery experience, whilst removing manual and time-consuming processes in the retailer’s warehouse.

Metapack’s delivery management platform enables retailers and brands worldwide to strengthen their delivery proposition, generate customer loyalty and website conversion, ensuring every customer has the best delivery experience.

Source: Metapack.com

In short, MetaPack provides different software solutions made for the shipping and ecommerce universe and offers them to e-commerce companys, retailers and high volume shippers.

Metapack has no public pricing list, it offers individual solutions.

Note: Metapack.com shipping tracking solution / Source

Integrated Platform vs. "Island Solutions"

One of the biggest advantages of Stamps.com and the company's other related software tools is the open and integrated approach on which the software is based. Every software is strongly focused on the highest possible level of integration and usability. This means that the software supports as many parcel / postal services as possible, such as "DHL" or "UPS", but also marketplaces like "Etsy", "Amazon" or "Shopify". Even small store systems like "Woocommerce" or "Wix" can be connected quite naturally to offer store operators of any size or professionalism a functioning software.

In contrast to that, there is no comparably good competition on the market. Many parcel / postal services rely on their own strongly limited isolated solutions, which cannot be integrated with other services or are difficult to integrate. This is a clear advantage for Stamps.com and the other software tools of Stamps.com. So Stamps.com is revolutionizing the old and not integrated software tools.

Note: Stamps.com vs. competitive software / Source

Loyal and qualitative good new customers

During the Codiv-19 pandemic, Stamps.com was able to acquire many new customers - an 33% increase Year-over-Year. However more interesting is the quality of those new customers and therefore the connected churn-rate of them. Q1 and Q2 2020 saw decreasing churn rates, but Q3 saw an 2% increase in churns. This increase was primarily driven by churns from the mailing segment, while churn rates in the much more important shipping segment further decreased. To conclude, Stamps.com was able to acquire many new very shipping focused customers with very low churn rates. On the other hand, mailing customers saw an increase in their churn rate. In the short term future, customer churn rates should further decrease, because of the good quality of the new shipping focused customers. In addition, more momentum in the customer growth should occure.

Note: Stamps.com's paid customers / Source

Note: Stamps.com's customer churn rate / Source

A strong growing market

Stamps.com is acting in a high growth market, which was further fueled by the Covid-19 pandemic. Due to the virus, a critical shift to even more online shopping has happend, from which Stamps.com has also profited. With growing marketplaces and new shipping businesses funded, Stamps.com will grow also and profit from this trajectory in more packages send and the need for reliable and integrated solutions for mailing and shipping.

Note: Retail e-commerce sales worldwide from Statista / Source

Recent News and Updates

GlobalPost extends it product offering and improves services

GlobalPost has released several news over the last month, in which they announced new features and offerings for their customers.

-

GlobalPost Introduces GlobalPost Plus SmartSaver Service Allowing Shippers to Reduce Delivery Delays to Canada, UK and Mexico

-

GlobalPost Introduces USPS Canada DDP Service Allowing Shippers to Fast-Track Packages to Canadian Customers

-

GlobalPost Introduces USPS Canada DDP Service Allowing Shippers to Fast-Track Packages to Canadian Customers

In addition, other services from Stamps.com have also released new features and initatives.

In general all those news have no severe impact on the business directly, but bundled they show a nice progress and steady evolution in the product developement from Stamps.com and show that Stamps.com is pushing it's services further ahead.

Read more.

The Release of the Results for the third Quarter 2020

Stamps.com has announced their latest earnings results on November 5th. Due to the dramatic acceleration in online mail order business, mainly due to the Covid-19 pandemic, Stamps.com has seen very strong sales and profits. Additional information from the earnings call reveals that the new customers won are of the same quality as those won before Corona. Therefore, strong growth should continue after Corona.

- Total Revenues increased 42% Year-over-Year to $193.9 Mio

- EPS ("EPS = Earnings per share") increased 528% Year-over-Year to $3.30

- Non-GAAP adjusted EBITDA (“Earning Before Interest, Taxes, Deprecations and Amortization”) increased 107% to $71.2 Mio

Stamps.com has also raised its outlook for the rest of 2020. Particularly noteworthy is the almost doubling of the expected profit and the more than halving of the effective tax rate. Stamps.com now expects the following figures for Q4 2020:

- Revenues: Before: $650 - 725 Mio - Now: $705 - 735 Mio

- EPS: Before: $3.93 - 6.70 - Now: $7.30 - 8.27

- Effective Tax Rate: Before: $28% - Now: 12%

For additional informations, please have a look at their latest earnings release.

UPS Partnership for Stamps.com's customers

UPS and Stamps.com (and all related software solutions) have announced a partnership. As UPS wants to further expand its rapidly growing business with smaller companies, UPS has initiated a special partnership with Stamps.com. Through the partnership, all Stamps.com customers will have smooth and seamless access to all UPS products at over 50% discount. Such attractive discount rates are normally only available to long term partners or large companies. The partnership is therefore a win-win-win situation for all parties involved. UPS receives more traffic and packages from the customers and users of Stamps.com. Stamps.com can offer its customers more service, more choice and better prices. The end customer benefits from lower prices, attractive tariffs and seamless software integration.

“UPS wants to make the shipping process seamless for small businesses, so they can focus on growing their business,” said Kevin Warren, UPS Chief Marketing Officer. “By collaborating with Stamps.com, their e-commerce customers will have easy access to UPS within the same familiar platform they’ve been using, offering them more choice and control over their shipping needs.”

“This new collaboration will allow us to bring the leading shipping solutions of UPS to our customer base in a simpler and more seamless fashion, and at very attractive new discounts,” said Ken McBride, Chairman and CEO of Stamps.com. “We want to empower our customers, and we know that delivery speeds and competitive rates are an important factor for small business success.”

Source: Press Release

This strategic move outlines the possible steps for Stamps.com to deliver strong benefits to customers, but also to initiate strong growth. In order to avoid a strong dependence on UPS, other similar partnerships should follow in order to diversify its business.

Read more.

The Read between the lines - Earnings Call

The aggregated information of the Q3 2020 earningscall can be seperated into three different categories, customers, product developement and growth & outlook:

- People looking for alternatives ways instead of the old brick and mortar way, to mail or ship an item. With the advantages Stamps.com offers the customers, e.g. $5 cent saving per USPS mail or an 62% discount for UPS daily rates, more customers are using Stamps.com The customer acquisition was up 90% Year-over-Year, while the total cost per acquisition was down by 30% Year-over-Year. This ended in an all time high of 987.000 paying customers. Those new customers are equal of quality to those that were acquired pre COVID. Shipping customers of the best quality and highest margins. This has led to an ARPU of $65.47 which was up 10% year-over-year driven primarily by growth in the shipping focused area of our business.

- UPS shipped packages increased 600% in Q2 2020 and about 50% in Q3 2020 sequentially. This shows and very good trajection for the newly UPS parnership. Products are further developed and improved by new partnerships, for example with SAP or Alibaba. This development make ShipStation the first US shipping solution to officially integrate with AliBaba.com. ShipStation also recently launched a new partnership with MercadoLibre which will open up the sizable Latin American market to ShipStation sellers and further enhances the advantages sellers have working with ShipStation.

- Growth will be achieved by launching into new countries with new languages. They are starting out with the French-speaking portions of Canada to get some experience with that solution first and then they expect to start to launch that in France during the fourth quarter and then they are wrapping up some final beta testing on that Spanish-language version of ShipStation. So that’s particularly exciting as well with some of the partnerships like MercadoLibre that was mentioned above, that allows Stamps.com to go after the big Latin American market. In addition, they expect a little revenue decline in Q4 2020, due to a transition from normal shopping behaviors from Q4 to Q3. They also noted, that there guidance is typically very conservative and low.

The deep Analysis

Financials

Operational History

If one looks at the company's chart or at the key figures mentioned above, one sees a sharp drop in the share price in 2019 until the beginning of 2020. This is mainly due to a slight decline in growth in 2019. Due to a lack of growth drivers, the company managed to further expand its customer base, but not its sales. The reason for this glaring contrast was therefore a sharp drop in ARPU ("ARPU = Average Revenue per User"), triggered by poor margins and an unfavorable customer base.

In the years before, this was much more successful and the sales, but also the profit increased strongly. This is also reflected in the positive development of the share price until 2019.

Dividend

The company currently does not pay a dividend. However Stamps.com is currently buying back their own shares ($20 Mio remaining until Februar 2021) to drive additional shareholder value. This means, that the company is buying their own shares and then "destroys" them, to reduce the total outstanding shares. This reduces marketcap and increases all metrics per share, which is good.

Share Structure

Stamps.com uses a one class share system. The current free-float to the public is very low compared to the institutions ownership.

Note: The share Structure of Stamps.com / Source

Insiders are holding approximately $130 Mio in shares, which is a good amount and shows that there is plenty of skin in the game for the insiders.

Chart

Valuation of the Stock

Stamps.com is currently low to fair valued. Stamps.com has got a one-year forward non-GAAP P/E-Ratio ("P/E-Ratio=Price to Earnings Ratio") of approximately 18, which is a low valuation. If we look at the Price/Revenue-Ratio, we have also a normal value of 4.5 for 2020. So at a first look, Stamps.com looks pretty cheap. But if Stamps.com cannot delivery enough growth for the next years, this valuation is pretty fair to normal. But if Stamps.com can continue its success from this year and can repeat its large growth numbers from the last years, it is valued very cheap and attractive. An additional plus is the big net cash amount and the debt-free balance sheet, which offers plenty options for additional growth or shareholder value. For example, some additional share buybacks or a dividend could follow up or new acquisitions for new growth could follow.

Business Model

It is not so easy to explain the business model of Stamps.com, because different software solutions apply different models. But mainly a monthly or annual subscription is used, which makes the sales predictable. Since the sales are predictable, this also increases the quality of the sales. Other business models are primarily negligible. Stamps.com earns its money by offering its software solutions as a service to its customers. They pay a certain amount of money monthly, depending on the contract or usage. This model also offers a certain dependency of customers on Stamps.com, because customers who use the software for a longer period of time cannot simply stop using it, because they are more or less dependent on it. With the subscriptions, the number of customers is a very important indicator for the business model, as well as the rate of churn.

Note: Stamps.com business model / Source

Management

Stamps.com is run by it's long time employees, which have built the business and the company and know it's really good. They all have many year of knowledge and experience in their field of business.

- Ken McBrinde - CEO - Ken McBride was named Chairman and CEO of Stamps.com in January 2012. He has been President and CEO of Stamps.com from August 2001 to January 2012 and also served as the CFO from October 2000 to January 2004. Previously, Mr. McBride served as the Senior Director of Finance for the company from April 1999 to October 2000.

- Jeff Carberry - CFO - Jeff Carberry was named Chief Financial Officer of Stamps.com in August 2017. Mr. Carberry served the company as Vice President of Finance from April 2014 to August 2017, Sr. Director of Finance from April 2011 to April 2014, and Director of Finance from July 2008 to April 2011.

- John Clem - CSO - John Clem was named Chief Product & Strategy Officer of Stamps.com in January 2012. He has been Vice President, Product and Service Operations of Stamps.com from March 2006 to January 2012. Previously, Mr. Clem served as the Director of Corporate Strategy from March 2003 to February 2004 and as a Director of Marketing from March 2004 to February 2006 where he led the launch of Stamps.com’s Package Insurance and PhotoStamps products.

- Jonathan Bourgoine - CTO - Jonathan Bourgoine was named Chief Technology Officer of Stamps.com in February 2018. Prior to joining Stamps.com, Mr. Bourgoine held the position of Vice President and Chief Technology Officer for Mattel, Inc. from 2011 to 2018.

Source: Stamps.com

Insiders are holding approximately about $130 Mio in own shares.

Competition

Stamps.com operates in a strong growth market, but still has few direct competitors. As Stamps.com itself writes, there are none to a few small competing products, most of which are old software or isolated solutions that cannot be integrated. Thus, Stamps.com really has no direct competition in the area of On the Move. But there are still many possible competitors, but also some dangers. Marketplace providers or store systems could, for example, reproduce and introduce products or features themselves and would thus make Stamps.com's products partially superfluous. When I think about this, I think especially of the big providers like Amazon, Shopify or Alibaba. Nevertheless, it is precisely these vendors that enter into close cooperation with Stamps.com, which should limit this danger for the time being. Further possible dangers exist in the exclusive partnerships such as with UPS or USPS - if they terminate the partnership or discontinue products, this can lead to a serious drop in sales, as has already happened in the past. However, these partnerships also offer good diversification potential if further partnerships are entered into. But also here, package providers could include features or software ideas from Stamps.com in their own offers.

The bottom line is that Stamps.com has built a good moat through its many years of experience and good products, which is not endangered in the short term.

Note: Competition in the shipping game / Source

What to expect in the near future

Growth-Strategy

Stamps.com will continue to focus strongly on growth in the coming years and all tracks will follow this direction. This will mainly be achieved, as mentioned in the earnings call, through customer beneficial partnerships and expansion into non-English speaking countries. Higher margins on products and an increase in ARPU should further support the growth targets. Due to the very high net cash position in the balance sheet, large acquisitions, as they have happened in the past, are very likely.

One-Platform-Strategy

For me as the author of this research, it was initially very difficult and incomprehensible why there are so many almost identical individual software solutions at Stamps.com, which hardly differ in functions and target group. The one or other reader will probably feel very similar. I personally see a lot of potential here to go a similar way as Microsoft has done. Microsoft has bundled its entire product range under "MS Office" and no longer sells "Word" or "Excel" as a stand-alone product. I could imagine a similar approach for Stamps.com. That all products are bundled under one name, in order to build up a uniform brand name and to create a solid and unique product range that is not duplicated or tripled. The advantages would be a high recognition value of the software, avoidance of feature redundancies and a significant savings potential. Furthermore, this type of product differentiation also offers a very strong cross-selling potential.

Conclusion

Stamps.com is a very exciting and unknown company with a strong and broad product range. It operates in a rapidly growing market that will continue to grow and grow. The company's growth in recent years clearly shows the trend and proves that companies are very interested in Stamps.com's solutions. The extremely solid and clean balance sheet offers plenty of room for new acquisitions. The only drawbacks against Stamps.com are the weak year 2019 and the company's development without the Covid-19 pandemic in 2020. Stamps.com offers a lot of upside potential with very little downside potential considering the above arguments. Imagining the different solutions as one big solution like described above, then this would be the next big beautiful software company with a very nice cloud product suite.

Currently we have a fair valuation for little to 0 growth. If the growth turns out to be slightly better or even continues at the earlier rates, the stock should rise strongly. In short, Stamps.com is a very exciting future game with a lot of upside potential with little to no downside.

Our recommendation: This stock is a buy. Use the current price for buying in or averaging up and use further price-falls to average up.

Disclaimer & Conflict of interest

The author currently holds a position in the mentioned stock. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Revenue by Quarter

Profitability by Quarter

Selected KPIs

Chart

Peers

All the Peers

FlexShopper Inc.

Bullish

Tattooed Chef Inc.

Neutral

Hellofresh SE

Bullish

Build-a-Bear Workshop Inc.

Outperform

Redfin Corporation

Bullish

Perion Network Ltd.

Outperform

Upwork Inc.

Bullish

Chegg Inc.

Bullish

Pinterest Inc.

Bullish

Bluelinx Holdings Inc

Bullish

Sprout Social Inc.

Bullish

Lang & Schwarz AG

Outperform