The Search

Your Search Results

News from us

Newest Symbols

Newest Industries

Click to expand

Advertising

See Stocks

Automotive

See Stocks

E-Commerce

See Stocks

E-Learning

See Stocks

Electricity

See Stocks

Engineering

See Stocks

FlexShopper Inc.

Bullish

Bullish

Tattooed Chef Inc.

Neutral

Neutral

Hellofresh SE

Bullish

Bullish

Build-a-Bear Workshop Inc.

Outperform

Outperform

Stamps.com Inc.

Bullish

Bullish

Redfin Corporation

Bullish

Bullish

Perion Network Ltd.

Outperform

Outperform

Upwork Inc.

Bullish

Bullish

Chegg Inc.

Bullish

Bullish

Pinterest Inc.

Bullish

Bullish

Bluelinx Holdings Inc

Bullish

Bullish

Momentus Inc.

Neutral

Neutral

Mynaric AG

Neutral

Neutral

Virgin Galactic Holdings Inc.

Neutral

Neutral

Maxar Technologies Inc.

Neutral

Neutral

Sunrun Inc.

Bullish

Bullish

Steico SE

Neutral

Neutral

Alfen N.V.

Neutral

Neutral

Research

Content Cards

Swipe

Our Article

FlexShopper Inc. - Article

Research: FlexShopper - The Lease-To-Own (LTO) Hamster Wheel

Note: FlexShopper / Source

Table of Content:

- Author’s Opinion

- Introduction to the Company

- Why is it so beloved?

- The Read between the lines

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author’s Opinion

We all know those hyper growth marketplace stocks like Etsy or Amazon, which have made early investors rich. But what if I tell you, that there is a really tiny small stock out there, which is profitable on an Adjusted EBITDA base since 2019 and also hosts an e-commerce marketplace. They are also a true fin-tech company, providing an offline and online e-commerce gateway payment solution, plus mobile solutions.

Sounds good so far? Okay, this company isn’t selling products, it’s leasing them to their owners on a weekly payment base. If you pay down 52 weeks your little amount for your newest FLEX product, then you will own it – that’s called Lease-to-own. This type of business model features stable and highly predictive cashflows, which is always good for a business.

How do they do it? They have an online B2C marketplace and in addition payment options, which can be used on other online stores or in traditonal brick-and-mortar stores and also on a mobile app. As an big plus, the company has an Price-to-Sales Ratio of under 1 (“!”) and shows signficant revenue growth rates in the mid twenties. So let’s dive deeper and get to know more about the FLEX.

Warning

Due to the very small marketcap and the low float (the amount of shares circling around and traded, which are not held by major investors) of FPAY shares, there are certain risks and an increased volatility.

Introduction: Let the company introduce itself

FlexShopper, LLC, a wholly owned subsidiary of FlexShopper, Inc. (FPAY), is a financial and technology company that provides brand name electronics, home furnishings and other durable goods to consumers on a lease-to-own (LTO) basis through its e-commerce marketplace (www.FlexShopper.com) as well as its patented and patent pending systems. FlexShopper also provides LTO technology platforms to retailers and e-retailers to facilitate transactions with consumers that want to acquire their products, but do not have sufficient cash or credit. FlexShopper approves consumers utilizing its proprietary consumer screening model, collects from consumers under an LTO contract and funds the LTO transactions by paying merchants for the goods.

Source: flexshopper.com

Omni-Channel Strategy drives diversification and builds up a loyal Customerbase

The Flexshopper Solution

FlexShopper offers a very simple product: If you have little to no money and / or a bad credit rating ( also called “subprime”) but still want to be able to “flex” with cool products, you can “buy” the items with the help of Flexshopper. The cash price of the product is divided by 52, and so paid off week by week for a year. So at first you lease the item and don’t own it until after a year and you have paid off your 52 weekly payments.

For example, a new MacBook Pro no longer costs $2500+, but only $40+ per week. But if you think you can save money here, you are wrong, because Flexshopper usually adds a hefty more than 100% leasing-fee on top of the cash price – so theoretical 20$ per week quickly turns into 45$ per week with Flexshopper’s fees. This lease-to-own (LTO) payment solution is the actual main product of FlexShopper and is offered by them at every “sales channel”. Customers can also save money with some early payoff options and also choose to return their merchandise back to FlexShopper anytime – this offers them some flexibility.

Note: Flexshopper LTO Solution

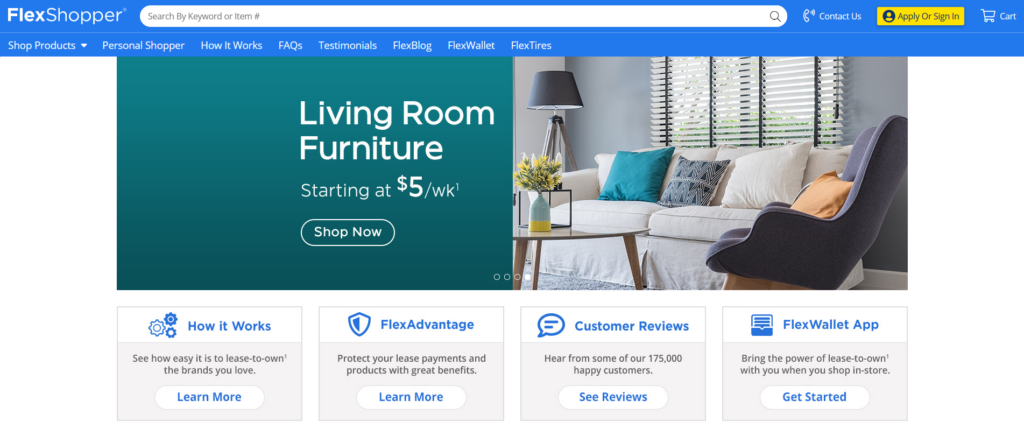

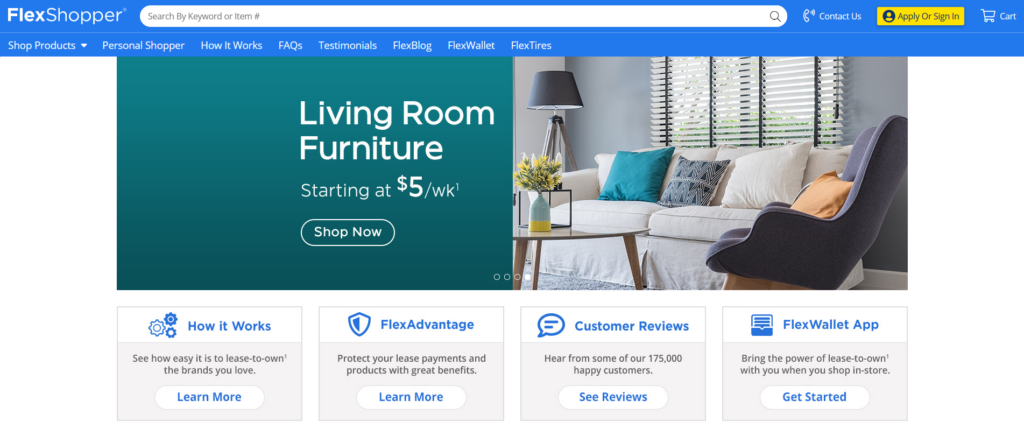

B2C Marketplace Flexshopper.com

FlexShopper.com is the company’s flagship product – it is a business-to-customer marketplace for mainly electronic consumer goods and also home furnishings. You can find laptops, smartphones, TVs, kitchen appliances, but also musical instruments, garden furniture and upholstered furniture. Flexshopper.com provides the marketplace as a platform, and thus brings together end customers and suppliers of these products on the platform. These items on the platform cannot be purchased directly, but are exclusively available for “purchase” via Flexshopper’s in-house “lease-to-own” (LTO) solution.

Note: Flexshopper.com marketplace

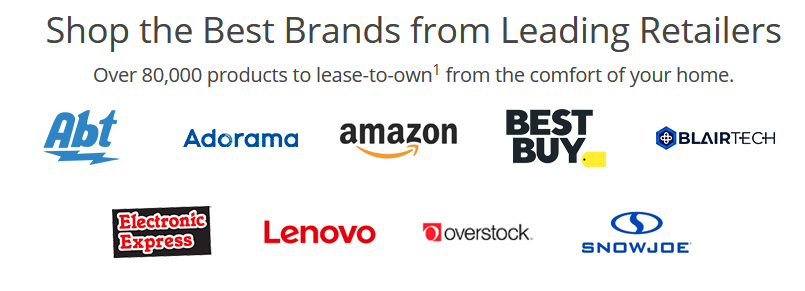

Suppliers on the Flexshopper.com Marketplace include well-known brands such as Amazon, Lenovo and Best Buy. More unknown local niche retailers like The Guitar Factory (they sell musical instruments) are also part of the concept and bring a special selection to the marketplace. More new retailers can be expected in the near future, which will further enrich the marketplace and attract new customers. These new customers attract new merchants, and so on….

Note: Flexshopper.com marketplace partner retailers

Since it is a marketplace, Flexshopper has no worries about inventory or logistics, as it is distributed exclusively through the merchants. Flexshopper turns over about 64% of its total leases on the marketplace, and the trend is upward. In addition, more than 50% of new leases come from existing customers – but more on this later. All this shows that the Flexshopper.com platform is very strong and will be an important growth driver in the future.

B2B In-Store “Save-the-Sale”

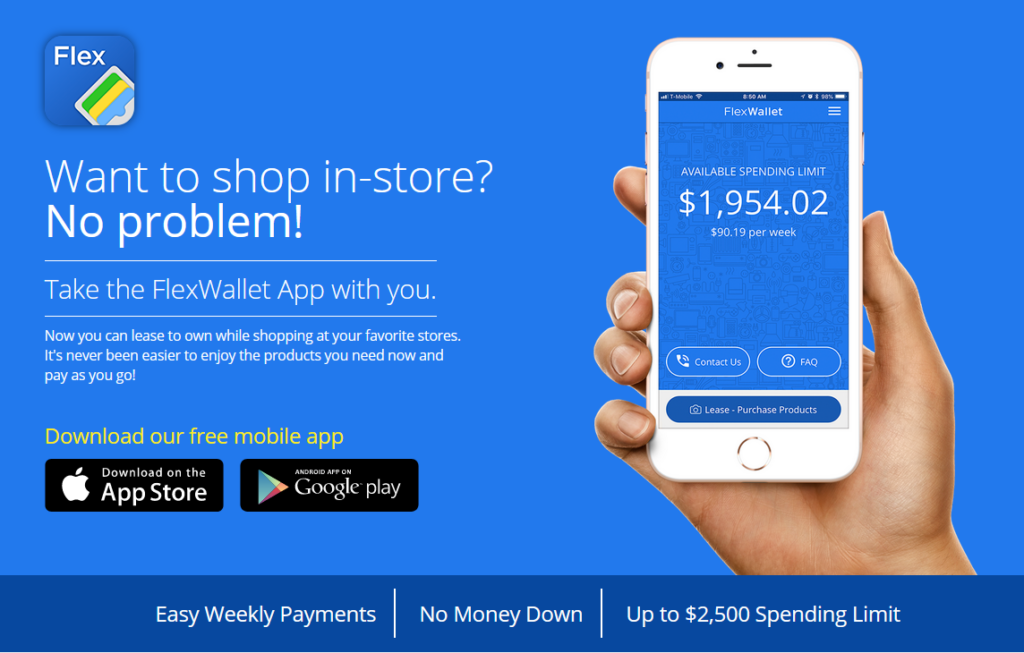

Flexshopper also has a “brick-and-mortar” channel in addition to its well-known marketplace. Customers can also purchase their purchases offline from well-known retailers via Flexshopper payment solution. There are no real hurdles for both the end customer and the retailer to take advantage of Flexshopper’s solution. Everything customers have to do is to download the smartphone wallet app, register themselves in a few steps and they have already leased their purchase. The connection for the retailer is even more straightforward – they just need to put up some point-of-sale signs pointing to Flexshopper. No integration with the retailer’s IT or point-of-sale system is necessary – so Flexshopper can be easily integrated into any store.

Note: Flexshopper’s In-Store partner retailers

The solution again has a huge benefit for both merchants and customers: customers can afford new expensive items that they otherwise wouldn’t be able to buy because of their cash on hand or credit rating. Merchants can secure purchases that would not / could not happen, also called “Safe the Sale”.

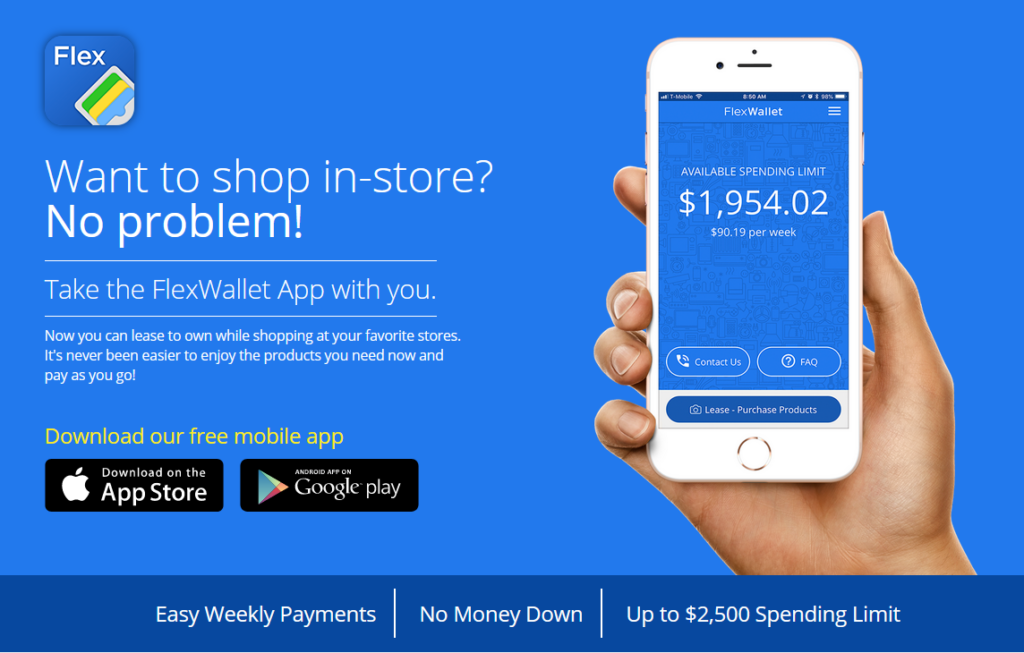

In about 30% of new leases in dollars are done through the “In Store” model – returning customers are a little over 25% of that, which is not quite as good as the Flexshopper.com marketplace. Nevertheless, these customers registered in the app are real cash cows in the Wallet app, because you can always conveniently buy items in other stores that also work with Flexshopper. In this way, once-acquired customers ensure new leases again and again.

Note: Flexshopper’s Wallet-App

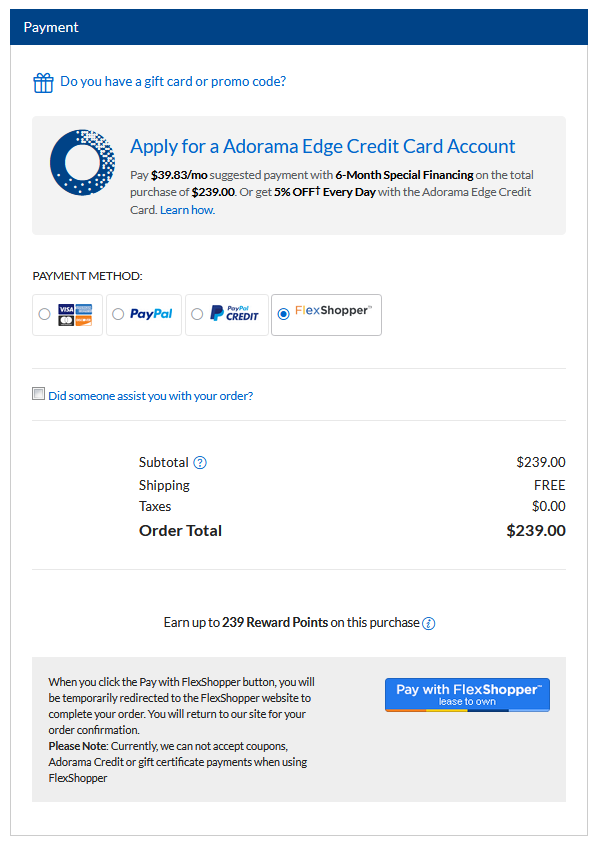

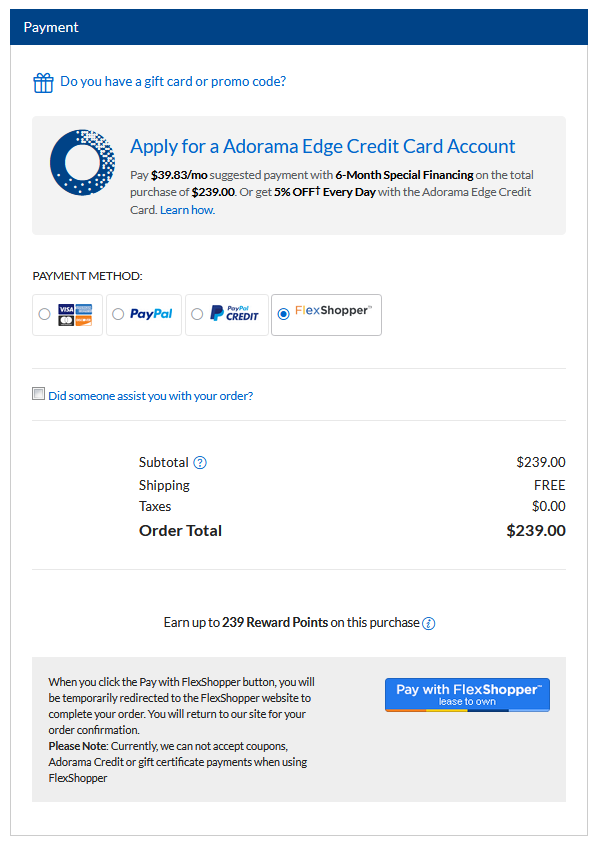

B2B E-Commerce Payment Method

The remaining 6% of the leases are concluded by Flexshopper via its own e-commerce payment gateway – comparable to the “Pay with Paypal Button” or the “Checkout with Paypal” button. So customers have the possibility to checkout on selected online stores with Flexshopper – the integration for this should be a bit more complicated than the “In Store” variant, but should work much more seamlessly. The % of returning customers is slightly better than the “In Store” solution. Again, the typical main arguments for Flexshoppers come into play: customers can afford items that they would not have been able to afford otherwise and retailers “secure the purchase” that would otherwise never have been able to take place. Likewise, the retailer does not have to worry about loans and installments and so on.

This payment gateway is also a great advertisement for further leasing via Flexshopper, because you can use Flexshopper, similar to Paypal also with other merchants.

Note: Flexshopper’s Payment Gateway in Action on Adorama.com

Consume, Lease, Pay-Off, Repeat – the “Subprime” Hamster Wheel

As described above, the main target group of Flexshopper is a rather financially weak target group with a bad (“subprime”) credit rating. Flexshopper nevertheless offers these customers their payment option – for a hefty fee of more than 130% of the cash price of the product. Due to the fact, that their customers have to pay off these products for a year, they are happy when they achieve this and are likely to do this again and again – so they are like a poor Hamster in a wheel, who never comes out of this endless spinning Consume, Lease, Pay-Off Hamster Wheel.

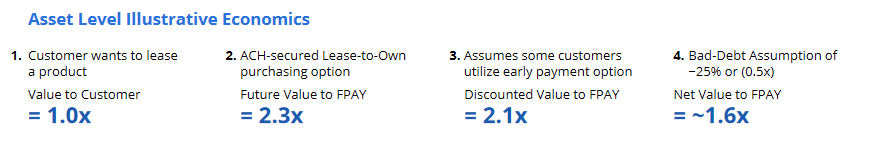

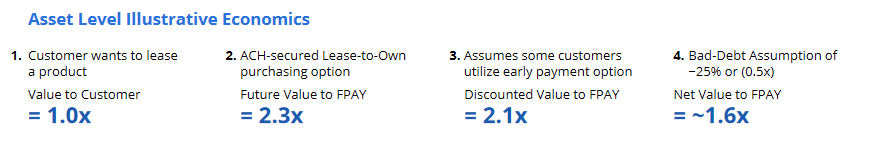

Talking about a repeating spinning wheel, it’s very important for Flexshopper to keep their customers in this wheel and move them to lease again and again. This little calculations shows the importance:

Flexshoppers average Gross Lease Value was $464 in Q4 2020.

So the cash price of this product is $464 with lease fees of 130%, which means a total price of $1067 ($464 x 2,3) for the endcustomer.

Assuming early payment options lower the discounted value to 110% for Flexshopper, which means $974 ($464 x 2,1) for Flexshopper.

At the end, we have to lower our revenue estimates due some Bad-debt and revenue loss. This makes up to -25% –> $742 ($464 x 1,6) for Flexshopper.

And now the most interesting point: So the average profit per new Lease Agreement is about $278 ($742 – $464) compared to an average customer acquisition cost of only $78. This means every new customer brings an average net profit of about $200! And if those customers keep repeating to sign new leases, they even bring more profits, because there are no new acquisition costs.

Note: Flexshopper’s Asset levels

2-sided Market Approach targeting the “Subprime” Consumers

As mentioned several times so far, Flexshopper has a 2 -sided market annex for its payment solution.

On the one hand, the end customer is enabled to purchase expensive products, which is normally not possible for him due to his creditworthiness and financial assets.

On the other hand, Flexshopper enables the merchants to sell their products to exactly these customers, although a sale would not have been possible in the traditional way – according to FlexShopper’s motto: Safe the Sale! This makes in total a Win-Win-Win situation for all three related parties.

Lease-to-Own Market Introduction

Flexshopper is riding on some massive trends – first of all the overall e-commerce trend with their LTO marketplace on FlexShopper.com. They are also playing in the massive fin-tech market.

Accordingly to their own investor deck, they are acting in a $25 Bio market.

Note: Flexshopper’s Market Opportunity

Navigating safe thorugh the pandemic – accelerating fast out of it into 2021

Flexshopper has had a fascinating and exciting year. Due to the Corona pandemic, Flexshopper was forced to slow its growth and monitor the situation. As Flexshopper’s main target group is financially weak people, the pandemic naturally had a strong impact on this target group. However, to the great surprise of many, the quality and interval of payments remained very good and there were no significant defaults by customers. This is mainly due to the high quality of underwriting and the generally good customer data. In addition, Flexshopper has a good overview of the payment performance of its customers very quickly due to its weekly payment model. After the crisis has abated somewhat, Flexshopper had “dared” to focus on growth again and admit new customers.

Specifically, the pandemic had two negative effects on Flexshopper:

1. Due to the stimulus checks issued by the government, some customers terminated their lease agreements prematurely, thus reducing the profit for Flexshopper. At the same time, however, this also ensured payment security.

2. Due to the forced store closures, the B2B “In Store” business model has suffered a sharp decline, as the stores were closed and therefore no new “In Store” lease agreements could be signed. At the same time, due to the e-commerce boom, the Flexshopper.com marketplace has experienced a “boom”.

These two risks for the company are still present to this day, but are rather manageable due to the cautious management and the knowledge about them.

The fourth quarter 2020 and the preliminary figures for January and February 2021 confirm that Flexshopper has ended the cautious and defensive Corona defense posture and now continues to fully focus on growth – so it remains very exciting.

News and Updates

Flexshopper has announced 4th Quarter 2020 Results

FlexShopper has annouced it’s latest earnings update on 8th of March. Their numbers were pretty strong and showed continued top-line growth over all relevant business KPIs. All of their Lease KPIs showed impressive growth, which are the fundament for later revenues. Their profitability has also improved.

The numbers in detail are:

- Total net Revenues increased 25% Year-over-Year to $28.1 Mio

- Amount of Gross Leases were up 26.5% Year-over-Year to 71,350 + Average Origination Value increased 8.7%

- Gross Lease Originations increased 37.3% to $33.1 Mio

- Adjusted EBITDA more than doubled to $2.6 Mio

For additional informations, please have a look at their latest earnings release.

Read between the lines: New Partnerships and Roll-out

Flexshopper’s management team stated in their last Earnings Call, that they are extending their partnerships with some of their partners and building out some of their pilot-programs for their “In Store” and “E-commerce” solutions. As described more above, the more partners and retailers they can gather on their ecosystem, the more value is created for the retailer and the customer.

“Subsequent to year end, we expanded our pilot program with a national retailer and now are a payment option in four states with them. We are also continuing to focus on securing additional retail partners and are optimistic regarding the progress of those discussions.”

Source: Rich House

For additional informations, please take a look at their press release.

Read between the lines: A Strong start into 2021

Flexshopper’s management has also stated, that they are experiencing ongoing strength in Januar and February 2021 in their most important Lease KPIs, which states, that their ongoing momentum is lasting and their growth efforts are bearing fruits.

“The strong origination growth experienced in the fourth quarter has continued into 2021, with originations rising 23% in January and February combined, compared with the same two-month period in 2020.”

“Leases originated in the fourth quarter driving favorable results in the first months of 2021. Adjusted EBITDA for January 2021 was approximately $1.59 million.”

Source: Rich House

For additional informations, please take a look at their press release.

More Facts

Business Model

Flexshopper’s business model is mainly to buy stuff from partner retailers (B2B) and then lease it to the end customer (B2C) for 1 year. If the customer pays for 1 year, the product belongs to him. The customer also has the option to end the lease early by redeeming the item through earlier one-time payments. He can also return the item and thus terminate the lease. FlexShopper basically acts as a payment service provider, so it only steps in when the end customer makes the purchase from the partner – so Flexshopper has no risk on inventory. FlexShopper earns specifically on the leasing fees, not on the sale of the items themselves. If an item costs $500, Flexshopper claims 130% of the purchase price as a fee for a normal leasing period of one year – Flexshopepr earns $650 (1 Year Lease: Item Cash Price $500 + $650 Lease Fee) over 1 year in this example.

FlexShopper generates two types of revenue:

Lease merchandise sold describes the revenue generated by sales from the lease portfolio, i.e. returned or confiscated items that have been sold.

Lease revenues and fees describes the net revenue generated by the lease, adjusted for missed installment payments.

Gross lease originations describes the value of newly concluded leases – the higher this value, the higher the revenue over the next year.

Gross leases describes the number of new leases.

Lease merchandise, net describes the residual value or the current market value of the lease portfolio. It is a very important and good indicator for the current and long-term development of the business. The higher it is, the better.

Valuation of the Stock

FlexShopper is currently valued with an Price-to-Sales Ratio of under 1. Due to the fact, that the company is not profitable, there is no Price-to-Earnings Ratio available. The Price-to-AEBITDA Ratio is under 10. Since FlexShopper is a younger company with mid twenties growth rates, that’s okay and cheap. Due to the business model, that all cashflows are highly predictable and recurring, the current valuation seems pretty low. Even if one wants to apply discounts to the share price due to the balance sheet structure and indebtedness, as well as risk adjustment due to the size of the company, it must be noted that the current valuation of the share is very low, especially compared to other peers out from the fintech and marketplace industry.

Share Structure

Probably the most amazing and at the same time unknown thing about Flexshopper is the extremely high insider ratio, which is rarely if ever found in any other listed stock. Insiders of the company hold about 70% of all outstanding shares, which keeps the tradable balance of shares extremely small. Furthermore, it is amazing that some insiders regularly acquire further shares every month and thus continue to increase their share. Normally, the opposite behavior is common for listed companies. This shows that the insiders and the management of the company are strongly in love with their company and want to profit very much from the success of their company.

| Insider | Shares Owned |

|---|---|

| Brad Mitchell Bernstein PRESIDENT – [O] | 200,000 |

| James Douglas Allen Director – [D] | 131,000 |

| Morry Rubin 10% Owner – [10%] | 5,151,259 |

| Heiser Harold Russell Jr. CFO – [O] | 763,105 |

| George Rubin Director, 10% Owner – [D] [10%] | 3,968,259 |

| T Scott King Director – [D] | 287,000 |

| Carl Pradelli Director – [D] | 78,000 |

| Ravi Radhakrishnan Chief Risk Officer – [O] | 156,800 |

| Waterfall Asset Management, LLC 10% Owner – [10%] | 1,629,546 |

| Howard Dvorkin Director, 10% Owner – [D] [10%] | 2,603,095 |

| Richard R Jr House Chief Executive Officer – [O] | 151,401 |

| Philip Michael Gitler Director – [D] | 788 |

| Frank Matasavage CFO – [O] | 2,000 |

| Katz Thomas O. Director – [D] | 18,500 |

| Paul B Healy Director – [D] | 0 |

Note: The Insider-Ownership of FlexShopper / Source

Dividend

The company currently does not pay a dividend.

Management

FlexShopper is partly run by it’s co-founders and long time employees, but also by a very new CEO. This is a good indicator, because they have some impressive skin in the game, through their hefty ownership. This will lead the managment to always remember that their own money is on the line.

The management consist of:

- Richard House Jr. – CEO – Richard House Jr. has served as our Chief Executive Officer since October 2019. From April 2018 to September 2019, Mr. House served as Operating Partner of Intrepid Capital Partners. From April 2014 to September 2019, Mr. House served as Chief Executive Officer of Veta Finance, Ltd., a provider of technology solutions to lenders in the United States and the United Kingdom. In 1997, Mr. House was the co-founder and then President of Atlanticus Holdings (formerly Compucredit Corp.).

- Brad Bernstein – President and Co-Founder – Brad Bernstein is a co-founder of FlexShopper and its President. Mr. Bernstein served as President and Chief Financial Officer of the Company, from January 2007 through December 2013 when the Company was named Anchor Funding Services, Inc. and through its wholly owned subsidiary, Anchor Funding Services, LLC (Anchor).

- H. Russel Heiser, Jr. – CFO – Russ Heiser has served as our Chief Financial Officer since December 2015. From July 2015 to December 2015, Mr. Heiser served as a consultant to the Company. From 2008 to 2015, Mr. Heiser served as an advisor to family offices in South Florida. In this role, Mr. Heiser focused on venture capital and private equity investments and was responsible for sourcing, financial analysis, transaction execution and management of portfolio companies across a variety of sectors.

Source: FlexShopper

Competition

FlexShopper is on the move in many areas and thus has some indirect competitors. One is the lease-to-own chain Aaron’s (NYSE: AAN), which now also operates an online store. Aaron’s, however, is a rather old-fashioned chain with a rather old-fashioned and outdated approach. FlexShopper, on the other hand, is the younger and dynamic competitor, with its own marketplace and payment option for B2B. On the other hand, there would also be other competitors, such as online stores, marketplaces or even payment providers, such as Paypal or Affirm, which, however, are primarily aimed at Prime Credit customers. FlexShopper therefore still operates in a rather special area and therefore has little competition that offers the same.

Note: FlexShopper Competitor Aaron’s / Source

What to expect in the near future

Growth-Strategy

FlexShopper will continue to focus on strong growth of its Marketplace and further expand its offering there. This will mainly be in the form of new leases and originations.

New Partnership-Strategy

Currently, the most growth for FlexShopper can be realized with new partnerships, especially new “in store” partnerships and new merchants for the online marketplace. Also new payment connections on e-commerce systems should happen in the near future.

Conclusion

FlexShopper is a clear buy candidate. Even though the company is extremely low valued and therefore a play on Walllstreet, all the above aspects speak for a significantly good company. Flexshopper has a very exciting growth story that is unbroken and just beginning. It has a good product, different income streams, diversified set up. The high insider ratio is extremely exceptional and also a safety factor.

Our recommendation: This stock is a clear speculative buy.

Disclaimer & Conflict of interest

The author currently holds a position in the mentioned stock. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

FlexShopper Inc. - Article

Research: FlexShopper - The Lease-To-Own (LTO) Hamster Wheel

Note: FlexShopper / Source

Table of Content:

- Author's Opinion

- Introduction to the Company

- Why is it so beloved?

- The Read between the lines

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author's Opinion

We all know those hyper growth marketplace stocks like Etsy or Amazon, which have made early investors rich. But what if I tell you, that there is a really tiny small stock out there, which is profitable on an Adjusted EBITDA base since 2019 and also hosts an e-commerce marketplace. They are also a true fin-tech company, providing an offline and online e-commerce gateway payment solution, plus mobile solutions.

Sounds good so far? Okay, this company isn't selling products, it's leasing them to their owners on a weekly payment base. If you pay down 52 weeks your little amount for your newest FLEX product, then you will own it - that's called Lease-to-own. This type of business model features stable and highly predictive cashflows, which is always good for a business.

How do they do it? They have an online B2C marketplace and in addition payment options, which can be used on other online stores or in traditonal brick-and-mortar stores and also on a mobile app. As an big plus, the company has an Price-to-Sales Ratio of under 1 ("!") and shows signficant revenue growth rates in the mid twenties. So let's dive deeper and get to know more about the FLEX.

Warning

Due to the very small marketcap and the low float (the amount of shares circling around and traded, which are not held by major investors) of FPAY shares, there are certain risks and an increased volatility.

Introduction: Let the company introduce itself

FlexShopper, LLC, a wholly owned subsidiary of FlexShopper, Inc. (FPAY), is a financial and technology company that provides brand name electronics, home furnishings and other durable goods to consumers on a lease-to-own (LTO) basis through its e-commerce marketplace (www.FlexShopper.com) as well as its patented and patent pending systems. FlexShopper also provides LTO technology platforms to retailers and e-retailers to facilitate transactions with consumers that want to acquire their products, but do not have sufficient cash or credit. FlexShopper approves consumers utilizing its proprietary consumer screening model, collects from consumers under an LTO contract and funds the LTO transactions by paying merchants for the goods.

Source: flexshopper.com

Omni-Channel Strategy drives diversification and builds up a loyal Customerbase

The Flexshopper Solution

FlexShopper offers a very simple product: If you have little to no money and / or a bad credit rating ( also called "subprime") but still want to be able to "flex" with cool products, you can "buy" the items with the help of Flexshopper. The cash price of the product is divided by 52, and so paid off week by week for a year. So at first you lease the item and don't own it until after a year and you have paid off your 52 weekly payments.

For example, a new MacBook Pro no longer costs $2500+, but only $40+ per week. But if you think you can save money here, you are wrong, because Flexshopper usually adds a hefty more than 100% leasing-fee on top of the cash price - so theoretical 20$ per week quickly turns into 45$ per week with Flexshopper's fees. This lease-to-own (LTO) payment solution is the actual main product of FlexShopper and is offered by them at every "sales channel". Customers can also save money with some early payoff options and also choose to return their merchandise back to FlexShopper anytime - this offers them some flexibility.

Note: Flexshopper LTO Solution

B2C Marketplace Flexshopper.com

FlexShopper.com is the company's flagship product - it is a business-to-customer marketplace for mainly electronic consumer goods and also home furnishings. You can find laptops, smartphones, TVs, kitchen appliances, but also musical instruments, garden furniture and upholstered furniture. Flexshopper.com provides the marketplace as a platform, and thus brings together end customers and suppliers of these products on the platform. These items on the platform cannot be purchased directly, but are exclusively available for "purchase" via Flexshopper's in-house "lease-to-own" (LTO) solution.

Note: Flexshopper.com marketplace

Suppliers on the Flexshopper.com Marketplace include well-known brands such as Amazon, Lenovo and Best Buy. More unknown local niche retailers like The Guitar Factory (they sell musical instruments) are also part of the concept and bring a special selection to the marketplace. More new retailers can be expected in the near future, which will further enrich the marketplace and attract new customers. These new customers attract new merchants, and so on....

Note: Flexshopper.com marketplace partner retailers

Since it is a marketplace, Flexshopper has no worries about inventory or logistics, as it is distributed exclusively through the merchants. Flexshopper turns over about 64% of its total leases on the marketplace, and the trend is upward. In addition, more than 50% of new leases come from existing customers - but more on this later. All this shows that the Flexshopper.com platform is very strong and will be an important growth driver in the future.

B2B In-Store "Save-the-Sale"

Flexshopper also has a "brick-and-mortar" channel in addition to its well-known marketplace. Customers can also purchase their purchases offline from well-known retailers via Flexshopper payment solution. There are no real hurdles for both the end customer and the retailer to take advantage of Flexshopper's solution. Everything customers have to do is to download the smartphone wallet app, register themselves in a few steps and they have already leased their purchase. The connection for the retailer is even more straightforward - they just need to put up some point-of-sale signs pointing to Flexshopper. No integration with the retailer's IT or point-of-sale system is necessary - so Flexshopper can be easily integrated into any store.

Note: Flexshopper's In-Store partner retailers

The solution again has a huge benefit for both merchants and customers: customers can afford new expensive items that they otherwise wouldn't be able to buy because of their cash on hand or credit rating. Merchants can secure purchases that would not / could not happen, also called "Safe the Sale".

In about 30% of new leases in dollars are done through the "In Store" model - returning customers are a little over 25% of that, which is not quite as good as the Flexshopper.com marketplace. Nevertheless, these customers registered in the app are real cash cows in the Wallet app, because you can always conveniently buy items in other stores that also work with Flexshopper. In this way, once-acquired customers ensure new leases again and again.

Note: Flexshopper's Wallet-App

B2B E-Commerce Payment Method

The remaining 6% of the leases are concluded by Flexshopper via its own e-commerce payment gateway - comparable to the "Pay with Paypal Button" or the "Checkout with Paypal" button. So customers have the possibility to checkout on selected online stores with Flexshopper - the integration for this should be a bit more complicated than the "In Store" variant, but should work much more seamlessly. The % of returning customers is slightly better than the "In Store" solution. Again, the typical main arguments for Flexshoppers come into play: customers can afford items that they would not have been able to afford otherwise and retailers "secure the purchase" that would otherwise never have been able to take place. Likewise, the retailer does not have to worry about loans and installments and so on.

This payment gateway is also a great advertisement for further leasing via Flexshopper, because you can use Flexshopper, similar to Paypal also with other merchants.

Note: Flexshopper's Payment Gateway in Action on Adorama.com

Consume, Lease, Pay-Off, Repeat - the "Subprime" Hamster Wheel

As described above, the main target group of Flexshopper is a rather financially weak target group with a bad ("subprime") credit rating. Flexshopper nevertheless offers these customers their payment option - for a hefty fee of more than 130% of the cash price of the product. Due to the fact, that their customers have to pay off these products for a year, they are happy when they achieve this and are likely to do this again and again - so they are like a poor Hamster in a wheel, who never comes out of this endless spinning Consume, Lease, Pay-Off Hamster Wheel.

Talking about a repeating spinning wheel, it's very important for Flexshopper to keep their customers in this wheel and move them to lease again and again. This little calculations shows the importance:

Flexshoppers average Gross Lease Value was $464 in Q4 2020.

So the cash price of this product is $464 with lease fees of 130%, which means a total price of $1067 ($464 x 2,3) for the endcustomer.

Assuming early payment options lower the discounted value to 110% for Flexshopper, which means $974 ($464 x 2,1) for Flexshopper.

At the end, we have to lower our revenue estimates due some Bad-debt and revenue loss. This makes up to -25% --> $742 ($464 x 1,6) for Flexshopper.

And now the most interesting point: So the average profit per new Lease Agreement is about $278 ($742 - $464) compared to an average customer acquisition cost of only $78. This means every new customer brings an average net profit of about $200! And if those customers keep repeating to sign new leases, they even bring more profits, because there are no new acquisition costs.

Note: Flexshopper's Asset levels

2-sided Market Approach targeting the "Subprime" Consumers

As mentioned several times so far, Flexshopper has a 2 -sided market annex for its payment solution.

On the one hand, the end customer is enabled to purchase expensive products, which is normally not possible for him due to his creditworthiness and financial assets.

On the other hand, Flexshopper enables the merchants to sell their products to exactly these customers, although a sale would not have been possible in the traditional way - according to FlexShopper's motto: Safe the Sale! This makes in total a Win-Win-Win situation for all three related parties.

Lease-to-Own Market Introduction

Flexshopper is riding on some massive trends - first of all the overall e-commerce trend with their LTO marketplace on FlexShopper.com. They are also playing in the massive fin-tech market.

Accordingly to their own investor deck, they are acting in a $25 Bio market.

Note: Flexshopper's Market Opportunity

Navigating safe thorugh the pandemic - accelerating fast out of it into 2021

Flexshopper has had a fascinating and exciting year. Due to the Corona pandemic, Flexshopper was forced to slow its growth and monitor the situation. As Flexshopper's main target group is financially weak people, the pandemic naturally had a strong impact on this target group. However, to the great surprise of many, the quality and interval of payments remained very good and there were no significant defaults by customers. This is mainly due to the high quality of underwriting and the generally good customer data. In addition, Flexshopper has a good overview of the payment performance of its customers very quickly due to its weekly payment model. After the crisis has abated somewhat, Flexshopper had "dared" to focus on growth again and admit new customers.

Specifically, the pandemic had two negative effects on Flexshopper:

1. Due to the stimulus checks issued by the government, some customers terminated their lease agreements prematurely, thus reducing the profit for Flexshopper. At the same time, however, this also ensured payment security.

2. Due to the forced store closures, the B2B "In Store" business model has suffered a sharp decline, as the stores were closed and therefore no new "In Store" lease agreements could be signed. At the same time, due to the e-commerce boom, the Flexshopper.com marketplace has experienced a "boom".

These two risks for the company are still present to this day, but are rather manageable due to the cautious management and the knowledge about them.

The fourth quarter 2020 and the preliminary figures for January and February 2021 confirm that Flexshopper has ended the cautious and defensive Corona defense posture and now continues to fully focus on growth - so it remains very exciting.

News and Updates

Flexshopper has announced 4th Quarter 2020 Results

FlexShopper has annouced it's latest earnings update on 8th of March. Their numbers were pretty strong and showed continued top-line growth over all relevant business KPIs. All of their Lease KPIs showed impressive growth, which are the fundament for later revenues. Their profitability has also improved.

The numbers in detail are:

- Total net Revenues increased 25% Year-over-Year to $28.1 Mio

- Amount of Gross Leases were up 26.5% Year-over-Year to 71,350 + Average Origination Value increased 8.7%

- Gross Lease Originations increased 37.3% to $33.1 Mio

- Adjusted EBITDA more than doubled to $2.6 Mio

For additional informations, please have a look at their latest earnings release.

Read between the lines: New Partnerships and Roll-out

Flexshopper's management team stated in their last Earnings Call, that they are extending their partnerships with some of their partners and building out some of their pilot-programs for their "In Store" and "E-commerce" solutions. As described more above, the more partners and retailers they can gather on their ecosystem, the more value is created for the retailer and the customer.

"Subsequent to year end, we expanded our pilot program with a national retailer and now are a payment option in four states with them. We are also continuing to focus on securing additional retail partners and are optimistic regarding the progress of those discussions.”

Source: Rich House

For additional informations, please take a look at their press release.

Read between the lines: A Strong start into 2021

Flexshopper's management has also stated, that they are experiencing ongoing strength in Januar and February 2021 in their most important Lease KPIs, which states, that their ongoing momentum is lasting and their growth efforts are bearing fruits.

"The strong origination growth experienced in the fourth quarter has continued into 2021, with originations rising 23% in January and February combined, compared with the same two-month period in 2020."

"Leases originated in the fourth quarter driving favorable results in the first months of 2021. Adjusted EBITDA for January 2021 was approximately $1.59 million."

Source: Rich House

For additional informations, please take a look at their press release.

More Facts

Business Model

Flexshopper's business model is mainly to buy stuff from partner retailers (B2B) and then lease it to the end customer (B2C) for 1 year. If the customer pays for 1 year, the product belongs to him. The customer also has the option to end the lease early by redeeming the item through earlier one-time payments. He can also return the item and thus terminate the lease. FlexShopper basically acts as a payment service provider, so it only steps in when the end customer makes the purchase from the partner - so Flexshopper has no risk on inventory. FlexShopper earns specifically on the leasing fees, not on the sale of the items themselves. If an item costs $500, Flexshopper claims 130% of the purchase price as a fee for a normal leasing period of one year - Flexshopepr earns $650 (1 Year Lease: Item Cash Price $500 + $650 Lease Fee) over 1 year in this example.

FlexShopper generates two types of revenue:

Lease merchandise sold describes the revenue generated by sales from the lease portfolio, i.e. returned or confiscated items that have been sold.

Lease revenues and fees describes the net revenue generated by the lease, adjusted for missed installment payments.

Gross lease originations describes the value of newly concluded leases - the higher this value, the higher the revenue over the next year.

Gross leases describes the number of new leases.

Lease merchandise, net describes the residual value or the current market value of the lease portfolio. It is a very important and good indicator for the current and long-term development of the business. The higher it is, the better.

Valuation of the Stock

FlexShopper is currently valued with an Price-to-Sales Ratio of under 1. Due to the fact, that the company is not profitable, there is no Price-to-Earnings Ratio available. The Price-to-AEBITDA Ratio is under 10. Since FlexShopper is a younger company with mid twenties growth rates, that's okay and cheap. Due to the business model, that all cashflows are highly predictable and recurring, the current valuation seems pretty low. Even if one wants to apply discounts to the share price due to the balance sheet structure and indebtedness, as well as risk adjustment due to the size of the company, it must be noted that the current valuation of the share is very low, especially compared to other peers out from the fintech and marketplace industry.

Share Structure

Probably the most amazing and at the same time unknown thing about Flexshopper is the extremely high insider ratio, which is rarely if ever found in any other listed stock. Insiders of the company hold about 70% of all outstanding shares, which keeps the tradable balance of shares extremely small. Furthermore, it is amazing that some insiders regularly acquire further shares every month and thus continue to increase their share. Normally, the opposite behavior is common for listed companies. This shows that the insiders and the management of the company are strongly in love with their company and want to profit very much from the success of their company.

| Insider | Shares Owned |

|---|---|

| Brad Mitchell Bernstein PRESIDENT - [O] | 200,000 |

| James Douglas Allen Director - [D] | 131,000 |

| Morry Rubin 10% Owner - [10%] | 5,151,259 |

| Heiser Harold Russell Jr. CFO - [O] | 763,105 |

| George Rubin Director, 10% Owner - [D] [10%] | 3,968,259 |

| T Scott King Director - [D] | 287,000 |

| Carl Pradelli Director - [D] | 78,000 |

| Ravi Radhakrishnan Chief Risk Officer - [O] | 156,800 |

| Waterfall Asset Management, LLC 10% Owner - [10%] | 1,629,546 |

| Howard Dvorkin Director, 10% Owner - [D] [10%] | 2,603,095 |

| Richard R Jr House Chief Executive Officer - [O] | 151,401 |

| Philip Michael Gitler Director - [D] | 788 |

| Frank Matasavage CFO - [O] | 2,000 |

| Katz Thomas O. Director - [D] | 18,500 |

| Paul B Healy Director - [D] | 0 |

Note: The Insider-Ownership of FlexShopper / Source

Dividend

The company currently does not pay a dividend.

Management

FlexShopper is partly run by it's co-founders and long time employees, but also by a very new CEO. This is a good indicator, because they have some impressive skin in the game, through their hefty ownership. This will lead the managment to always remember that their own money is on the line.

The management consist of:

- Richard House Jr. - CEO - Richard House Jr. has served as our Chief Executive Officer since October 2019. From April 2018 to September 2019, Mr. House served as Operating Partner of Intrepid Capital Partners. From April 2014 to September 2019, Mr. House served as Chief Executive Officer of Veta Finance, Ltd., a provider of technology solutions to lenders in the United States and the United Kingdom. In 1997, Mr. House was the co-founder and then President of Atlanticus Holdings (formerly Compucredit Corp.).

- Brad Bernstein - President and Co-Founder - Brad Bernstein is a co-founder of FlexShopper and its President. Mr. Bernstein served as President and Chief Financial Officer of the Company, from January 2007 through December 2013 when the Company was named Anchor Funding Services, Inc. and through its wholly owned subsidiary, Anchor Funding Services, LLC (Anchor).

- H. Russel Heiser, Jr. - CFO - Russ Heiser has served as our Chief Financial Officer since December 2015. From July 2015 to December 2015, Mr. Heiser served as a consultant to the Company. From 2008 to 2015, Mr. Heiser served as an advisor to family offices in South Florida. In this role, Mr. Heiser focused on venture capital and private equity investments and was responsible for sourcing, financial analysis, transaction execution and management of portfolio companies across a variety of sectors.

Source: FlexShopper

Competition

FlexShopper is on the move in many areas and thus has some indirect competitors. One is the lease-to-own chain Aaron's (NYSE: AAN), which now also operates an online store. Aaron's, however, is a rather old-fashioned chain with a rather old-fashioned and outdated approach. FlexShopper, on the other hand, is the younger and dynamic competitor, with its own marketplace and payment option for B2B. On the other hand, there would also be other competitors, such as online stores, marketplaces or even payment providers, such as Paypal or Affirm, which, however, are primarily aimed at Prime Credit customers. FlexShopper therefore still operates in a rather special area and therefore has little competition that offers the same.

Note: FlexShopper Competitor Aaron's / Source

What to expect in the near future

Growth-Strategy

FlexShopper will continue to focus on strong growth of its Marketplace and further expand its offering there. This will mainly be in the form of new leases and originations.

New Partnership-Strategy

Currently, the most growth for FlexShopper can be realized with new partnerships, especially new "in store" partnerships and new merchants for the online marketplace. Also new payment connections on e-commerce systems should happen in the near future.

Conclusion

FlexShopper is a clear buy candidate. Even though the company is extremely low valued and therefore a play on Walllstreet, all the above aspects speak for a significantly good company. Flexshopper has a very exciting growth story that is unbroken and just beginning. It has a good product, different income streams, diversified set up. The high insider ratio is extremely exceptional and also a safety factor.

Our recommendation: This stock is a clear speculative buy.

Disclaimer & Conflict of interest

The author currently holds a position in the mentioned stock. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Revenue, GrossProfit & AEBITDA by Quarter

KPIs

Gross Leases

Chart

Peers

All the Peers

Tattooed Chef Inc.

Neutral

Hellofresh SE

Bullish

Build-a-Bear Workshop Inc.

Outperform

Stamps.com Inc.

Bullish

Redfin Corporation

Bullish

Perion Network Ltd.

Outperform

Upwork Inc.

Bullish

Chegg Inc.

Bullish

Pinterest Inc.

Bullish