The Search

Your Search Results

News from us

Newest Symbols

Newest Industries

Click to expand

Advertising

See Stocks

Automotive

See Stocks

E-Commerce

See Stocks

E-Learning

See Stocks

Electricity

See Stocks

Engineering

See Stocks

FlexShopper Inc.

Bullish

Bullish

Tattooed Chef Inc.

Neutral

Neutral

Hellofresh SE

Bullish

Bullish

Build-a-Bear Workshop Inc.

Outperform

Outperform

Stamps.com Inc.

Bullish

Bullish

Redfin Corporation

Bullish

Bullish

Perion Network Ltd.

Outperform

Outperform

Upwork Inc.

Bullish

Bullish

Chegg Inc.

Bullish

Bullish

Pinterest Inc.

Bullish

Bullish

Bluelinx Holdings Inc

Bullish

Bullish

Momentus Inc.

Neutral

Neutral

Mynaric AG

Neutral

Neutral

Virgin Galactic Holdings Inc.

Neutral

Neutral

Maxar Technologies Inc.

Neutral

Neutral

Sunrun Inc.

Bullish

Bullish

Steico SE

Neutral

Neutral

Alfen N.V.

Neutral

Neutral

Research

Content Cards

Swipe

Our Article

Perion Network Ltd. - Article

Research: Perion Network – An Genius Ad-Tech Company at the Very Beginning

Note: The Perion Logo / Source

Table of Content:

- Author’s Opinion

- Introduction to the Company

- What makes it so special?

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author’s Opinion

The title of the research note could easily be misleading. Perion Network is indeed not a young start-up that has just gone public, but has been on the stock market for many years, and many years older still. However, the successful reorientation of the company and the transformation associated with it was only recently completed – and so Perion Network is really only at the beginning – starting with the price and the reflection of the company value on the stock exchange. Perion, an Israeli Ad-Tech company, is one of the most advanced pioneers in advertising technology. Strong partnerships, for example with Microsoft and a visionary CEO, who has completely restored the company, are just the cherry on top.

Introduction: Let the company introduce itself

Perion Network Ltd. (NASDAQ: PERI), a global technology company that delivers its Synchronized Digital Branding solution across the three main pillars of digital advertising – ad search, social media and display / video advertising

Source: Perion Network

What makes Perion so special?

The three main pillars of digital advertising

“Ad Search”

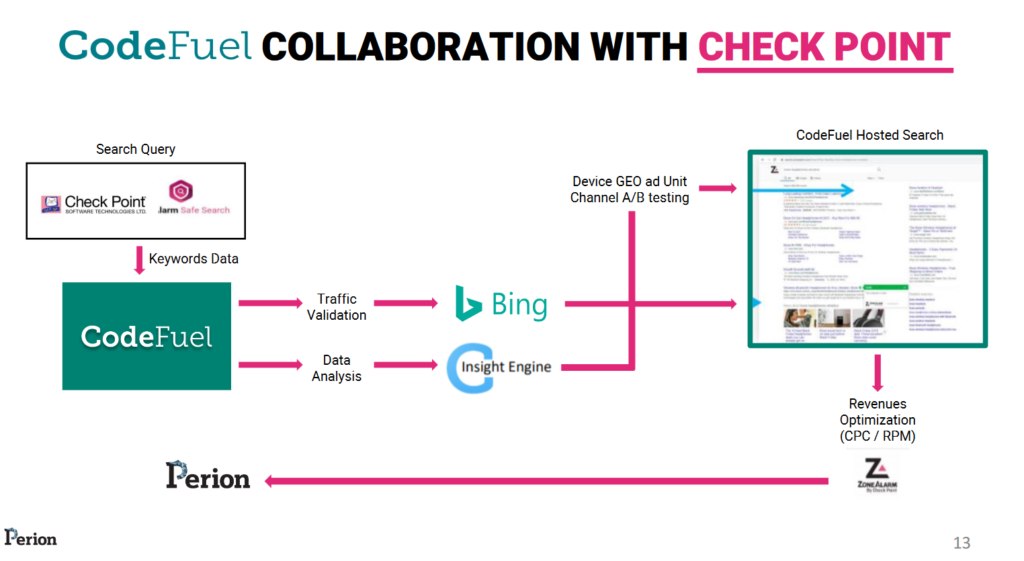

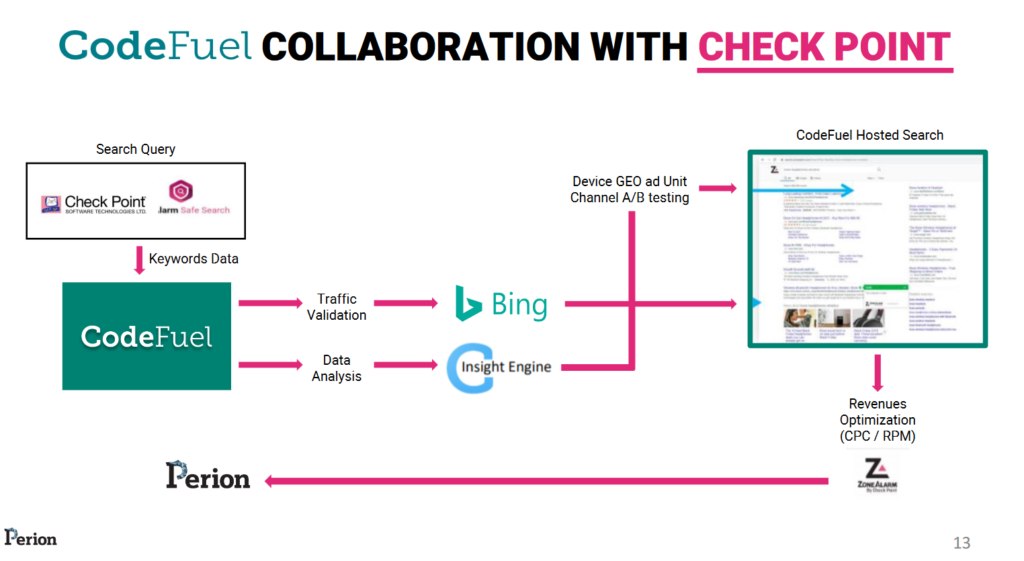

Ad search is the smaller revenue-stream for Perion Network. Their Ad-Search business, which is run by the company “CodeFuel” has seen dramatic growth in the recent years. CodeFuel is the ad-search partner for Microsoft‘s search-engine “BING“. There partnership is more than 10 years old and was renewed for another 4 years, one week ago.

They are also hosting the ads on the “MSN“-Network. Furthermore, Microsoft and CodeFuel codeveloped the private search-engine PRIVADO.

Note: How CodeFuel works. / Source

“Display & Social advertising”

Perion Network has two main other revenue streams: Display search, which means banner-ads or video-ads on a homepages are delivered by “Undertone“. Social media adds are delivered by “MakeMeReach“.

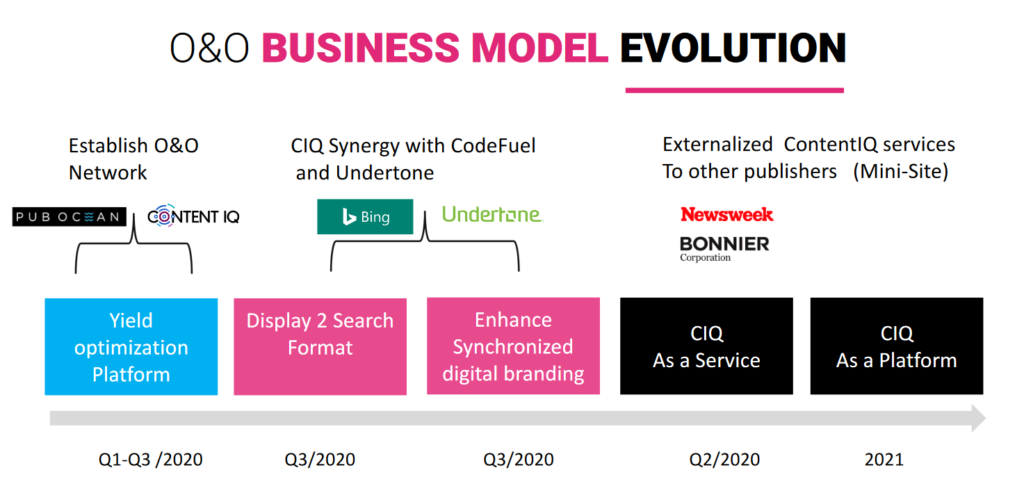

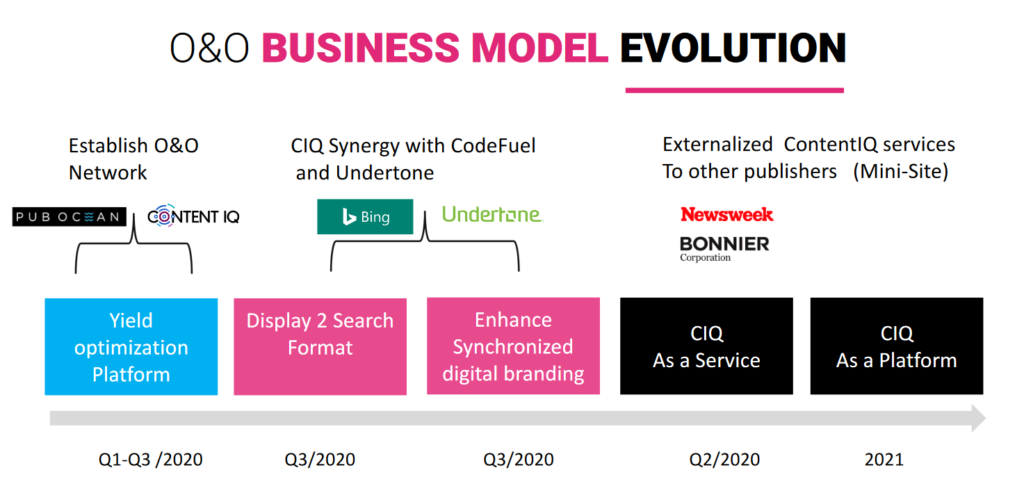

Perion Network recently acquired “PubOcean” and “ContentIQ“, which are optimizing their ad service and adding additional features, insights and optimizations to their ad-technology. They are currently developing their ad-system from a service to a platform system. Perion Network wants to improve their business and growth by improving their ads and funnel system, which leads to very high conversations-rates and longer user sessions. Second, by building out automation, to reduce SG&A (“SG&A = Selling, general and administrative expense”) costs and third, by igniting growth, with additional partnerships and new features.

Note: Strategy for the Ad-Business on a timeline. / Source

Their last two recent acquisitions also bring additional synergys for their whole product platform.

“ContentIQ”

As brands find it increasingly difficult to effectively tell their story to consumers, and branded contentbecomes a more critical and effective form of engagement, a new paradigm is required. Brands must gain the ability to scale to highly relevantaudiences, and through that to assert greater control over the media environment. CIQ’s offering fills this gap and provides Perion with a proprietarysolution that gives publishers and brands the tools they need to prosper in a challenging digital world.

Source: Perion

Note:ContentIQ’s technology and productline. / Source

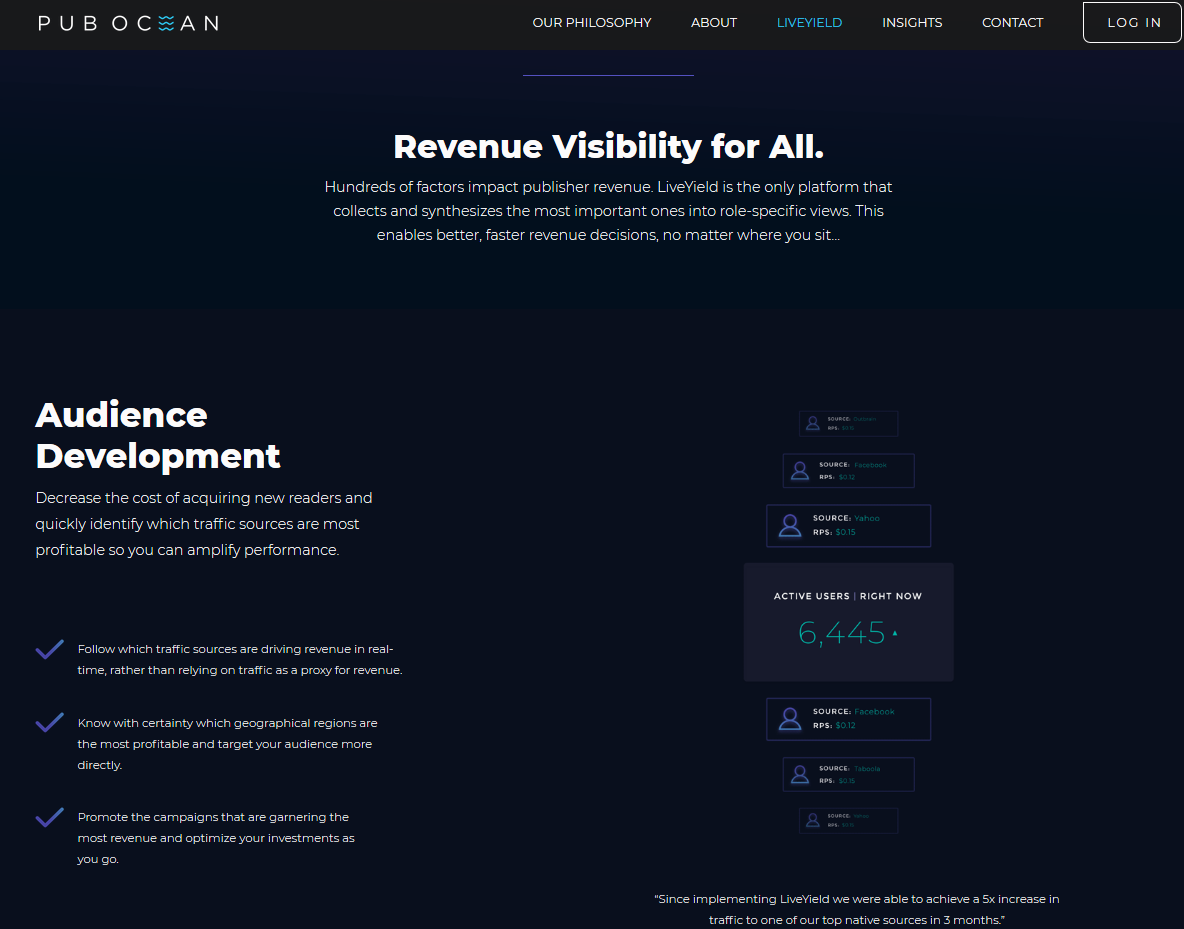

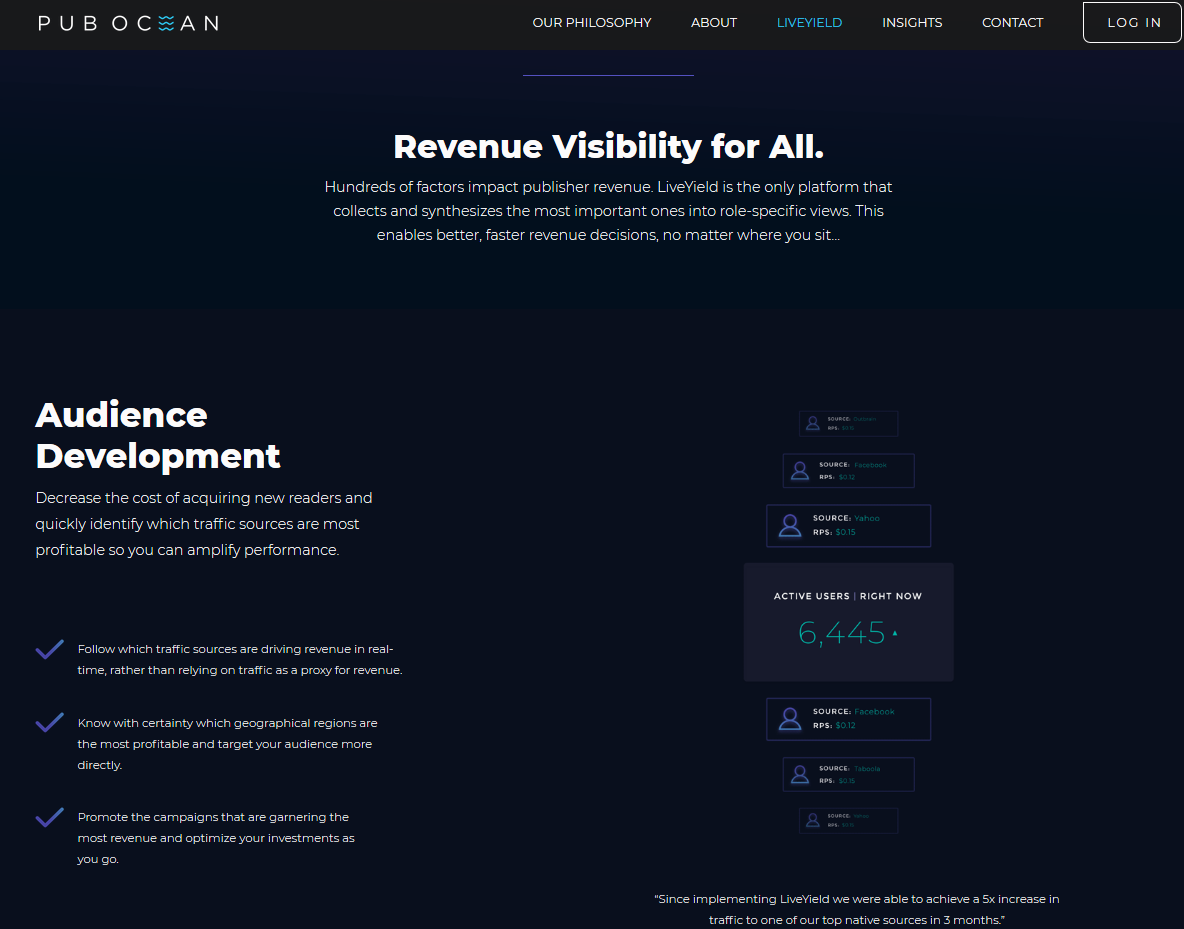

“PubOcean”

Pub Ocean is a rapidly-growing digital publisher-focused technology company with scalable content distributionand real-time revenue analytics technology. Pub Ocean offers significant and immediate synergies to ContentIQ (CIQ), which Perion acquired inJanuary, driving incremental revenue opportunities and enhanced profitability.

Source: Perion

Note: PubOcean’s main product. / Source

Ability to provide guidance, when Competitors couldn’t

The advertising industry has suffered greatly from COVID. In some cases, entire industries have cut all advertising spending, leading to a sharp drop in sales along the entire advertising industry. As an agile company, Perion reacted very quickly to this situation and announced a $10M savings package. As one of the very few companies, Perion was already able in Q2 to give a forecast for the rest of 2020 despite the very opaque situation, which is astonishing. This was only possible because of the technologically superior platform and the insights it provided.

In addition, Perion was able to grew its search business 8% year-over-year, compared to a global 15% decline for the rest of it’s competitors.

Successfull turnaround with a better line-up

Attentive observers of the stock chart see that Perion has been on the stock market for over 10 years and has already seen much better times. The stock used to be quoted at highs of over $40. At the beginning of 2014, there was the Great Crash and quite a stagnation of the business. Perion used to distribute the email advertising software “IncrediMail”, but this was not really working for some time and has now been shut down.

Since then, they have been trying to realign the business, which did not work at first. Through a management change and the very successful commitment of Doron Gerstel, the new CEO since mid 2017, Perion has managed to achieve a very successful turnaround.

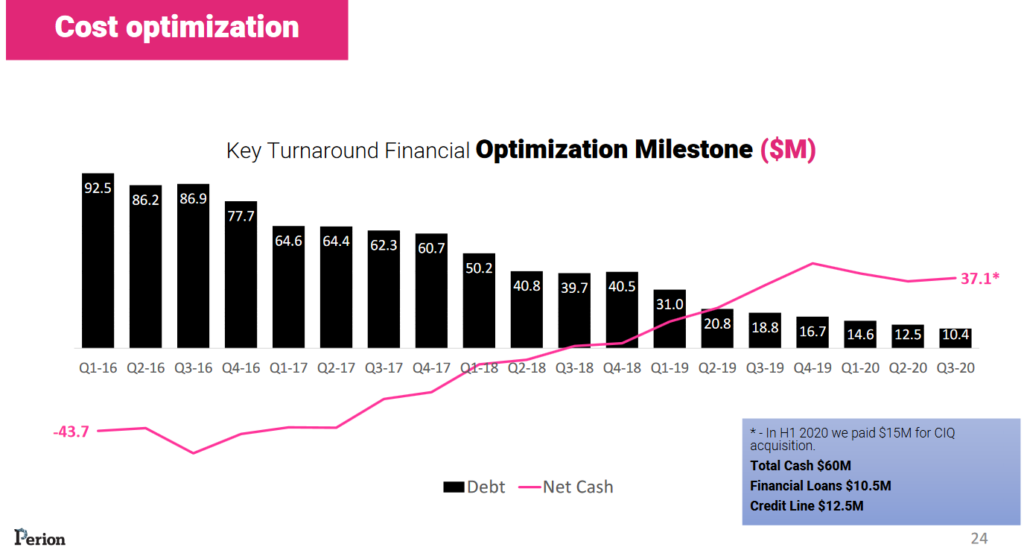

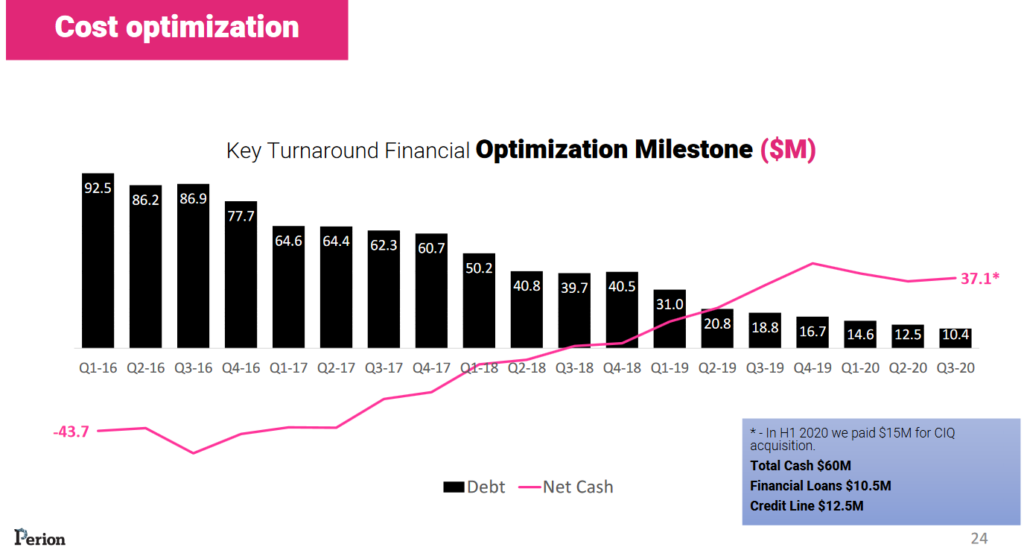

The more successful turnaround can be seen in the following figure alone, which shows the debt of the company and the net cash position.

Note: Perion succesfully turned around their balancesheet. / Source

Doron Gerstel and his new team have managed to reduce a very high level of debt almost entirely while building a high net cash position – a very impressive achievement. But a lot has also happened on the product side, as the points already mentioned above have shown.

Recent News and Updates

The Release of the Results for the third Quarter 2020 and Guidance for 2020

Perion Network Inc. has announced their latest earnings results on October 28th. Although the Corona virus continues to ravage the world, a large number of companies have returned to place more advertising. Perion has benefited greatly from this change of tack, which is reflected in the growth figures below. In addition, Perion Network has significantly increased the guidance published in Q2.

- Total Revenues increased 27% Year-over-Year to $83.4Mio

- Advertising Revenues increased 76% Year-over-Year to $37.9Mio

- Search and other Revenues increased 3% Year-over-Year to $45.5Mio

- Adjusted EBITDA (“Earning Before Interest, Taxes, Deprecations and Amortization”) was $8.7Mio, compared to $7.6Mio one year before. So on an adjusted EBITDA base, and also on the Non-GAAP (“GAAP = General Accepted Accounting Principles”) net income, Perion is profitable, despite it’s undergoing transformation, growth and expansion.

A few weeks earlier, Perion also raised its outlook for 2020 significantly. Considering that we are currently experiencing a huge pandemic, and that Perion as an ad-tech company is severely affected by the effects of the virus, this is incredible. They are now expecting for the full year 2020:

- Revenue of about $290-300Mio and Adjusted EBITDA of about $25-27Mio.

If one looks in particular at the adjusted EBITDA, it can be seen that a large part of the profit is generated in the second half of the year. This is due to the seasonal business with Christmas, Thanksgiving and Blackfriday, and also to the strong losses caused by the corona virus in the first half of the year.

For additional informations, please have a look at their latest earnings release.

Perion and Microsoft renew their Partnership for 4 additional years

As a logical consequence of the very successful and lucrative cooperation between Microsoft and Perion, Microsoft and Perion have extended their partnership for another 4 years. This ensures Perion secure revenue streams from the Ad-Search segment and underpins innovative projects, such as the jointly developed search engine PRIVADO.

The continuing collaboration between the companies will enable CodeFuel to further grow its publisher relationships offering, lucrative searchtechnology solutions, and sophisticated expertise for monetizing their digital properties. These include shopping, product comparison and contentwebsites, applications, browser extensions, mobile launchers, and white label search engines. Leveraging CodeFuel’s publishers’ network enablesMicrosoft to increase search advertising market share and connect advertisers to millions of potential customers while enriching user experiencethrough publisher properties

In the past two years, CodeFuel has exhibited significant growth through empowering publishers to create new revenue streams and unique searchexperiences, while focusing on increasingly high quality monetization solutions to track search demand.

Source: Perions Press Release

Note: Privado – the coockieless and private search-engine.

Acquisition of PubOcean and ContentIQ

Perion made two successful acquisitions in 2020. In January, ContentIQ was acquired for approximately $73M. Seven months later PubOcean was acquired for $22M. Perion see advantages like the following from the acquisitions:

With the financial optimization of Perion and the turnaround of our Search business completed, the Boardhas prioritized efforts to further expand and enhance the technological capabilities of our Synchronized Digital Branding as a key step to drive a moresustainable, predictable and profitable operating model. The acquisition of CIQ provides a strategic and significant opportunity for Perion to bolster thateffort as the ad-tech landscape continues to rapidly evolve. I am confident that this acquisition will further diversify our offering, providing significantand accretive growth opportunities across our business. With the earnout, we have prudently structured the acquisition to reduce risk and to ensurethat CIQ’s financial contribution to Perion’s top and bottom line are properly aligned with the investment we are making.

Source: Press Release

Or:

Pub Ocean is a strategically important acquisition for Perion, as we advance the buildout of a Synchronized Digital Branding solution across all digitalchannels,” said Doron Gerstel, CEO of Perion. “We see meaningful synergies between CIQ and Pub Ocean. We could not be more thrilled to welcomePub Ocean and its founder Chris into the Perion and CIQ family.

Source: Press Release

ContentIQ will add the following financial numbers to Perion:

- Revenue 2019 of about $39M

- Adjusted EBITDA of about $6M

The PubOcean numbers are not public, but assuming the same valuation strategy as for ContentIQ, they should make about

- $10-15M in revenues and

- $2M in Adjusted EBITDA

Due to those acquisition, Perion was able to grow it’s business in the Q3 this year and feather the revenue drop in Q2. The increase in the Q3 figures were only achieved by those acquisitions, the organic growth was about 0 to single digit growth.

In conclusion, the two acquisitions are good priced growth opportunities for Perion. Thanks to them, the impact of the Covid-19 pandemic was well mitigated and growth accelerated in the third quarter.

The deep Analysis

Financials

Dividend

The company currently does not pay a dividend.

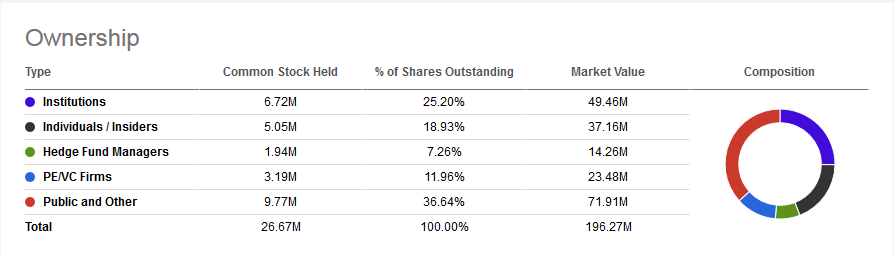

Share Structure

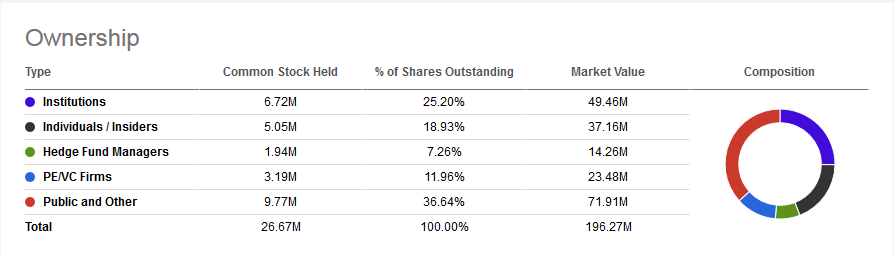

Perion uses a one class share system. There are normal mutual fund or institutional holdings.

Note: The share Structure of Perion Network Ltd. / Source

Insiders of the company are holding up to 19% of the outstanding shares, which is a good amount – it is always good, when insinders have some skin in the game.

Chart

Valuation of the Stock

Perion is currently very favorably valued – indeed, already undervalued compared to its peers. We have a one-year forward non-GAAP P/E-Ratio (“P/E-Ratio=Pric to Earnings Ratio”) of approximately 11, which is a very favorable valuation compared to their competitors, some of whom have values in excess of 100, and should leave plenty of room for improvement. If we look at the Price/Revenue-Ratio, we don’t even come up with a value of 1 for 2020. This is also extremely cheap. If we look at the EBITDA, we also have a strong undervaluation for 2020, which is approximately 4 in relation to the share price. Since Perion is a growth company and plans double digit growth numbers, it can basically grow strong in the next few years, the current valuation is ridiculously low, especially compared to the other peers.

On top there is a net cash position of over $37M and an ongoing decline in debt, which is only just over $10M.

Business Model

Perion is a kind of digital advertising agency, which places the best possible campaigns for its clients. Customers pay Perion money, which Perion places in the best possible way in the form of digital advertising with the best possible results for the customer. Through technology, customers are better addressed and a higher conversion rate is achieved.

Currently, a lot of “manual work” is still needed for this. However, this should be greatly reduced by the new acquisitions and the expansion to a fully automated platform.

Due to the advertising segment, Perion has saisonal earnings. This means, that Perions revenue is naturally higher in Q4 than in other quarters, because of the holiday season and extended advertising budgets of their customers.

Management

Perion Network has delivered an impressive turnaround to its strong management team and has modernized and automated its outdated business model. The leading role in this process was and still is:

- Doron Gerstel – CEO – Doron Gerstel joined Perion as CEO in April 2017. Serving as CEO for the last 16 years, he has established an outstanding ability to drive growth in hi-tech companies and competitive markets. In his previous role as CEO of Panaya, he led a company turnaround that saw an increase in annual revenue and the company’s acquisition by Infosys. He has also held CEO positions at Nolio, Syneron and Zend Technologies.

- Maoz Sigron – CFO – Maoz is an experienced finance executive with more than a decade of experience working with NASDAQ-listed companies. Prior to joining Perion, Maoz served as Vice President of Allot Communications, where he led the full lifecycle of M&A deals, from due diligence through the final integration phase, to re-organizational and post M&A activities.

- Miki Kolko – COO – Miki Kolko has served as Perion’s Chief Technology Officer since January 2015. He has over 19 years of experience in internet and big data technologies and previously served as VP Data at Perion. Prior to this, Miki served as VP Data at LivePerson (NASDAQ:LSPN), and held various engineering management positions in other companies. He founded 3 enterprise software and internet B2C startups.

Source: Perion

What is most impressive about Perion Management is the clear vision and focus that the management has. They do not shy away from new technologies, but buy them up and then integrate them themselves. They have completely restored and realigned a business model that is dead for the future and a highly indebted company, which is an impressive achievement.

Competition

Perion operates in a highly competitive but also strongly growing market – therefore there is a lot of competition.

Some of the well-known competitors are for example Google (NASDAQ: GOOGL), Amazon (NASDAQ: AMZN), The Trade Desk (NASDAQ: TTD) or Digital Turbine (NASDAQ: APPS).

All of these companies take a different or similar approach to Perion Network. Nevertheless, Perion manages to keep up with the growth of the other companies through new technologies, diversification and acquisitions. In particular, Perion’s strong focus on automation and increased investment in research and development has led to positive results. In addition, the rating is ridiculously low compared to the competition, which is sometimes rated by a factor of 10 or even higher.

What to expect in the near future

Platform-Strategy

Perion has announced that it intends to further expand its platform, which is currently not yet fully automated, and to install additional automation. Furthermore, it only makes sense to further integrate the 3 different products with each other to create a closed platform that is seamlessly integrated. Their statement to further increase the R&D (“Research & Development”) expenditures underpins this plan.

Acquisition-Strategy

Perion’s very strong net cash position allows it to continue its current expansion strategy and to buy up potential candidates. Again, many optimizations and synergies could emerge – product improvements, expansion of the product portfolio and customer base, cross-selling opportunities and of course new integration possibilities into the platform to save personnel costs. The current pandemic has weakened many of these small advertising companies, which could look for a strong partner with a clear vision.

Conclusion

Perion Network is a clear buy – they are riding and investing in a megatrend, have a very agile and expierenced management team and a clear vision. Their research & develop + acquisition strategy bears early juicy fruits. Their current valuation is very low – assuming a fair P/E-Ratio of about 33, the stock can easily triple itself, to up to $22.5. Perion itself with its partnerships and technologies makes it also to an attractive takeover-candidate.

Our recommendation: This stock is a clear buy. Use the current low price for buying in or averaging up.

Disclaimer & Conflict of interest

The author currently holds a position in the mentioned stock. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Perion Network Ltd. - Article

Research: Perion Network – An Genius Ad-Tech Company at the Very Beginning

Note: The Perion Logo / Source

Table of Content:

- Author's Opinion

- Introduction to the Company

- What makes it so special?

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author's Opinion

The title of the research note could easily be misleading. Perion Network is indeed not a young start-up that has just gone public, but has been on the stock market for many years, and many years older still. However, the successful reorientation of the company and the transformation associated with it was only recently completed - and so Perion Network is really only at the beginning - starting with the price and the reflection of the company value on the stock exchange. Perion, an Israeli Ad-Tech company, is one of the most advanced pioneers in advertising technology. Strong partnerships, for example with Microsoft and a visionary CEO, who has completely restored the company, are just the cherry on top.

Introduction: Let the company introduce itself

Perion Network Ltd. (NASDAQ: PERI), a global technology company that delivers its Synchronized Digital Branding solution across the three main pillars of digital advertising - ad search, social media and display / video advertising

Source: Perion Network

What makes Perion so special?

The three main pillars of digital advertising

"Ad Search"

Ad search is the smaller revenue-stream for Perion Network. Their Ad-Search business, which is run by the company "CodeFuel" has seen dramatic growth in the recent years. CodeFuel is the ad-search partner for Microsoft's search-engine "BING". There partnership is more than 10 years old and was renewed for another 4 years, one week ago.

They are also hosting the ads on the "MSN"-Network. Furthermore, Microsoft and CodeFuel codeveloped the private search-engine PRIVADO.

Note: How CodeFuel works. / Source

"Display & Social advertising"

Perion Network has two main other revenue streams: Display search, which means banner-ads or video-ads on a homepages are delivered by "Undertone". Social media adds are delivered by "MakeMeReach".

Perion Network recently acquired "PubOcean" and "ContentIQ", which are optimizing their ad service and adding additional features, insights and optimizations to their ad-technology. They are currently developing their ad-system from a service to a platform system. Perion Network wants to improve their business and growth by improving their ads and funnel system, which leads to very high conversations-rates and longer user sessions. Second, by building out automation, to reduce SG&A ("SG&A = Selling, general and administrative expense") costs and third, by igniting growth, with additional partnerships and new features.

Note: Strategy for the Ad-Business on a timeline. / Source

Their last two recent acquisitions also bring additional synergys for their whole product platform.

"ContentIQ"

As brands find it increasingly difficult to effectively tell their story to consumers, and branded contentbecomes a more critical and effective form of engagement, a new paradigm is required. Brands must gain the ability to scale to highly relevantaudiences, and through that to assert greater control over the media environment. CIQ’s offering fills this gap and provides Perion with a proprietarysolution that gives publishers and brands the tools they need to prosper in a challenging digital world.

Source: Perion

Note:ContentIQ's technology and productline. / Source

"PubOcean"

Pub Ocean is a rapidly-growing digital publisher-focused technology company with scalable content distributionand real-time revenue analytics technology. Pub Ocean offers significant and immediate synergies to ContentIQ (CIQ), which Perion acquired inJanuary, driving incremental revenue opportunities and enhanced profitability.

Source: Perion

Note: PubOcean's main product. / Source

Ability to provide guidance, when Competitors couldn't

The advertising industry has suffered greatly from COVID. In some cases, entire industries have cut all advertising spending, leading to a sharp drop in sales along the entire advertising industry. As an agile company, Perion reacted very quickly to this situation and announced a $10M savings package. As one of the very few companies, Perion was already able in Q2 to give a forecast for the rest of 2020 despite the very opaque situation, which is astonishing. This was only possible because of the technologically superior platform and the insights it provided.

In addition, Perion was able to grew its search business 8% year-over-year, compared to a global 15% decline for the rest of it's competitors.

Successfull turnaround with a better line-up

Attentive observers of the stock chart see that Perion has been on the stock market for over 10 years and has already seen much better times. The stock used to be quoted at highs of over $40. At the beginning of 2014, there was the Great Crash and quite a stagnation of the business. Perion used to distribute the email advertising software "IncrediMail", but this was not really working for some time and has now been shut down.

Since then, they have been trying to realign the business, which did not work at first. Through a management change and the very successful commitment of Doron Gerstel, the new CEO since mid 2017, Perion has managed to achieve a very successful turnaround.

The more successful turnaround can be seen in the following figure alone, which shows the debt of the company and the net cash position.

Note: Perion succesfully turned around their balancesheet. / Source

Doron Gerstel and his new team have managed to reduce a very high level of debt almost entirely while building a high net cash position - a very impressive achievement. But a lot has also happened on the product side, as the points already mentioned above have shown.

Recent News and Updates

The Release of the Results for the third Quarter 2020 and Guidance for 2020

Perion Network Inc. has announced their latest earnings results on October 28th. Although the Corona virus continues to ravage the world, a large number of companies have returned to place more advertising. Perion has benefited greatly from this change of tack, which is reflected in the growth figures below. In addition, Perion Network has significantly increased the guidance published in Q2.

- Total Revenues increased 27% Year-over-Year to $83.4Mio

- Advertising Revenues increased 76% Year-over-Year to $37.9Mio

- Search and other Revenues increased 3% Year-over-Year to $45.5Mio

- Adjusted EBITDA ("Earning Before Interest, Taxes, Deprecations and Amortization") was $8.7Mio, compared to $7.6Mio one year before. So on an adjusted EBITDA base, and also on the Non-GAAP ("GAAP = General Accepted Accounting Principles") net income, Perion is profitable, despite it's undergoing transformation, growth and expansion.

A few weeks earlier, Perion also raised its outlook for 2020 significantly. Considering that we are currently experiencing a huge pandemic, and that Perion as an ad-tech company is severely affected by the effects of the virus, this is incredible. They are now expecting for the full year 2020:

- Revenue of about $290-300Mio and Adjusted EBITDA of about $25-27Mio.

If one looks in particular at the adjusted EBITDA, it can be seen that a large part of the profit is generated in the second half of the year. This is due to the seasonal business with Christmas, Thanksgiving and Blackfriday, and also to the strong losses caused by the corona virus in the first half of the year.

For additional informations, please have a look at their latest earnings release.

Perion and Microsoft renew their Partnership for 4 additional years

As a logical consequence of the very successful and lucrative cooperation between Microsoft and Perion, Microsoft and Perion have extended their partnership for another 4 years. This ensures Perion secure revenue streams from the Ad-Search segment and underpins innovative projects, such as the jointly developed search engine PRIVADO.

The continuing collaboration between the companies will enable CodeFuel to further grow its publisher relationships offering, lucrative searchtechnology solutions, and sophisticated expertise for monetizing their digital properties. These include shopping, product comparison and contentwebsites, applications, browser extensions, mobile launchers, and white label search engines. Leveraging CodeFuel’s publishers’ network enablesMicrosoft to increase search advertising market share and connect advertisers to millions of potential customers while enriching user experiencethrough publisher properties

In the past two years, CodeFuel has exhibited significant growth through empowering publishers to create new revenue streams and unique searchexperiences, while focusing on increasingly high quality monetization solutions to track search demand.

Source: Perions Press Release

Note: Privado - the coockieless and private search-engine.

Acquisition of PubOcean and ContentIQ

Perion made two successful acquisitions in 2020. In January, ContentIQ was acquired for approximately $73M. Seven months later PubOcean was acquired for $22M. Perion see advantages like the following from the acquisitions:

With the financial optimization of Perion and the turnaround of our Search business completed, the Boardhas prioritized efforts to further expand and enhance the technological capabilities of our Synchronized Digital Branding as a key step to drive a moresustainable, predictable and profitable operating model. The acquisition of CIQ provides a strategic and significant opportunity for Perion to bolster thateffort as the ad-tech landscape continues to rapidly evolve. I am confident that this acquisition will further diversify our offering, providing significantand accretive growth opportunities across our business. With the earnout, we have prudently structured the acquisition to reduce risk and to ensurethat CIQ’s financial contribution to Perion’s top and bottom line are properly aligned with the investment we are making.

Source: Press Release

Or:

Pub Ocean is a strategically important acquisition for Perion, as we advance the buildout of a Synchronized Digital Branding solution across all digitalchannels,” said Doron Gerstel, CEO of Perion. “We see meaningful synergies between CIQ and Pub Ocean. We could not be more thrilled to welcomePub Ocean and its founder Chris into the Perion and CIQ family.

Source: Press Release

ContentIQ will add the following financial numbers to Perion:

- Revenue 2019 of about $39M

- Adjusted EBITDA of about $6M

The PubOcean numbers are not public, but assuming the same valuation strategy as for ContentIQ, they should make about

- $10-15M in revenues and

- $2M in Adjusted EBITDA

Due to those acquisition, Perion was able to grow it's business in the Q3 this year and feather the revenue drop in Q2. The increase in the Q3 figures were only achieved by those acquisitions, the organic growth was about 0 to single digit growth.

In conclusion, the two acquisitions are good priced growth opportunities for Perion. Thanks to them, the impact of the Covid-19 pandemic was well mitigated and growth accelerated in the third quarter.

The deep Analysis

Financials

Dividend

The company currently does not pay a dividend.

Share Structure

Perion uses a one class share system. There are normal mutual fund or institutional holdings.

Note: The share Structure of Perion Network Ltd. / Source

Insiders of the company are holding up to 19% of the outstanding shares, which is a good amount - it is always good, when insinders have some skin in the game.

Chart

Valuation of the Stock

Perion is currently very favorably valued - indeed, already undervalued compared to its peers. We have a one-year forward non-GAAP P/E-Ratio ("P/E-Ratio=Pric to Earnings Ratio") of approximately 11, which is a very favorable valuation compared to their competitors, some of whom have values in excess of 100, and should leave plenty of room for improvement. If we look at the Price/Revenue-Ratio, we don't even come up with a value of 1 for 2020. This is also extremely cheap. If we look at the EBITDA, we also have a strong undervaluation for 2020, which is approximately 4 in relation to the share price. Since Perion is a growth company and plans double digit growth numbers, it can basically grow strong in the next few years, the current valuation is ridiculously low, especially compared to the other peers.

On top there is a net cash position of over $37M and an ongoing decline in debt, which is only just over $10M.

Business Model

Perion is a kind of digital advertising agency, which places the best possible campaigns for its clients. Customers pay Perion money, which Perion places in the best possible way in the form of digital advertising with the best possible results for the customer. Through technology, customers are better addressed and a higher conversion rate is achieved.

Currently, a lot of "manual work" is still needed for this. However, this should be greatly reduced by the new acquisitions and the expansion to a fully automated platform.

Due to the advertising segment, Perion has saisonal earnings. This means, that Perions revenue is naturally higher in Q4 than in other quarters, because of the holiday season and extended advertising budgets of their customers.

Management

Perion Network has delivered an impressive turnaround to its strong management team and has modernized and automated its outdated business model. The leading role in this process was and still is:

- Doron Gerstel - CEO - Doron Gerstel joined Perion as CEO in April 2017. Serving as CEO for the last 16 years, he has established an outstanding ability to drive growth in hi-tech companies and competitive markets. In his previous role as CEO of Panaya, he led a company turnaround that saw an increase in annual revenue and the company’s acquisition by Infosys. He has also held CEO positions at Nolio, Syneron and Zend Technologies.

- Maoz Sigron - CFO - Maoz is an experienced finance executive with more than a decade of experience working with NASDAQ-listed companies. Prior to joining Perion, Maoz served as Vice President of Allot Communications, where he led the full lifecycle of M&A deals, from due diligence through the final integration phase, to re-organizational and post M&A activities.

- Miki Kolko - COO - Miki Kolko has served as Perion’s Chief Technology Officer since January 2015. He has over 19 years of experience in internet and big data technologies and previously served as VP Data at Perion. Prior to this, Miki served as VP Data at LivePerson (NASDAQ:LSPN), and held various engineering management positions in other companies. He founded 3 enterprise software and internet B2C startups.

Source: Perion

What is most impressive about Perion Management is the clear vision and focus that the management has. They do not shy away from new technologies, but buy them up and then integrate them themselves. They have completely restored and realigned a business model that is dead for the future and a highly indebted company, which is an impressive achievement.

Competition

Perion operates in a highly competitive but also strongly growing market - therefore there is a lot of competition.

Some of the well-known competitors are for example Google (NASDAQ: GOOGL), Amazon (NASDAQ: AMZN), The Trade Desk (NASDAQ: TTD) or Digital Turbine (NASDAQ: APPS).

All of these companies take a different or similar approach to Perion Network. Nevertheless, Perion manages to keep up with the growth of the other companies through new technologies, diversification and acquisitions. In particular, Perion's strong focus on automation and increased investment in research and development has led to positive results. In addition, the rating is ridiculously low compared to the competition, which is sometimes rated by a factor of 10 or even higher.

What to expect in the near future

Platform-Strategy

Perion has announced that it intends to further expand its platform, which is currently not yet fully automated, and to install additional automation. Furthermore, it only makes sense to further integrate the 3 different products with each other to create a closed platform that is seamlessly integrated. Their statement to further increase the R&D ("Research & Development") expenditures underpins this plan.

Acquisition-Strategy

Perion's very strong net cash position allows it to continue its current expansion strategy and to buy up potential candidates. Again, many optimizations and synergies could emerge - product improvements, expansion of the product portfolio and customer base, cross-selling opportunities and of course new integration possibilities into the platform to save personnel costs. The current pandemic has weakened many of these small advertising companies, which could look for a strong partner with a clear vision.

Conclusion

Perion Network is a clear buy - they are riding and investing in a megatrend, have a very agile and expierenced management team and a clear vision. Their research & develop + acquisition strategy bears early juicy fruits. Their current valuation is very low - assuming a fair P/E-Ratio of about 33, the stock can easily triple itself, to up to $22.5. Perion itself with its partnerships and technologies makes it also to an attractive takeover-candidate.

Our recommendation: This stock is a clear buy. Use the current low price for buying in or averaging up.

Disclaimer & Conflict of interest

The author currently holds a position in the mentioned stock. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Revenue by Quarter

Profitability by Quarter

Revenue Mix by Segment

Chart

Peers

All the Peers

Pinterest Inc.

Bullish

FlexShopper Inc.

Bullish

Tattooed Chef Inc.

Neutral

Hellofresh SE

Bullish

Build-a-Bear Workshop Inc.

Outperform

Stamps.com Inc.

Bullish

Redfin Corporation

Bullish

Upwork Inc.

Bullish