The Search

Your Search Results

News from us

Newest Symbols

Newest Industries

Click to expand

Advertising

See Stocks

Automotive

See Stocks

E-Commerce

See Stocks

E-Learning

See Stocks

Electricity

See Stocks

Engineering

See Stocks

FlexShopper Inc.

Bullish

Bullish

Tattooed Chef Inc.

Neutral

Neutral

Hellofresh SE

Bullish

Bullish

Build-a-Bear Workshop Inc.

Outperform

Outperform

Stamps.com Inc.

Bullish

Bullish

Redfin Corporation

Bullish

Bullish

Perion Network Ltd.

Outperform

Outperform

Upwork Inc.

Bullish

Bullish

Chegg Inc.

Bullish

Bullish

Pinterest Inc.

Bullish

Bullish

Bluelinx Holdings Inc

Bullish

Bullish

Momentus Inc.

Neutral

Neutral

Mynaric AG

Neutral

Neutral

Virgin Galactic Holdings Inc.

Neutral

Neutral

Maxar Technologies Inc.

Neutral

Neutral

Sunrun Inc.

Bullish

Bullish

Steico SE

Neutral

Neutral

Alfen N.V.

Neutral

Neutral

Research

Content Cards

Swipe

Our Article

Sprout Social Inc. - Article

Research: Sprout Social - "Managing Social Media as a Service"

Note: Sprout Social / Source

Table of Content:

- Author’s Opinion

- Introduction to the Company

- Why is it so beloved?

- The Read between the lines

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author’s Opinion

Sprout Social reminds me a lot of Salesforce 10-15 years ago when the software genre or term CRM (“Customer Relationship Management”) was created. With its platform and very strong and perfectly tailored software range, Sprout Social manages to directly grasp the social media management need that is now becoming more and more important. While in 2020 and 2021 the social media platforms will be used more and more by the users and will virtually be overrun by them, the innovation for the companies to also profit from this is missing. More and more companies are recognizing the importance of social media in these difficult times and need reliable tools, such as those from Sprout Social.

Introduction: Let the company introduce itself

Sprout Social offers deep social media listening and analytics, social management, customer care, and advocacy solutions to more than 25,000 brands and agencies worldwide. Sprout’s suite of solutions supports every aspect of a cohesive social program and enables organizations of all sizes to extend their reach, amplify their brand and create the kind of real connection with their consumers that drives their businesses forward. Headquartered in Chicago, Sprout operates across major social and digital platforms, including Twitter, Facebook, Instagram, Pinterest, LinkedIn and Google.

Source: sproutsocial.com

The power of the social – with Sprout!

The Software Platform with it’s 4 main Features

Sprout Social offers one cloud software platform with 4 main features build and made for companies, who want to elevate their social media strategy. With those built-in tools, they can track and engage with their audience, publish and schedule content in a better way and afterwards, they are able to listen to their community. All of that is rounded up by a pallete of analytics tools.

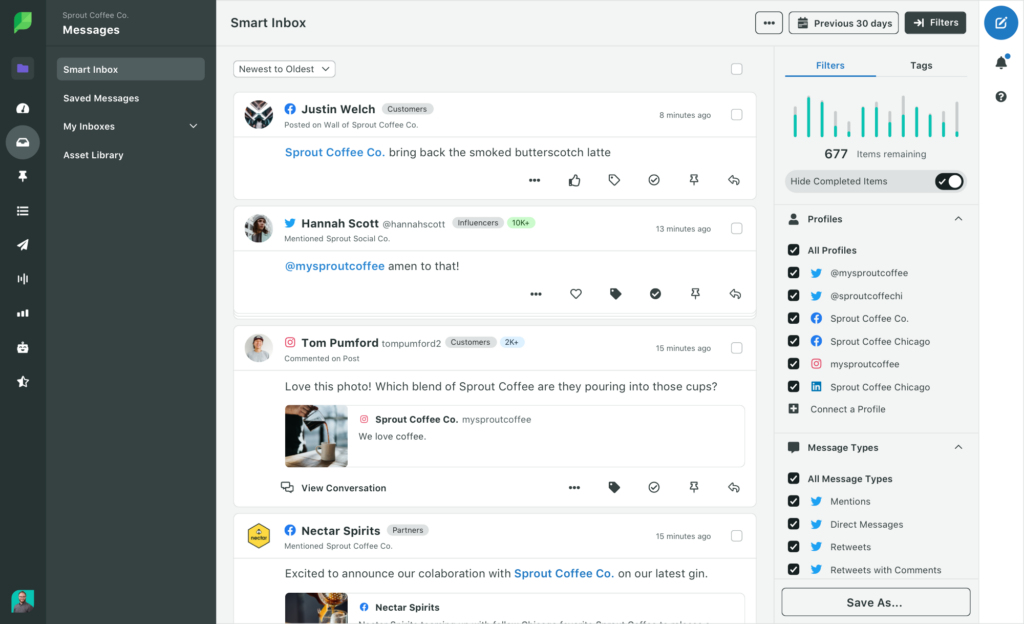

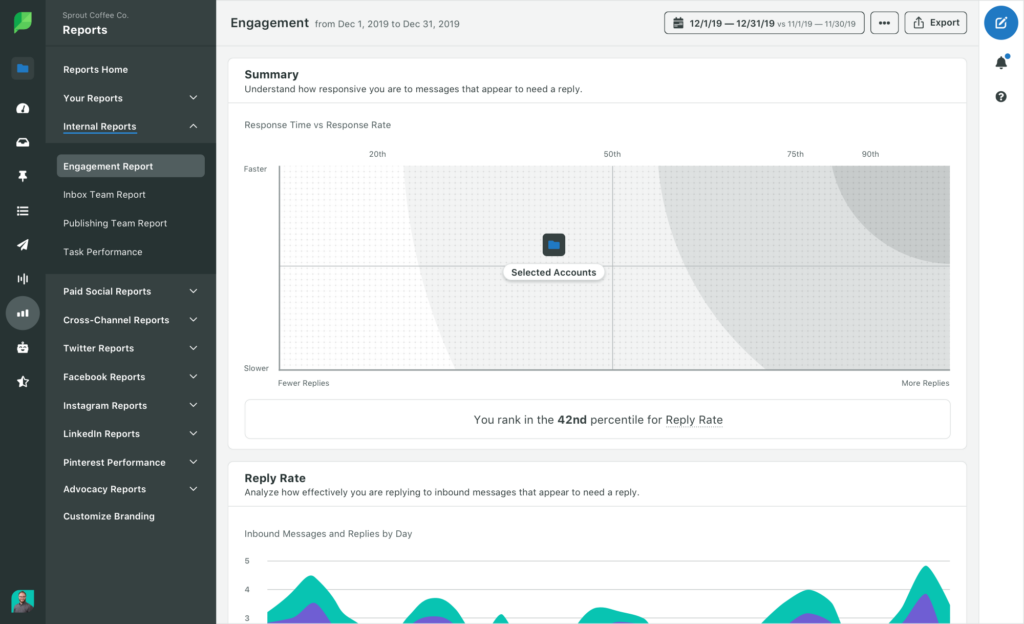

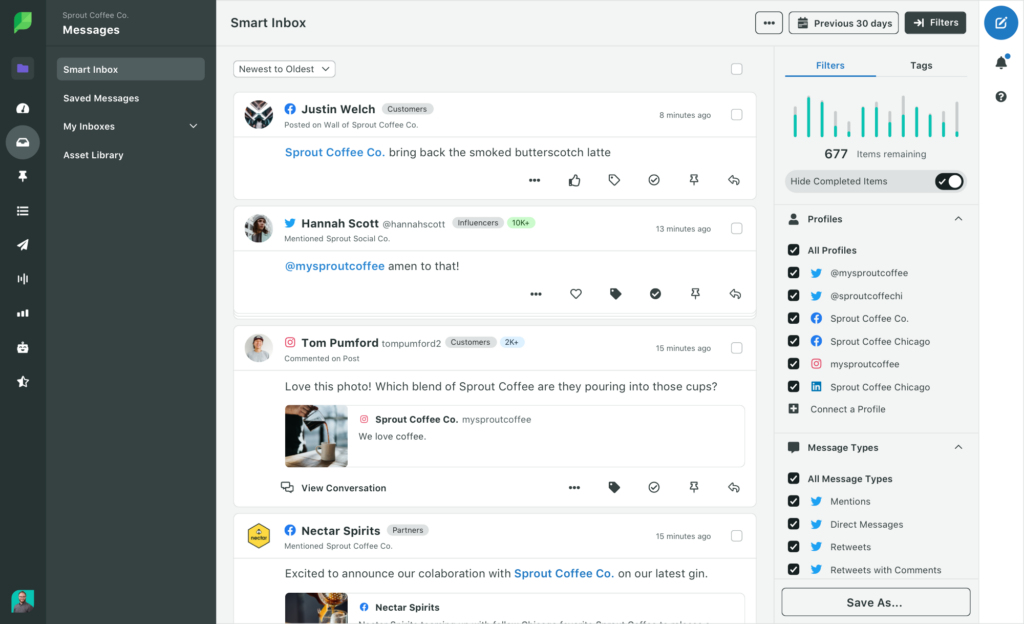

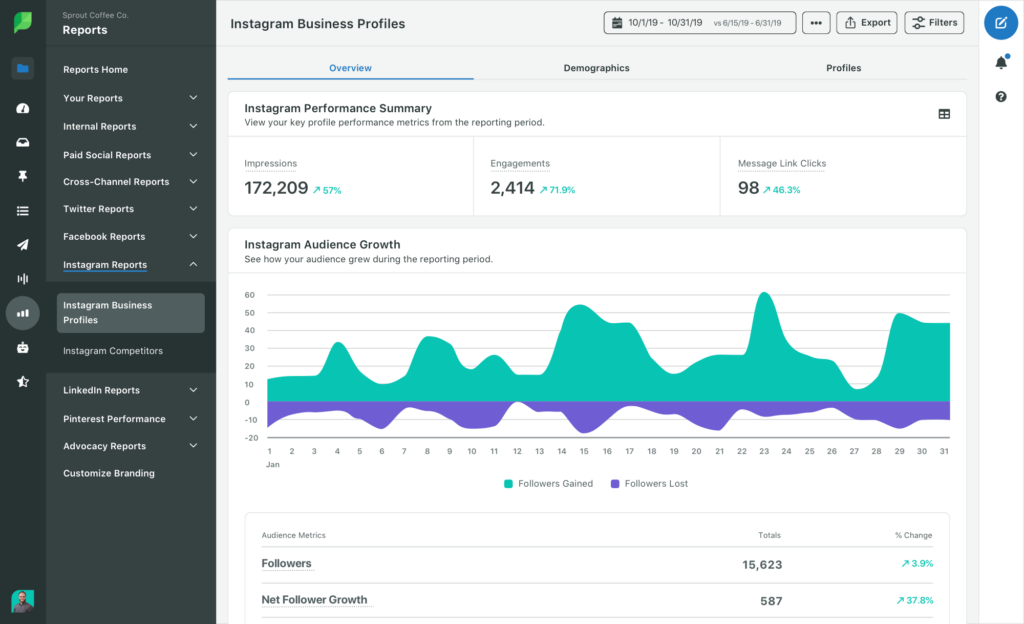

Engagement

The first pillar of their product suite is the Engagement part. It offers users a way to easily engage with their communities- through messaging, comments or chat bots. Relationships tools or collaboration tools are also built into this part.

Note: Smart Inbox from Sprout / Source

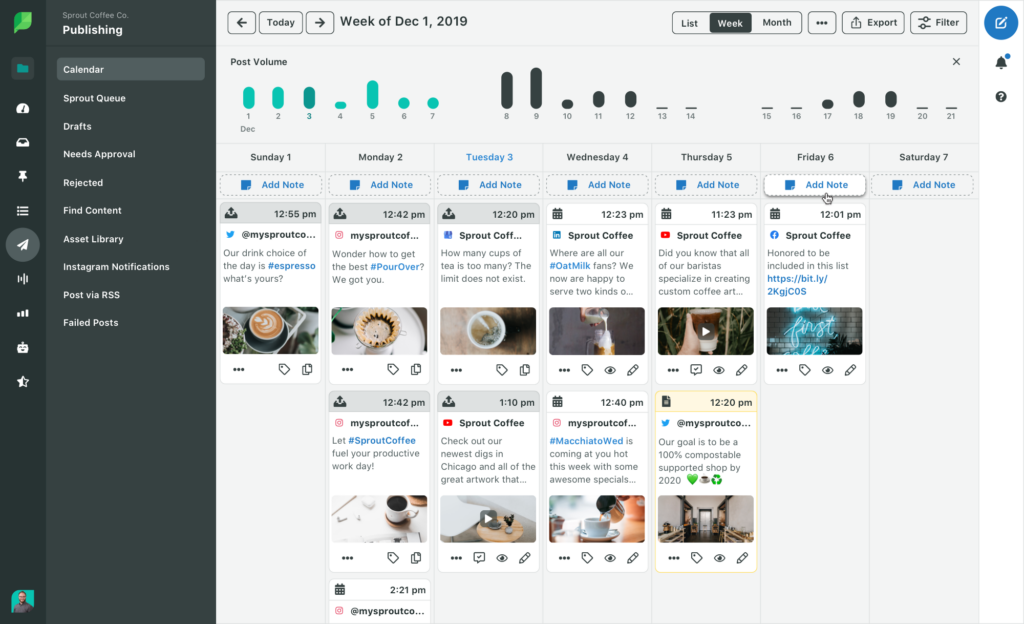

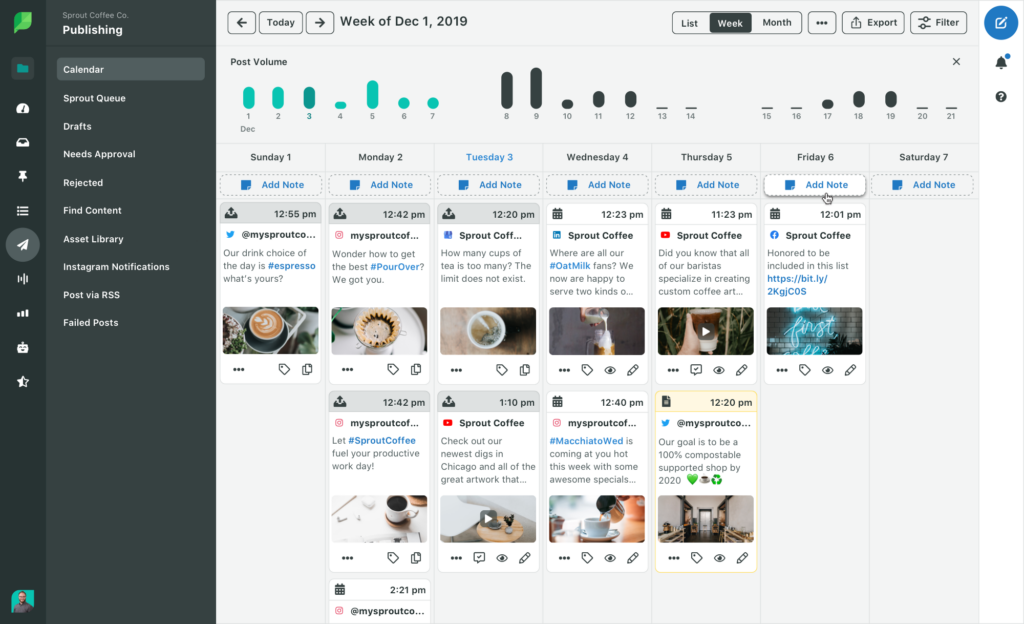

Publishing & Scheduling

Next up is the publishing & scheduling feature – with that feature, you can organize mostly every new post and content for your social media multi-channel strategy.

Note: Schedule Calendar from Sprout / Source

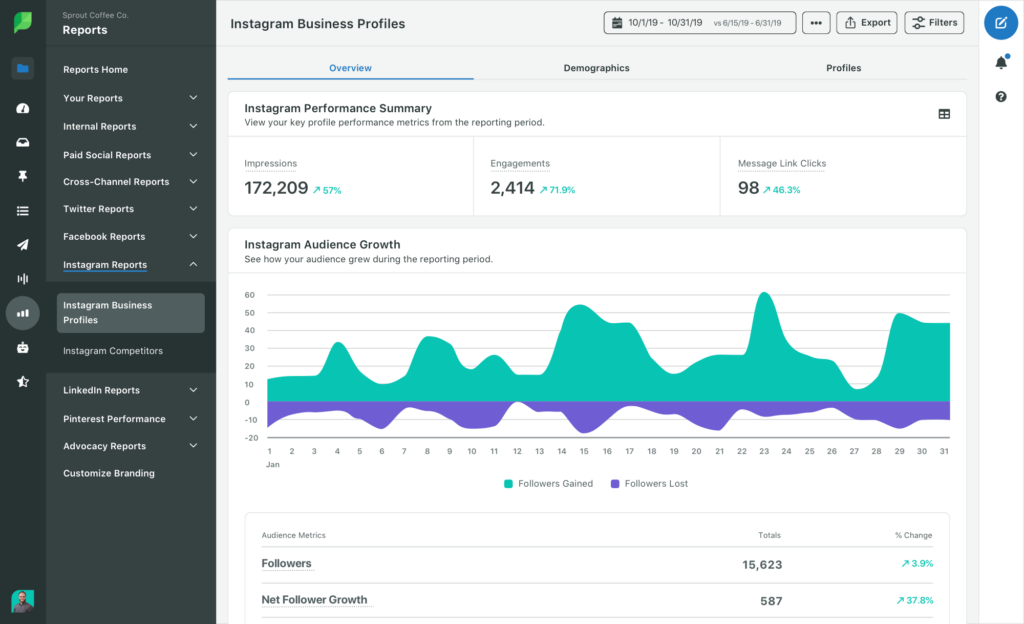

Analytics

Ever wanted to know more about your post performance or your profile? Maybe about competitors or about your team and their tasks? You can measure and analyse everything with Analytics from Sprout Social.

Note: Analytics Report from Sprout / Source

Listening

With the feature “Listening” you are able to notice about certain topics, trends or hashtags – you can discover new trends or often repeated words / phrases. You can also see them, get a rating for them and look, if that’s postive or negative. Listening is a very great tool for observing your community and biases.

Note: Listening Report from Sprout / Source

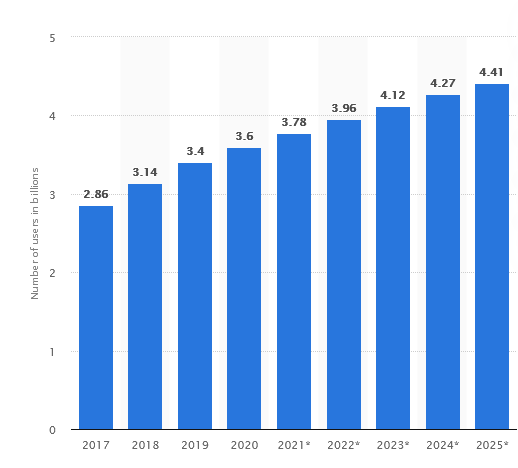

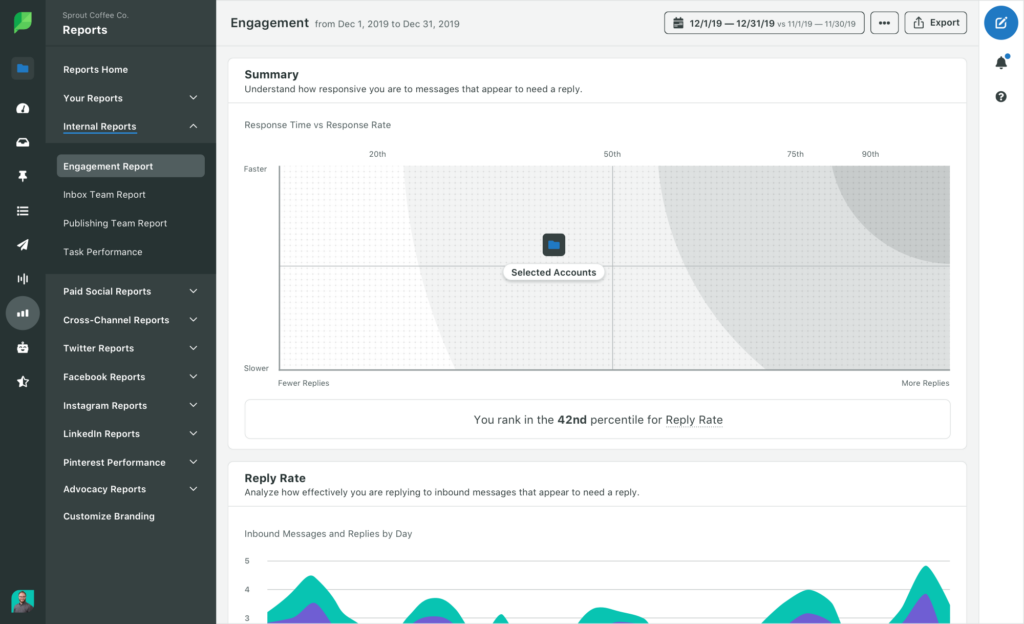

Big accelerated Social Media Growth

One of the biggest positive trends is the accelerated growth of social media, which has been seen in recent months. Millions of new users have entered the social media platforms and existing users have spent more time there, due to the pandemic. But businesses have been left behind, because the platforms have kept rolling out new features for the “users” as the actual end customers,. Due to numerous lockdowns and a shift of life into the digital world, companies are now increasingly looking to social media to stay in touch with their users. This naturally leads to a strong need for good and reliable tools for them, such as those offered by Sprout Social. This trend, which is just beginning to emerge, will certainly continue to solidify itself into sustainable growth. It is therefore an important investment thesis and favorable for Sprout Social. This was also noted several times in the Investor Calls – companies are really looking for contact on social media, after years of negligence by many companies.

Note: Social Media Users Forecast by Statista / Source

High Organic Growth

Sprout Social has an outstandig high organic growth rate of approximately 35% in the latest reported quarter, 3rd quarter of 2020.

Looking back over the years, the company has also been able to demonstrate very high organic growth rates, showing an ideal balance between strong growth and not too strong and unprofitable growth.

It is worth noting that Sprout Social has a lower (!) total revenue growth rate due to an acquisition made in the past than if you only look at its own organic revenue growth. This strongly suggests that the core business is developing very well and strongly.

Multi-Platform Integrations will drive further Acceptance & Growth

Sprout Social features several close partnerships with known social media companies like Facebook, Pinterest, LinkedIn, Twitter, Youtube or Instagram. They also regulary announce new integrations of their software into bigger software-platforms or collaborations like Slack or MS Teams app. Those integrations capabilities will further drive opportunities and attention to Sprout Social. On the other hand they also can increase their footprint to pull ashore new customers by expanding their social media platform integrations. Just think of the opportunities if they broaden their reach into platforms like LinkedIn. So in fact, they just have recently announced a new close partnership with Glassdoor, which operates in a similar space like LinkedIn – more on that in the next chapter.

Note: Social Media Integrations

A similiar Situation like 10-15 year ago to CRM?

The current development in the world and the social media forces companies to drive better and sound strategies on social media – a similar situation as it was 10-15 years ago, when the first CRM software became widespread. Sprout Social and similar companies in this area are in a similar situation as back then and will emerge as winners of this enormously increasing demand.

A product not only for big Companies

One of the more special things about the Sprout Social product platform is, that not only the typical marketing team of a bigger company is a potential customer. Sprout Social’s product is also the perfect match for Influencers, Agencies, little to small businesses and of course bigger companies.

Especially the fact, that also Influencer are a potential customer target group, makes Sprout Social very attractive and could gain even more from the current social media hype.

Note: Sprout Social customer types

Recent News and Updates

The Release of the Results for the third Quarter 2020

Sprout Social has annouced it’s latest earnings update on 9th of November. Their results were above their own guidance, which is pretty good and was underpinned by an increase of their Q4 guidance. Their good results were especially driven by a strong increase in new customers, but also in a much better product mix. This means, that their existing customers spend much more money, than the year before, which is a pretty impressive.On the other hand, Sprout Social posted a loss again, but that’s okay, because the company currently focuses on growth and a positive cash-flow. The net loss for this quarter was $6.97 Mio and a negative operation cash-flow of $2.63 Mio.

The numbers in detail are:

- Revenue increase 27% Year-over-Year to $33.7 Mio

- Organic Revenue increased more than 34%

- Customer growth compared to Q2 2020 and to Q3 2019

- Customers which pay more than $10 k per year increased 42% Year-over-Year

Sprout Social expects that revenues will increase to about $36 Mio in the 4th quarter, with an Non-GAAP loss of about $5.5 Mio. This reflects an impressive Year-over-Year Growth of about 27% and also and Quarter over Quarter growth.

For additional informations, please have a look at their latest earnings release.

Promotion of Ryan Barretto to President

Ryan Barretto has been promoted to president on 28th of December. This means, that he will report to the CEO and Chairman, but has now most of the control. Mr. Barretto has joint Sprout Social in 2016 and grew the Annual Recuring Revenue from $30 Mio to now more than $140 Mio.

It is very good that an experienced supporter, who has built up the company in the last years, is getting this position.

I am grateful for this opportunity to help lead the next chapter in Sprout’s story,” said Ryan Barretto, President of Sprout Social, who will now oversee global sales, customer success and marketing. “I’ve been honored to be a part of Sprout’s growth over the past four years particularly because it’s been fueled by an equal commitment to both our employees’ and customers’ success. That foundation, and the leadership of Justyn and the other co-founders, has positioned us as a clear leader in the social media management category, which is poised for disruptive growth. I’m looking forward to partnering more closely with Justyn, the board, and our senior leadership team as we build on that success and create even more value for our employees, customers, partners and shareholders.

Source: Sprout Social Press Release.

For additional informations, please take a look at their press release.

Integration with Glassdoor

Sprout Social and Glassdoor have announced on October the 20th a special partnership, which will enable Sprout Social users to review, analyse and observe the companies reviews on the Glassdoor platform.

The line between corporate brand and employer brand is blurring if not downright disappearing,” said Andrew Caravella, VP of Global Partnerships at Sprout Social. “All brands must maintain a strong presence across many touchpoints—from social media to employee review sites

Source: Source: Sprout Social Press Release.

This means in detail, that social media professionals can have a look beyond the famous social media platforms, to gain more information about a company’s community and their reputation.

This press release definitetly shows one possible business segment for Sprout Social, which will be increased in the next years. More partnerships and integrations, like this one, should be in Sprout’s pipeline .

For additional informations, please have a look at their press release.

The Read between the lines – Earnings Call

The aggregated information of the Q3 2020 earningscall can be seperated into three different categories, the three main pillars of Sprout Social’s future strategy: Upmarket Momentum, Integrations and Investments for 2021:

Upmarket Momentum:

-

During the third quarter, we signed the largest new ACV contract in our company’s history; onboarded several Fortune 500 brands, including multiple wins from highly competitive RFPs; and delivered 42% growth in our greater than 10-K ARR customers. We raised the bar in every aspect of our upmarket business in the third quarter.

The successful wins in large Fortune 500 RFP processes stand out for 2 reasons. The notable size of these deals and the implications on our served markets suggest that established companies are beginning to invest considerable resources behind social. This supports our thesis that social media management is becoming a foundational layer in the digital tech stack. And we competed against every competitor in our space through sophisticated technology, security and compliance evaluations. We believe we have many structural competitive advantages, and they all have begun to culminate in the success, which we expect to only expand in the coming years.

Integrations:

-

We build software that is powerful, elegant and easy to use, and our integration strategy is no different. We functionally integrated with 8 new partners since we last spoke with you, which is an incredible achievement from our technology and partnership teams. These include new integrations with Microsoft Dynamics 365, Salesforce, Dropbox, Slack, a first of its kind integration with Glassdoor, an enhanced listening relationship with Reddit, a new Pro Media Video integration with Twitter and our more recent work with Facebook to integrate the new messaging API which supports Instagram messaging.

A variety of technology integrations across this ecosystem of new and existing partners enables our flywheel to help social further proliferate across the entire customer and brand journey.

Investments for 2021:

-

Our listening and premium analytics offerings are early, both in terms of market penetration and product road map. In 2021, we intend to continue to evolve these offerings as we further democratize the power of social data and intelligence.

We are also making product investments to help bring the value of social further into our customers’ organizations. We’ll continue to perfect our core experiences and prioritize social customer care, commerce, engagement and additional integrations. We’ll also continue to accelerate our investments behind the strong trends we’ve seen in our sales and marketing efforts.

Late in the second quarter and throughout the third quarter, we saw the strength of our business and competitive differentiators really taking hold and have seen exactly what we wanted to see across the business. We’re an objectively stronger company than we were entering the year. And importantly, this has been driven by fundamental strength rather than situational anomalies.

The deep Analysis

Financials

Operational History

Sprout Social has a very young company history – it was found in 2010 and made about $30 Mio in ARR in 2016. At the very end of 2019 in December, Sprout Social went public, performing very good – in 2020 they will make about $140 Mio in ARR, which is a pretty impressive growth for such a young company. Since it’s inception, Sprout Social has had no real “problems” or difficult phases in their short carrer.

Dividend

The company currently does not pay a dividend.

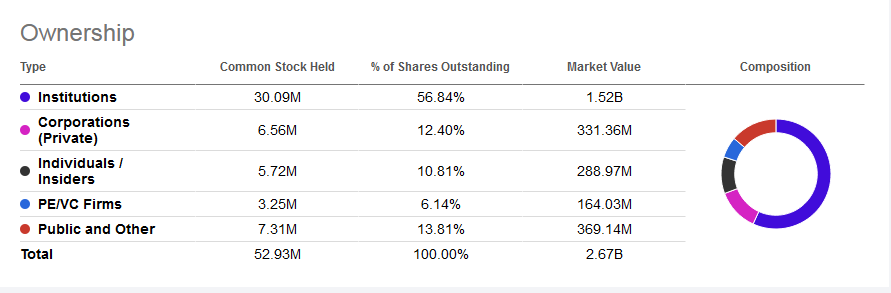

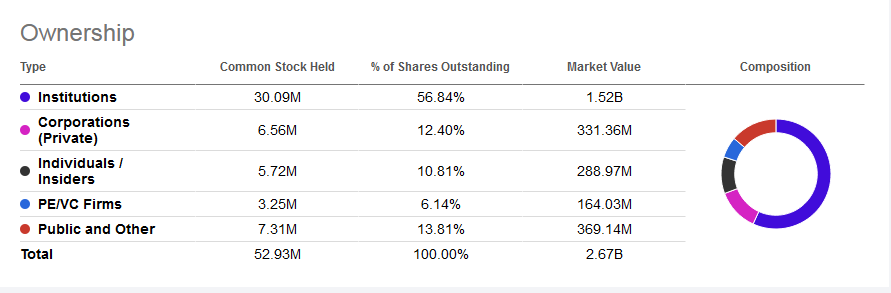

Share Structure

Sprout Social uses a one class share system. There is a significant insider ownership of about 11%, which makes up to $288 Mio – so insider have plenty of skin in the game.

Note: The share Structure of Sprout Social / Source

Chart

Valuation of the Stock

Like many software companies out there, Sprout Social carries a high to very high premium, comparable to a ServiceNow, Slack or Salesforce. In numbers this means, a Price/Revenue-Ratio of about 20. This is very elevated, but common for subscriptions companies nowadays. Because the company is not profitable at the moment, a P/E-Ratio (“P/E-Ratio=Price to Earnings Ratio”) cannot be calculated. Due to its IPO in very late 2019 and its follow-on offer in mid 2020, there is plenty of cash in the balance sheet, to further fuel growth and support a period of time without profits. The company should focus on becoming operational cashflow positive.

Like many software companies, the conclusion is very easy. The company has a premium valuation, for a premium product. If the company manages to outperform the consensus and grow like it has planned, the stock price will follow – if not, it will consolidate or sink.

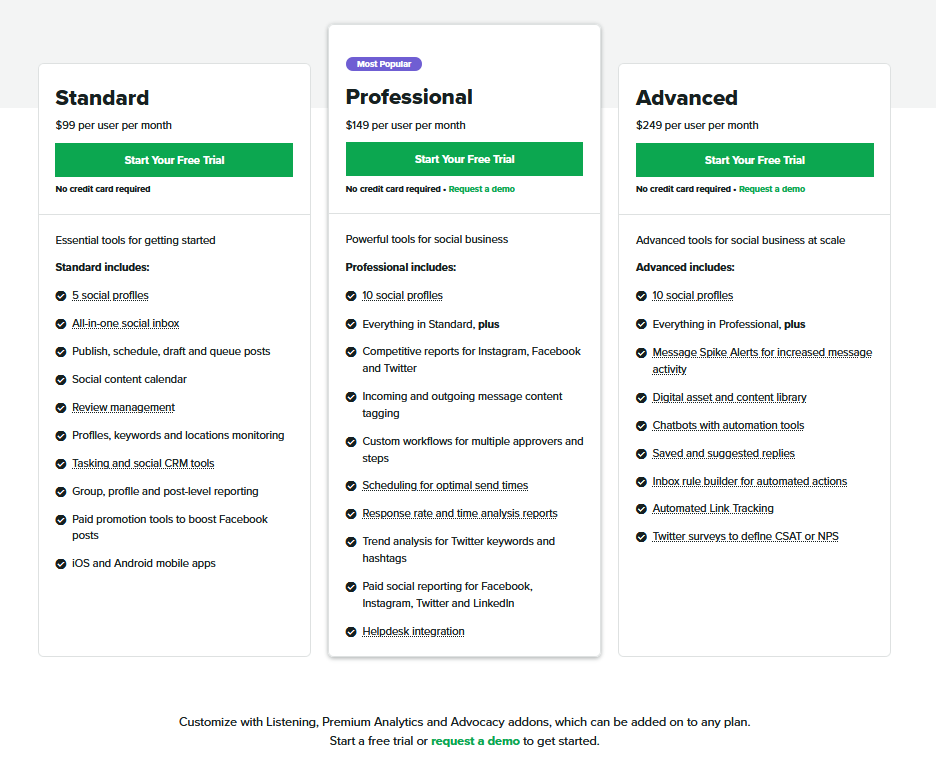

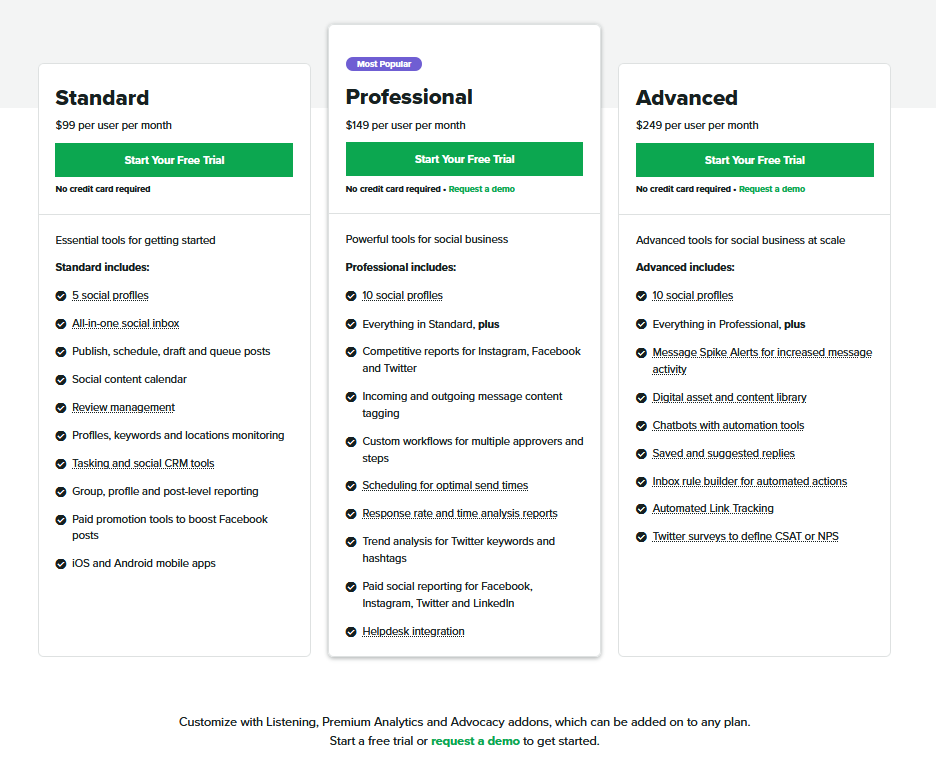

Business Model

Sprout Social has pretty simple and easy to understand business model. It offers a subscription software product, which can be most common subscribed monthly. There are several plans, which offer advanced options and cost more or less. There is also the option, to get individual pricing for large contracts.

Subscription always means recuring revenue, which is very good, because it makes the revenue and cash-flows predictable and the company can calculate better, which ends in less (negative) suprises for the company. Therefor stands the very important KPI Annual Recuring Revenue (ARR), which sums up the total contracted revenue for this year.

Also very important is the so called Churn-Rate, which reflects the amount of customers, who cancel their subscription. The lower the Churn-Rate, the bigger the lock-in effect of the platform is and the more predictable is the ARR.

Note: Sprout Social Pricing

Sprout Social groups their customers into two segments – those “little” customers, who have less than $10 k in ARR and those you have at least $10 k or more in ARR.

Customer Growth / Segments split by Q3 2020:

Management

Sprout Social is run by it’s co-founders and long time employees. This is a good indicator, because they have some impressive skin in the game, through their ownership. This will lead the managment to always remember that their own money is on the line.

The management consist of:

- Justyn Howard – CEO – Justyn Howard co-founded Sprout Social and has served as our Chief Executive Officer and President and as a member of our board of directors since April 2010. Mr. Howard has won a number of awards and honors as our Chief Executive Officer, including recognition in Glassdoor’s “Highest Rated CEOs” in 2018 and 2017.

- Aaron Rankin – CTO – Aaron Rankin co-founded Sprout Social and has served as our Chief Technology Officer and as a member of our board of directors since April 2010. Prior to founding Sprout Social, Mr. Rankin was a software engineer at Endeca Technologies, Inc. from August 2006 until February 2010.

- Ryan Barretto – President – Mr. Barretto joined Sprout Social in 2016 as SVP of Global Sales & Success and has built the foundation to scale from $30M in ARR to a fast-growing industry leader with greater than $140M in ARR. Barretto has served as a trusted member of the executive team leading go-to-market initiatives including the scaling of customer success, expansion into the enterprise segment, and the opening of international offices.

- Joe Del Preto – CFO

Source: Sprout Social

Insiders are holding approximately about $288 Mio in own shares.

Competition

Sprout Social has to fear competition from many sides. For example there is the direct competitor called Hootsuite, which offers more or same the exact product. Hootsuite is not a public listed company, but makes about more than double to triple the amount of revenue, that Sprout Social does. On the other hand, Sprout Social seems to offer the better and more quality product of those 2. Due to big and increasing market, there shouldn’t hurt some competition to much.

A much bigger potential risk are the big CRM players like Microsoft or Salesforce in this space, who already offer products / upgrades for the Social Media space. Those big players can easily exert pricing pressure onto little companies like Sprout Social. But like already mentioned above, Sprout Social has the much better product, which is just only dedicated for this one purpose. So this risk from above is also a big chance for Sprout Social, because it makes Sprout Social to the ideal candidate to be aquired. A similar deal is just two months old, when Salesforce acquired Slack.

Note: Sprout Social Competitor Hootsuite

What to expect in the near future

Acquisitions

Sprout Social has not made many acquisitions yet, but they have a full war chest that they could use to further expand their inorganic growth. Especially in the recent past, acquisitions have paid off for Sprout Social, for example to buy new technologies and features to further improve their core product and their strongest growth driver. But acquisitions in the CRM area would also be conceivable, or to build up an even further mainstay.

As a potential investor, I would like to see bold acquisitions in technology that pay off and add value to the main product.

Integration-Strategy

However, the main growth driver at Sprout Social will remain the integration strategy. It enables so many growth opportunities in different places – by connecting new social media platforms, the potential customer base is increased and the product becomes much more attractive for many companies. Furthermore, through end-solution integrations, awareness, as well as the level of awareness for Sprout Social can also be increased. The product increases the added value and is thus rewarded in the form of new customers and better price-mix strategies.

Conclusion

In summary, Sprout Social is one of the many new software companies, but it is on a very interesting path and covers an extremely exciting area. Sprout Social has a very high valuation but not yet a “crazy” one like some very hyped IPO stocks have.

Should Sprout Social be able to meet and exceed its financial goals, the stock is certainly a great play for the next few years.

Our recommendation: This stock is a neutral to buy. Use a sell-off for buying in or averaging up and use further price-falls to average up.

Disclaimer & Conflict of interest

The author currently does NOT hold a position in the mentioned stock. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Sprout Social Inc. - Article

Research: Sprout Social - "Managing Social Media as a Service"

Note: Sprout Social / Source

Table of Content:

- Author's Opinion

- Introduction to the Company

- Why is it so beloved?

- The Read between the lines

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author's Opinion

Sprout Social reminds me a lot of Salesforce 10-15 years ago when the software genre or term CRM ("Customer Relationship Management") was created. With its platform and very strong and perfectly tailored software range, Sprout Social manages to directly grasp the social media management need that is now becoming more and more important. While in 2020 and 2021 the social media platforms will be used more and more by the users and will virtually be overrun by them, the innovation for the companies to also profit from this is missing. More and more companies are recognizing the importance of social media in these difficult times and need reliable tools, such as those from Sprout Social.

Introduction: Let the company introduce itself

Sprout Social offers deep social media listening and analytics, social management, customer care, and advocacy solutions to more than 25,000 brands and agencies worldwide. Sprout’s suite of solutions supports every aspect of a cohesive social program and enables organizations of all sizes to extend their reach, amplify their brand and create the kind of real connection with their consumers that drives their businesses forward. Headquartered in Chicago, Sprout operates across major social and digital platforms, including Twitter, Facebook, Instagram, Pinterest, LinkedIn and Google.

Source: sproutsocial.com

The power of the social - with Sprout!

The Software Platform with it's 4 main Features

Sprout Social offers one cloud software platform with 4 main features build and made for companies, who want to elevate their social media strategy. With those built-in tools, they can track and engage with their audience, publish and schedule content in a better way and afterwards, they are able to listen to their community. All of that is rounded up by a pallete of analytics tools.

Engagement

The first pillar of their product suite is the Engagement part. It offers users a way to easily engage with their communities- through messaging, comments or chat bots. Relationships tools or collaboration tools are also built into this part.

Note: Smart Inbox from Sprout / Source

Publishing & Scheduling

Next up is the publishing & scheduling feature - with that feature, you can organize mostly every new post and content for your social media multi-channel strategy.

Note: Schedule Calendar from Sprout / Source

Analytics

Ever wanted to know more about your post performance or your profile? Maybe about competitors or about your team and their tasks? You can measure and analyse everything with Analytics from Sprout Social.

Note: Analytics Report from Sprout / Source

Listening

With the feature "Listening" you are able to notice about certain topics, trends or hashtags - you can discover new trends or often repeated words / phrases. You can also see them, get a rating for them and look, if that's postive or negative. Listening is a very great tool for observing your community and biases.

Note: Listening Report from Sprout / Source

Big accelerated Social Media Growth

One of the biggest positive trends is the accelerated growth of social media, which has been seen in recent months. Millions of new users have entered the social media platforms and existing users have spent more time there, due to the pandemic. But businesses have been left behind, because the platforms have kept rolling out new features for the "users" as the actual end customers,. Due to numerous lockdowns and a shift of life into the digital world, companies are now increasingly looking to social media to stay in touch with their users. This naturally leads to a strong need for good and reliable tools for them, such as those offered by Sprout Social. This trend, which is just beginning to emerge, will certainly continue to solidify itself into sustainable growth. It is therefore an important investment thesis and favorable for Sprout Social. This was also noted several times in the Investor Calls - companies are really looking for contact on social media, after years of negligence by many companies.

Note: Social Media Users Forecast by Statista / Source

High Organic Growth

Sprout Social has an outstandig high organic growth rate of approximately 35% in the latest reported quarter, 3rd quarter of 2020.

Looking back over the years, the company has also been able to demonstrate very high organic growth rates, showing an ideal balance between strong growth and not too strong and unprofitable growth.

It is worth noting that Sprout Social has a lower (!) total revenue growth rate due to an acquisition made in the past than if you only look at its own organic revenue growth. This strongly suggests that the core business is developing very well and strongly.

Multi-Platform Integrations will drive further Acceptance & Growth

Sprout Social features several close partnerships with known social media companies like Facebook, Pinterest, LinkedIn, Twitter, Youtube or Instagram. They also regulary announce new integrations of their software into bigger software-platforms or collaborations like Slack or MS Teams app. Those integrations capabilities will further drive opportunities and attention to Sprout Social. On the other hand they also can increase their footprint to pull ashore new customers by expanding their social media platform integrations. Just think of the opportunities if they broaden their reach into platforms like LinkedIn. So in fact, they just have recently announced a new close partnership with Glassdoor, which operates in a similar space like LinkedIn - more on that in the next chapter.

Note: Social Media Integrations

A similiar Situation like 10-15 year ago to CRM?

The current development in the world and the social media forces companies to drive better and sound strategies on social media - a similar situation as it was 10-15 years ago, when the first CRM software became widespread. Sprout Social and similar companies in this area are in a similar situation as back then and will emerge as winners of this enormously increasing demand.

A product not only for big Companies

One of the more special things about the Sprout Social product platform is, that not only the typical marketing team of a bigger company is a potential customer. Sprout Social's product is also the perfect match for Influencers, Agencies, little to small businesses and of course bigger companies.

Especially the fact, that also Influencer are a potential customer target group, makes Sprout Social very attractive and could gain even more from the current social media hype.

Note: Sprout Social customer types

Recent News and Updates

The Release of the Results for the third Quarter 2020

Sprout Social has annouced it's latest earnings update on 9th of November. Their results were above their own guidance, which is pretty good and was underpinned by an increase of their Q4 guidance. Their good results were especially driven by a strong increase in new customers, but also in a much better product mix. This means, that their existing customers spend much more money, than the year before, which is a pretty impressive.On the other hand, Sprout Social posted a loss again, but that's okay, because the company currently focuses on growth and a positive cash-flow. The net loss for this quarter was $6.97 Mio and a negative operation cash-flow of $2.63 Mio.

The numbers in detail are:

- Revenue increase 27% Year-over-Year to $33.7 Mio

- Organic Revenue increased more than 34%

- Customer growth compared to Q2 2020 and to Q3 2019

- Customers which pay more than $10 k per year increased 42% Year-over-Year

Sprout Social expects that revenues will increase to about $36 Mio in the 4th quarter, with an Non-GAAP loss of about $5.5 Mio. This reflects an impressive Year-over-Year Growth of about 27% and also and Quarter over Quarter growth.

For additional informations, please have a look at their latest earnings release.

Promotion of Ryan Barretto to President

Ryan Barretto has been promoted to president on 28th of December. This means, that he will report to the CEO and Chairman, but has now most of the control. Mr. Barretto has joint Sprout Social in 2016 and grew the Annual Recuring Revenue from $30 Mio to now more than $140 Mio.

It is very good that an experienced supporter, who has built up the company in the last years, is getting this position.

I am grateful for this opportunity to help lead the next chapter in Sprout's story,” said Ryan Barretto, President of Sprout Social, who will now oversee global sales, customer success and marketing. “I've been honored to be a part of Sprout's growth over the past four years particularly because it's been fueled by an equal commitment to both our employees' and customers' success. That foundation, and the leadership of Justyn and the other co-founders, has positioned us as a clear leader in the social media management category, which is poised for disruptive growth. I'm looking forward to partnering more closely with Justyn, the board, and our senior leadership team as we build on that success and create even more value for our employees, customers, partners and shareholders.

Source: Sprout Social Press Release.

For additional informations, please take a look at their press release.

Integration with Glassdoor

Sprout Social and Glassdoor have announced on October the 20th a special partnership, which will enable Sprout Social users to review, analyse and observe the companies reviews on the Glassdoor platform.

The line between corporate brand and employer brand is blurring if not downright disappearing,” said Andrew Caravella, VP of Global Partnerships at Sprout Social. “All brands must maintain a strong presence across many touchpoints—from social media to employee review sites

Source: Source: Sprout Social Press Release.

This means in detail, that social media professionals can have a look beyond the famous social media platforms, to gain more information about a company's community and their reputation.

This press release definitetly shows one possible business segment for Sprout Social, which will be increased in the next years. More partnerships and integrations, like this one, should be in Sprout's pipeline .

For additional informations, please have a look at their press release.

The Read between the lines - Earnings Call

The aggregated information of the Q3 2020 earningscall can be seperated into three different categories, the three main pillars of Sprout Social's future strategy: Upmarket Momentum, Integrations and Investments for 2021:

Upmarket Momentum:

-

During the third quarter, we signed the largest new ACV contract in our company's history; onboarded several Fortune 500 brands, including multiple wins from highly competitive RFPs; and delivered 42% growth in our greater than 10-K ARR customers. We raised the bar in every aspect of our upmarket business in the third quarter.

The successful wins in large Fortune 500 RFP processes stand out for 2 reasons. The notable size of these deals and the implications on our served markets suggest that established companies are beginning to invest considerable resources behind social. This supports our thesis that social media management is becoming a foundational layer in the digital tech stack. And we competed against every competitor in our space through sophisticated technology, security and compliance evaluations. We believe we have many structural competitive advantages, and they all have begun to culminate in the success, which we expect to only expand in the coming years.

Integrations:

-

We build software that is powerful, elegant and easy to use, and our integration strategy is no different. We functionally integrated with 8 new partners since we last spoke with you, which is an incredible achievement from our technology and partnership teams. These include new integrations with Microsoft Dynamics 365, Salesforce, Dropbox, Slack, a first of its kind integration with Glassdoor, an enhanced listening relationship with Reddit, a new Pro Media Video integration with Twitter and our more recent work with Facebook to integrate the new messaging API which supports Instagram messaging.

A variety of technology integrations across this ecosystem of new and existing partners enables our flywheel to help social further proliferate across the entire customer and brand journey.

Investments for 2021:

-

Our listening and premium analytics offerings are early, both in terms of market penetration and product road map. In 2021, we intend to continue to evolve these offerings as we further democratize the power of social data and intelligence.

We are also making product investments to help bring the value of social further into our customers' organizations. We'll continue to perfect our core experiences and prioritize social customer care, commerce, engagement and additional integrations. We'll also continue to accelerate our investments behind the strong trends we've seen in our sales and marketing efforts.

Late in the second quarter and throughout the third quarter, we saw the strength of our business and competitive differentiators really taking hold and have seen exactly what we wanted to see across the business. We're an objectively stronger company than we were entering the year. And importantly, this has been driven by fundamental strength rather than situational anomalies.

The deep Analysis

Financials

Operational History

Sprout Social has a very young company history - it was found in 2010 and made about $30 Mio in ARR in 2016. At the very end of 2019 in December, Sprout Social went public, performing very good - in 2020 they will make about $140 Mio in ARR, which is a pretty impressive growth for such a young company. Since it's inception, Sprout Social has had no real "problems" or difficult phases in their short carrer.

Dividend

The company currently does not pay a dividend.

Share Structure

Sprout Social uses a one class share system. There is a significant insider ownership of about 11%, which makes up to $288 Mio - so insider have plenty of skin in the game.

Note: The share Structure of Sprout Social / Source

Chart

Valuation of the Stock

Like many software companies out there, Sprout Social carries a high to very high premium, comparable to a ServiceNow, Slack or Salesforce. In numbers this means, a Price/Revenue-Ratio of about 20. This is very elevated, but common for subscriptions companies nowadays. Because the company is not profitable at the moment, a P/E-Ratio ("P/E-Ratio=Price to Earnings Ratio") cannot be calculated. Due to its IPO in very late 2019 and its follow-on offer in mid 2020, there is plenty of cash in the balance sheet, to further fuel growth and support a period of time without profits. The company should focus on becoming operational cashflow positive.

Like many software companies, the conclusion is very easy. The company has a premium valuation, for a premium product. If the company manages to outperform the consensus and grow like it has planned, the stock price will follow - if not, it will consolidate or sink.

Business Model

Sprout Social has pretty simple and easy to understand business model. It offers a subscription software product, which can be most common subscribed monthly. There are several plans, which offer advanced options and cost more or less. There is also the option, to get individual pricing for large contracts.

Subscription always means recuring revenue, which is very good, because it makes the revenue and cash-flows predictable and the company can calculate better, which ends in less (negative) suprises for the company. Therefor stands the very important KPI Annual Recuring Revenue (ARR), which sums up the total contracted revenue for this year.

Also very important is the so called Churn-Rate, which reflects the amount of customers, who cancel their subscription. The lower the Churn-Rate, the bigger the lock-in effect of the platform is and the more predictable is the ARR.

Note: Sprout Social Pricing

Sprout Social groups their customers into two segments - those "little" customers, who have less than $10 k in ARR and those you have at least $10 k or more in ARR.

Customer Growth / Segments split by Q3 2020:

Management

Sprout Social is run by it's co-founders and long time employees. This is a good indicator, because they have some impressive skin in the game, through their ownership. This will lead the managment to always remember that their own money is on the line.

The management consist of:

- Justyn Howard - CEO - Justyn Howard co-founded Sprout Social and has served as our Chief Executive Officer and President and as a member of our board of directors since April 2010. Mr. Howard has won a number of awards and honors as our Chief Executive Officer, including recognition in Glassdoor’s “Highest Rated CEOs” in 2018 and 2017.

- Aaron Rankin - CTO - Aaron Rankin co-founded Sprout Social and has served as our Chief Technology Officer and as a member of our board of directors since April 2010. Prior to founding Sprout Social, Mr. Rankin was a software engineer at Endeca Technologies, Inc. from August 2006 until February 2010.

- Ryan Barretto - President - Mr. Barretto joined Sprout Social in 2016 as SVP of Global Sales & Success and has built the foundation to scale from $30M in ARR to a fast-growing industry leader with greater than $140M in ARR. Barretto has served as a trusted member of the executive team leading go-to-market initiatives including the scaling of customer success, expansion into the enterprise segment, and the opening of international offices.

- Joe Del Preto - CFO

Source: Sprout Social

Insiders are holding approximately about $288 Mio in own shares.

Competition

Sprout Social has to fear competition from many sides. For example there is the direct competitor called Hootsuite, which offers more or same the exact product. Hootsuite is not a public listed company, but makes about more than double to triple the amount of revenue, that Sprout Social does. On the other hand, Sprout Social seems to offer the better and more quality product of those 2. Due to big and increasing market, there shouldn't hurt some competition to much.

A much bigger potential risk are the big CRM players like Microsoft or Salesforce in this space, who already offer products / upgrades for the Social Media space. Those big players can easily exert pricing pressure onto little companies like Sprout Social. But like already mentioned above, Sprout Social has the much better product, which is just only dedicated for this one purpose. So this risk from above is also a big chance for Sprout Social, because it makes Sprout Social to the ideal candidate to be aquired. A similar deal is just two months old, when Salesforce acquired Slack.

Note: Sprout Social Competitor Hootsuite

What to expect in the near future

Acquisitions

Sprout Social has not made many acquisitions yet, but they have a full war chest that they could use to further expand their inorganic growth. Especially in the recent past, acquisitions have paid off for Sprout Social, for example to buy new technologies and features to further improve their core product and their strongest growth driver. But acquisitions in the CRM area would also be conceivable, or to build up an even further mainstay.

As a potential investor, I would like to see bold acquisitions in technology that pay off and add value to the main product.

Integration-Strategy

However, the main growth driver at Sprout Social will remain the integration strategy. It enables so many growth opportunities in different places - by connecting new social media platforms, the potential customer base is increased and the product becomes much more attractive for many companies. Furthermore, through end-solution integrations, awareness, as well as the level of awareness for Sprout Social can also be increased. The product increases the added value and is thus rewarded in the form of new customers and better price-mix strategies.

Conclusion

In summary, Sprout Social is one of the many new software companies, but it is on a very interesting path and covers an extremely exciting area. Sprout Social has a very high valuation but not yet a "crazy" one like some very hyped IPO stocks have.

Should Sprout Social be able to meet and exceed its financial goals, the stock is certainly a great play for the next few years.

Our recommendation: This stock is a neutral to buy. Use a sell-off for buying in or averaging up and use further price-falls to average up.

Disclaimer & Conflict of interest

The author currently does NOT hold a position in the mentioned stock. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Revenue, Gross Profit and Loss by Quarter

Profitability by Quarter

Customer Segments

Chart

Peers

All the Peers

Pinterest Inc.

Bullish

Lang & Schwarz AG

Outperform

Stamps.com Inc.

Bullish

Chegg Inc.

Bullish