The Search

Your Search Results

News from us

Newest Symbols

Newest Industries

Click to expand

Advertising

See Stocks

Automotive

See Stocks

E-Commerce

See Stocks

E-Learning

See Stocks

Electricity

See Stocks

Engineering

See Stocks

FlexShopper Inc.

Bullish

Bullish

Tattooed Chef Inc.

Neutral

Neutral

Hellofresh SE

Bullish

Bullish

Build-a-Bear Workshop Inc.

Outperform

Outperform

Stamps.com Inc.

Bullish

Bullish

Redfin Corporation

Bullish

Bullish

Perion Network Ltd.

Outperform

Outperform

Upwork Inc.

Bullish

Bullish

Chegg Inc.

Bullish

Bullish

Pinterest Inc.

Bullish

Bullish

Bluelinx Holdings Inc

Bullish

Bullish

Momentus Inc.

Neutral

Neutral

Mynaric AG

Neutral

Neutral

Virgin Galactic Holdings Inc.

Neutral

Neutral

Maxar Technologies Inc.

Neutral

Neutral

Sunrun Inc.

Bullish

Bullish

Steico SE

Neutral

Neutral

Alfen N.V.

Neutral

Neutral

Research

Content Cards

Swipe

Our Article

Lang & Schwarz AG - Article

Research: Lang & Schwarz - Millennial Powered Shareholding Renaissance in the Capitalistic-Skeptic Germany?

Table of Content:

- Introduction

- How is L&S this much of a beneficiary?

- Recent News and Updates

- Business and financial highlights

- Growth perspective

- Management and share structure

- Dividend policy

- Competition and risks

- Valuation

- Conclusion

Millennials are flooding the stock market with easily detecting the COVID-19 pandemic as an historic chance to profit from a recovery. Robinhood the most influential neo-app-broker has seen swindling growth rates both in user and trading risk. Its strategy boils down to making the investing experience as easy as possible (one-tap) and slashing (visible) fees to zero. Adding social media to the mix, which frames investing as an easy way to make money, the renaissance of the stock market has been resurrected. Especially the optimism of taking the dive into the market, in the first virus months, has paid a spectacular dividend and gives the newborn investors and speculators the benefit of the doubt. But looking away from the developed capitalist countries, the chance with this trend in stock market skeptic countries like Germany provide a great entry point while mindsets are shifting. Fueled by young investors and negative interest rates, trading activities on German exchanges and with neobrokers have skyrocketed even more than in America. A profiteer which brings innovation to the trend is the financial service provider Lang & Schwarz AG €LUS.

How is L&S this much of a beneficiary?

Backbone of the German Robinhood

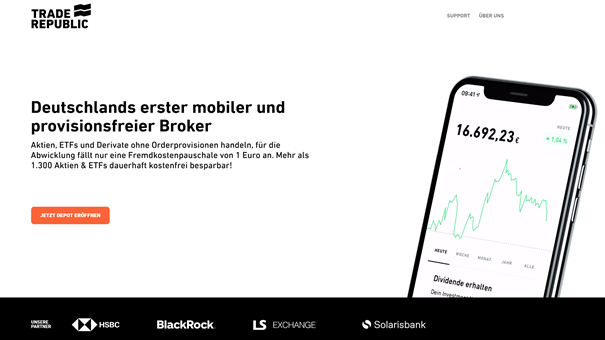

With the vision of Robinhood, “Trade Republic” provides the same easy to use app-mentality combined with an almost zero trading fee policy. The VC legend and investor Peter Thiel describes them with the following comment:

Trade Republic’s rapid growth in Germany testifies to the superiority of its technology platform over legacy offerings. The company is poised to become a major player in European finance.

Peter Thiel @ Techcrunch

Trade stocks, ETFs and derivatives without order commissions, only a third-party fee of 1 euro is charged for processing. More than 1,300 stocks & ETFs can be saved permanently free of charge!

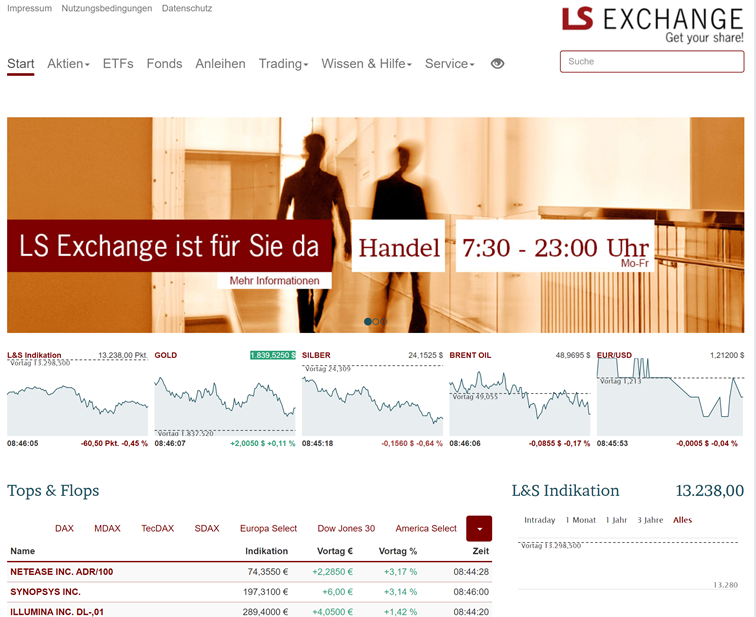

This growth is manifested by almost doubling the user count in 2020. The biggest beneficiary is the backbone provider behind the start-up, because all the orders are handled by the electronic exchange LS exchange operated by Lang & Schwarz. Their relationship is strengthened by L&S’ chairman taking the position as CEO at “Trade Republic”. Smaller neo brokers like JUST TRADE rely as well on LS exchange.

New age of volatility & interest rates

With the beginning of the COVID-19 crisis the volatility (“= movement of stocks”) has hit record highs and still is at an historical elevated level. Uncertainty will not magically step away especially when industry trends come and go as fast as never before. Fueled by the rapid spread of trends through social media hypes like the electric car trend, H₂ revolution or the cannabis market scheme will always drive certain stocks. The opinion clash of these topics heats up participating stocks, pushes up the volatility and grants exchanges new volume records. The bull and bear battles are fought even fiercer in today’s time. The fast rise and fall of a company like NIKOLA demonstrate that in an exemplary way.

This will even take place in a market that is not plagued by once in a lifetime pandemic. Apps that facilitate trading help a great deal with that and trading-affine retail investors seem to take the ruder in certain stocks. An example for that is the Norwegian H₂ highflyer NEL ASA – worth almost $4B – which is mostly held by Clearstream Banking SA, a nominee account owned by Deutsche Börse AG, holding stocks for mainly German Banks. The beneficial owners are more than 140000 private German retail shareholders.

Another factor bringing large amounts of money to the exchange is the new age of interest rates. The Federal Reserve Bank (” =FED”) has slashed interest rates to zero in a reaction to the COVID-19 catastrophe. The European Central Bank (” =ECB”) already was supplying money before the pandemic by a staggering rate and has only accelerated distribution of it with the last means it had. Looking into the future inflation target the Central Banks set themselves, do not seem to be reachable and state debts will not allow interest rate rises any more like it has been done for decades. This dilemma is the biggest reason for more and more money influx into stocks, because negative real interest rates will melt monetary value away in years.

Lots of people already reacted by starting to invest, as mentioned before, but the low German shareholding rate still provides a huge upside. Reforming the German pension system is also in the talks, because the old Bismarckian system is dramatically outdated and stocks are considerably neglected by it. This will only bring folks a step closer to the financial markets. Benefiting companies are those that facilitate trades through their platform or those that provide innovative products in this field.

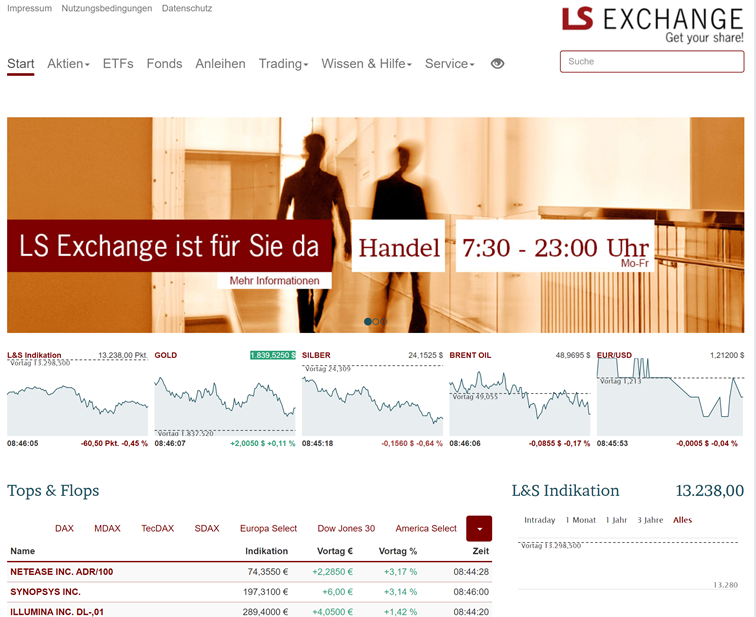

Change in exchanges

Exchanges are structured as regional Exchanges with a trading floor and people taking care of the orders and electronic exchanges where the order book is automated. Those can be divided in systems that clear orders after every trade and those that only clear at the end of the day. Regional exchanges are losing more and more market share because of their outdated operating and cost structures.

L&S operates its exchange (L&S X), regulated by “Börse Hamburg” with a market making model, so they close out trades at the end of the day. The customer does not have to pay a clearing fee for every order. Trades are carried out by the L&S Tradecenter (L&S TC), L&S´s market making and liquidity providing part. Competing and biggest European electronic exchange is XETRA, operated by Deutsche Börse AG (” =DB”), they clear after every trade so trading fees are significantly higher. The specialty of Deutsche Börse AG is that they also own the Clearing Bank Clearstream, as mentioned before. This means they are keen on XETRAs revenues because they earn them a trading and clearing fee. Deutsche Börse also operates an Exchange like L&S: Tradegate. But it is taking market share away from their regional offer “Frankfurter Wertpapierbörse ”(” =FWB”) and Xetra with which each trade makes a lot more. This means Tradegate is DB’s most important product in volume and growth; but also their ugly duckling in profits.

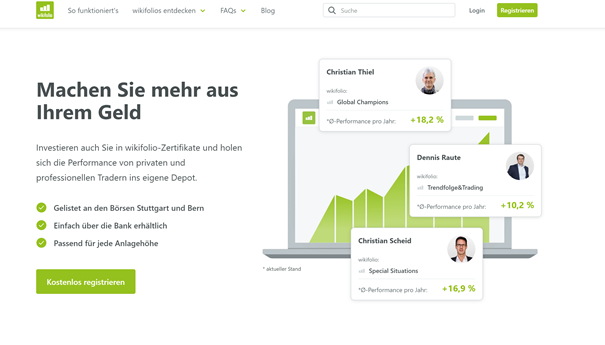

Fund-light social trading as innovation driver

In the time of social media, driven by participation, diversity, and transparency, the social-trading platform “WIKIFOLIO” allows the user to follow portfolios created by successful traders and earn alongside their trading strategy. Those portfolios are depositary receipts (” =RD”), smoothly traded on the regional exchange “Börse Stuttgart” ’s EUWAX or directly with L&S. The RDs are issued by L&S AG. The great thing about this concept is that the publicity for the product is created by the influencers. They, the buying user, Wikifolio, the exchange and the issuer L&S AG are profiting – A win-win-win-win-win situation. The portfolios are effortlessly comparable by their performance and risk, and take niche strategies. The Cost structure is comparable to the 2/20 hedge fund rule – there is a 0,95% flat fee and a performance fee of 5-30% chosen by the trader. Wikifolio portfolios already add up to €420m AUM (“AUM =assets under management”) at a growth rate of more than 50% YOY.

Invest in wikifolio certificates and get the performance of private and professional traders into your own portfolio: Listed on the Stuttgart and Bern stock exchanges; Easily available with brokers & banks; Suitable for every investment sum

Recent News and Updates

Lang & Schwarz AG: Business development remains at record level in the third quarter of 2020

11.11.2020 12:39

- Consolidated net income of EUR 23,842 thousand in the first three quarters of 2020 (previous year: EUR -501 thousand)

- Earnings from ordinary business activities EUR 13,612 thousand in the third quarter of 2020 (first quarter of 2020: EUR 8,739 thousand, second quarter of 2020 EUR 12,384 thousand)

- Consolidated earnings per share EUR 3.01 in the third quarter of 2020 (previous year’s quarter: EUR 0.37)

- Consolidated earnings per share EUR 7.58 in the first three quarters of 2020 (previous year: EUR -0.16)

In the third quarter of 2020, Lang & Schwarz Aktiengesellschaft posted consolidated net income according to HGB of EUR 9,450 thousand, which is the third record quarter in a row. The previous record quarterly result from the previous quarter could be increased again by EUR 762 thousand and thus almost 9%. The result from ordinary business activities in the third quarter of 2020 also increased by almost 10% to EUR 13,612 thousand compared to the previous quarter (EUR 12,384 thousand). Compared to the second quarter of 2020 (EUR 19,336 thousand), the result from trading activities was slightly below the previous quarter at EUR 18,708 thousand. Administrative expenses (personnel expenses plus other operating expenses) were lower in the third quarter of 2020 at EUR 5,204 thousand than in the second quarter of 2020 (EUR 7,651 thousand). The tax expense on the result in the third quarter of 2020 amounts to EUR 4,183 thousand after EUR 3,696 thousand in the previous quarter.

After the first three quarters of 2020, the consolidated result is EUR 23,842 thousand (first three quarters of 2019: EUR -501 thousand, whereby this was charged with a one-off tax expense of EUR 2,823 thousand). The result from ordinary business activities of EUR 34,735 thousand was more than tenfold compared to the first three quarters of 2019 (EUR 3,371 thousand). The result from trading activities increased almost fourfold to EUR 52,715 thousand compared to the first three quarters of 2019 (EUR 13,654 thousand). Administrative expenses increased by a total of EUR 8,738 thousand compared to the first three quarters of 2019 to a total of EUR 18,636 thousand. This increase mainly relates to the formation of provisions for variable remuneration. The tax expense for the first three quarters of 2020 amounts to a total of EUR 10,917 thousand and thus increased by EUR 7,044 thousand compared to the first three quarters of 2019.

The result from ordinary business activities includes other operating income in the amount of EUR 1,153 thousand. These relate to a portion of the capital gain from the sale of an investment (Trade Republic Bank GmbH) at EUR 460 thousand. This is around half of the expected total capital gain. As reported, the sale is subject to various conditions of precedent.

The consolidated earnings per share for the third quarter of 2020 are EUR 3.01 (previous quarter: EUR 2.76). This enabled consolidated earnings per share of EUR 7.58 to be achieved for the first three quarters of 2020.

As of September 30, 2020, Lang & Schwarz Aktiengesellschaft had a balance sheet equity of EUR 51.3 million (December 31, 2019: EUR 27.5 million).

The number of employees in the Group as of September 30, 2020 was 60.

“With almost 10 million trades in the first nine months of 2020 alone at LS-X and a total of 16 million trades in our TradeCenter, we are extremely successful on our way to establishing Lang & Schwarz as one of the most important trading centers in Germany,” reports the CEO, André Bütow, and continues: “The sales growth is unbroken and is supported by all of our activities, nationally and internationally. Our sales in 2020 are now more than two and a half times that of the same period in the previous year. We confirm our statement in Corporate News from August 27, 2020, on the course of the third quarter of 2020. The trend in sales growth is unbroken, we are still on our course to take trading activities and market maker activities to a new level. “

“With the continued high and in some cases increasing demand for our services in the fourth quarter of 2020 and the associated results, our expectations of further expanding the record result for the 2020 financial year with the fourth quarter of 2020″ added fellow board member Torsten Klanten and adds: “With the verbal decision that our application of equity to the tax office (with a view to corporate income tax, including the solidarity surcharge) should be granted, we see our view confirmed that the amendment to Section 8b (7) KStG does not have an impact on Lang & Schwarz AG. We are continuing to concentrate our efforts on fully correcting the effects of the amendment to Section 8b (7) KStG and refer in this context to our report of October 29, 2020. “

The figures as of September 30, 2020 have not been audited and have not been reviewed by an auditor.

Business and financial highlights

The business activities are divided in 3 parts: the issuing of derivative financial instruments with L&S AG, the market making of L&S Tradecenter and the specialty bank L&S Broker

The parent company L&S AG is the operating holding focused on the issuing of RDs. In the first part of 2020 they issued 28000 own products which are tradable directly with L&S’ subsidiary L&S TC in a regulated environment of EUWAX (Börse Stuttgart) or the Swiss exchange BX Swiss. L&S makes around 30% of the profits in this segment.

L&S TC provides a market for 11000 stocks, bonds, funds and ETPs (ETFs, ETCs and ETNs) even on the weekend. L&S TC is the preferred partner at L&S X, they trade as market maker (MM) at the FWB, “Wiener Börse”(WBAG; Austria) and BX Swiss. Brokers and banks can be connected directly to L&S TC, and they already reach 15m customers that way.

L&S Broker, again a subsidiary of L&S AG, is a specialty bank that is a designated sponsor for XETRA. They additionally do consulting works for going- and being public, including IPO and corporate finance consulting.

Market making takes the rest of the profits (70%) and is the most important part of the company right now.

Growth perspective

L&S TC is already handling 21% of all German stock trades. In the first 9 months they have traded 16m orders that was more than 5 times as much as in the first 9 months of 2019. L&S X alone has processed 5m trades in the first 6 months making it the German exchange with the highest growth rate. At the same time Tradegate has dealt with 27,6m trades.

The development of trades processed in COVID-times show that the COVID-19 effect is not a one time occurrence it just accelerated growth and established a new trend. For the full year, the company guides continued strong growth even from the achieved record results.

Management & Share structure

Typically German, the executive members have been with the company for a long time and the members of the board bring in a fresh outside view. Normally parts of the board are also seated by unionized employee representatives. Those traditions can make companies stale and hard on innovation and speed, but L&S’ product progress and growth shows a great and successful management team that breaks with the country’s norms.

André Bütow, with the company since 2002, is the CEO and Torsten Klanten, with the company since 2000, is its CFO. Vice Chairman of the Board is Andreas Willius, the CEO of Trade republic.

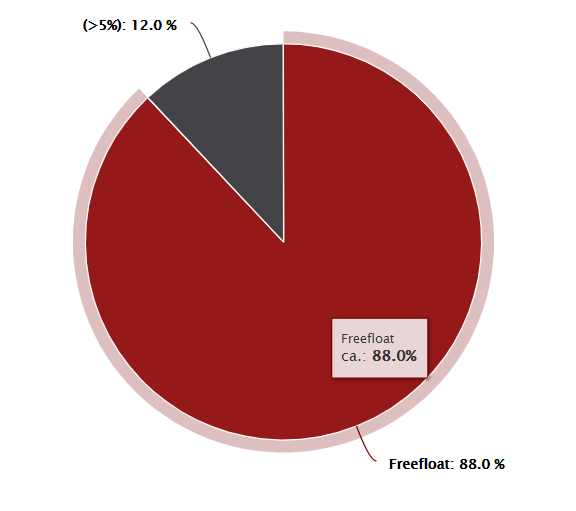

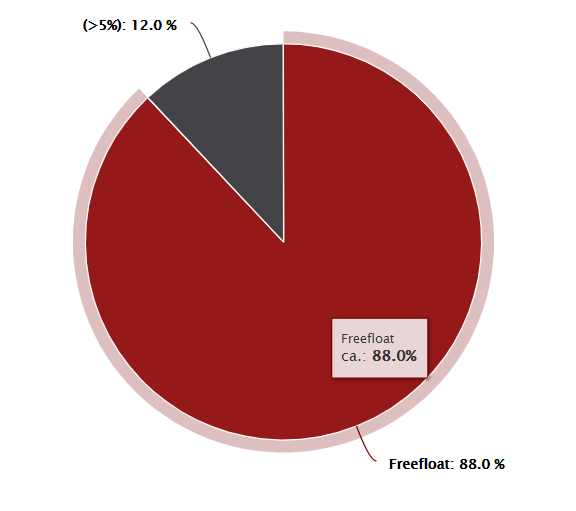

88% of the stock are free float, 12% are held by large institutions. With no structural investor L&S is prone to be bought by a huge institution (Nasdaq?) or bank. L&S’ market cap at close to €200m is a steal for lots of companies with cash piling up. But this scenario is not that probable.

Dividend policy

The company’s payout is decided on an entrepreneurial basis. This means the dividend will be cut once the money will have a higher return inside the company.

In 2019, they have decided to cut the dividend to invest more into the L&S trading platform; these fruits are being harvested right now. This implies L&S will always favor the return on invest over the cashflow for the investor. For the year 2020 the dividend comeback might be huge with a partial payout (50%) already providing about €5 – almost a 10% return. A verdict on that is yet to be taken by the management, because they have called out a capital requirement to bolster the balance sheet for further growth.

Competition and risks

On the neobrokers front, competition for the L&S partners is intensifying with the Blackrock (global biggest asset manager) backed neobrokers SCALABLE CAPITAL(SC). SC’s orders are processed by the electronic stock exchange gettex, regulated by “Börse München” and the market maker is “BAADER BANK”. Gettex is as well zero-fee first choice on WALLSTREETONLINE´s SMARTBROKER – still smartbroker advertises additionally with L&S.

Wikifolio is the biggest platform in Europe and provides a vast offering of products without restrictions. But their products rely on RDs concentrated only on the DACH (Germany, Austria, Swiss) area. Global competitor eToro, an Israeli company, is a zero-fee broker that operates COPYTRADER, which only allows you to automatically copy trades by successful users. So, there is not really a competing fund-light product like Wikifolio out there.

On the risk side, the market does not see L&S’ renaissance as a long term factor because once the global markets enter a years spanning bear scenario the newbie-churn-rate might be devastating. This is exactly what happened after the dotcom bubble burst in the early 2000s. German market makers like “Baader Bank” have quadruple their revenue because everyone was trading stocks. Their shares have hit an all-time high which was never reached again.

Source: Google Finance

This is might be one reason why L&S’ valuation is that cheap, but it is not warranted. Times have changed, investment communities led by financial influencers are strong as ever and the “store of value” alternatives are scarce. Social media is the biggest buy-patron and not a sell-accelerator, as seen in the COVID-crash.

Valuation

For the years 2019 & 2018 L&S’ PE ratio was between 20 and 30. Even the years before that, the ratio still was double digits. So, with a forecasted EPS of €10 (2020), the current PE ratio sits almost at 7. The US stock exchange front-runner “Nasdaq” or “Deutsche Börse AG” (DB) respectively are valued at a forward PE ratio of 21 and 25. But they do not show the growth perspective of L&S even in these pandemic times or a back to normal state. DB has reported a single digit revenue growth for the last quarter and Nasdaq’s growth was barely double-digit. A similar situation is the companies’ dividend yield at 2,1% and 1,9% – miniscule compared to what L&S might pay.

Conclusion

The current valuation makes no sense for the growth trend the German market is experiencing. An underdog, innovative and lean as L&S, is hard to find in a time and environment we are in now.

Our recommendation: This stock is a clear buy. Use the current price for buying in or averaging up and use further price-falls to average up.

Disclaimer & Conflict of interest

The author currently has a position of the mentioned stock. NO referenced company compensates the author or the publisher of this website.

This post is not investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Lang & Schwarz AG - Article

Research: Lang & Schwarz - Millennial Powered Shareholding Renaissance in the Capitalistic-Skeptic Germany?

Table of Content:

- Introduction

- How is L&S this much of a beneficiary?

- Recent News and Updates

- Business and financial highlights

- Growth perspective

- Management and share structure

- Dividend policy

- Competition and risks

- Valuation

- Conclusion

Millennials are flooding the stock market with easily detecting the COVID-19 pandemic as an historic chance to profit from a recovery. Robinhood the most influential neo-app-broker has seen swindling growth rates both in user and trading risk. Its strategy boils down to making the investing experience as easy as possible (one-tap) and slashing (visible) fees to zero. Adding social media to the mix, which frames investing as an easy way to make money, the renaissance of the stock market has been resurrected. Especially the optimism of taking the dive into the market, in the first virus months, has paid a spectacular dividend and gives the newborn investors and speculators the benefit of the doubt. But looking away from the developed capitalist countries, the chance with this trend in stock market skeptic countries like Germany provide a great entry point while mindsets are shifting. Fueled by young investors and negative interest rates, trading activities on German exchanges and with neobrokers have skyrocketed even more than in America. A profiteer which brings innovation to the trend is the financial service provider Lang & Schwarz AG €LUS.

How is L&S this much of a beneficiary?

Backbone of the German Robinhood

With the vision of Robinhood, "Trade Republic" provides the same easy to use app-mentality combined with an almost zero trading fee policy. The VC legend and investor Peter Thiel describes them with the following comment:

Trade Republic’s rapid growth in Germany testifies to the superiority of its technology platform over legacy offerings. The company is poised to become a major player in European finance.

Peter Thiel @ Techcrunch

Trade stocks, ETFs and derivatives without order commissions, only a third-party fee of 1 euro is charged for processing. More than 1,300 stocks & ETFs can be saved permanently free of charge!

This growth is manifested by almost doubling the user count in 2020. The biggest beneficiary is the backbone provider behind the start-up, because all the orders are handled by the electronic exchange LS exchange operated by Lang & Schwarz. Their relationship is strengthened by L&S' chairman taking the position as CEO at "Trade Republic". Smaller neo brokers like JUST TRADE rely as well on LS exchange.

New age of volatility & interest rates

With the beginning of the COVID-19 crisis the volatility ("= movement of stocks") has hit record highs and still is at an historical elevated level. Uncertainty will not magically step away especially when industry trends come and go as fast as never before. Fueled by the rapid spread of trends through social media hypes like the electric car trend, H₂ revolution or the cannabis market scheme will always drive certain stocks. The opinion clash of these topics heats up participating stocks, pushes up the volatility and grants exchanges new volume records. The bull and bear battles are fought even fiercer in today's time. The fast rise and fall of a company like NIKOLA demonstrate that in an exemplary way.

This will even take place in a market that is not plagued by once in a lifetime pandemic. Apps that facilitate trading help a great deal with that and trading-affine retail investors seem to take the ruder in certain stocks. An example for that is the Norwegian H₂ highflyer NEL ASA - worth almost $4B – which is mostly held by Clearstream Banking SA, a nominee account owned by Deutsche Börse AG, holding stocks for mainly German Banks. The beneficial owners are more than 140000 private German retail shareholders.

Another factor bringing large amounts of money to the exchange is the new age of interest rates. The Federal Reserve Bank (" =FED") has slashed interest rates to zero in a reaction to the COVID-19 catastrophe. The European Central Bank (" =ECB") already was supplying money before the pandemic by a staggering rate and has only accelerated distribution of it with the last means it had. Looking into the future inflation target the Central Banks set themselves, do not seem to be reachable and state debts will not allow interest rate rises any more like it has been done for decades. This dilemma is the biggest reason for more and more money influx into stocks, because negative real interest rates will melt monetary value away in years.

Lots of people already reacted by starting to invest, as mentioned before, but the low German shareholding rate still provides a huge upside. Reforming the German pension system is also in the talks, because the old Bismarckian system is dramatically outdated and stocks are considerably neglected by it. This will only bring folks a step closer to the financial markets. Benefiting companies are those that facilitate trades through their platform or those that provide innovative products in this field.

Change in exchanges

Exchanges are structured as regional Exchanges with a trading floor and people taking care of the orders and electronic exchanges where the order book is automated. Those can be divided in systems that clear orders after every trade and those that only clear at the end of the day. Regional exchanges are losing more and more market share because of their outdated operating and cost structures.

L&S operates its exchange (L&S X), regulated by “Börse Hamburg'' with a market making model, so they close out trades at the end of the day. The customer does not have to pay a clearing fee for every order. Trades are carried out by the L&S Tradecenter (L&S TC), L&S´s market making and liquidity providing part. Competing and biggest European electronic exchange is XETRA, operated by Deutsche Börse AG (" =DB"), they clear after every trade so trading fees are significantly higher. The specialty of Deutsche Börse AG is that they also own the Clearing Bank Clearstream, as mentioned before. This means they are keen on XETRAs revenues because they earn them a trading and clearing fee. Deutsche Börse also operates an Exchange like L&S: Tradegate. But it is taking market share away from their regional offer “Frankfurter Wertpapierbörse ''(" =FWB") and Xetra with which each trade makes a lot more. This means Tradegate is DB’s most important product in volume and growth; but also their ugly duckling in profits.

Fund-light social trading as innovation driver

In the time of social media, driven by participation, diversity, and transparency, the social-trading platform “WIKIFOLIO” allows the user to follow portfolios created by successful traders and earn alongside their trading strategy. Those portfolios are depositary receipts (" =RD"), smoothly traded on the regional exchange “Börse Stuttgart” ’s EUWAX or directly with L&S. The RDs are issued by L&S AG. The great thing about this concept is that the publicity for the product is created by the influencers. They, the buying user, Wikifolio, the exchange and the issuer L&S AG are profiting - A win-win-win-win-win situation. The portfolios are effortlessly comparable by their performance and risk, and take niche strategies. The Cost structure is comparable to the 2/20 hedge fund rule – there is a 0,95% flat fee and a performance fee of 5-30% chosen by the trader. Wikifolio portfolios already add up to €420m AUM ("AUM =assets under management") at a growth rate of more than 50% YOY.

Invest in wikifolio certificates and get the performance of private and professional traders into your own portfolio: Listed on the Stuttgart and Bern stock exchanges; Easily available with brokers & banks; Suitable for every investment sum

Recent News and Updates

Lang & Schwarz AG: Business development remains at record level in the third quarter of 2020

11.11.2020 12:39

- Consolidated net income of EUR 23,842 thousand in the first three quarters of 2020 (previous year: EUR -501 thousand)

- Earnings from ordinary business activities EUR 13,612 thousand in the third quarter of 2020 (first quarter of 2020: EUR 8,739 thousand, second quarter of 2020 EUR 12,384 thousand)

- Consolidated earnings per share EUR 3.01 in the third quarter of 2020 (previous year's quarter: EUR 0.37)

- Consolidated earnings per share EUR 7.58 in the first three quarters of 2020 (previous year: EUR -0.16)

In the third quarter of 2020, Lang & Schwarz Aktiengesellschaft posted consolidated net income according to HGB of EUR 9,450 thousand, which is the third record quarter in a row. The previous record quarterly result from the previous quarter could be increased again by EUR 762 thousand and thus almost 9%. The result from ordinary business activities in the third quarter of 2020 also increased by almost 10% to EUR 13,612 thousand compared to the previous quarter (EUR 12,384 thousand). Compared to the second quarter of 2020 (EUR 19,336 thousand), the result from trading activities was slightly below the previous quarter at EUR 18,708 thousand. Administrative expenses (personnel expenses plus other operating expenses) were lower in the third quarter of 2020 at EUR 5,204 thousand than in the second quarter of 2020 (EUR 7,651 thousand). The tax expense on the result in the third quarter of 2020 amounts to EUR 4,183 thousand after EUR 3,696 thousand in the previous quarter.

After the first three quarters of 2020, the consolidated result is EUR 23,842 thousand (first three quarters of 2019: EUR -501 thousand, whereby this was charged with a one-off tax expense of EUR 2,823 thousand). The result from ordinary business activities of EUR 34,735 thousand was more than tenfold compared to the first three quarters of 2019 (EUR 3,371 thousand). The result from trading activities increased almost fourfold to EUR 52,715 thousand compared to the first three quarters of 2019 (EUR 13,654 thousand). Administrative expenses increased by a total of EUR 8,738 thousand compared to the first three quarters of 2019 to a total of EUR 18,636 thousand. This increase mainly relates to the formation of provisions for variable remuneration. The tax expense for the first three quarters of 2020 amounts to a total of EUR 10,917 thousand and thus increased by EUR 7,044 thousand compared to the first three quarters of 2019.

The result from ordinary business activities includes other operating income in the amount of EUR 1,153 thousand. These relate to a portion of the capital gain from the sale of an investment (Trade Republic Bank GmbH) at EUR 460 thousand. This is around half of the expected total capital gain. As reported, the sale is subject to various conditions of precedent.

The consolidated earnings per share for the third quarter of 2020 are EUR 3.01 (previous quarter: EUR 2.76). This enabled consolidated earnings per share of EUR 7.58 to be achieved for the first three quarters of 2020.

As of September 30, 2020, Lang & Schwarz Aktiengesellschaft had a balance sheet equity of EUR 51.3 million (December 31, 2019: EUR 27.5 million).

The number of employees in the Group as of September 30, 2020 was 60.

"With almost 10 million trades in the first nine months of 2020 alone at LS-X and a total of 16 million trades in our TradeCenter, we are extremely successful on our way to establishing Lang & Schwarz as one of the most important trading centers in Germany," reports the CEO, André Bütow, and continues: "The sales growth is unbroken and is supported by all of our activities, nationally and internationally. Our sales in 2020 are now more than two and a half times that of the same period in the previous year. We confirm our statement in Corporate News from August 27, 2020, on the course of the third quarter of 2020. The trend in sales growth is unbroken, we are still on our course to take trading activities and market maker activities to a new level. "

"With the continued high and in some cases increasing demand for our services in the fourth quarter of 2020 and the associated results, our expectations of further expanding the record result for the 2020 financial year with the fourth quarter of 2020" added fellow board member Torsten Klanten and adds: "With the verbal decision that our application of equity to the tax office (with a view to corporate income tax, including the solidarity surcharge) should be granted, we see our view confirmed that the amendment to Section 8b (7) KStG does not have an impact on Lang & Schwarz AG. We are continuing to concentrate our efforts on fully correcting the effects of the amendment to Section 8b (7) KStG and refer in this context to our report of October 29, 2020. "

The figures as of September 30, 2020 have not been audited and have not been reviewed by an auditor.

Business and financial highlights

The business activities are divided in 3 parts: the issuing of derivative financial instruments with L&S AG, the market making of L&S Tradecenter and the specialty bank L&S Broker

The parent company L&S AG is the operating holding focused on the issuing of RDs. In the first part of 2020 they issued 28000 own products which are tradable directly with L&S’ subsidiary L&S TC in a regulated environment of EUWAX (Börse Stuttgart) or the Swiss exchange BX Swiss. L&S makes around 30% of the profits in this segment.

L&S TC provides a market for 11000 stocks, bonds, funds and ETPs (ETFs, ETCs and ETNs) even on the weekend. L&S TC is the preferred partner at L&S X, they trade as market maker (MM) at the FWB, “Wiener Börse”(WBAG; Austria) and BX Swiss. Brokers and banks can be connected directly to L&S TC, and they already reach 15m customers that way.

L&S Broker, again a subsidiary of L&S AG, is a specialty bank that is a designated sponsor for XETRA. They additionally do consulting works for going- and being public, including IPO and corporate finance consulting.

Market making takes the rest of the profits (70%) and is the most important part of the company right now.

Growth perspective

L&S TC is already handling 21% of all German stock trades. In the first 9 months they have traded 16m orders that was more than 5 times as much as in the first 9 months of 2019. L&S X alone has processed 5m trades in the first 6 months making it the German exchange with the highest growth rate. At the same time Tradegate has dealt with 27,6m trades.

The development of trades processed in COVID-times show that the COVID-19 effect is not a one time occurrence it just accelerated growth and established a new trend. For the full year, the company guides continued strong growth even from the achieved record results.

Management & Share structure

Typically German, the executive members have been with the company for a long time and the members of the board bring in a fresh outside view. Normally parts of the board are also seated by unionized employee representatives. Those traditions can make companies stale and hard on innovation and speed, but L&S’ product progress and growth shows a great and successful management team that breaks with the country's norms.

André Bütow, with the company since 2002, is the CEO and Torsten Klanten, with the company since 2000, is its CFO. Vice Chairman of the Board is Andreas Willius, the CEO of Trade republic.

88% of the stock are free float, 12% are held by large institutions. With no structural investor L&S is prone to be bought by a huge institution (Nasdaq?) or bank. L&S’ market cap at close to €200m is a steal for lots of companies with cash piling up. But this scenario is not that probable.

Dividend policy

The company’s payout is decided on an entrepreneurial basis. This means the dividend will be cut once the money will have a higher return inside the company.

In 2019, they have decided to cut the dividend to invest more into the L&S trading platform; these fruits are being harvested right now. This implies L&S will always favor the return on invest over the cashflow for the investor. For the year 2020 the dividend comeback might be huge with a partial payout (50%) already providing about €5 - almost a 10% return. A verdict on that is yet to be taken by the management, because they have called out a capital requirement to bolster the balance sheet for further growth.

Competition and risks

On the neobrokers front, competition for the L&S partners is intensifying with the Blackrock (global biggest asset manager) backed neobrokers SCALABLE CAPITAL(SC). SC’s orders are processed by the electronic stock exchange gettex, regulated by “Börse München” and the market maker is "BAADER BANK". Gettex is as well zero-fee first choice on WALLSTREETONLINE´s SMARTBROKER - still smartbroker advertises additionally with L&S.

Wikifolio is the biggest platform in Europe and provides a vast offering of products without restrictions. But their products rely on RDs concentrated only on the DACH (Germany, Austria, Swiss) area. Global competitor eToro, an Israeli company, is a zero-fee broker that operates COPYTRADER, which only allows you to automatically copy trades by successful users. So, there is not really a competing fund-light product like Wikifolio out there.

On the risk side, the market does not see L&S' renaissance as a long term factor because once the global markets enter a years spanning bear scenario the newbie-churn-rate might be devastating. This is exactly what happened after the dotcom bubble burst in the early 2000s. German market makers like "Baader Bank" have quadruple their revenue because everyone was trading stocks. Their shares have hit an all-time high which was never reached again.

Source: Google Finance

This is might be one reason why L&S' valuation is that cheap, but it is not warranted. Times have changed, investment communities led by financial influencers are strong as ever and the "store of value" alternatives are scarce. Social media is the biggest buy-patron and not a sell-accelerator, as seen in the COVID-crash.

Valuation

For the years 2019 & 2018 L&S’ PE ratio was between 20 and 30. Even the years before that, the ratio still was double digits. So, with a forecasted EPS of €10 (2020), the current PE ratio sits almost at 7. The US stock exchange front-runner “Nasdaq” or “Deutsche Börse AG” (DB) respectively are valued at a forward PE ratio of 21 and 25. But they do not show the growth perspective of L&S even in these pandemic times or a back to normal state. DB has reported a single digit revenue growth for the last quarter and Nasdaq's growth was barely double-digit. A similar situation is the companies’ dividend yield at 2,1% and 1,9% - miniscule compared to what L&S might pay.

Conclusion

The current valuation makes no sense for the growth trend the German market is experiencing. An underdog, innovative and lean as L&S, is hard to find in a time and environment we are in now.

Our recommendation: This stock is a clear buy. Use the current price for buying in or averaging up and use further price-falls to average up.

Disclaimer & Conflict of interest

The author currently has a position of the mentioned stock. NO referenced company compensates the author or the publisher of this website.

This post is not investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Revenue and EBT by Quarter

Chart

Peers

All the Peers

FlexShopper Inc.

Bullish

Sprout Social Inc.

Bullish

Stamps.com Inc.

Bullish

Chegg Inc.

Bullish