The Search

Your Search Results

News from us

Newest Symbols

Newest Industries

Click to expand

Advertising

See Stocks

Automotive

See Stocks

E-Commerce

See Stocks

E-Learning

See Stocks

Electricity

See Stocks

Engineering

See Stocks

FlexShopper Inc.

Bullish

Bullish

Tattooed Chef Inc.

Neutral

Neutral

Hellofresh SE

Bullish

Bullish

Build-a-Bear Workshop Inc.

Outperform

Outperform

Stamps.com Inc.

Bullish

Bullish

Redfin Corporation

Bullish

Bullish

Perion Network Ltd.

Outperform

Outperform

Upwork Inc.

Bullish

Bullish

Chegg Inc.

Bullish

Bullish

Pinterest Inc.

Bullish

Bullish

Bluelinx Holdings Inc

Bullish

Bullish

Momentus Inc.

Neutral

Neutral

Mynaric AG

Neutral

Neutral

Virgin Galactic Holdings Inc.

Neutral

Neutral

Maxar Technologies Inc.

Neutral

Neutral

Sunrun Inc.

Bullish

Bullish

Steico SE

Neutral

Neutral

Alfen N.V.

Neutral

Neutral

Research

Content Cards

Swipe

Our Article

Embracer Group AB - Article

Big Game Hunt: On the Hunt for Big Games - Sumo Group, Embracer Group, Paradox Interactive, CD Projekt

Table of Content

- Gaming Trends

- Entertainment War

- Scalability & Profitability

- Geographic specialties

- Investment in your own hands

- Conservative Contract Developer: Sumo Group

- Big Buyer: Embracer Group

- Niche Strategy Giant Paradox

- Fallen Star: CD Projekt

- Conclusion

Gaming Trends

Note: Google Stadia, Playstation Now, Amazon Luna, Apple Arcade, Mircosoft Xbox Game Pass, Facebook Gaming

Entertainment WAR

The biggest companies all compete in a game of “user attention”. Facebook not only battles their peers like Snapchat, TikTok or Pinterest but also wants to draw the attention from Youtube, Netflix or Disney+ viewers. This “attention resource” is deeply fought over and harvests only a handful of hours every day, so to win you need to hold users as long as possible on their platform. This means the product that provides the most immersed connection triumphs, so naturally a game that bounds you to a e-sport multiplayer experience or submerges you in a roleplaying open world will not easily give up your awareness.

The big companies also clash on the question “Who wants to be the Netflix of Gaming”. Sony and Microsoft, that have already fiercely battled on the console field, now upgraded their service with a subscription. The FAANG (Facebook, Apple, Amazon, Netflix, Google) giants (excluding Netflix) have entered the market as well, with their own (streaming) subscription projects. What binds them together are their extra deep pockets filled with cash and their determination to growth their service platform with content(games!).

Scalability & Profitability

The best-case scenario is a game release, which generates that much heat out of thin air that its sales bring in the development and marketing costs in seconds. This is possible through the virality of social media and the infinite scalability of a digital sales channel. An example for that is the on first sight crappy looking werewolf-style game AMONG US which made its way around the Internet with highspeed taking millions of hearts. But to reach this kind of publicity the developers need to deliver the highest quality game which increases development time and reduces profitability. A conflict of interest for short term oriented people.

Note: Innersloth Among Us

But starting with the first sale a whole suite of deployable monetization strategies open themselves up. DownLoadable smaller Content (DLC), a larger expansion, in game currency shops for customization and the mixture of these approaches provide great upselling possibilities. FORTNITE for example, simply said, is just a entertainment platform to sell digital costumes and as a rule of thumb the more digital sales are, the higher the profit margin.

Note: Epic Games Fortnite

Geographic specialties

Generally said the most important resource in a game development is the human skill factor. Humbly clinched, places with lower wages, like eastern Europe countries, have a natural advantage. The wide-ranging fact that developing video games is always kind of a passion-project, where fun plays a huge role, helps with finding software engineers that normally would earn a lot more working on a stale objective.

Governments in Europe have noticed that by supporting gaming studios, they can easily attract lots of highly skilled workers using the entertainment industry as a starting point. The UK for example bolsters up to 20% of the gross development costs for a game developed in GB with a certain “cultural impact”. France countered the offer with a 30% expenditure tax relief.

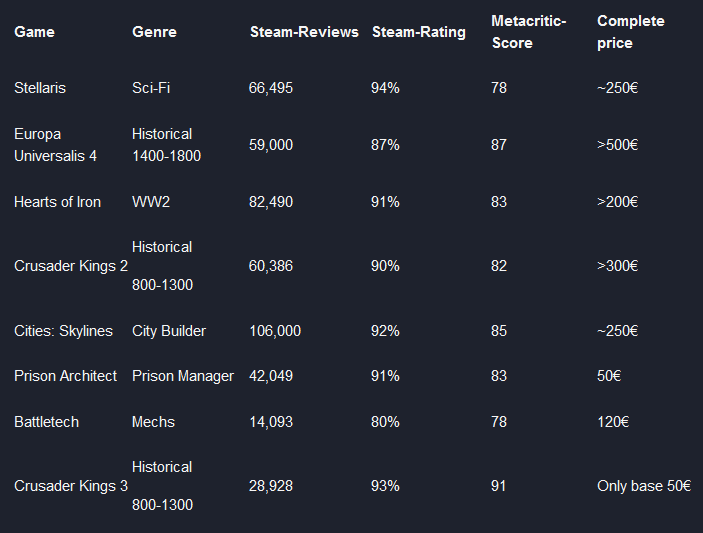

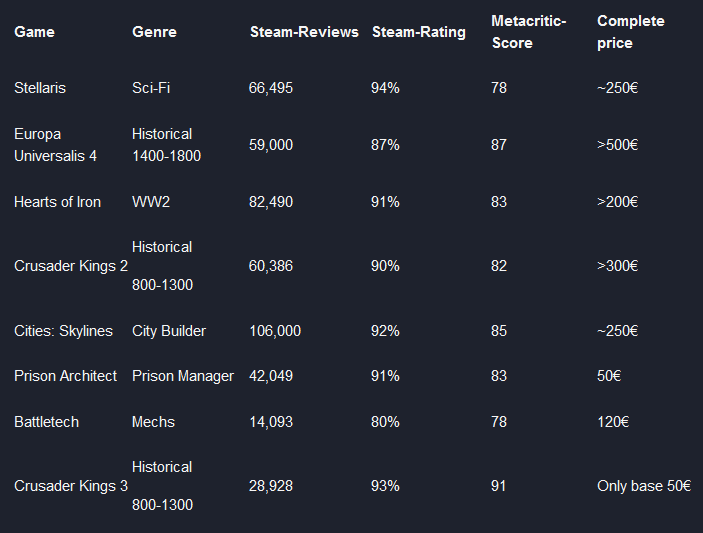

Investment in your own hands

The great thing about investing in gaming stocks is that you can undermine your thesis with own calculations powered by countless reviews around the internet. They effortlessly provide you with an edge to investors that only look at old time quantifiable balance sheets. In that way game ratings on Metacritic or Steam give you an instant view on some game´s success. Also, a social media investigation on Facebook, Youtube or Twitter will provide you with a reliable source surrounding virality and the overall mood of a product.

Conservative Contract developer: Sumo Group

Note: Sumo Digital

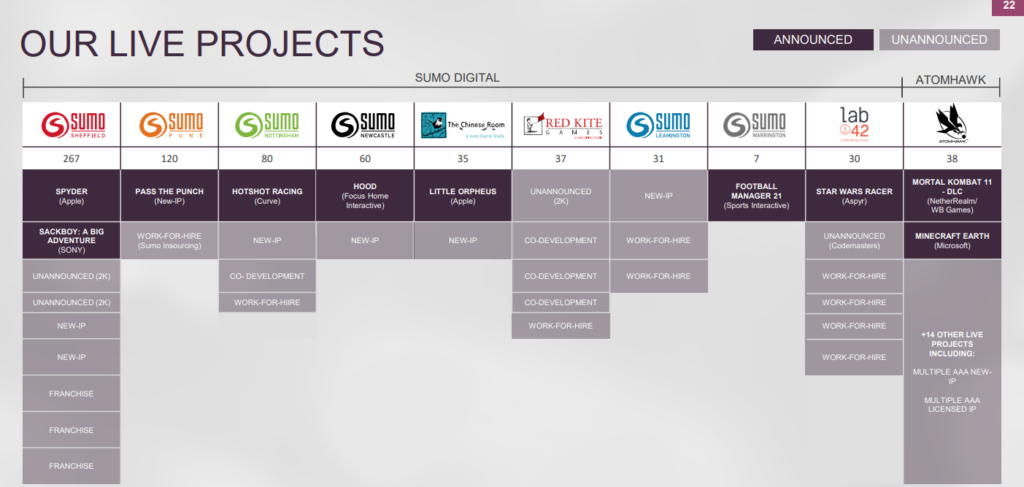

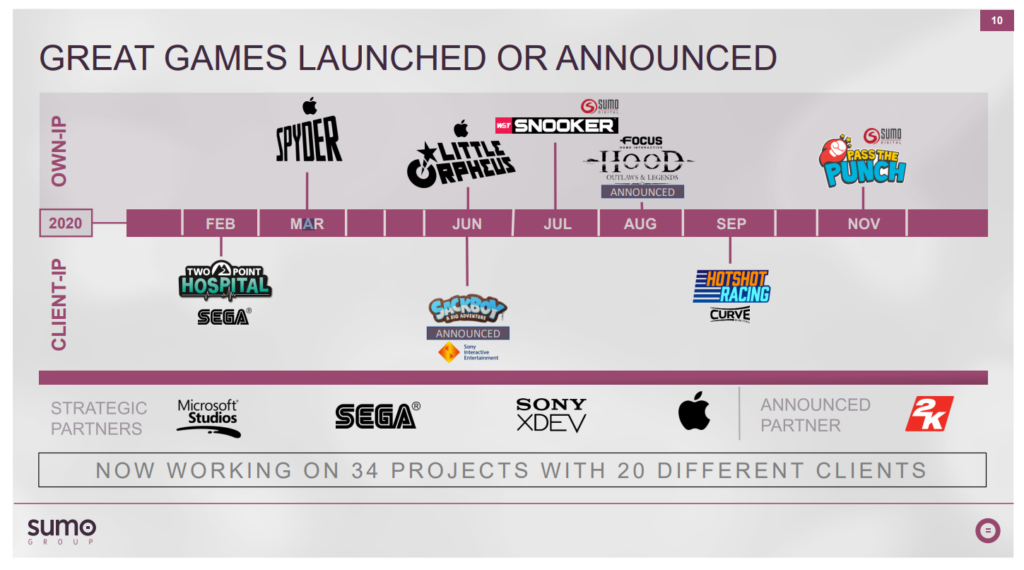

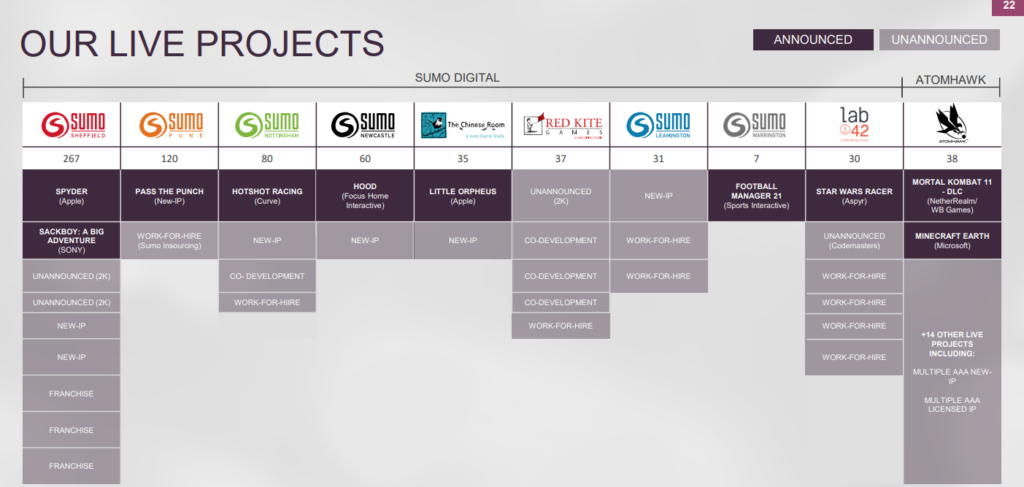

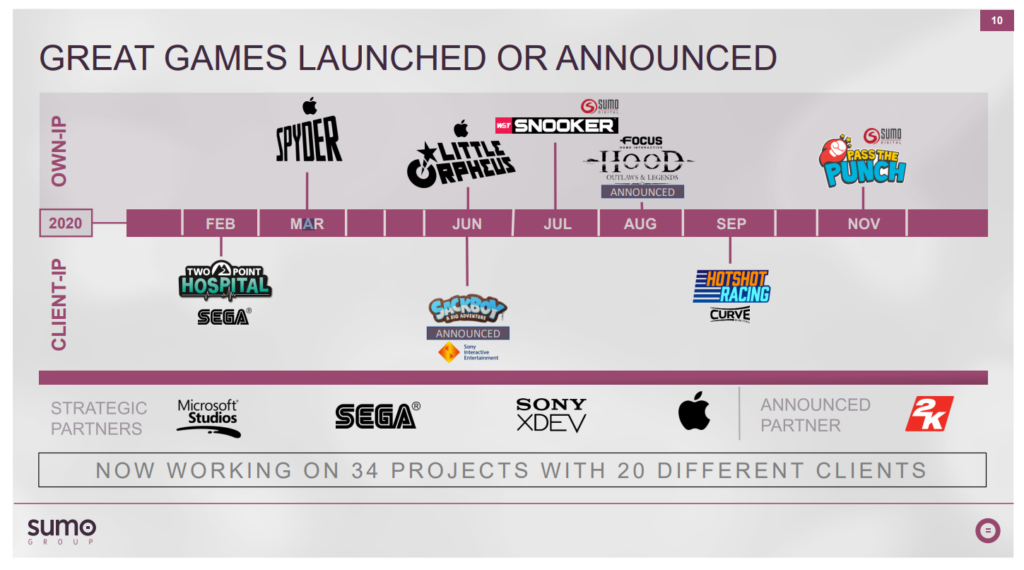

To start in a moderate manner, big game developers often support their team by hiring a strengthening force for dire times. A British contract developer is Sumo Digital. Partnering with colossuses like Mircosoft, Sony, Apple or EA, almost 1000 people across 12 studios in the UK, Canada, India and the United States, always provide a helping hand.

Adding to development revenue earned while working on client intellectual properties (IP), they diversifiy by creating their own Ips. This strategy combines a low-risk medium reward model with high-risk/reward ventures. The Own-IP schemes also vary in their implementation, because some projects are still co-owned with a publisher which again reduces risks. in their 2019 annual report they meticulously demonstrate how gaming deals a structure in serveral case studios. As mentioned before Sumo Digital benefits quite well form the UK video game tax relief program.

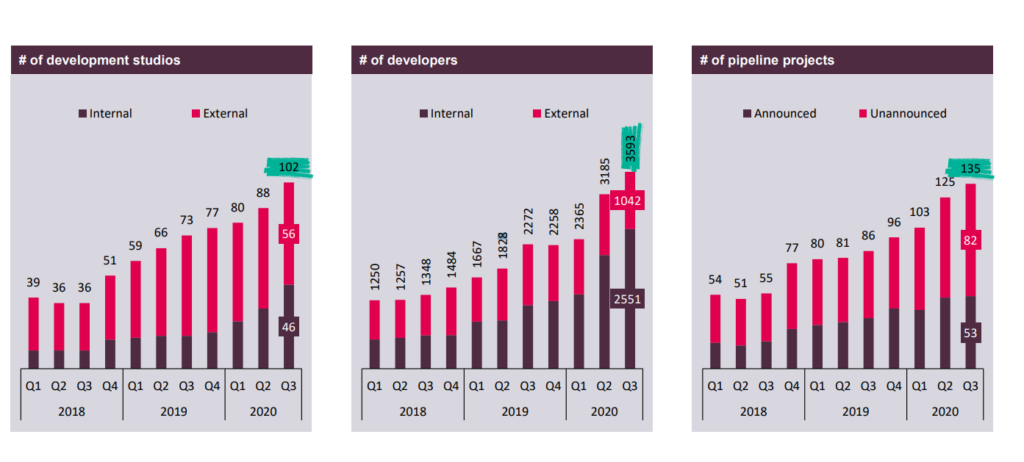

Note: Sumo Group plc Half Year Results 2020

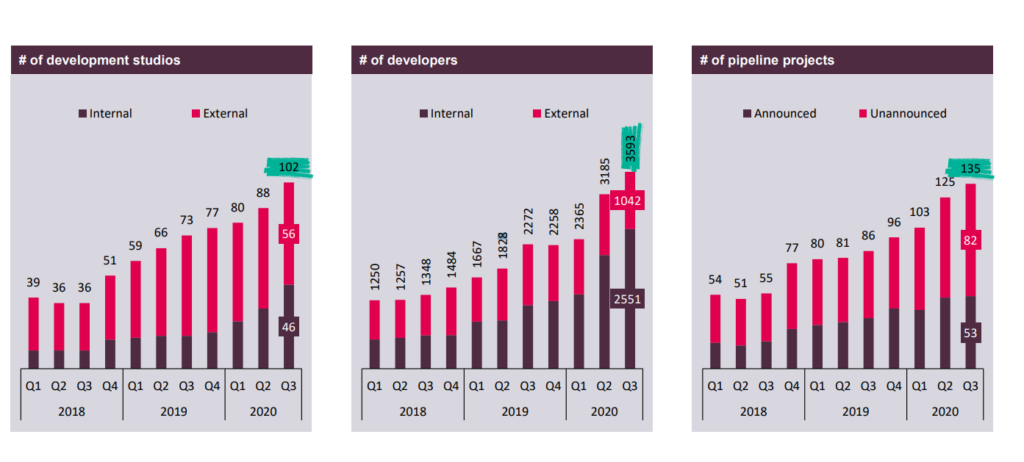

They have shown a strong and resilient performance through COVID-19 pandemic, by holding on to their efforts of expanding their headcount even further. They also embark on enlarging their footprint by taking over contractor studios around the world. Just recently they bought the US studio Pipeworks, with around 123 developers, for $100m.

Note: Sumo Group plc Half Year Results 2020

On the quantitative side they give a top line growth in the mid-20s supported by a gross margin in the 40s, but you are going to pay a steep PE-Ratio in the 50s.

Big Buyer: Embracer Group

Note: Embracer Group

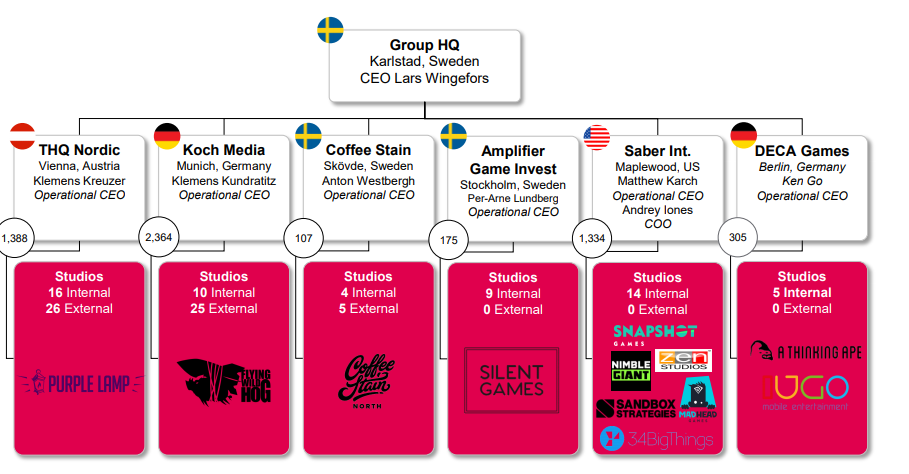

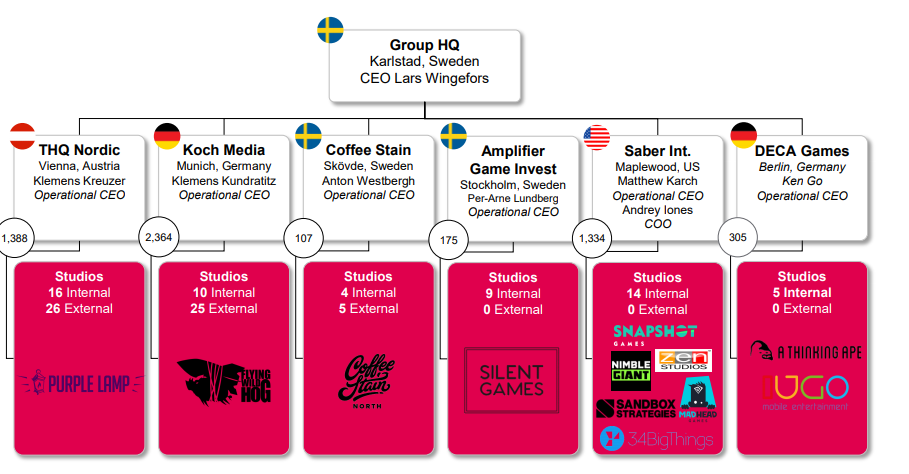

Embracer is one of the biggest players in the industry with a heavy focus on Merger&Acquisitions and a delicate balance act of quantity and quality of their games. They try to buy as many studios as possible and let them on a loose leach so that they developers use their creativity to create blockbusters. With 135 pipeline project, 102 studios and 3600 developers they try to finance projects en masse. They have organized their studios after genres: Germany based Deep Silver handles big AAA-titles, Austria based THQ Nordic manages AA-titles, Coffee Stain conducts the small games business from Sweden and the DECA operating unit focuses on mobile and free to play games. The recently overtaken US studio Saber Interactive is rather independent in its operation and to conclude they also have a micro game investing organization, Amplifier. This is still not every part they engage in, they also leverage their publishing efforts with Koch Media, where coordinate sales and marketing for third party games or movies.

Note: Embracer Group Pipeline

On the 18th of November Embracer declared the acquisition of 13 studios- with in total 1259 employees. These portfolio extensions are heavily finance through pre-announcement capital raises, so the shareholders could not fully participate, because the more people get a piece of the pie, the more your portion of the cake will shrink. Still the private deals can provide huge upside, because these companies are not investable in another way Note: Embracer Group M&A update

Note: Embracer Group M&A update

The group is held together by Lars Wingefors its founder, CEO, and biggest shareholder (even after the endless capital raises).

The M&A activities fuel the growth engine with the group sales growing by a staggering 90% YoY in the last quarter. The EBIT swelled by double the rate, by 171% YoY. This growth is extremely expensive with a forward PE-Ratio of 137. But the company can be seen as an Gaming ETF or an IP incubator looking for the next big game.

Niche Strategy Giant Paradox

Note: Paradox Interactive IR

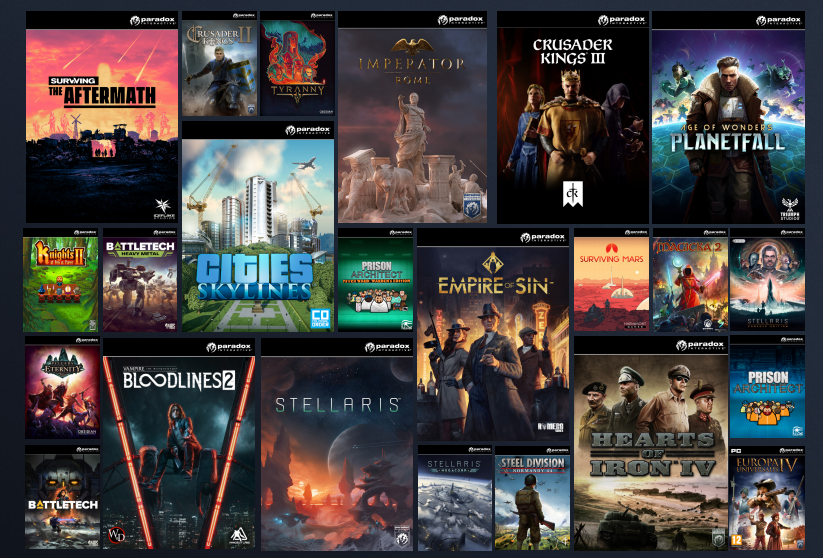

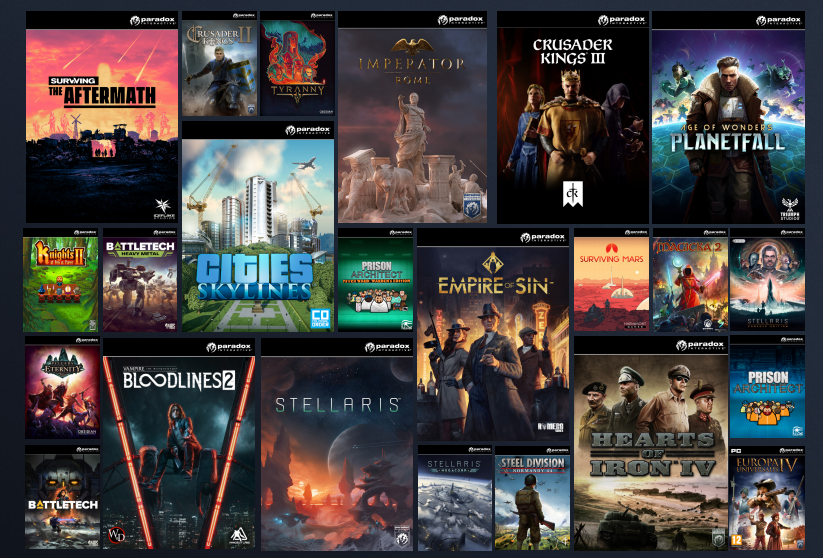

The Swedish developer Paradox Interactive, allows you to dive deep into the management of countries, cities, empires, prisons and multiplanetary species. The company is focused on a portfolio of game platforms with a vast array of game-expanding content packs. Their brands include:

Note: Paradox’ brands

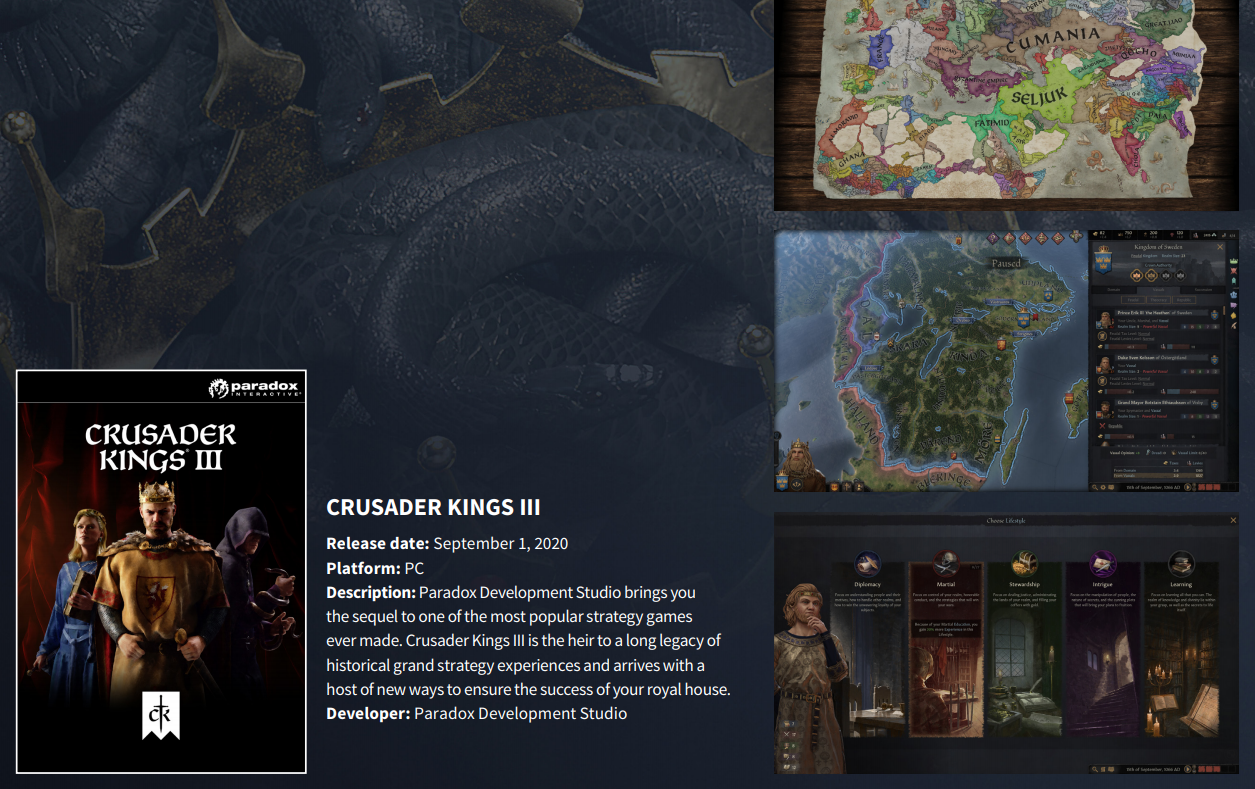

Their Grand strategy titles expansions’ can be seen like a subscription platform that is extended until the game is old enough to release the new version to start the circle again.

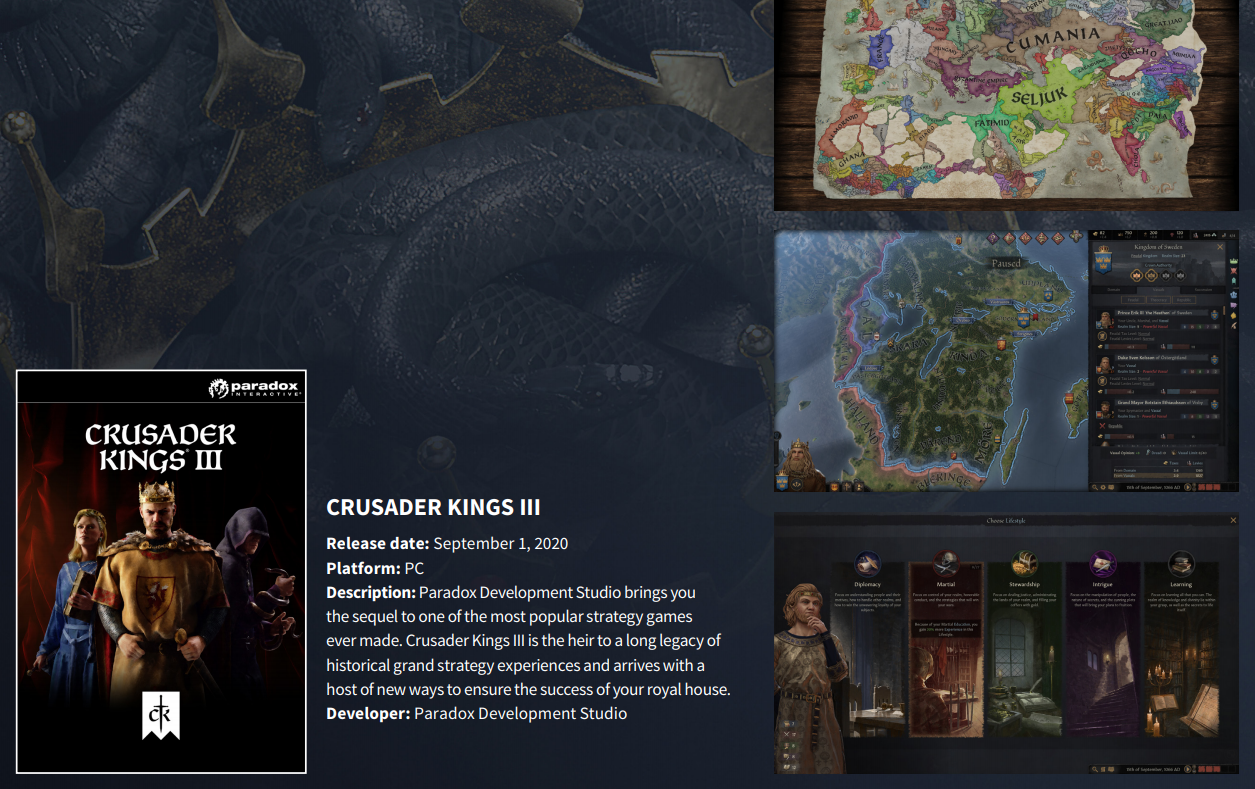

Note: Paradox newest success Crusader Kings III

In the first nine months the top line grew by 50% and operating profits grew 78%. For that growth you can get the company for a PE-Ratio of 47.

Fallen Star: CD Projekt

Note: CD Projekt IR

CD Projekt (CDP) is a polish AAA-game developer focus on quality over quantity with a major release every five years. With their Witcher franchise, a fantasy game of thrones like roleplaying game with a dark eastern European twist, they were continuously able to further train the development team and lay the groundwork for their successful model. Over the five years since publication the Witcher 3 sold over 50m copies, most of it in its final complete edition. This, also called game of the year edition, includes the rather huge DLCs that were released in the first year after the base game. The overall critics’ opinions place Witcher 3 in the league of the best games of all time. This gave CDP a huge advance praise which was as well cause by perfect community management.

Note: The Witcher Wildhunt

CDP even built up a relationship with Netflix to produce the Witcher series which was a critical achievement to expand the fantasy universe and bring in a new audience for the games. As a side project they have carve a card-minigame out of Witcher 3, polished it, added a multiplayer and released it as a standalone version even for phones. To accommodate their product line they have launched an own game store GOG with the focus of bringing back good old games (to let them run on new machines). But it has evolved into the way of distributing their games without digital rights management (DRM).

Note: The Witcher on Netflix

In 2013, while Witcher 3 still has been in development and the studio itself was a fraction of the size it is now, Cyberpunk 2077 the new CDP franchise was announced. The sci-fi dystopian roleplaying game where corporations rule the world is based on a tabletop game and its perception grew with the success the Witcher franchise showed. It was planned to release the game and an Expansion pass with small free updates in between. The version for the next generation consoles will hit shelfs in 2021. This would bring the total gross value of the complete edition for day one buyers to more than 100$. Analysts anticipate more than 20M sales in the first year and the total amount of sales should reach the Witcher 3 mark in the first 4 years. But the monetization does not end here, CDP revealed a multiplayer mode to launch in 2022. It will be like the Sci-Fi version of GTA online, the greatest cashcow for its publisher Take Two Interactive.

Note: CDP’s Cyberpunk 2077

The plan to launch the most hyped video game of the last years backfired dramatically for CD Projekt. It was at first delayed several times which caused fan outcries, even though these decision were took to assure the games quality. But that was not enough, the development roadmap the management lined out was way too ambitious and a final delay, due to marketing contracts in the hundred million, not feasible. This fact was swept under the carpet and was not communicated accordingly to the fans, that already bought the game. In the release version of Dec 10th, technical difficulties plague the console (XBOX one& PS4) versions and make the overall experience unbearable. Adding to the outrageous situation gaming journalists did not have the chance to warn of the game’s state, because they only had the chance to test the PC version. This caused a huge shitstorm and ripped CDPs perfect reputation apart. But the gaming experience on PC, which was the highest priority platform for the developers, was praised for and the game gained a rather good Metacritic rating of 86 and mostly positive reviews on Steam. The count of reviews on that platform is close to the total amount of the Witcher 3, in the first week, which reflects the enormous agitation in the player base. Still a high-end machine is needed to reach the graphical fidelity the marketing material showed. Particularly the deep story experience Cyberpunk delivers was underlined in reviews, which gives it a great starting point for the proposed Netflix anime adaptation in 2022.

Note: Xbox One Collectors Edition for $260

Certain features the extensive marketing campaign highlighted, that concern the open world experience, were rather basic and broke with the hype-inflated fan expectation. Especially those features seem to have been kicked back on the priority list and fell over the ledge in the last months when time was scarce. But they are a core point in the multiplayer version, which was planned for 2022 and will, with a high probability, be overworked.

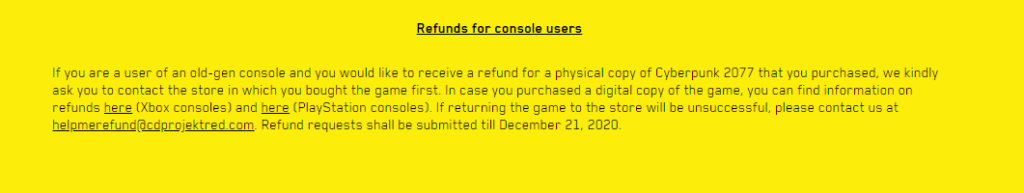

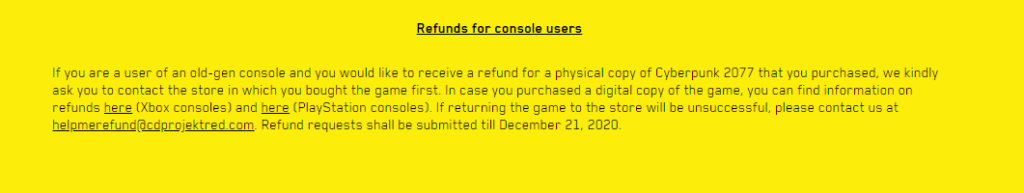

CDPs response to the drama was rapid and determined. In the release-following investors call the company layed out a roadmap to fix the technical problems with weekly hotfixes and big updates in January and February. For example, the patch 1.05, released on a Sunday (!), already fixed a lot of problems. Everyone that has bought the game can easily refund it with Sony even taking the game out of their store until its fidelity is restored. The employees, once celebrated for their great achieve and now hated by extra loud haters, are seemingly determined to regain the immaculate prerelease standing and rescue the game itself.

Note: Refunds first

On the side of first sales numbers prerelease sales already put the game into a territory where it infinitely prints money. With 13M net sales in the first 10 days the +20M sales in the first year should be reachable with the re-release on old gen consoles + the next gen console version

To conclude this discourse: The outcry is powered by a loud but smaller margin of gamers that hyped that game up to a sphere that never in any way was reachable. Development will continue to fix the problems, small free feature will buy back reputation to a certain degree and the expansion pass and multiplayer mode will only be delayed by some months. In the end looking back at the whole situation in some years from now, the explosive publicity might even be a huge benefit to boost this newly started franchise. What is clear right now the cyberpunk 2077’s of 2021, 2022, and 2023 will be completely enhanced and polished to the next level.

Conclusion

Gaming stocks provide a great mixture between high profitability an high growth in the biggest entertainment medium. This big game hunt sorts its picks from lower risk to high risk, easily symbolized through the companies’ business models. The volatility a concentrated developer like CD Projekt provides is its risk but also gives fantastic chances once the market opinion can be proven wrong. So take caution and do your own due diligence!

Disclaimer & Conflict of interest

The author currently has a position in the mentioned stocks. NO referenced company compensates the author or the publisher of this website.

This post is not investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Embracer Group AB - Article

Big Game Hunt: On the Hunt for Big Games - Sumo Group, Embracer Group, Paradox Interactive, CD Projekt

Table of Content

- Gaming Trends

- Entertainment War

- Scalability & Profitability

- Geographic specialties

- Investment in your own hands

- Conservative Contract Developer: Sumo Group

- Big Buyer: Embracer Group

- Niche Strategy Giant Paradox

- Fallen Star: CD Projekt

- Conclusion

Gaming Trends

Note: Google Stadia, Playstation Now, Amazon Luna, Apple Arcade, Mircosoft Xbox Game Pass, Facebook Gaming

Entertainment WAR

The biggest companies all compete in a game of “user attention”. Facebook not only battles their peers like Snapchat, TikTok or Pinterest but also wants to draw the attention from Youtube, Netflix or Disney+ viewers. This “attention resource” is deeply fought over and harvests only a handful of hours every day, so to win you need to hold users as long as possible on their platform. This means the product that provides the most immersed connection triumphs, so naturally a game that bounds you to a e-sport multiplayer experience or submerges you in a roleplaying open world will not easily give up your awareness.

The big companies also clash on the question “Who wants to be the Netflix of Gaming”. Sony and Microsoft, that have already fiercely battled on the console field, now upgraded their service with a subscription. The FAANG (Facebook, Apple, Amazon, Netflix, Google) giants (excluding Netflix) have entered the market as well, with their own (streaming) subscription projects. What binds them together are their extra deep pockets filled with cash and their determination to growth their service platform with content(games!).

Scalability & Profitability

The best-case scenario is a game release, which generates that much heat out of thin air that its sales bring in the development and marketing costs in seconds. This is possible through the virality of social media and the infinite scalability of a digital sales channel. An example for that is the on first sight crappy looking werewolf-style game AMONG US which made its way around the Internet with highspeed taking millions of hearts. But to reach this kind of publicity the developers need to deliver the highest quality game which increases development time and reduces profitability. A conflict of interest for short term oriented people.

Note: Innersloth Among Us

But starting with the first sale a whole suite of deployable monetization strategies open themselves up. DownLoadable smaller Content (DLC), a larger expansion, in game currency shops for customization and the mixture of these approaches provide great upselling possibilities. FORTNITE for example, simply said, is just a entertainment platform to sell digital costumes and as a rule of thumb the more digital sales are, the higher the profit margin.

Note: Epic Games Fortnite

Geographic specialties

Generally said the most important resource in a game development is the human skill factor. Humbly clinched, places with lower wages, like eastern Europe countries, have a natural advantage. The wide-ranging fact that developing video games is always kind of a passion-project, where fun plays a huge role, helps with finding software engineers that normally would earn a lot more working on a stale objective.

Governments in Europe have noticed that by supporting gaming studios, they can easily attract lots of highly skilled workers using the entertainment industry as a starting point. The UK for example bolsters up to 20% of the gross development costs for a game developed in GB with a certain “cultural impact”. France countered the offer with a 30% expenditure tax relief.

Investment in your own hands

The great thing about investing in gaming stocks is that you can undermine your thesis with own calculations powered by countless reviews around the internet. They effortlessly provide you with an edge to investors that only look at old time quantifiable balance sheets. In that way game ratings on Metacritic or Steam give you an instant view on some game´s success. Also, a social media investigation on Facebook, Youtube or Twitter will provide you with a reliable source surrounding virality and the overall mood of a product.

Conservative Contract developer: Sumo Group

Note: Sumo Digital

To start in a moderate manner, big game developers often support their team by hiring a strengthening force for dire times. A British contract developer is Sumo Digital. Partnering with colossuses like Mircosoft, Sony, Apple or EA, almost 1000 people across 12 studios in the UK, Canada, India and the United States, always provide a helping hand.

Adding to development revenue earned while working on client intellectual properties (IP), they diversifiy by creating their own Ips. This strategy combines a low-risk medium reward model with high-risk/reward ventures. The Own-IP schemes also vary in their implementation, because some projects are still co-owned with a publisher which again reduces risks. in their 2019 annual report they meticulously demonstrate how gaming deals a structure in serveral case studios. As mentioned before Sumo Digital benefits quite well form the UK video game tax relief program.

Note: Sumo Group plc Half Year Results 2020

They have shown a strong and resilient performance through COVID-19 pandemic, by holding on to their efforts of expanding their headcount even further. They also embark on enlarging their footprint by taking over contractor studios around the world. Just recently they bought the US studio Pipeworks, with around 123 developers, for $100m.

Note: Sumo Group plc Half Year Results 2020

On the quantitative side they give a top line growth in the mid-20s supported by a gross margin in the 40s, but you are going to pay a steep PE-Ratio in the 50s.

Big Buyer: Embracer Group

Note: Embracer Group

Embracer is one of the biggest players in the industry with a heavy focus on Merger&Acquisitions and a delicate balance act of quantity and quality of their games. They try to buy as many studios as possible and let them on a loose leach so that they developers use their creativity to create blockbusters. With 135 pipeline project, 102 studios and 3600 developers they try to finance projects en masse. They have organized their studios after genres: Germany based Deep Silver handles big AAA-titles, Austria based THQ Nordic manages AA-titles, Coffee Stain conducts the small games business from Sweden and the DECA operating unit focuses on mobile and free to play games. The recently overtaken US studio Saber Interactive is rather independent in its operation and to conclude they also have a micro game investing organization, Amplifier. This is still not every part they engage in, they also leverage their publishing efforts with Koch Media, where coordinate sales and marketing for third party games or movies.

Note: Embracer Group Pipeline

On the 18th of November Embracer declared the acquisition of 13 studios- with in total 1259 employees. These portfolio extensions are heavily finance through pre-announcement capital raises, so the shareholders could not fully participate, because the more people get a piece of the pie, the more your portion of the cake will shrink. Still the private deals can provide huge upside, because these companies are not investable in another way Note: Embracer Group M&A update

Note: Embracer Group M&A update

The group is held together by Lars Wingefors its founder, CEO, and biggest shareholder (even after the endless capital raises).

The M&A activities fuel the growth engine with the group sales growing by a staggering 90% YoY in the last quarter. The EBIT swelled by double the rate, by 171% YoY. This growth is extremely expensive with a forward PE-Ratio of 137. But the company can be seen as an Gaming ETF or an IP incubator looking for the next big game.

Niche Strategy Giant Paradox

Note: Paradox Interactive IR

The Swedish developer Paradox Interactive, allows you to dive deep into the management of countries, cities, empires, prisons and multiplanetary species. The company is focused on a portfolio of game platforms with a vast array of game-expanding content packs. Their brands include:

Note: Paradox' brands

Their Grand strategy titles expansions’ can be seen like a subscription platform that is extended until the game is old enough to release the new version to start the circle again.

Note: Paradox newest success Crusader Kings III

In the first nine months the top line grew by 50% and operating profits grew 78%. For that growth you can get the company for a PE-Ratio of 47.

Fallen Star: CD Projekt

Note: CD Projekt IR

CD Projekt (CDP) is a polish AAA-game developer focus on quality over quantity with a major release every five years. With their Witcher franchise, a fantasy game of thrones like roleplaying game with a dark eastern European twist, they were continuously able to further train the development team and lay the groundwork for their successful model. Over the five years since publication the Witcher 3 sold over 50m copies, most of it in its final complete edition. This, also called game of the year edition, includes the rather huge DLCs that were released in the first year after the base game. The overall critics’ opinions place Witcher 3 in the league of the best games of all time. This gave CDP a huge advance praise which was as well cause by perfect community management.

Note: The Witcher Wildhunt

CDP even built up a relationship with Netflix to produce the Witcher series which was a critical achievement to expand the fantasy universe and bring in a new audience for the games. As a side project they have carve a card-minigame out of Witcher 3, polished it, added a multiplayer and released it as a standalone version even for phones. To accommodate their product line they have launched an own game store GOG with the focus of bringing back good old games (to let them run on new machines). But it has evolved into the way of distributing their games without digital rights management (DRM).

Note: The Witcher on Netflix

In 2013, while Witcher 3 still has been in development and the studio itself was a fraction of the size it is now, Cyberpunk 2077 the new CDP franchise was announced. The sci-fi dystopian roleplaying game where corporations rule the world is based on a tabletop game and its perception grew with the success the Witcher franchise showed. It was planned to release the game and an Expansion pass with small free updates in between. The version for the next generation consoles will hit shelfs in 2021. This would bring the total gross value of the complete edition for day one buyers to more than 100$. Analysts anticipate more than 20M sales in the first year and the total amount of sales should reach the Witcher 3 mark in the first 4 years. But the monetization does not end here, CDP revealed a multiplayer mode to launch in 2022. It will be like the Sci-Fi version of GTA online, the greatest cashcow for its publisher Take Two Interactive.

Note: CDP's Cyberpunk 2077

The plan to launch the most hyped video game of the last years backfired dramatically for CD Projekt. It was at first delayed several times which caused fan outcries, even though these decision were took to assure the games quality. But that was not enough, the development roadmap the management lined out was way too ambitious and a final delay, due to marketing contracts in the hundred million, not feasible. This fact was swept under the carpet and was not communicated accordingly to the fans, that already bought the game. In the release version of Dec 10th, technical difficulties plague the console (XBOX one& PS4) versions and make the overall experience unbearable. Adding to the outrageous situation gaming journalists did not have the chance to warn of the game’s state, because they only had the chance to test the PC version. This caused a huge shitstorm and ripped CDPs perfect reputation apart. But the gaming experience on PC, which was the highest priority platform for the developers, was praised for and the game gained a rather good Metacritic rating of 86 and mostly positive reviews on Steam. The count of reviews on that platform is close to the total amount of the Witcher 3, in the first week, which reflects the enormous agitation in the player base. Still a high-end machine is needed to reach the graphical fidelity the marketing material showed. Particularly the deep story experience Cyberpunk delivers was underlined in reviews, which gives it a great starting point for the proposed Netflix anime adaptation in 2022.

Note: Xbox One Collectors Edition for $260

Certain features the extensive marketing campaign highlighted, that concern the open world experience, were rather basic and broke with the hype-inflated fan expectation. Especially those features seem to have been kicked back on the priority list and fell over the ledge in the last months when time was scarce. But they are a core point in the multiplayer version, which was planned for 2022 and will, with a high probability, be overworked.

CDPs response to the drama was rapid and determined. In the release-following investors call the company layed out a roadmap to fix the technical problems with weekly hotfixes and big updates in January and February. For example, the patch 1.05, released on a Sunday (!), already fixed a lot of problems. Everyone that has bought the game can easily refund it with Sony even taking the game out of their store until its fidelity is restored. The employees, once celebrated for their great achieve and now hated by extra loud haters, are seemingly determined to regain the immaculate prerelease standing and rescue the game itself.

Note: Refunds first

On the side of first sales numbers prerelease sales already put the game into a territory where it infinitely prints money. With 13M net sales in the first 10 days the +20M sales in the first year should be reachable with the re-release on old gen consoles + the next gen console version

To conclude this discourse: The outcry is powered by a loud but smaller margin of gamers that hyped that game up to a sphere that never in any way was reachable. Development will continue to fix the problems, small free feature will buy back reputation to a certain degree and the expansion pass and multiplayer mode will only be delayed by some months. In the end looking back at the whole situation in some years from now, the explosive publicity might even be a huge benefit to boost this newly started franchise. What is clear right now the cyberpunk 2077’s of 2021, 2022, and 2023 will be completely enhanced and polished to the next level.

Conclusion

Gaming stocks provide a great mixture between high profitability an high growth in the biggest entertainment medium. This big game hunt sorts its picks from lower risk to high risk, easily symbolized through the companies' business models. The volatility a concentrated developer like CD Projekt provides is its risk but also gives fantastic chances once the market opinion can be proven wrong. So take caution and do your own due diligence!

Disclaimer & Conflict of interest

The author currently has a position in the mentioned stocks. NO referenced company compensates the author or the publisher of this website.

This post is not investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.