The Search

Your Search Results

News from us

Newest Symbols

Newest Industries

Click to expand

Advertising

See Stocks

Automotive

See Stocks

E-Commerce

See Stocks

E-Learning

See Stocks

Electricity

See Stocks

Engineering

See Stocks

FlexShopper Inc.

Bullish

Bullish

Tattooed Chef Inc.

Neutral

Neutral

Hellofresh SE

Bullish

Bullish

Build-a-Bear Workshop Inc.

Outperform

Outperform

Stamps.com Inc.

Bullish

Bullish

Redfin Corporation

Bullish

Bullish

Perion Network Ltd.

Outperform

Outperform

Upwork Inc.

Bullish

Bullish

Chegg Inc.

Bullish

Bullish

Pinterest Inc.

Bullish

Bullish

Bluelinx Holdings Inc

Bullish

Bullish

Momentus Inc.

Neutral

Neutral

Mynaric AG

Neutral

Neutral

Virgin Galactic Holdings Inc.

Neutral

Neutral

Maxar Technologies Inc.

Neutral

Neutral

Sunrun Inc.

Bullish

Bullish

Steico SE

Neutral

Neutral

Alfen N.V.

Neutral

Neutral

Research

Content Cards

Swipe

Our Article

Tattooed Chef Inc. - Article

Research: Tattooed Chef - Beyond White Labels Are the Tattooed Meats

Table of Content:

- Introduction to the Company

- Trend Radar

- Business Model & Financials

- Recent News and Updates

- Management & Share Structure

- Competition & Risks

- Valuation

- Conclusion

1.Introduction

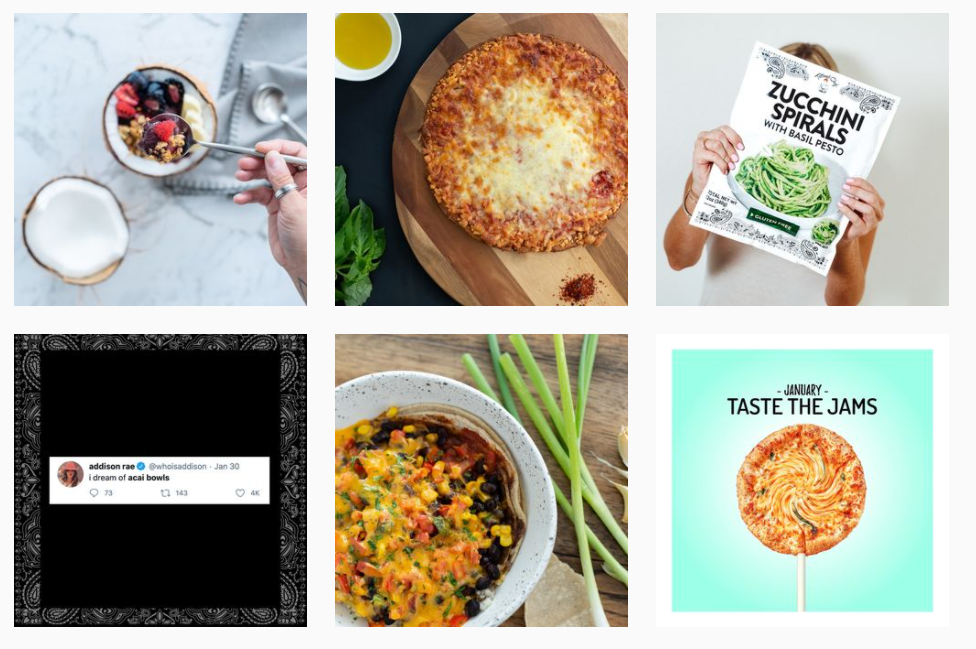

A dramatic change in eating habits, brought to you by environmental consciousness and a health-first-desire, is flooding grocery ailes and convenience stores with new trendy and edgy products. What combines them is their plant-based nature. Modern food trends rely on adjective stacking like : vegetarian, vegan, gluten-free, organic, non gmo, cruelty free, „source of protein”, rBST Free, etc. If you combine this with modern branding, an ecommerce strategy, vertical integration and a white label safety net, you got the quintessential recipe for success – Tattooed Chef (TTCF) is the perfect example for that.

Note: Zucchini Spirals

2.Trend Radar

Vegetablization and Fake meats

Plant-favored diets are on the rise which creates completely new food categories with exuberant growth possibilities. For example, the US dairy milk total addressable market is $14bn (GFI) with a plant-based penetration of 14% in 2020 (GFI). In the UK alone sales of alt-milks were up 28.3% last year, and a third of UK households (32%) now buy dairy-free milk. If you compare this to the much larger $95bn meat TAM (GFI) with a 1% plant-based penetration, the opportunity seems endless. Looking at the possible market from a different perspective,the following pie chart illustrates the market share of frozen food categories:

Source: investor presentation + CY 2019, Nielsen xAOC + Conv

The near term chance for Tattooed Chef lies in the desserts and the prepared foods slice.

Note: Buffalo Cauliflower

Vegetable bowling for the treasure hunter crown

Acai or smoothie bowls liter Instagram feed and burn in image of extreme healthiness and into your mind. This inspiration is carried on to the grocery store where, through an edgy packaging, you instantly gravitate towards the “ORGANIC RASPBERRY KOMBUCHA SMOOTHIE BOWL”. No further ads needed – influencers already sold a product to you that you did not know before. This is Tattooed Chefs strategy: Bringing coolness to the frozen party. But there are also readymade foods that activate your hunting instinct, in their portfolio. Treasure hunter products bring prestige to your local one stop wholesaler. With a changing and ever surprising roster, they intend to spark excitement (even though the TTCF mac & cheese was only pimped with cauliflower). Wall Street Strategies analyst Brian Sozzi describes it as: “You walk into Costco for tuna and end up getting a Marc Jacobs coat.”

This trend is the edible version of millennial thrift store shopping. This strategy was invented by the European private label specialist like LIDL or ALDI, with its American icon Trader Joe´s. To close the circle: Tattooed Chef is as well part of producing and cornering the market for Trader Joe’s as one of their white label suppliers.

3.Business model

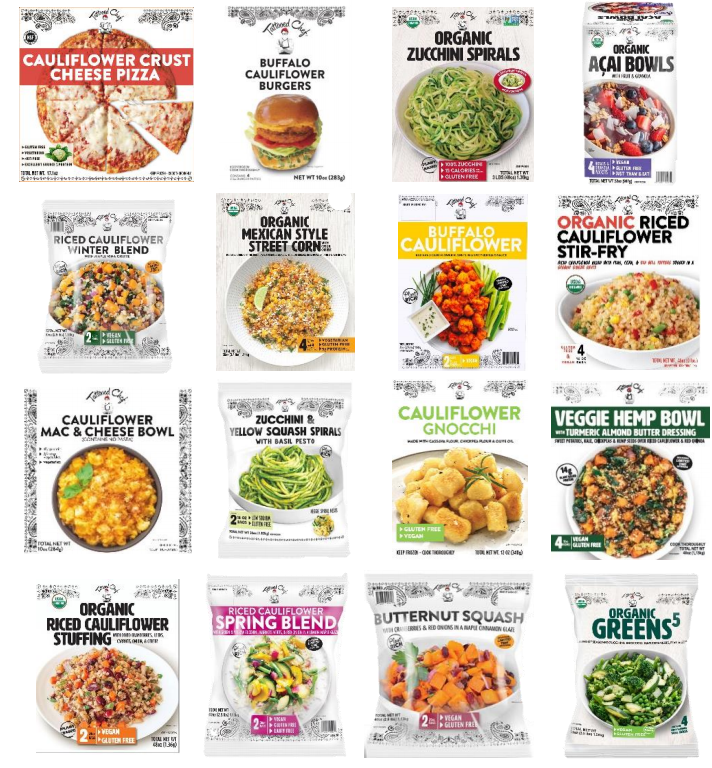

“Tattooed Chef is a leading plant-based food company offering a broad portfolio of innovative plant-based food products that taste great and are sustainably sourced. Tattooed Chef’s signature products include ready-to-cook bowls, zucchini spirals, riced cauliflower, acai and smoothie bowls, and cauliflower pizza crusts, which are available in the frozen food sections of leading national retail food stores across the United States. Understanding consumer lifestyle and food trends, and a commitment to innovation, allows Tattooed Chef to continuously introduce new products. Tattooed Chef provides great-tasting, approachable, and innovative products not only to the growing group of consumers who seek to adopt a plant-based lifestyle, but to any of the “People Who Give a Crop”.”

Operations – Italian tomato-syndicate?

Tattooed Chef operates two manufacturing facilities in California and its heritage country Italy. They control every part of their supply chain, allowing them to administer the products quality down the seed. TTCF’s specialty is its vegetable sourcing form Italy, helping the branding story with its the Italian cuisine origin.

“Italian Grown – Los Angeles Made: We do Farm to – Table our own way. We care so much about the ingredients that we grow them ourselves! (And we stay with them every step of the way.)”

Source: investor presentation

The operational growth plans are ambitious, but they allow them to handle the growth opportunities lying in front of them. A special aspect of TTCF’s deep vertical integration is the proactive way of doing business, with innovations being born into fully fletched product in only three months. This gives them fast access to emerging trends set by social media viralities. It also demonstrates TTCF’s experience in manufacturing, distribution and supply chain management – remarkable for such a small and young company.

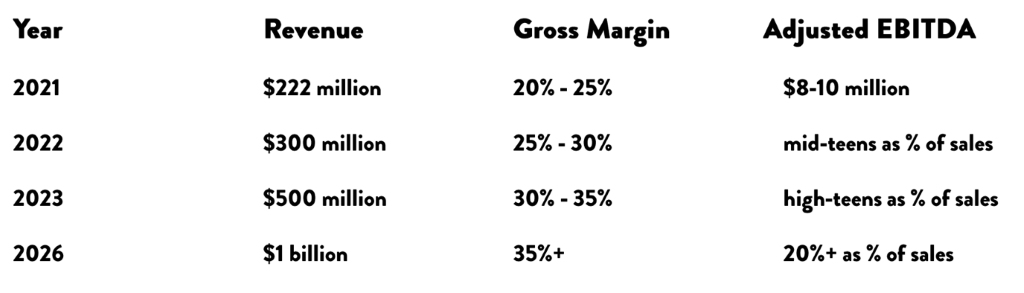

Note: TTCF’s product line

Products – Can tattooed cauliflower be a Rockstar?

The Product lineup started with a selection of 2 products in 2017 – to now more than 62 SKUs (Stock Keeping Unit – unique product identifier, often visualized by bar codes with 8-, 12-, or 13-digit numbers) in 2021.

Core component of TTCF’s strategy is combing the high-margin branded-content business with their white labeling efforts. This has historically grown out of the CEO’s first company Stonegate, which was an importer of vegetables and other Italian products to be sold to national natural channel retailer. Their first manufacturing facility was opened in 2015 and the company changed its name to Ittella Inc. (Galletti backward and without the G) to highlight the change form importing to white labeling. Then in 2017 the brand Tattooed Chef was launched and with the next branding shift the company renamed itself again during the going public process.

In the Q3 the revenue from branded products has first time surpassed the private product revenue, marking the company’s metamorphosis.

Partners – with vegetables to the moon?

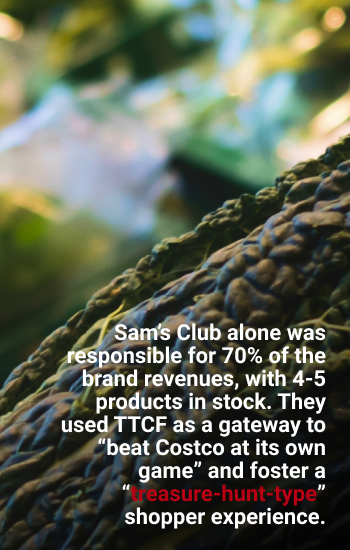

Through the years of doing business, TTCF has built up a remarkable network of partners. Their core business strategy was to market their products through the club sales channels of Sam´s Club (Walmart’s club wholesaler) and Costco. Sam’s Club alone was responsible for 70% of the brand revenues, with 4-5 products in stock. They used TTCF as a gateway to “beat Costco at its own game” and foster a “treasure-hunt-type” shopper experience. But TTCF is focused on increasing their point of sales by cooperating with regional and national grocery partners like Sprouts, Alberto. This plays a huge role because it allows TTCF’s product portfolio to be fully utilized (wholesalers normally sell only a few SKU) on more shelf miles and more geographics. But the most important point is that bulk–club-wholesale customers are not the typical Silicon Valley hipsters that are TTCF’s core audience. Working with different grocers allows TTCF to tap into a younger and more cosmopolitan crowd.

On the private label front, the biggest enabler is Costco, although TTCF’s growth plans are with their own brand.

The cooperation with Target lets them stock their smoothie bowls, of which the Acai Bowl is biggest seller. The average retail price was $4.71.

Another example is Walmart which doubled their SKUs to 11 in 2700 stores nationwide. For that, the average sales price is a bit lower than Target’s at $3.96.

Marketing – Bringing coolness to the frozen party.

Note: TTCF’s instagram

Whopping 100m of revenues without spending a dime is a great feat and it shows the management’s skills and experience. But to further scale up and bring the brand on more dinner tables, a marketing strategy is needed. TTCF started in Q3 a promotional campaign and is building up its network to create a 360-degree brand ecosystem. For that they work together with brand advisor Nitro C, having companies like HelloFresh, Warner or Mars in their portfolio. Most important customer touch point for TTCF is Instagram, where it shows its products and happy costumers. But only 19k people are following them yet. Furthermore, in line with their edgy identity, the tattooed chef Sarah curates a Spotify playlist, exposing the company’s vibe. But this effort only attracts a handful of people, which makes it rather ridiculous, because the spotify playlist is prominentally placed on the homepage.

Financials – juicy margins and healthy balances

Management explained the gross margin hit in the Q3 with by a special Costco promotion for their acai bowls. Those “expenses” and the marketing costs will reduce EBITDA-margins in the near term but TTCF intends to grow out of this trough. One-time effects like the merger costs ($4.8m) also plague the Q3 bottom line. This is the main reason for the huge loss. What must be closely watched is the company’s QoQ growth because of the estimated revenue decline in Q4. Still TTCF could also have been rather conservative with its near-term guidance. A verdict on the growth perspective can taken when Q4 results are released.

The Balance sheet, with $95 in cash, is as healthy as their products.

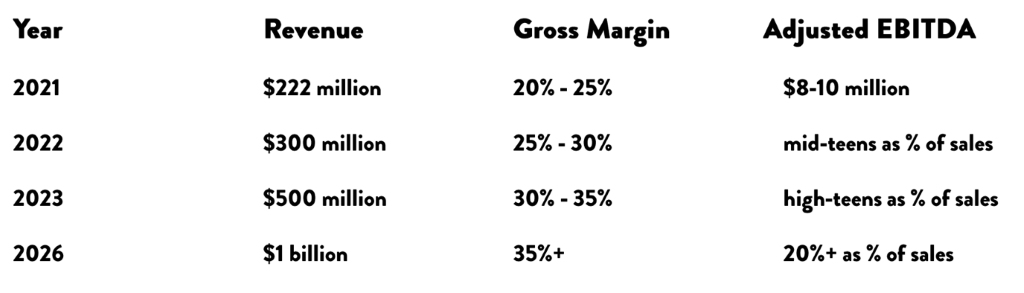

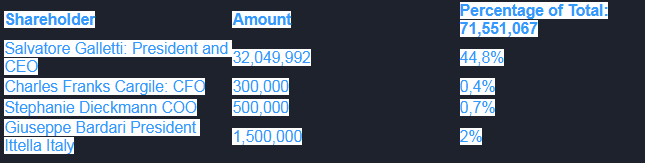

Following growth plans were laid out by the company in the end of 2020:

Note: Company Presentation

It boils down to top line CAGR in the 30s and a EBITDA CAGR in the 80s.

Growth catalysts – Cauliflower Bombers

Growth plans build upon the start of TTCF’s marketing campaign, their ecommerce store, new partners, geographic expansion and maybe acquisitions.

Revenues will yield a short-term boost, when products are hitting the shelfs through new partnerships But if those partnerships really prove to be sustainably beneficial is yet to be shown.

The Product line-up has no creative barrier. Peer companies like Amy’s also produce snacks and for example Beyond meat has just recently inked an agreement with snack giant Pepsi. So, this area, perfectly fitting into the company’s CI, might be profitable.

On 10/26/20 their Shopify-ecommerce store was launched, which directly brings all their products to the consumers. Operated on a lean footprint and with high pricing it might not be the go-to place to buy the products, but once Sam´s Club’s shelfs are emptied and a new batch needs some time to reach them, the online store is TTCF’s back-up. Metaphorically speaking it is a valve to let out pressurized demand-steam. Some call this an amateur move but it could also be innovative in a conservative industry. The store also allows them, without a middleman, to try out products (exclusives) and upsell products with their branding power. What is clearly a huge point, is the direct approach’s bloated margins. Product have double the retail prices to not antagonize its existing sales channels.

Conquering European markets would be an easy feat, because they already have operations in Italy. Still they have not partnered with any grocers in Europe yet and what might prove difficult are the fractured European markets, which are not as profitable as the US and dominated by local private label champions like LIDL. But of course, the plant-based trend is also huge in Europe.

An acquisition paid for by their vast cash reserves would provide great chances to further develop production, brands or the company’s overall skill set.

Growth in 2020 was mostly driven (80%) by their existing SKUs, in 2021 however the company intends to capitalize on its new SKUs and the once launched in 2020.

4.Recent News – Hello Freshness

PARAMOUNT, Calif., Dec. 08, 2020 (GLOBE NEWSWIRE) — Tattooed Chef, Inc. (TTCFW) (“Tattooed Chef” or the “Company”), a leader in plant-based foods, announced today it has expanded its product range with meat alternatives, offering an innovative and clean ingredient approach on plant protein with the taste and texture of real meat. Tattooed Chef’s plant-based pepperoni and plant-based sausage crumbles are currently featured in two new innovative items and available in the club channel nationwide.

Tattooed Chef’s plant-based pepperoni and plant-based sausage crumbles are gluten-free, made with real food ingredients, mimicking meat in both taste and experience.

Tattooed Chef’s Cauliflower Pizza Bowl with Plant-Based Pepperoni has 14g of protein and is a top-rated item at a leading, national club retailer.

Tattooed Chef’s Plant-Based Sausage Breakfast Bowl has 23g of protein and is the Company’s first ever breakfast item.

The Company expects to launch three additional items featuring meat alternatives in the club channel in 2021.

“Being busy doesn’t mean you can’t eat well. We make plant-based eating much simpler by creating meat alternatives to use for value-added items – it’s truly plant-powered without the prep,” said Sarah Galletti, Chief Creative Officer and the “Tattooed Chef”. “These two new bowls have a flexitarian approach, connecting to a large and growing base of consumers who want to add more plant-based foods into their diets. Innovation is core to our company, and it’s important that our products resonate with consumers. My method is nostalgic innovation, putting a plant-based twist on classic dishes consumers know and love. It’s very exciting to know we can play in multiple plant-based food categories and are not limited to introducing new items into the market.”

PARAMOUNT, Calif., Nov. 09, 2020 (GLOBE NEWSWIRE) — Tattooed Chef, Inc. (TTCFW) (“Tattooed Chef” or the “Company”), a leading plant-based frozen food company with a broad portfolio of innovative products, today announced financial results for the three and nine months ended September 30, 2020.

Third quarter 2020 financial results for Tattooed Chef reflect the three months ended September 30, 2020, prior to the closing of the recent business combination (the “Business Combination”) between Ittella International and Forum Merger II Corporation (FMCIU) (FMCI) which occurred on October 15, 2020. In connection with the closing of the Business Combination, the Company changed its name to Tattooed Chef, Inc.

Sam Galletti, President and CEO of Tattooed Chef said, “Our third quarter revenue marks the highest level in company history. We are pleased to achieve such a milestone in our last quarter as a private company. 2020 has been a monumental year for us, most notably with the completion of our merger with FMCI and Tattooed Chef becoming a public company. We expect to continue to drive top-line growth based on the ongoing success with our key club customers, expansion in new and existing retail customers, and our direct-to-consumer e-commerce site. We are pleased to have completed the merger and are more determined than ever to capitalize on the tremendous growth opportunities we have.”

Sarah Galletti, Creative Director and “The Tattooed Chef”, added, “There is so much to be excited about at the Tattooed Chef. Our branded product sales increased to a record $22.6 million in the third quarter and surpassed private label sales for the third consecutive quarter. Since launching our e-commerce site two weeks ago, the reaction in the marketplace has been overwhelmingly positive and we are thrilled with the initial success. Our brand awareness is growing, our distribution is expanding, our innovation pipeline is robust, and we are confident that we can and will continue to build off the excellent foundation we have established and drive significant growth in the years to come.”

Financial Highlights for the Third Quarter of 2020 Compared to Third Quarter of 2019

Revenue was a record $41.0 million, a 65% increase compared to $24.8 million in the prior year period; Tattooed Chef branded product revenue was a record $22.6 million, an increase of 288% compared to $5.8 million in the prior year period;

Net loss attributable to common stockholders was $3.3 million compared to a net income of $1.8 million in the prior year period due to $4.6 million of non-recurring transaction costs; and Adjusted EBITDA was $1.5 million, or 3.6% of net revenue, compared to $2.3 million, or 9.4% of net revenue, in the prior year period.

Financial Highlights for First Nine Months of 2020 Compared to First Nine Months of 2019

Revenue was $108.9 million, an 87% increase compared to $58.1 million in the prior year period; Net income attributable to common stockholders was $3.9 million compared to $3.4 million in the prior year period; and Adjusted EBITDA was $10.6 million, or 9.7% of net revenue, compared to $4.7 million, or 8.2% of net revenue, in the prior year period.

Third Quarter 2020 Results

Revenue increased by $16.2 million, or 65.3%, to $41.0 million for the three months ended September 30, 2020 compared to $24.8 million for the three months ended September 30, 2019. The revenue increase was primarily driven by a $16.8 million increase in revenue of “Tattooed Chef” branded products, offset by a $0.1 million decrease in revenue of private label products and a $0.5 million decrease in legacy fish and commodity vegetable products for select private label retailers. The increase in Tattooed Chef branded products resulted from expansion in the number of U.S. distribution points, as well as increased volume at existing retail customers with our current portfolio of products and new product introductions including acai bowls, spring vegetable blends, buffalo cauliflower, and other value-added riced cauliflower meals.

Gross profit was $3.8 million for the three months ended September 30, 2020 compared to $4.5 million for the three months ended September 30, 2019. Gross margin in the three months ended September 30, 2020 was 9.2% compared to 18.2% in the three months ended September 30, 2019. The decline in both gross profit and gross margin was primarily due to a $1.4 million program with one of our top club customers to promote our Organic Acai Bowls. No such program occurred in the prior year period. This successful promotion gave the Tattooed Chef brand exposure in 450 stores for an eight-week period across the entire U.S. and resulted in increased sales and brand awareness.

Operating expenses increased $4.8 million to $7.2 million for the three months ended September 30, 2020 compared to $2.4 million for the three months ended September 30, 2019. The increase in operating expenses was primarily due to $4.6 million in nonrecurring expenses related to the merger with FMCI, as well as a $0.6 million increase in sales and marketing expenses resulting from a shift in focus to building the Tattooed Chef brand and initiatives to accelerate sales to retail grocery store outlets. As a percentage of revenue, total operating expenses were 17.5% for the three months ended September 30, 2020, compared to 9.5% for the prior year period. Excluding the $4.6 million of transaction expenses, operating expenses for the three months ended September 30, 2020 would have been $2.6 million, slightly higher than the prior year period, or 6.3% of sales.

Adjusted EBITDA of $1.5 million, or 3.6% of net revenue, for the three months ended September 30, 2020 decreased $0.9 million compared to $2.3 million, or 9.4% of net revenue, in the three months ended September 30, 2019. The decrease in Adjusted EBITDA was primarily due to the lower gross profit from the promotional program explained above. Adjusted EBITDA for the third quarter of 2020 was also lower sequentially, compared to $2.0 million in the second quarter of 2020 due to increased growth in sales from the products manufactured by our facilities in Italy and timing of delivery to key customers. Adjusted EBITDA is a non-GAAP financial measure defined under “Non-GAAP Measures.” Please see “Adjusted EBITDA Reconciliation” at the end of this press release.

Balance Sheet and Cash Flow

As of September 30, 2020, Tattooed Chef had cash and cash equivalents of $3.2 million and an outstanding balance on the line of credit of $19.7 million. Following the completion of the Business Combination on October 15, 2020, the Company had cash and cash equivalents of approximately $95 million and an outstanding balance on the line of credit of approximately $5 million.

5.Management & sharestructure – Sam and the Beanstalk

Salvatore “Sam” Galletti

President, CEO

Salvatore “Sam” Galletti has served as President and CEO of Ittella Parent since it was founded in 2009 as Stonegate Foods, Inc. Sam has over 35 years’ experience in the food industry including prior operational and investor roles at Ittella, Sonora Mills, Good Karma Foods, and others, where he gained experience manufacturing a variety of products including seafood, breaded vegetables, grilled chicken and other organic foods. Through these prior roles, he has established key relationships with many of the retailers who now carry Ittella Parent’s products.

Sam and his brother turned into Southwind Foods in 1999. Southwind is currently a half-a-billion-dollar-a-year wholesale brand with relationships across over 30 different grocery chains, ranging from Supervalu to Whole Foods, as well as national food service distributors like Sysco and US Foods.

Sam founded Ittella Parent primarily as an importer of Italian vegetables and other products, having realized the quality of produce from Italy surpassed that of available comparable produce from the U.S. Following Ittella Parent’s entrance into private label production and manufacturing of frozen products in its own facility, the name was changed to Ittella International in 2015.

Sarah Galletti

Creative Director

Sarah Galletti holds the title of “Tattooed Chef” and Creative Director and since 2014 has led Ittella Parent’s transition from a producer of private label frozen vegetables to a branded, innovator of frozen plant-based meals and snacks. She is primarily responsible for the development of new products as well as the strategic and creative direction of the Tattooed Chef brand. Sarah remains highly involved in Ittella Parent’s sales and marketing efforts, including management of the Tattooed Chef brand’s digital marketing platform and development of Ittella Parent’s online DTC functionality.

Prior to her involvement with Ittella Parent, Sarah spent time (3-4 months :D) in Italy working as a pizza and pastry chef at various eateries. Her time abroad led to her inspiration for the Tattooed Chef brand, having recognized a lack of high-quality, plant-based options available within the U.S. Since 2014, Sarah worked with Ittella Parent to develop and create the Tattooed Chef brand as an expression of her passion to supply consumers with unique, clean label, plant-based meals and other food products.

Charles Cargile

Chief Financial Officer

Charles Cargile has over 30 years of financial and operational experience, most recently serving as Chief Executive Officer of Nasdaq-listed Sunworks, Inc. from March 2017 until joining Ittella Parent in August 2020. Prior to joining Sunworks, Mr. Cargile served as Senior Vice President, Chief Financial Officer and Treasurer of Newport Corporation from October 2000 until April 2016, when Newport Corporation was acquired by MKS Instruments. At Newport Corporation, Mr. Cargile was responsible for all accounting, financial reporting, tax, treasury, investor relations and information technology functions, as well as strategic planning, mergers, acquisitions, and divestitures.

Stephanie Dieckmann

Chief Operating Officer

Stephanie Dieckmann has served as COO and CFO of Ittella Parent since 2017 and has over 12 years of combined food industry experience. Prior to this role, Ms. Dieckmann was CFO at APPA Fine Foods, a private label food manufacturer of fresh ready to eat, frozen meals, and grilled chicken products, where she worked for over seven years. She also held a financial controller position with The Perfect Bite Co., a gourmet frozen appetizer company. During her time at APPA Fine Foods, Ms. Dieckmann became acquainted with Mr. Galletti, who was a former investor in the company.

In her role as COO, Ms. Dieckmann is primarily responsible for all operations in the U.S. and has led growth of Ittella Parent from approximately $32.5 million in sales in 2017 to approximately $84.9 million in 2019.

Giuseppe Bardari

President, Ittella Italy

Giuseppe Bardari is the current President of Ittella Italy. Mr. Bardari joined Ittella Parent in 2010 as a Director of International Business Development, which he held for seven years, and was responsible for the procurement of items from Italy and managing the process of items leaving Italy and arriving in the United States. In 2017, he became President of the Italian division of Ittella Parent, Ittella Italy. Mr. Bardari is responsible for overseeing all operations of Ittella Italy, which includes managing relationships with local growers, procuring imported ingredients and the exporting of finished products.

Mr. Bardari holds additional frozen food industry experience from over six years spent as an export manager for Gias Spa. He holds a Degree in Economics from Messina University and MBA with specialization for Hi-Tech from Sdipa/Bocconi.

Matthew Williams

Chief Growth Officer

Matthew Williams has over 25 years of experience in sales leadership and general management roles in the consumer-packaged goods industry, most recently as the President of food brands for Sugar Mountain, a creative food company with brands Beecher’s Handmade Cheese and Mishima Reserve American Wagyu, since March 2019. Prior to his role at Sugar Mountain, he served as Senior Vice President for Dean Foods from August 2014 until March 2019. In his most recent role with Dean Foods, he was Senior Vice President of the frozen business unit, where he was responsible for sales and marketing of Dean’s branded and private label ice cream business.

Source: https://ir.tattooedchef.com/corporate-governance/management

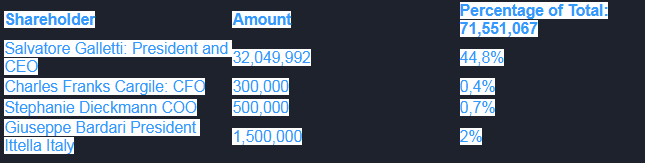

Sharestructure

With the Galetti’s and the board almost having a controlling majority of shares, so there is no danger of a hostile takeover. This means no larger player can snack away the emerging company.

A CEO whose fortune is that much entwined with his company’s success will always favor creating shareholder value creating.

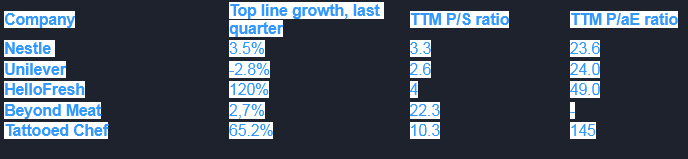

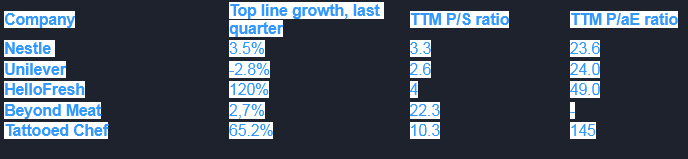

6.Competition and Risks – Sam’s tales: Battling giants with tattooed beans

Competition lures behind every corner; old guards like Nestlé or Unilever, newcomers like Beyond Meat or Hellofresh and hot brands like Daiya or Caulipower – all of them want a piece of the vegetable growth pie. TTCF is already an established player with many products and the total food market is large enough for lots of players.

TTCF’s concentration on only a few partners is dangerous, but the company is focused on reducing its reliability, so it should not be that problematic in the future.

Food trends can always change, which makes it extremely important to a have innovative processes. But aside from that plant-based diet main drivers are health and climate change and those trends will not vanish in anytime soon.

Concentrating on plants in their product line up also helps avoiding food scandals (Chipotle’s e.coli or norovirus outbreak), because they are often caused when handling meats.

7.Valuation

The Following table show a comparison of the different competitors and their valuation:

The table perfectly demonstrates the difference between the old champions and emerging celebrities. Nestle and Unilever both engaged in the same field as TTCF, with its brands Garden Gourmet and the Vegetarian Butcher, but they bury the growth opportunities in its clogged cholesterol arteries of their product portfolios. For that reason they are valued rather cheaply.

As described in our research, HelloFresh is housed in a league of its own.

Beyond might be the best comparison partner in the plant-based arena, with a dramatic valuation and weak last quarter, but it validates that great branding facilitates loftier multiples. This is the way for TTCF.

If the Chef can fulfill its ambitious growth hassle, then the profitability, provided by high teen double-digit bottom-line margins, would let the PE ratio shrink into a fair territory.

8.Conclusion

The Tattooed Chef can be summed up as a play on food trends and a bet on the buildup of a new brand. With new partners, its ecommerce strategy and new products the way for more growth is paved. If you get the gist of the Tattooed Chefs roadmap and want a emerging stock in a rather conservative industry with crazily valued stars like Beyond Meat – then you should get a vegetable tattoo by Sarah and buy some stocks on the way. But if you have doubts about the sustainablity of the growth perspective and don’t blindly trust the branding power, then stay on the sideline until the mentioned breakpoints are hit or the company is a lot cheaper.

We rate Tattooed Chef as a NEUTRAL.

Disclaimer & Conflict of interest

The author currently does not hold a position in the mentioned stock. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Tattooed Chef Inc. - Article

Research: Tattooed Chef - Beyond White Labels Are the Tattooed Meats

Table of Content:

- Introduction to the Company

- Trend Radar

- Business Model & Financials

- Recent News and Updates

- Management & Share Structure

- Competition & Risks

- Valuation

- Conclusion

1.Introduction

A dramatic change in eating habits, brought to you by environmental consciousness and a health-first-desire, is flooding grocery ailes and convenience stores with new trendy and edgy products. What combines them is their plant-based nature. Modern food trends rely on adjective stacking like : vegetarian, vegan, gluten-free, organic, non gmo, cruelty free, „source of protein”, rBST Free, etc. If you combine this with modern branding, an ecommerce strategy, vertical integration and a white label safety net, you got the quintessential recipe for success – Tattooed Chef (TTCF) is the perfect example for that. Note: Zucchini Spirals

Note: Zucchini Spirals

2.Trend Radar

Vegetablization and Fake meats

Plant-favored diets are on the rise which creates completely new food categories with exuberant growth possibilities. For example, the US dairy milk total addressable market is $14bn (GFI) with a plant-based penetration of 14% in 2020 (GFI). In the UK alone sales of alt-milks were up 28.3% last year, and a third of UK households (32%) now buy dairy-free milk. If you compare this to the much larger $95bn meat TAM (GFI) with a 1% plant-based penetration, the opportunity seems endless. Looking at the possible market from a different perspective,the following pie chart illustrates the market share of frozen food categories: Source: investor presentation + CY 2019, Nielsen xAOC + Conv The near term chance for Tattooed Chef lies in the desserts and the prepared foods slice.Vegetable bowling for the treasure hunter crown

Acai or smoothie bowls liter Instagram feed and burn in image of extreme healthiness and into your mind. This inspiration is carried on to the grocery store where, through an edgy packaging, you instantly gravitate towards the “ORGANIC RASPBERRY KOMBUCHA SMOOTHIE BOWL”. No further ads needed - influencers already sold a product to you that you did not know before. This is Tattooed Chefs strategy: Bringing coolness to the frozen party. But there are also readymade foods that activate your hunting instinct, in their portfolio. Treasure hunter products bring prestige to your local one stop wholesaler. With a changing and ever surprising roster, they intend to spark excitement (even though the TTCF mac & cheese was only pimped with cauliflower). Wall Street Strategies analyst Brian Sozzi describes it as: “You walk into Costco for tuna and end up getting a Marc Jacobs coat." This trend is the edible version of millennial thrift store shopping. This strategy was invented by the European private label specialist like LIDL or ALDI, with its American icon Trader Joe´s. To close the circle: Tattooed Chef is as well part of producing and cornering the market for Trader Joe’s as one of their white label suppliers.3.Business model

“Tattooed Chef is a leading plant-based food company offering a broad portfolio of innovative plant-based food products that taste great and are sustainably sourced. Tattooed Chef’s signature products include ready-to-cook bowls, zucchini spirals, riced cauliflower, acai and smoothie bowls, and cauliflower pizza crusts, which are available in the frozen food sections of leading national retail food stores across the United States. Understanding consumer lifestyle and food trends, and a commitment to innovation, allows Tattooed Chef to continuously introduce new products. Tattooed Chef provides great-tasting, approachable, and innovative products not only to the growing group of consumers who seek to adopt a plant-based lifestyle, but to any of the “People Who Give a Crop”.”

Operations – Italian tomato-syndicate?

Tattooed Chef operates two manufacturing facilities in California and its heritage country Italy. They control every part of their supply chain, allowing them to administer the products quality down the seed. TTCF’s specialty is its vegetable sourcing form Italy, helping the branding story with its the Italian cuisine origin.“Italian Grown - Los Angeles Made: We do Farm to - Table our own way. We care so much about the ingredients that we grow them ourselves! (And we stay with them every step of the way.)” Source: investor presentationThe operational growth plans are ambitious, but they allow them to handle the growth opportunities lying in front of them. A special aspect of TTCF’s deep vertical integration is the proactive way of doing business, with innovations being born into fully fletched product in only three months. This gives them fast access to emerging trends set by social media viralities. It also demonstrates TTCF’s experience in manufacturing, distribution and supply chain management - remarkable for such a small and young company.

Note: TTCF's product line

Note: TTCF's product line

Products - Can tattooed cauliflower be a Rockstar?

The Product lineup started with a selection of 2 products in 2017 - to now more than 62 SKUs (Stock Keeping Unit - unique product identifier, often visualized by bar codes with 8-, 12-, or 13-digit numbers) in 2021. Core component of TTCF’s strategy is combing the high-margin branded-content business with their white labeling efforts. This has historically grown out of the CEO’s first company Stonegate, which was an importer of vegetables and other Italian products to be sold to national natural channel retailer. Their first manufacturing facility was opened in 2015 and the company changed its name to Ittella Inc. (Galletti backward and without the G) to highlight the change form importing to white labeling. Then in 2017 the brand Tattooed Chef was launched and with the next branding shift the company renamed itself again during the going public process. In the Q3 the revenue from branded products has first time surpassed the private product revenue, marking the company's metamorphosis.Partners – with vegetables to the moon?

Through the years of doing business, TTCF has built up a remarkable network of partners. Their core business strategy was to market their products through the club sales channels of Sam´s Club (Walmart’s club wholesaler) and Costco. Sam’s Club alone was responsible for 70% of the brand revenues, with 4-5 products in stock. They used TTCF as a gateway to “beat Costco at its own game” and foster a “treasure-hunt-type” shopper experience. But TTCF is focused on increasing their point of sales by cooperating with regional and national grocery partners like Sprouts, Alberto. This plays a huge role because it allows TTCF’s product portfolio to be fully utilized (wholesalers normally sell only a few SKU) on more shelf miles and more geographics. But the most important point is that bulk–club-wholesale customers are not the typical Silicon Valley hipsters that are TTCF’s core audience. Working with different grocers allows TTCF to tap into a younger and more cosmopolitan crowd. On the private label front, the biggest enabler is Costco, although TTCF’s growth plans are with their own brand. The cooperation with Target lets them stock their smoothie bowls, of which the Acai Bowl is biggest seller. The average retail price was $4.71. Another example is Walmart which doubled their SKUs to 11 in 2700 stores nationwide. For that, the average sales price is a bit lower than Target’s at $3.96.Marketing - Bringing coolness to the frozen party.

Note: TTCF's instagram

Whopping 100m of revenues without spending a dime is a great feat and it shows the management’s skills and experience. But to further scale up and bring the brand on more dinner tables, a marketing strategy is needed. TTCF started in Q3 a promotional campaign and is building up its network to create a 360-degree brand ecosystem. For that they work together with brand advisor Nitro C, having companies like HelloFresh, Warner or Mars in their portfolio. Most important customer touch point for TTCF is Instagram, where it shows its products and happy costumers. But only 19k people are following them yet. Furthermore, in line with their edgy identity, the tattooed chef Sarah curates a Spotify playlist, exposing the company's vibe. But this effort only attracts a handful of people, which makes it rather ridiculous, because the spotify playlist is prominentally placed on the homepage.

Note: TTCF's instagram

Whopping 100m of revenues without spending a dime is a great feat and it shows the management’s skills and experience. But to further scale up and bring the brand on more dinner tables, a marketing strategy is needed. TTCF started in Q3 a promotional campaign and is building up its network to create a 360-degree brand ecosystem. For that they work together with brand advisor Nitro C, having companies like HelloFresh, Warner or Mars in their portfolio. Most important customer touch point for TTCF is Instagram, where it shows its products and happy costumers. But only 19k people are following them yet. Furthermore, in line with their edgy identity, the tattooed chef Sarah curates a Spotify playlist, exposing the company's vibe. But this effort only attracts a handful of people, which makes it rather ridiculous, because the spotify playlist is prominentally placed on the homepage.

Financials – juicy margins and healthy balances

Management explained the gross margin hit in the Q3 with by a special Costco promotion for their acai bowls. Those “expenses” and the marketing costs will reduce EBITDA-margins in the near term but TTCF intends to grow out of this trough. One-time effects like the merger costs ($4.8m) also plague the Q3 bottom line. This is the main reason for the huge loss. What must be closely watched is the company’s QoQ growth because of the estimated revenue decline in Q4. Still TTCF could also have been rather conservative with its near-term guidance. A verdict on the growth perspective can taken when Q4 results are released. The Balance sheet, with $95 in cash, is as healthy as their products. Following growth plans were laid out by the company in the end of 2020: Note: Company Presentation

It boils down to top line CAGR in the 30s and a EBITDA CAGR in the 80s.

Note: Company Presentation

It boils down to top line CAGR in the 30s and a EBITDA CAGR in the 80s.

Growth catalysts – Cauliflower Bombers

Growth plans build upon the start of TTCF’s marketing campaign, their ecommerce store, new partners, geographic expansion and maybe acquisitions. Revenues will yield a short-term boost, when products are hitting the shelfs through new partnerships But if those partnerships really prove to be sustainably beneficial is yet to be shown. The Product line-up has no creative barrier. Peer companies like Amy's also produce snacks and for example Beyond meat has just recently inked an agreement with snack giant Pepsi. So, this area, perfectly fitting into the company’s CI, might be profitable. On 10/26/20 their Shopify-ecommerce store was launched, which directly brings all their products to the consumers. Operated on a lean footprint and with high pricing it might not be the go-to place to buy the products, but once Sam´s Club’s shelfs are emptied and a new batch needs some time to reach them, the online store is TTCF's back-up. Metaphorically speaking it is a valve to let out pressurized demand-steam. Some call this an amateur move but it could also be innovative in a conservative industry. The store also allows them, without a middleman, to try out products (exclusives) and upsell products with their branding power. What is clearly a huge point, is the direct approach’s bloated margins. Product have double the retail prices to not antagonize its existing sales channels. Conquering European markets would be an easy feat, because they already have operations in Italy. Still they have not partnered with any grocers in Europe yet and what might prove difficult are the fractured European markets, which are not as profitable as the US and dominated by local private label champions like LIDL. But of course, the plant-based trend is also huge in Europe. An acquisition paid for by their vast cash reserves would provide great chances to further develop production, brands or the company's overall skill set. Growth in 2020 was mostly driven (80%) by their existing SKUs, in 2021 however the company intends to capitalize on its new SKUs and the once launched in 2020.4.Recent News - Hello Freshness

PARAMOUNT, Calif., Dec. 08, 2020 (GLOBE NEWSWIRE) -- Tattooed Chef, Inc. (TTCFW) (“Tattooed Chef” or the “Company”), a leader in plant-based foods, announced today it has expanded its product range with meat alternatives, offering an innovative and clean ingredient approach on plant protein with the taste and texture of real meat. Tattooed Chef’s plant-based pepperoni and plant-based sausage crumbles are currently featured in two new innovative items and available in the club channel nationwide. Tattooed Chef’s plant-based pepperoni and plant-based sausage crumbles are gluten-free, made with real food ingredients, mimicking meat in both taste and experience. Tattooed Chef’s Cauliflower Pizza Bowl with Plant-Based Pepperoni has 14g of protein and is a top-rated item at a leading, national club retailer. Tattooed Chef’s Plant-Based Sausage Breakfast Bowl has 23g of protein and is the Company’s first ever breakfast item. The Company expects to launch three additional items featuring meat alternatives in the club channel in 2021. “Being busy doesn't mean you can't eat well. We make plant-based eating much simpler by creating meat alternatives to use for value-added items - it's truly plant-powered without the prep,” said Sarah Galletti, Chief Creative Officer and the “Tattooed Chef”. “These two new bowls have a flexitarian approach, connecting to a large and growing base of consumers who want to add more plant-based foods into their diets. Innovation is core to our company, and it's important that our products resonate with consumers. My method is nostalgic innovation, putting a plant-based twist on classic dishes consumers know and love. It’s very exciting to know we can play in multiple plant-based food categories and are not limited to introducing new items into the market.” PARAMOUNT, Calif., Nov. 09, 2020 (GLOBE NEWSWIRE) -- Tattooed Chef, Inc. (TTCFW) (“Tattooed Chef” or the “Company”), a leading plant-based frozen food company with a broad portfolio of innovative products, today announced financial results for the three and nine months ended September 30, 2020. Third quarter 2020 financial results for Tattooed Chef reflect the three months ended September 30, 2020, prior to the closing of the recent business combination (the “Business Combination”) between Ittella International and Forum Merger II Corporation (FMCIU) (FMCI) which occurred on October 15, 2020. In connection with the closing of the Business Combination, the Company changed its name to Tattooed Chef, Inc. Sam Galletti, President and CEO of Tattooed Chef said, “Our third quarter revenue marks the highest level in company history. We are pleased to achieve such a milestone in our last quarter as a private company. 2020 has been a monumental year for us, most notably with the completion of our merger with FMCI and Tattooed Chef becoming a public company. We expect to continue to drive top-line growth based on the ongoing success with our key club customers, expansion in new and existing retail customers, and our direct-to-consumer e-commerce site. We are pleased to have completed the merger and are more determined than ever to capitalize on the tremendous growth opportunities we have.” Sarah Galletti, Creative Director and “The Tattooed Chef”, added, “There is so much to be excited about at the Tattooed Chef. Our branded product sales increased to a record $22.6 million in the third quarter and surpassed private label sales for the third consecutive quarter. Since launching our e-commerce site two weeks ago, the reaction in the marketplace has been overwhelmingly positive and we are thrilled with the initial success. Our brand awareness is growing, our distribution is expanding, our innovation pipeline is robust, and we are confident that we can and will continue to build off the excellent foundation we have established and drive significant growth in the years to come.” Financial Highlights for the Third Quarter of 2020 Compared to Third Quarter of 2019 Revenue was a record $41.0 million, a 65% increase compared to $24.8 million in the prior year period; Tattooed Chef branded product revenue was a record $22.6 million, an increase of 288% compared to $5.8 million in the prior year period; Net loss attributable to common stockholders was $3.3 million compared to a net income of $1.8 million in the prior year period due to $4.6 million of non-recurring transaction costs; and Adjusted EBITDA was $1.5 million, or 3.6% of net revenue, compared to $2.3 million, or 9.4% of net revenue, in the prior year period. Financial Highlights for First Nine Months of 2020 Compared to First Nine Months of 2019 Revenue was $108.9 million, an 87% increase compared to $58.1 million in the prior year period; Net income attributable to common stockholders was $3.9 million compared to $3.4 million in the prior year period; and Adjusted EBITDA was $10.6 million, or 9.7% of net revenue, compared to $4.7 million, or 8.2% of net revenue, in the prior year period. Third Quarter 2020 Results Revenue increased by $16.2 million, or 65.3%, to $41.0 million for the three months ended September 30, 2020 compared to $24.8 million for the three months ended September 30, 2019. The revenue increase was primarily driven by a $16.8 million increase in revenue of “Tattooed Chef” branded products, offset by a $0.1 million decrease in revenue of private label products and a $0.5 million decrease in legacy fish and commodity vegetable products for select private label retailers. The increase in Tattooed Chef branded products resulted from expansion in the number of U.S. distribution points, as well as increased volume at existing retail customers with our current portfolio of products and new product introductions including acai bowls, spring vegetable blends, buffalo cauliflower, and other value-added riced cauliflower meals. Gross profit was $3.8 million for the three months ended September 30, 2020 compared to $4.5 million for the three months ended September 30, 2019. Gross margin in the three months ended September 30, 2020 was 9.2% compared to 18.2% in the three months ended September 30, 2019. The decline in both gross profit and gross margin was primarily due to a $1.4 million program with one of our top club customers to promote our Organic Acai Bowls. No such program occurred in the prior year period. This successful promotion gave the Tattooed Chef brand exposure in 450 stores for an eight-week period across the entire U.S. and resulted in increased sales and brand awareness. Operating expenses increased $4.8 million to $7.2 million for the three months ended September 30, 2020 compared to $2.4 million for the three months ended September 30, 2019. The increase in operating expenses was primarily due to $4.6 million in nonrecurring expenses related to the merger with FMCI, as well as a $0.6 million increase in sales and marketing expenses resulting from a shift in focus to building the Tattooed Chef brand and initiatives to accelerate sales to retail grocery store outlets. As a percentage of revenue, total operating expenses were 17.5% for the three months ended September 30, 2020, compared to 9.5% for the prior year period. Excluding the $4.6 million of transaction expenses, operating expenses for the three months ended September 30, 2020 would have been $2.6 million, slightly higher than the prior year period, or 6.3% of sales. Adjusted EBITDA of $1.5 million, or 3.6% of net revenue, for the three months ended September 30, 2020 decreased $0.9 million compared to $2.3 million, or 9.4% of net revenue, in the three months ended September 30, 2019. The decrease in Adjusted EBITDA was primarily due to the lower gross profit from the promotional program explained above. Adjusted EBITDA for the third quarter of 2020 was also lower sequentially, compared to $2.0 million in the second quarter of 2020 due to increased growth in sales from the products manufactured by our facilities in Italy and timing of delivery to key customers. Adjusted EBITDA is a non-GAAP financial measure defined under “Non-GAAP Measures.” Please see “Adjusted EBITDA Reconciliation” at the end of this press release. Balance Sheet and Cash Flow As of September 30, 2020, Tattooed Chef had cash and cash equivalents of $3.2 million and an outstanding balance on the line of credit of $19.7 million. Following the completion of the Business Combination on October 15, 2020, the Company had cash and cash equivalents of approximately $95 million and an outstanding balance on the line of credit of approximately $5 million.5.Management & sharestructure - Sam and the Beanstalk

Salvatore “Sam” Galletti President, CEO Salvatore “Sam” Galletti has served as President and CEO of Ittella Parent since it was founded in 2009 as Stonegate Foods, Inc. Sam has over 35 years’ experience in the food industry including prior operational and investor roles at Ittella, Sonora Mills, Good Karma Foods, and others, where he gained experience manufacturing a variety of products including seafood, breaded vegetables, grilled chicken and other organic foods. Through these prior roles, he has established key relationships with many of the retailers who now carry Ittella Parent’s products.

Sam and his brother turned into Southwind Foods in 1999. Southwind is currently a half-a-billion-dollar-a-year wholesale brand with relationships across over 30 different grocery chains, ranging from Supervalu to Whole Foods, as well as national food service distributors like Sysco and US Foods.

Sam founded Ittella Parent primarily as an importer of Italian vegetables and other products, having realized the quality of produce from Italy surpassed that of available comparable produce from the U.S. Following Ittella Parent’s entrance into private label production and manufacturing of frozen products in its own facility, the name was changed to Ittella International in 2015.

Sarah Galletti

Creative Director

Salvatore “Sam” Galletti has served as President and CEO of Ittella Parent since it was founded in 2009 as Stonegate Foods, Inc. Sam has over 35 years’ experience in the food industry including prior operational and investor roles at Ittella, Sonora Mills, Good Karma Foods, and others, where he gained experience manufacturing a variety of products including seafood, breaded vegetables, grilled chicken and other organic foods. Through these prior roles, he has established key relationships with many of the retailers who now carry Ittella Parent’s products.

Sam and his brother turned into Southwind Foods in 1999. Southwind is currently a half-a-billion-dollar-a-year wholesale brand with relationships across over 30 different grocery chains, ranging from Supervalu to Whole Foods, as well as national food service distributors like Sysco and US Foods.

Sam founded Ittella Parent primarily as an importer of Italian vegetables and other products, having realized the quality of produce from Italy surpassed that of available comparable produce from the U.S. Following Ittella Parent’s entrance into private label production and manufacturing of frozen products in its own facility, the name was changed to Ittella International in 2015.

Sarah Galletti

Creative Director

Sarah Galletti holds the title of “Tattooed Chef” and Creative Director and since 2014 has led Ittella Parent’s transition from a producer of private label frozen vegetables to a branded, innovator of frozen plant-based meals and snacks. She is primarily responsible for the development of new products as well as the strategic and creative direction of the Tattooed Chef brand. Sarah remains highly involved in Ittella Parent’s sales and marketing efforts, including management of the Tattooed Chef brand’s digital marketing platform and development of Ittella Parent’s online DTC functionality.

Prior to her involvement with Ittella Parent, Sarah spent time (3-4 months :D) in Italy working as a pizza and pastry chef at various eateries. Her time abroad led to her inspiration for the Tattooed Chef brand, having recognized a lack of high-quality, plant-based options available within the U.S. Since 2014, Sarah worked with Ittella Parent to develop and create the Tattooed Chef brand as an expression of her passion to supply consumers with unique, clean label, plant-based meals and other food products.

Charles Cargile

Chief Financial Officer

Charles Cargile has over 30 years of financial and operational experience, most recently serving as Chief Executive Officer of Nasdaq-listed Sunworks, Inc. from March 2017 until joining Ittella Parent in August 2020. Prior to joining Sunworks, Mr. Cargile served as Senior Vice President, Chief Financial Officer and Treasurer of Newport Corporation from October 2000 until April 2016, when Newport Corporation was acquired by MKS Instruments. At Newport Corporation, Mr. Cargile was responsible for all accounting, financial reporting, tax, treasury, investor relations and information technology functions, as well as strategic planning, mergers, acquisitions, and divestitures.

Stephanie Dieckmann

Chief Operating Officer

Stephanie Dieckmann has served as COO and CFO of Ittella Parent since 2017 and has over 12 years of combined food industry experience. Prior to this role, Ms. Dieckmann was CFO at APPA Fine Foods, a private label food manufacturer of fresh ready to eat, frozen meals, and grilled chicken products, where she worked for over seven years. She also held a financial controller position with The Perfect Bite Co., a gourmet frozen appetizer company. During her time at APPA Fine Foods, Ms. Dieckmann became acquainted with Mr. Galletti, who was a former investor in the company.

In her role as COO, Ms. Dieckmann is primarily responsible for all operations in the U.S. and has led growth of Ittella Parent from approximately $32.5 million in sales in 2017 to approximately $84.9 million in 2019.

Giuseppe Bardari

President, Ittella Italy

Giuseppe Bardari is the current President of Ittella Italy. Mr. Bardari joined Ittella Parent in 2010 as a Director of International Business Development, which he held for seven years, and was responsible for the procurement of items from Italy and managing the process of items leaving Italy and arriving in the United States. In 2017, he became President of the Italian division of Ittella Parent, Ittella Italy. Mr. Bardari is responsible for overseeing all operations of Ittella Italy, which includes managing relationships with local growers, procuring imported ingredients and the exporting of finished products.

Mr. Bardari holds additional frozen food industry experience from over six years spent as an export manager for Gias Spa. He holds a Degree in Economics from Messina University and MBA with specialization for Hi-Tech from Sdipa/Bocconi.

Matthew Williams

Chief Growth Officer

Matthew Williams has over 25 years of experience in sales leadership and general management roles in the consumer-packaged goods industry, most recently as the President of food brands for Sugar Mountain, a creative food company with brands Beecher’s Handmade Cheese and Mishima Reserve American Wagyu, since March 2019. Prior to his role at Sugar Mountain, he served as Senior Vice President for Dean Foods from August 2014 until March 2019. In his most recent role with Dean Foods, he was Senior Vice President of the frozen business unit, where he was responsible for sales and marketing of Dean’s branded and private label ice cream business.

Source: https://ir.tattooedchef.com/corporate-governance/management

Sharestructure

Sarah Galletti holds the title of “Tattooed Chef” and Creative Director and since 2014 has led Ittella Parent’s transition from a producer of private label frozen vegetables to a branded, innovator of frozen plant-based meals and snacks. She is primarily responsible for the development of new products as well as the strategic and creative direction of the Tattooed Chef brand. Sarah remains highly involved in Ittella Parent’s sales and marketing efforts, including management of the Tattooed Chef brand’s digital marketing platform and development of Ittella Parent’s online DTC functionality.

Prior to her involvement with Ittella Parent, Sarah spent time (3-4 months :D) in Italy working as a pizza and pastry chef at various eateries. Her time abroad led to her inspiration for the Tattooed Chef brand, having recognized a lack of high-quality, plant-based options available within the U.S. Since 2014, Sarah worked with Ittella Parent to develop and create the Tattooed Chef brand as an expression of her passion to supply consumers with unique, clean label, plant-based meals and other food products.

Charles Cargile

Chief Financial Officer

Charles Cargile has over 30 years of financial and operational experience, most recently serving as Chief Executive Officer of Nasdaq-listed Sunworks, Inc. from March 2017 until joining Ittella Parent in August 2020. Prior to joining Sunworks, Mr. Cargile served as Senior Vice President, Chief Financial Officer and Treasurer of Newport Corporation from October 2000 until April 2016, when Newport Corporation was acquired by MKS Instruments. At Newport Corporation, Mr. Cargile was responsible for all accounting, financial reporting, tax, treasury, investor relations and information technology functions, as well as strategic planning, mergers, acquisitions, and divestitures.

Stephanie Dieckmann

Chief Operating Officer

Stephanie Dieckmann has served as COO and CFO of Ittella Parent since 2017 and has over 12 years of combined food industry experience. Prior to this role, Ms. Dieckmann was CFO at APPA Fine Foods, a private label food manufacturer of fresh ready to eat, frozen meals, and grilled chicken products, where she worked for over seven years. She also held a financial controller position with The Perfect Bite Co., a gourmet frozen appetizer company. During her time at APPA Fine Foods, Ms. Dieckmann became acquainted with Mr. Galletti, who was a former investor in the company.

In her role as COO, Ms. Dieckmann is primarily responsible for all operations in the U.S. and has led growth of Ittella Parent from approximately $32.5 million in sales in 2017 to approximately $84.9 million in 2019.

Giuseppe Bardari

President, Ittella Italy

Giuseppe Bardari is the current President of Ittella Italy. Mr. Bardari joined Ittella Parent in 2010 as a Director of International Business Development, which he held for seven years, and was responsible for the procurement of items from Italy and managing the process of items leaving Italy and arriving in the United States. In 2017, he became President of the Italian division of Ittella Parent, Ittella Italy. Mr. Bardari is responsible for overseeing all operations of Ittella Italy, which includes managing relationships with local growers, procuring imported ingredients and the exporting of finished products.

Mr. Bardari holds additional frozen food industry experience from over six years spent as an export manager for Gias Spa. He holds a Degree in Economics from Messina University and MBA with specialization for Hi-Tech from Sdipa/Bocconi.

Matthew Williams

Chief Growth Officer

Matthew Williams has over 25 years of experience in sales leadership and general management roles in the consumer-packaged goods industry, most recently as the President of food brands for Sugar Mountain, a creative food company with brands Beecher’s Handmade Cheese and Mishima Reserve American Wagyu, since March 2019. Prior to his role at Sugar Mountain, he served as Senior Vice President for Dean Foods from August 2014 until March 2019. In his most recent role with Dean Foods, he was Senior Vice President of the frozen business unit, where he was responsible for sales and marketing of Dean’s branded and private label ice cream business.

Source: https://ir.tattooedchef.com/corporate-governance/management

Sharestructure

With the Galetti’s and the board almost having a controlling majority of shares, so there is no danger of a hostile takeover. This means no larger player can snack away the emerging company.

A CEO whose fortune is that much entwined with his company’s success will always favor creating shareholder value creating.

With the Galetti’s and the board almost having a controlling majority of shares, so there is no danger of a hostile takeover. This means no larger player can snack away the emerging company.

A CEO whose fortune is that much entwined with his company’s success will always favor creating shareholder value creating.

6.Competition and Risks - Sam’s tales: Battling giants with tattooed beans

Competition lures behind every corner; old guards like Nestlé or Unilever, newcomers like Beyond Meat or Hellofresh and hot brands like Daiya or Caulipower – all of them want a piece of the vegetable growth pie. TTCF is already an established player with many products and the total food market is large enough for lots of players. TTCF's concentration on only a few partners is dangerous, but the company is focused on reducing its reliability, so it should not be that problematic in the future. Food trends can always change, which makes it extremely important to a have innovative processes. But aside from that plant-based diet main drivers are health and climate change and those trends will not vanish in anytime soon. Concentrating on plants in their product line up also helps avoiding food scandals (Chipotle's e.coli or norovirus outbreak), because they are often caused when handling meats.7.Valuation

The Following table show a comparison of the different competitors and their valuation: The table perfectly demonstrates the difference between the old champions and emerging celebrities. Nestle and Unilever both engaged in the same field as TTCF, with its brands Garden Gourmet and the Vegetarian Butcher, but they bury the growth opportunities in its clogged cholesterol arteries of their product portfolios. For that reason they are valued rather cheaply.

As described in our research, HelloFresh is housed in a league of its own.

Beyond might be the best comparison partner in the plant-based arena, with a dramatic valuation and weak last quarter, but it validates that great branding facilitates loftier multiples. This is the way for TTCF.

If the Chef can fulfill its ambitious growth hassle, then the profitability, provided by high teen double-digit bottom-line margins, would let the PE ratio shrink into a fair territory.

The table perfectly demonstrates the difference between the old champions and emerging celebrities. Nestle and Unilever both engaged in the same field as TTCF, with its brands Garden Gourmet and the Vegetarian Butcher, but they bury the growth opportunities in its clogged cholesterol arteries of their product portfolios. For that reason they are valued rather cheaply.

As described in our research, HelloFresh is housed in a league of its own.

Beyond might be the best comparison partner in the plant-based arena, with a dramatic valuation and weak last quarter, but it validates that great branding facilitates loftier multiples. This is the way for TTCF.

If the Chef can fulfill its ambitious growth hassle, then the profitability, provided by high teen double-digit bottom-line margins, would let the PE ratio shrink into a fair territory.

8.Conclusion

The Tattooed Chef can be summed up as a play on food trends and a bet on the buildup of a new brand. With new partners, its ecommerce strategy and new products the way for more growth is paved. If you get the gist of the Tattooed Chefs roadmap and want a emerging stock in a rather conservative industry with crazily valued stars like Beyond Meat – then you should get a vegetable tattoo by Sarah and buy some stocks on the way. But if you have doubts about the sustainablity of the growth perspective and don't blindly trust the branding power, then stay on the sideline until the mentioned breakpoints are hit or the company is a lot cheaper. We rate Tattooed Chef as a NEUTRAL. Disclaimer & Conflict of interest The author currently does not hold a position in the mentioned stock. The mentioned company does NOT compensate the author or the publisher of this website. This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.Financial Data by Quarter

Revenue Mix by Segment

Industry Split Frozen US Food Market

Chart

Peers

All the Peers

FlexShopper Inc.

Bullish

Hellofresh SE

Bullish

Build-a-Bear Workshop Inc.

Outperform

Stamps.com Inc.

Bullish

Redfin Corporation

Bullish

Perion Network Ltd.

Outperform

Upwork Inc.

Bullish

Chegg Inc.

Bullish

Pinterest Inc.

Bullish