The Search

Your Search Results

News from us

Newest Symbols

Newest Industries

Click to expand

Advertising

See Stocks

Automotive

See Stocks

E-Commerce

See Stocks

E-Learning

See Stocks

Electricity

See Stocks

Engineering

See Stocks

FlexShopper Inc.

Bullish

Bullish

Tattooed Chef Inc.

Neutral

Neutral

Hellofresh SE

Bullish

Bullish

Build-a-Bear Workshop Inc.

Outperform

Outperform

Stamps.com Inc.

Bullish

Bullish

Redfin Corporation

Bullish

Bullish

Perion Network Ltd.

Outperform

Outperform

Upwork Inc.

Bullish

Bullish

Chegg Inc.

Bullish

Bullish

Pinterest Inc.

Bullish

Bullish

Bluelinx Holdings Inc

Bullish

Bullish

Momentus Inc.

Neutral

Neutral

Mynaric AG

Neutral

Neutral

Virgin Galactic Holdings Inc.

Neutral

Neutral

Maxar Technologies Inc.

Neutral

Neutral

Sunrun Inc.

Bullish

Bullish

Steico SE

Neutral

Neutral

Alfen N.V.

Neutral

Neutral

Research

Content Cards

Swipe

Our Article

Hellofresh SE - Article

Research: HelloFresh - The Misunderstood Goliath Crushing Them All

Note: HelloFresh / Source

Table of Content:

- Author’s Opinion

- Introduction to the Company

- Why is it so beloved?

- The Read between the lines

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author’s Opinion

After reading the headlines of this research, you may asked yourself “Who is ‘them’ “. Well, the answer is pretty simple. Them are the competitors, the doubters, the wrong analysts and the private investor who simple don’t understand or misunderstand HelloFresh. The company always has delivered best in class results, exceeding or matching their own targets. This all has changed dramatically in 2020, when the global pandemic hit the world and people began to stay at home. This change in social behavior boosted HelloFresh so much, that the company was forced to increase their guidance 5th times in a year plus cancelling orders, because their was to much demand for their mealboxes. Looking into the future, HelloFresh will be one of the fastest growing, digital and most recognized companies in the food industry, riding the emerging digital food market as one of the leaders. HelloFresh is clearly a buy.

Introduction: Let the company introduce itself

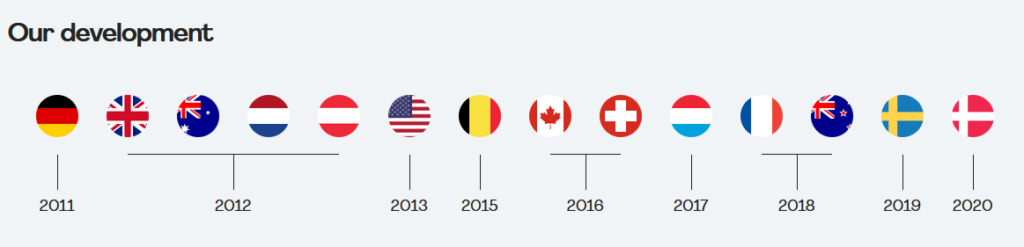

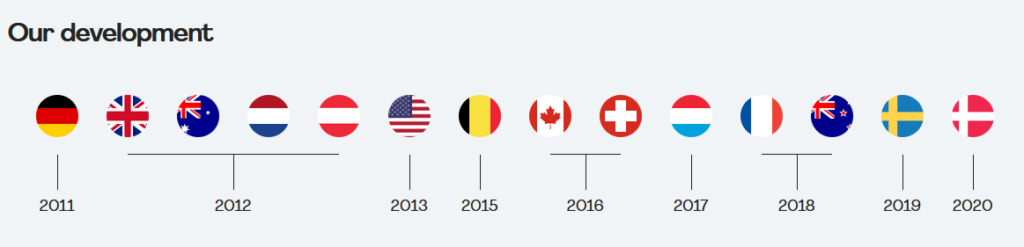

HelloFresh SE is the world’s leading meal-kit company and operates in the U.S., the United Kingdom, Germany, the Netherlands, Belgium, Luxembourg, Australia, Austria, Switzerland, Canada, New Zealand, Sweden, France and Denmark. In Q3 2020, HelloFresh delivered over 162 million meals and reached five million active customers. HelloFresh was founded in Berlin in November 2011 and went public on the Frankfurt Stock Exchange in November 2017.HelloFresh has offices in New York, Berlin, London, Amsterdam, Sydney, Toronto, Auckland, Paris and Copenhagen.

Source: hellofresh.com

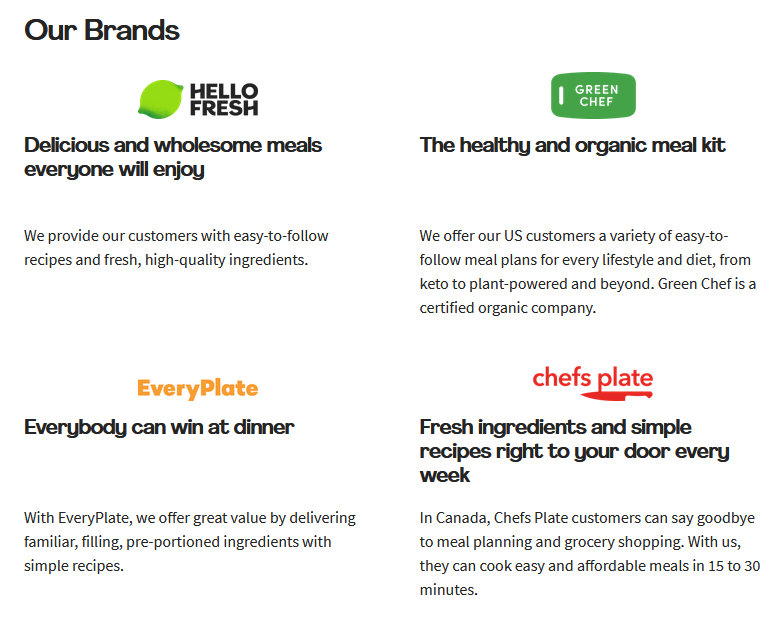

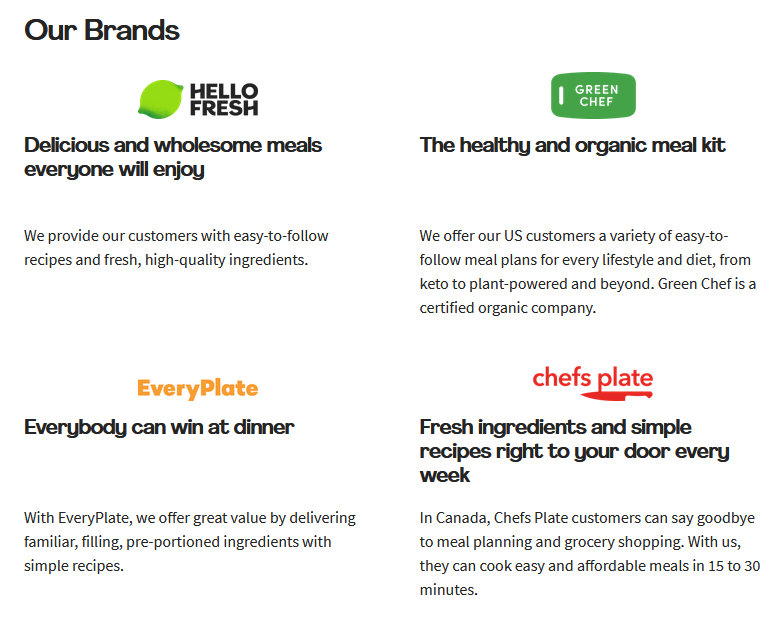

Different Brands and Ideas make happy customers

Brands

HelloFresh, considered as a group of companies, includes several brands that all specialize in cooking boxes and operate in different markets, except for one company, which focuses on healthy ready meals.

Note:HelloFresh SE brands / Source

HelloFresh

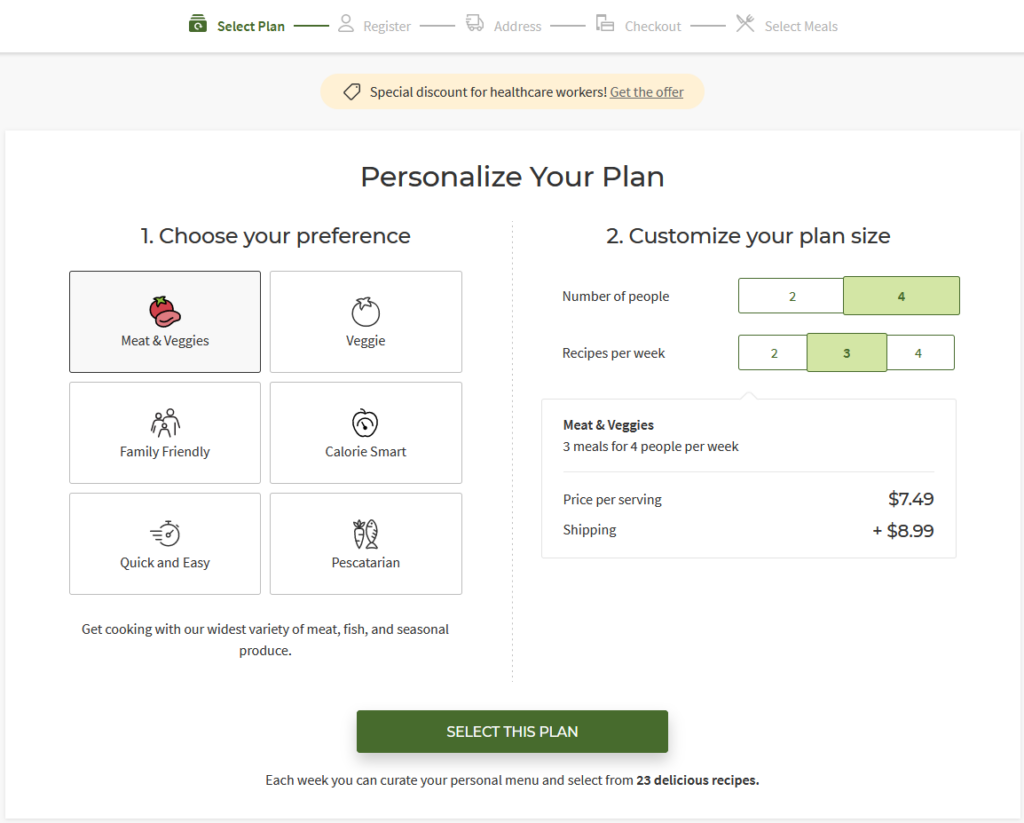

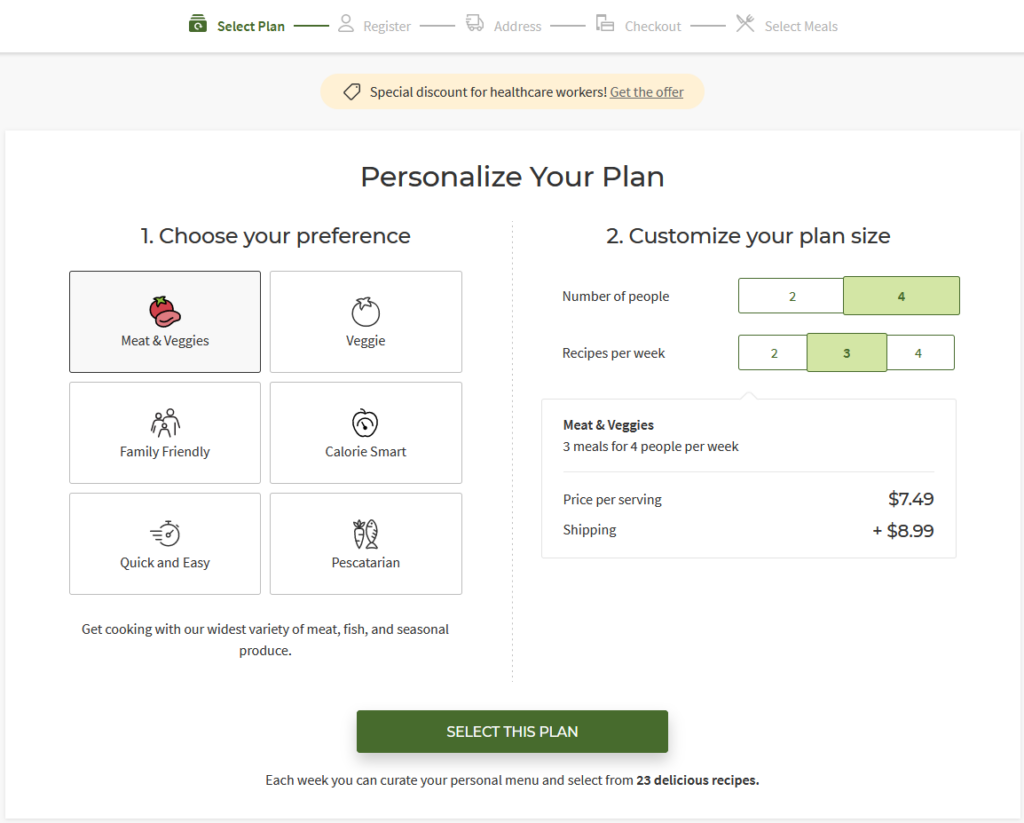

HelloFresh is the main brand and namesake of the company. It is by far the company’s top-selling brand and has become the noun for the concept of the cooking box. Cooking boxes usually work like this: Customers subscribe to a weekly cooking box, after that they must specify the size of the box in advance, i.e. the number of portions and serving per week. They still select the dishes would like to cook. The box is then delivered by mail a few days later, and the customer cooks the recipes day after day, week after week. It is therefore an interactive lifestyle subscription with recurring revenues per customer.

Note: How HelloFresh works

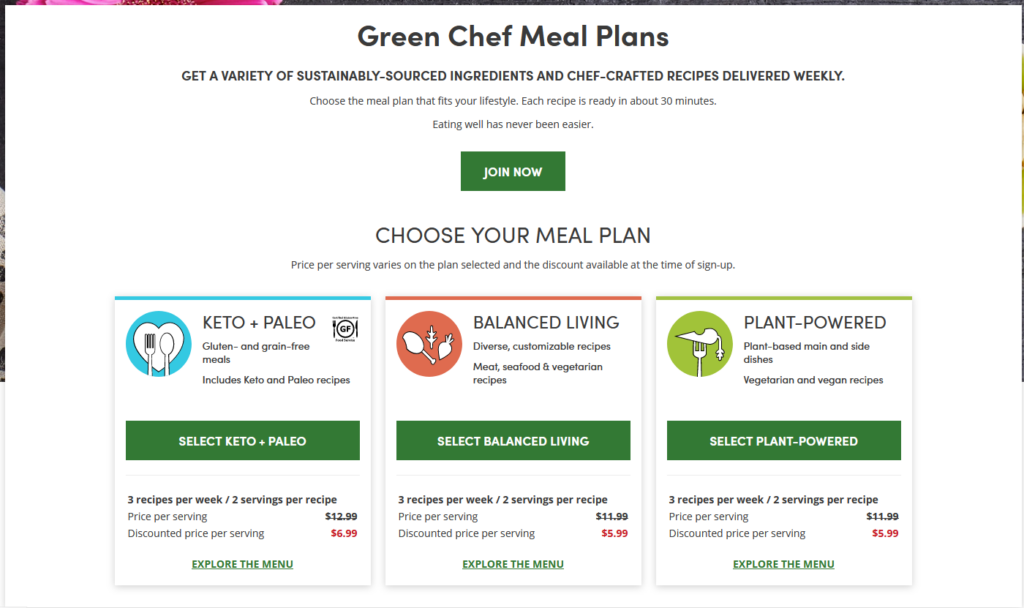

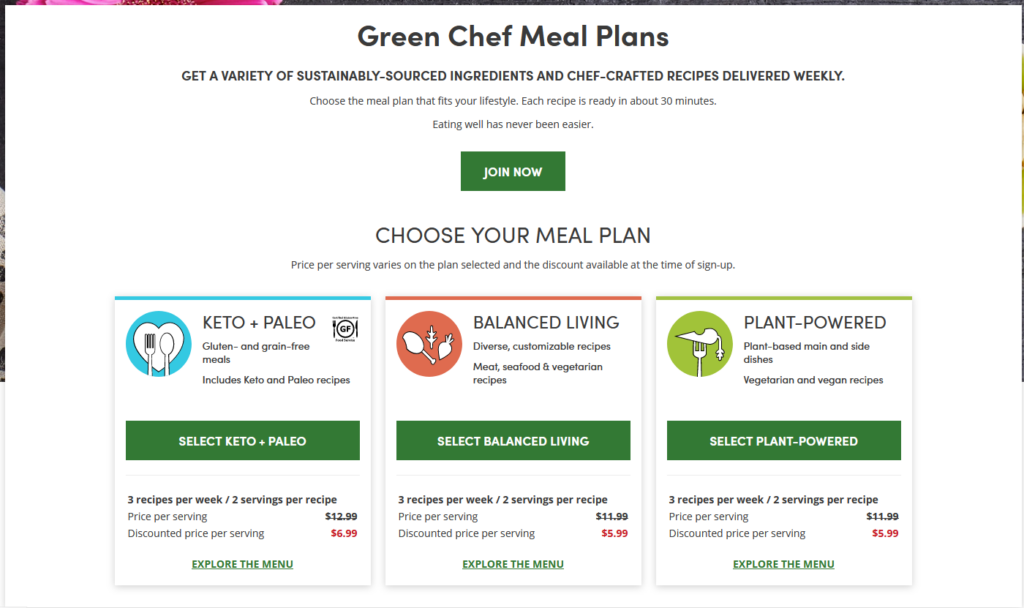

GreenChef

GreenChef is basically the premium cooking box brand from HelloFresh. Everything from GreenChef is organic and the dishes, that can be ordered, are suitable for different diets, for example vegan. The premium position allows higher margins and riding the “healthy food” wave.

Note: GreenChefs premium priced Meal Plans / Source

ChefsPlate

ChefsPlate is a similar offer compared to the standard HelloFresh cooking box – it has been acquired by HelloFresh in late 2018, to gain traction on the Canadian market. ChefsPlate is a good example of how an acquisition of an already established brand can get you into an important market without taking too much risk of your own.

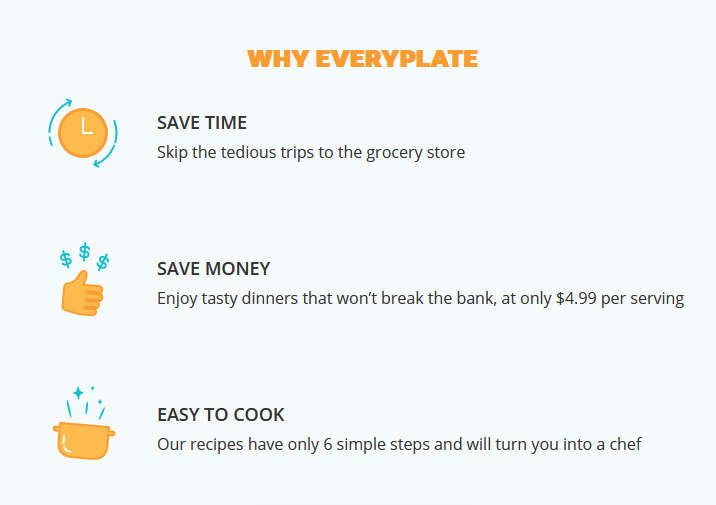

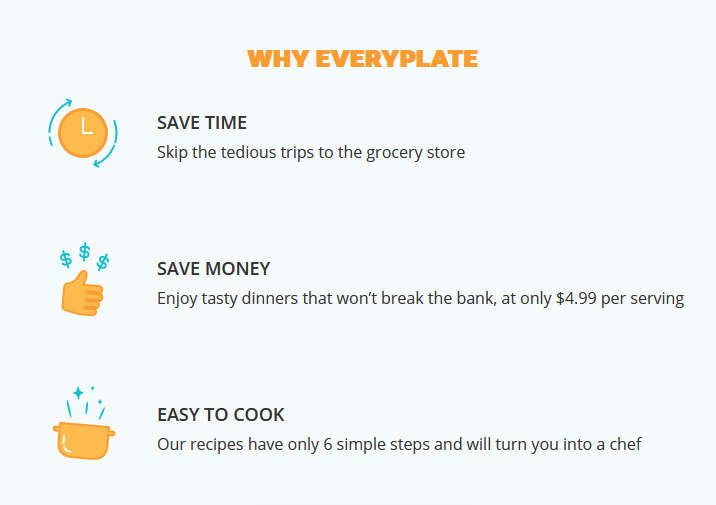

EveryPlate

EveryPlate is also a cooking box, but priced slightly below HelloFresh. The target group here is to provide good and balanced meals for a good and affordable price – so the target group is clearly the US population, which otherwise tends to buy cheap in many supermarkets and focuses more on price instead of quality.

Note: EveryPlate features / Source

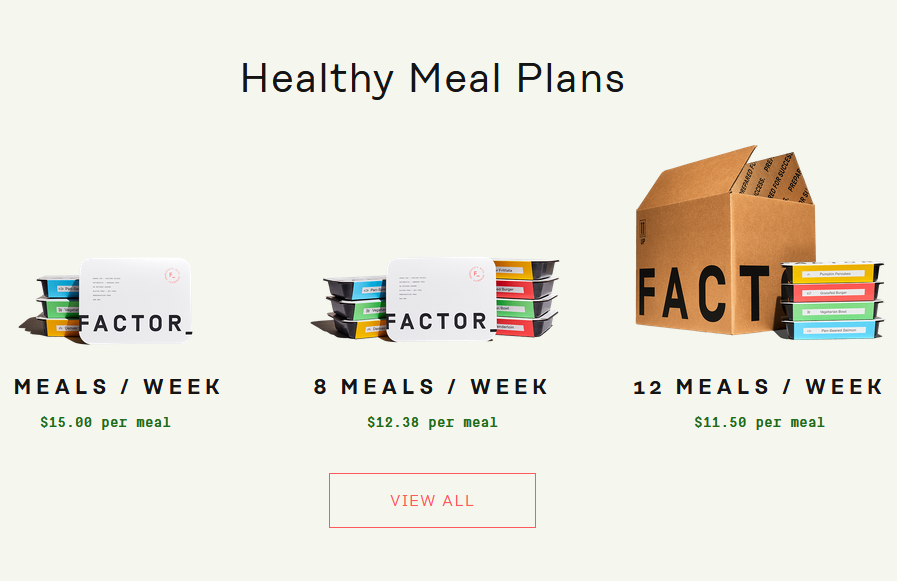

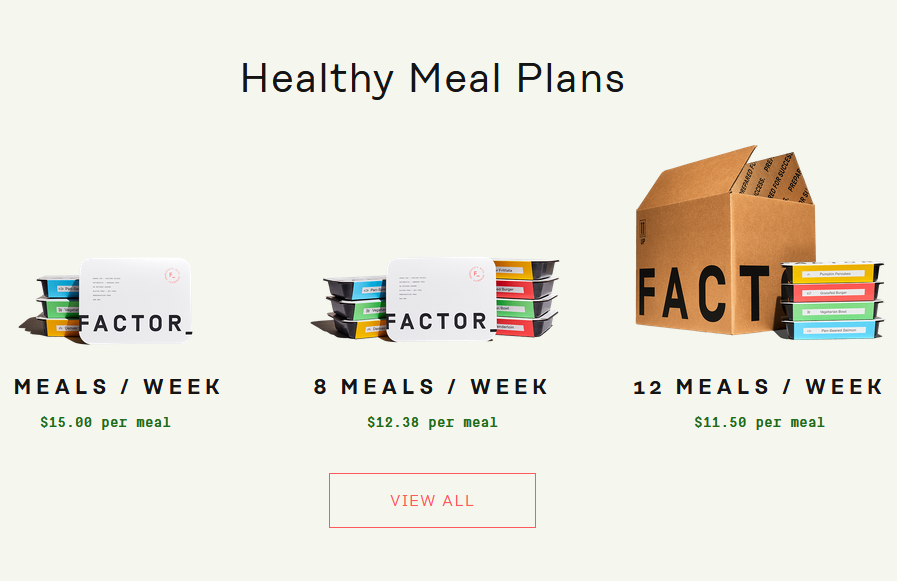

Factor75

Factor75 is HelloFresh’s latest acquisition and also the most exciting, as it clearly shows HelloFresh’s future direction – not just cooking boxes, but expanding the segment and becoming a serious player in online grocery and ready meals market. Factor75 produces healthy premium ready meals in the USA, which can be purchased online. These are also sold on a weekly subscription basis. The special feature here is the fact that the meals are ready-to-eat and no longer need to be cooked.

Note: Factor75 meal plans / Source

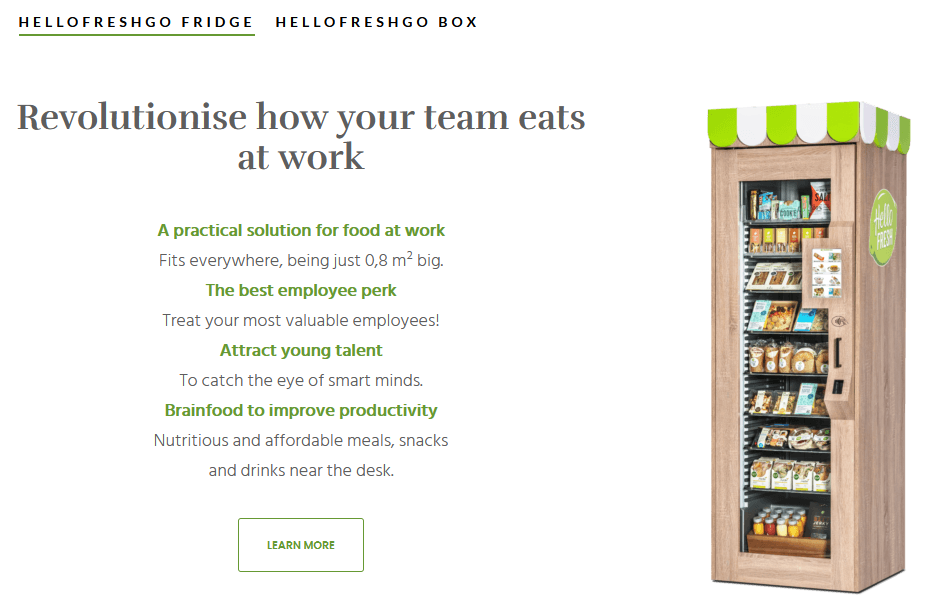

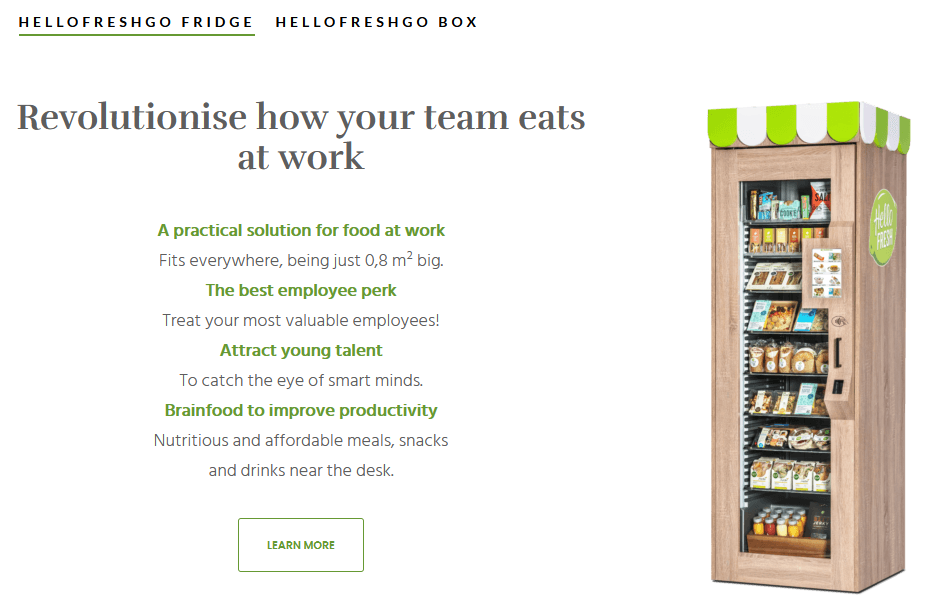

HelloFresh GO

HelloFresh GO is also a very exciting development within the HelloFresh brand. Technology, Modern Workplaces and healthy Ready-to-Eat snacks come together and are called HelloFresh GO:

Exchange uninspiring snack boxes and time-consuming food ordering for a high-tech smart vending machine – filled with great meals at affordable prices.

HelloFreshGO combines innovative features and quality materials while being a real eye-catcher in your office. This vending machine can be your new favourite perk – your employees will love the convenience, speed and food variety.

Note: HelloFresh Go / Source

HelloFresh offers HFG Go Boxes, which also contain snacks and are intended for the HomeOffice or smaller office, for example, in addition to the modern food vending machines filled with snacks – you can also see here: HelloFresh adapts quickly and brings new ideas and products from the same segment to the market.

Note: HelloFresh Go / Source

Theme Boxes and Intelligent Upselling

HelloFresh has started upselling its cooking boxes through its technological capabilities, as well as logistical optimization. Thematic boxes were also introduced.

Upselling: In selected markets, customers now have the option of upgrading their cooking box to include extra content, such as premium ingredients or dishes, for a small surcharge – in this way, the customer is individually suggested suitable “products” similar to an advertisement, which make them more satisfied, while HelloFresh earns a golden goose in the process.

Note: HelloFresh Extras/ Source

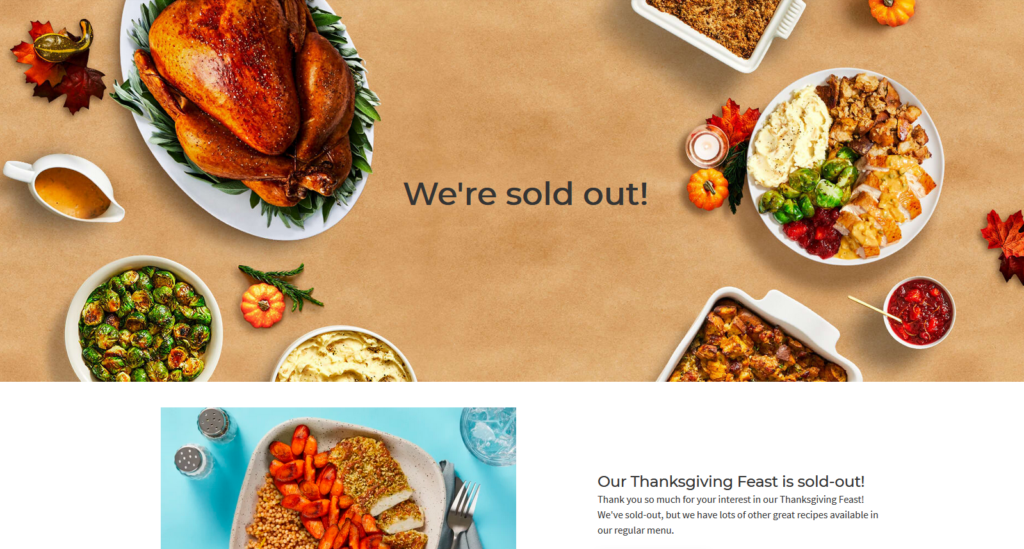

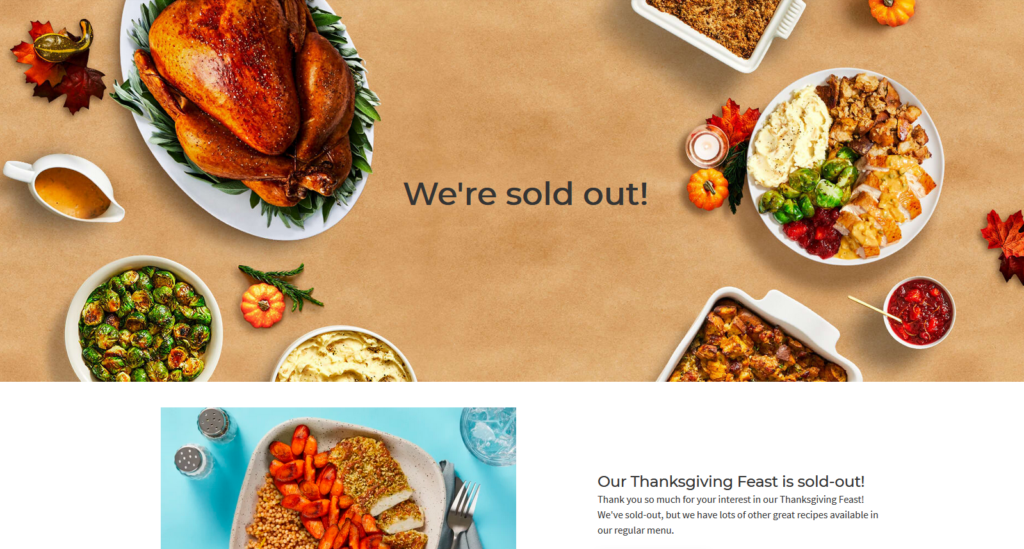

In addition, HelloFresh now also offers themed / seasonal cooking boxes to match the season or upcoming holiday, such as a turkey for ThanksGiving or the roast for Christmas. These boxes are also extremely well received by customers, as they do not have to shop during the “holiday rush” and are thus supplied by HelloFresh. More ideas from this direction are very likely to be seen in the future.

Note: HelloFresh Theme Boxes / Source

Market Introduction

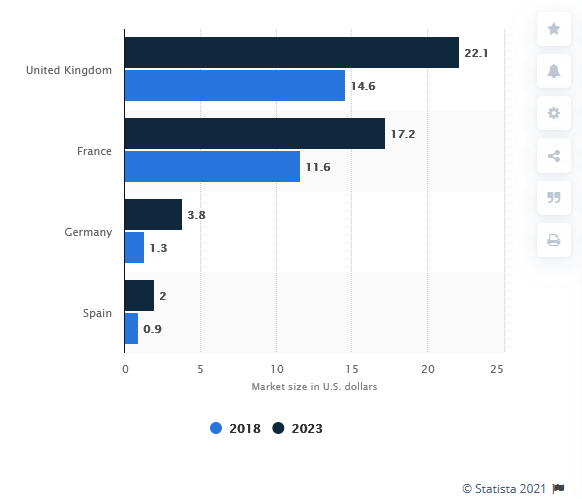

E-commerce is booming, and not just since the outbreak of the Corona pandemic. In recent years, the market volume in Germany alone has increased from around 18.3 billion euros in 2010 to more than 72 billion euros in 2019. Due to the Corona pandemic, this figure will presumably increase disproportionately once again this year. Sales of food in online retail rose from 618 million euros in 2014 to 1.36 billion euros in 2018. Compared to bricks-and-mortar retail, which turned over 123.1 billion euros in 2018, this is only a small share. However, a trend can be identified on the basis of these figures.

Online trade in the beverage and food sector has also continued to grow globally in recent years. Sales increased from $100 billion in 2017 to over $127 billion in 2018, and the market grew by the same amount again the following year. According to estimates, this year the market will have reached a volume of approximately $236 billion. A steady increase is expected in the coming years as well.

In comparison to the sudden growth in market volume, the number of users has risen very steadily in recent years. While in 2017 about 609 million people ordered groceries online, by the end of this year the number will be about 1,041 million.

Furthermore, the share vis-à-vis brick-and-mortar retail is also gradually increasing. While online retailing still accounted for 1.2% of grocery sales in 2017, this figure will have doubled by the end of 2020. Estimates assume that the share will rise to 3% by 2023. At first glance, this sounds like a niche market. However, it should be noted that the market has a volume of around 10 trillion dollars, and the 3% share therefore corresponds to around 300 billion dollars. In terms of sales, the most important markets are China, Japan, the USA, the UK and South Korea. The latter is also the country with the highest market penetration. Almost 40% of the population uses such services. In the UK, the figure is roughly similar. In Japan, it is still around one in three. These figures give an idea of the potential this market offers a company like HelloFresh and that the growth potential has not yet been exhausted.

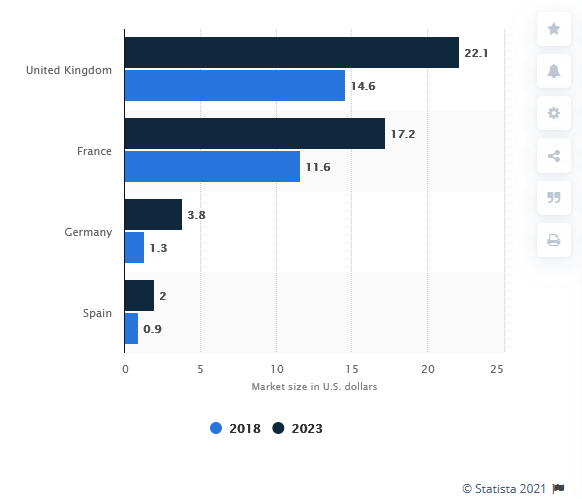

Note: Forecasted Online Grocery Market Size by Statista / Source

Outlook

In the short term, the further course of the Covid 19 situation has a major impact on the company’s growth. The implementation of lockdown measures and the closure of restaurants in countries such as Germany, the UK or parts of the USA have massively increased customer demand for cooking boxes during this period. How sustainable this development is remains to be seen. The company itself seems very optimistic about this. During the year, for example, they signed leases for two new production facilities. One of them in England and the other in the USA. In addition, the number of employees increased from 6,000 to around 9,000. E-commerce trade, and the food sector in particular, has not just been growing since the outbreak of Covid-19. The trend has merely been accelerated as a result. Another factor will be how much the e-commerce market for groceries develops.

Note: HelloFresh new markets / Source

Recent News and Updates

Increase of Full Year 2020 Guidance (5th time in a FY) plus 2021 Outlook

After HelloFresh has already sharply revised its own forecast for the year upward 4 times in 2020, the company raised its forecast for the fifth time on December 9. It now expects revenue growth of 112% and an EBITDA margin of 13.5%. This is several percentage points above the outdated forecast in each case.

Furthermore, HelloFresh has additionally given a first very conservative outlook for 2021 and expects a growth of 20-25% on the revenue side here. An EBITDA margin of 9-12% is targeted, as well as expansion into 2 new countries. This forecast has not pleased many critics, as they have always assumed that HelloFresh would lose its customers after the Covid pandemic, or that further strong growth would not be possible – HelloFresh sees this very differently.

For additional informations, please take a look at their press release.

Factor75 acquisition

HelloFresh announced on November 23 2020 that it would take over Factor75. Factor75, as described above, is a company from the USA that sells ready-made dishes digitally. Factor75 is expected to generate $100 million in revenue in 2020. There are 3 aspects of the acquisition that are particularly exciting:

- The acquisition was paid entirely in cash, easily out of the operating cash flow – this reflects the enormous strength of HelloFresh’s day-to-day business and shows investors that further growth is possible without dilution in the similar segment.

- Factor75 is not a cooking box, no it is a new type of business segment for HelloFresh and the first step to gain a foothold in the digital online food business and ready meals industry.

- It is a punch in the face for all critics of HelloFresh, who often accuse the company of selling only “1” product, which often meets with incomprehension, especially among older people (and older analysts).

For additional informations, please take a look at their press release.

The Read between the lines

Strategy

Last year, the main focus was on increasing market penetration. The company wanted to achieve this on the one hand by acquiring a low-cost brand in the USA, namely Chefs Plate. This was subsequently also introduced in Canada and significantly expanded the addressable markets in both countries. In addition, the main brand is also expected to continue to grow. In 2019, its business segments grew by about 30%. Furthermore, it aims to attract more customers by offering a wider range of products. This is done by, among other things, premium boxes, additional recipes or also seasonal cooking boxes, such as an extra offer for Thanksgiving. In addition, since September 2020, cooking boxes with products from the meat substitute manufacturer Beyond Meat have also been available for U.S. customers to purchase.

In addition, a larger selection of recipes is to be offered. Furthermore, customer feedback will be used to improve personalization and adapt to consumer preference behavior.

Another strategy is to selectively increase distribution. This is to be done primarily in countries where there is a relatively high disposable income. Other criteria are high Internet penetration and a well-developed infrastructure.

In addition, the delivery centers are also to be increasingly automated. This will increase unit economics and also enable a wider selection as well as better personalization of service.

Lastly, financial ratios are to be optimized through economies of scale as well as operational improvement. Firstly, a further increase in efficiency is to be achieved. This is to be achieved by optimizing procurement processes and better menu planning. In the delivery centers, there should be an increase in productivity as well as better fixed cost utilization. All this would increase the contribution margin. Furthermore, a growing customer base will reduce the relative share of marketing expenses. Lastly, G&A expenses are expected to increase slower than overall growth.

The deep Analysis

Financials

Operational History

The company HelloFresh was founded in 2011 by Dominik Richter, Jessica Nilsson and Thomas Griese. In the beginning, they were fiancially supported and advised by the investment company Rocket Internet. However, Rocket later sold its shares again.

At the beginning of 2012, they started delivering cooking bags in Berlin. Later were delivered instead of these cooking boxes. Since September 2012, the company has been delivering throughout Germany. By the end of 2020, the company will be selling its products in 14 countries and expansion into new countries has already been announced. At first, an IPO was planned for 2015. However, this only happend about two years later. Since the 2nd of November 2017, the shares have been traded in the Frankfurt Prime Standard. Currently, the company has a market capitalization of approximately 10 billion euros. Since its founding, the Green Chef, EveryPlate and Chefs Plate brands have been have been acquired and integrated into the company. In November 2020, the US company Factor75 was acquired. Up to $277 million was due for this. Initially, $177 million was paid directly. The remaining $100 million is linked to performance-based components and will be paid upon achievement of certain financial metrics. Factor75 is one of the leading U.S. providers of ready-to-eat, fresh, and healthy and healthy meals. It is intended to strengthen the business in this market and, in addition synergies can possibly also be exploited.

Dividend

The company currently does not pay a dividend.

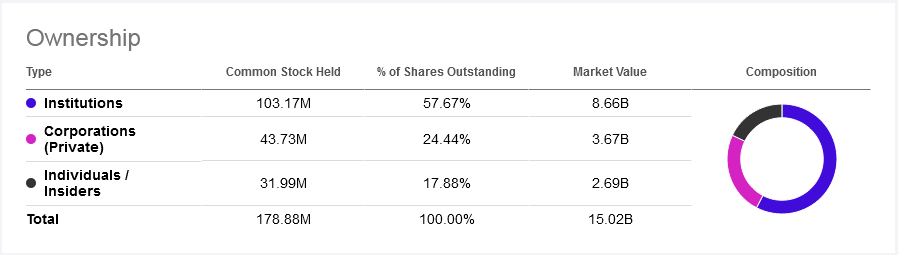

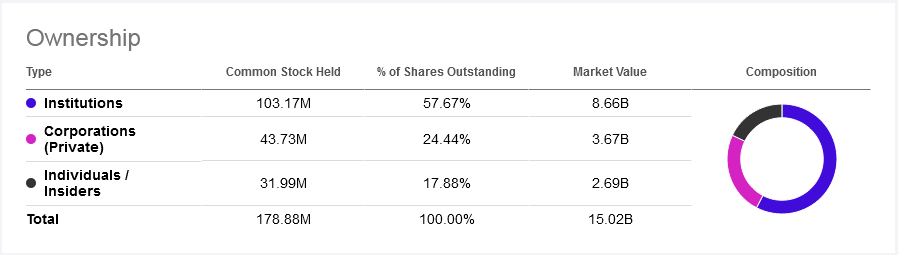

Share Structure

The shareholder structure is as follows. 8.91% of the company is owned by Insigth which is divided into the shareholdings of HF Main Insight S.à.r.l., HF Del Insight S.à.r.l. and HF Cay S.à.r.l. 6,52 % are owned by BlackRock INC, 11.1 % of the shares are owned by Baillie Gifford & Co, 0.19% are owned by the company and the remaining 73.28% are in free float in free float.

Note: The share structure of HelloFresh / Source

Chart

Valuation of the Stock

The development of the free cash flow is to be assessed as positive. While -73.7 million euros were still on the books as of Dec. 31, 18, this figure was already in positive territory at 3.40 million euros at the end of 2019. In the current year, free cash flow has already increased to 361.3 million euros at the end of the 3rd quarter. This corresponds to a margin of 37.24%. Marley Spoon is heading for an FCF of 1.90 million euros in the current year after an FCF of -34.7 last year. This results in a margin of 0.76%. Nestlé is expected to achieve a margin of 12.25%. Zalando is heading for a figure of 1.99%.

The company has reduced its leverage ratio from 56.98% to 53.27%, in contrast to the previous year’s reporting date. In contrast, equity has increased, rising from 43.02% to 46.73%. Expressed in figures, the equity ratio has risen from 245.3 million euros to 518.5 million. Non-current liabilities now amount to 272.1 million euros and current liabilities to 381.9 million. The gearing ratio, i.e. the ratio of debt to equity, has fallen from 132% to 126%.

By comparison, Blue Apron had an equity ratio of only 25.56% at the end of 2019. Nestlé has an equity ratio of 41.31%.

Another way to evaluate a company is the price-earnings ratio. This puts the share price in relation to earnings per share. Since the company made a loss in 2019, this ratio was in negative territory this year.

Based on the 3rd quarter and with the share price as of the reporting date of Nov. 10, 2020, the P/E ratio is 31.21. At the end of the year and with forecast values, the value at the end of the year 2020 is 31.5. Again, a comparison with the direct competition makes little sense since they do not generate a profit. At the end of 2019, Nestlé’s P/E ratio was 24.34, Zalando’s was 112.19, and Delivery Hero’s was 57.8.

Business Model

The company sells so-called cooking boxes. For these, ingredients are portioned and put together with the appropriate recipes. These so-called cooking boxes are then sold via a subscription model and then delivered to customers at a time of their choice. As we all know, subscription means recurring revenues with a good predictability – this leads to a high quality kind of revenue, compared to normal product sales. This is mainly done under the brand name HelloFresh but also under various other brands, such as EveryPlate. The business model breaks with the traditional supply chain model as there are no intermediaries such as distributors or wholesalers. It also works closely with its own network of suppliers as well as numerous local vendors. Key business processes are data and technology driven. The software makes it possible to make efficient purchasing decisions in ingredients procurement. Another important point is product innovation. As part of this, new recipes are constantly added and menu planning is revised. There are also additional products in the most important regions, such as premium boxes, different appetizers, seasonal boxes or even a wine list. Furthermore, there is a flexible ordering system where customers can pause or even cancel deliveries at any time. In addition, the company works closely with producers to offer customers fresh and seasonal products. The company works on the just-in-time principle, as a large part of the goods are perishable and therefore it is possible to operate with low stocks. The storage centers also serve as production sites, from which the cooking boxes are then delivered directly to the customers.

Note: HelloFresh Plans & Pricing

HelloFresh groups their customers into two regional segments – USA and International:

Management

HelloFresh is run by it’s co-founders and long time employees. This is a good indicator, because they have some impressive skin in the game, through their ownership. This will lead the managment to always remember that their own money is on the line.

The management consist of:

- Dominik Richter – CEO – Dominik has been CEO since starting HelloFresh in 2011. He is responsible for keeping a general oversight of the business and strategy. Dominik’s an entrepreneur to the core and started his first two businesses while still at university. Dominik graduated from WHU with a degree in International Business in 2009, and from the London School of Economics in 2010 with a Masters in Finance and worked for Goldman Sachs before founding HelloFresh.

- Thomas Griesel – CEO – Thomas is responsible for the international segment at HelloFresh and co-founded the company with Dominik in 2011. Thomas previously worked at OC&C Strategy Consultants and started a range of his own businesses and ideas. He graduated from WHU with a degree in International Business Administration in 2009, and from the London Business School in 2010 with a Masters in Management.

- Christian Gärtner – CFO – Prior to joining HelloFresh, Christian spent 19 years in banking, most recently at Bank of America Merrill Lynch where he ran the Equity Capital Markets business for the German speaking region. Prior to that he was at Goldman Sachs in London and Frankfurt.

- Edward Boyes – CCO – Ed joined HelloFresh back in 2012 and co-founded the company’s UK business as CEO of HelloFresh UK. Four years later he was appointed CEO of HelloFresh in the US. In January 2020 Ed joined the HelloFresh Management Board as Chief Commercial Officer. Before joining HelloFresh, Ed worked at Booz & Company. He previously graduated from Oxford University with a degree in Economics and Management in 2010.

Source: HelloFresh

Insiders are holding approximately about $2820 Mio in own shares. This is a huge and impressive amount.

Competition

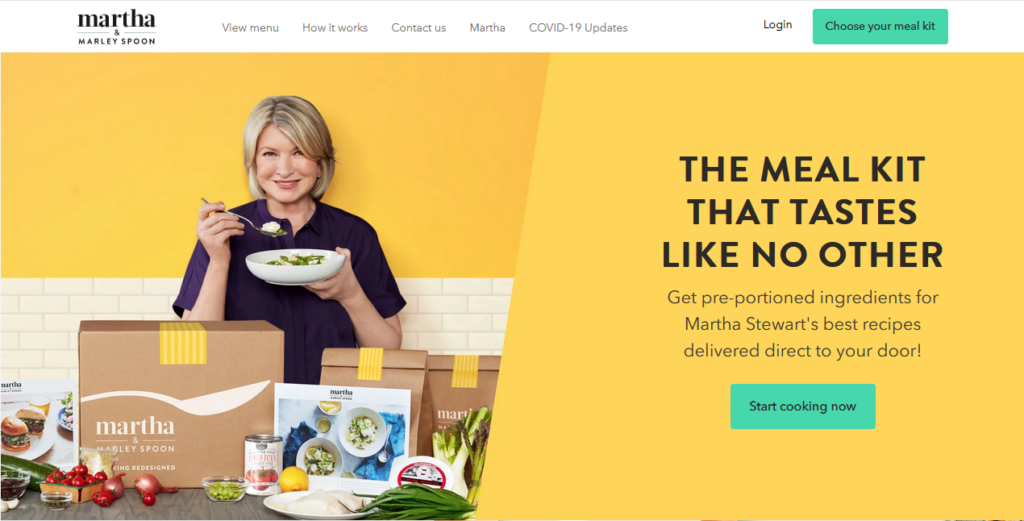

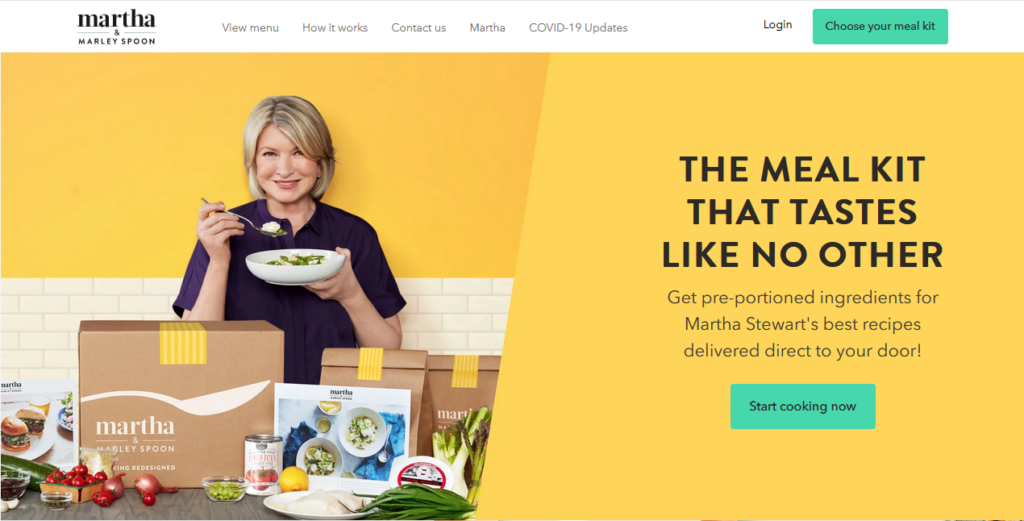

The cooking box market has shrunk to a market dominated by a few companies after a real “hyper competition” that prevailed in the years 2013-2017. One of the main competitors in recent years, BlueApron, has been losing market share for years and only marginally benefited even from the Corona pandemic. The companies Instacart and freshdirect offer a similar business model and are mainly active in the North American market. Amazon is represented in various countries by its subsidiary Amazon Fresh and sells fresh food via its own website and in its own stores in the USA. In addition, they offer cooking boxes in the USA via their stationary retail chain Wholefoods. However, a comparison with Amazon’s figures is not very useful as Amazon only publishes bundled figures for the entire group. Another competitor is Ocado. The company, which originates from Great Britain, is a supermarket that sells its products exclusively online. In addition, there is MarleySpoon, a company from Germany, which is a competitor especially in the Australian market. Finally, I would like to mention the company Freshly. This company sells meals that only need to be heated up. They have a large customer base, especially in the USA. At the beginning of November 2020, they were taken over by Nestlé.

Note: HelloFresh Competitor Martha / Marley Spoon

What to expect in the near future

Acquisitions-Strategy

HelloFresh will make further acquisitions in the near future, which will either further expand the main business of cooking boxes or other new segments, such as that of Factor75. These acquisitions are easily possible due to the good cash position and I also expect them as an investor.

New Market-Strategy

HelloFresh plans to attack new markets – currently 2 new countries per year. In particular, the Asian region leaves a lot of room for dreaming, since the acceptance of food delivery and online food delivery is already much more widespread there. A wealthy target group complements the potential there.

New Product / Product-Segment-Strategy

Most of all, as an investor, I expect expansion and creativity into new product segments in online grocery. A strong expansion of the Factor75 business and HelloFresh GO are just the beginning here – there is plenty of room and space for further growth and more innovations in the coming years.

Conclusion

At the end, it now lends itself to a final verdict on the company.

On the one hand, I find it problematic that it is basically a product that is easy to imitate. The company has a small moat due to its position and large market share, but in my opinion it does not have a unique selling proposition. If a company like Amazon or Nestlé were to decide to open up the market further, there is little that HelloFresh can do to counter this.

In addition, it is also questionable how sustainable the development is that was caused by the current situation. It remains to be seen whether customers can be retained or whether sales will drop sharply after the end of the Corona pandemic.

On the other hand, however, steady growth was already evident in the years before Corona. Among other things, positive EBIT was already achieved in the previous year.

Furthermore, the company has a stable capital structure with a high equity ratio, which has even been increased in recent years. The return on equity, which will be in the region of 70% at the end of the year, is very positive, not only in relation to the value recommended in the specialist literature, but also in comparison with companies in similar fields of business.

The EBIT margin also compares favorably with other companies.

In addition, the free cash flow margin of over 37% is above average. From these funds, any debts can be repaid and the profit can be retained or used to pay dividends. Furthermore, the capital turnover is good and if the expected sales are achieved, the ROI is similar to that of Nestle.

Apart from the figures, there are also positive developments at the company. Already at this stage, steps have been taken for the time after Corona. On the one hand, the company Factor75 in the USA has been acquired, this can strengthen the company’s own position in this market. In addition, synergies such as the use of cost allocations or a better analysis of customer preferences through more data can be exploited. With this purchase, the company is also defending itself against Nestlé, which bought up a similar company with Freshly. In addition, the CEO announced that the company will expand into one or two more countries in Europe in the coming year.

It should also be noted that HelloFresh is the only company listed on the stock exchange that generates a positive net income from the sale of cooking boxes.

The valuation on the capital market is also appropriate in my opinion. Compared to other e-commerce companies, the P/E ratio is very low, and even compared to an established company like Nestlé, it is only about 30% higher. The return on sales is also at a good level compared to similar companies.

In addition, the pandemic also led to a relatively strong increase in sales compared to other competitors.

In my opinion, the company is well on the way to further expanding and consolidating its market power as long as new markets can be opened up and its market penetration can be further increased.

Our recommendation: This stock is a clear buy. Use a sell-off for buying in or averaging up and use further price-falls to average up.

Disclaimer & Conflict of interest

The author currently holds a position in the mentioned stock. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Hellofresh SE - Article

Research: HelloFresh - The Misunderstood Goliath Crushing Them All

Note: HelloFresh / Source

Table of Content:

- Author's Opinion

- Introduction to the Company

- Why is it so beloved?

- The Read between the lines

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author's Opinion

After reading the headlines of this research, you may asked yourself "Who is 'them' ". Well, the answer is pretty simple. Them are the competitors, the doubters, the wrong analysts and the private investor who simple don't understand or misunderstand HelloFresh. The company always has delivered best in class results, exceeding or matching their own targets. This all has changed dramatically in 2020, when the global pandemic hit the world and people began to stay at home. This change in social behavior boosted HelloFresh so much, that the company was forced to increase their guidance 5th times in a year plus cancelling orders, because their was to much demand for their mealboxes. Looking into the future, HelloFresh will be one of the fastest growing, digital and most recognized companies in the food industry, riding the emerging digital food market as one of the leaders. HelloFresh is clearly a buy.

Introduction: Let the company introduce itself

HelloFresh SE is the world’s leading meal-kit company and operates in the U.S., the United Kingdom, Germany, the Netherlands, Belgium, Luxembourg, Australia, Austria, Switzerland, Canada, New Zealand, Sweden, France and Denmark. In Q3 2020, HelloFresh delivered over 162 million meals and reached five million active customers. HelloFresh was founded in Berlin in November 2011 and went public on the Frankfurt Stock Exchange in November 2017.HelloFresh has offices in New York, Berlin, London, Amsterdam, Sydney, Toronto, Auckland, Paris and Copenhagen.

Source: hellofresh.com

Different Brands and Ideas make happy customers

Brands

HelloFresh, considered as a group of companies, includes several brands that all specialize in cooking boxes and operate in different markets, except for one company, which focuses on healthy ready meals.

Note:HelloFresh SE brands / Source

HelloFresh

HelloFresh is the main brand and namesake of the company. It is by far the company's top-selling brand and has become the noun for the concept of the cooking box. Cooking boxes usually work like this: Customers subscribe to a weekly cooking box, after that they must specify the size of the box in advance, i.e. the number of portions and serving per week. They still select the dishes would like to cook. The box is then delivered by mail a few days later, and the customer cooks the recipes day after day, week after week. It is therefore an interactive lifestyle subscription with recurring revenues per customer.

Note: How HelloFresh works

GreenChef

GreenChef is basically the premium cooking box brand from HelloFresh. Everything from GreenChef is organic and the dishes, that can be ordered, are suitable for different diets, for example vegan. The premium position allows higher margins and riding the "healthy food" wave.

Note: GreenChefs premium priced Meal Plans / Source

ChefsPlate

ChefsPlate is a similar offer compared to the standard HelloFresh cooking box - it has been acquired by HelloFresh in late 2018, to gain traction on the Canadian market. ChefsPlate is a good example of how an acquisition of an already established brand can get you into an important market without taking too much risk of your own.

EveryPlate

EveryPlate is also a cooking box, but priced slightly below HelloFresh. The target group here is to provide good and balanced meals for a good and affordable price - so the target group is clearly the US population, which otherwise tends to buy cheap in many supermarkets and focuses more on price instead of quality.

Note: EveryPlate features / Source

Factor75

Factor75 is HelloFresh's latest acquisition and also the most exciting, as it clearly shows HelloFresh's future direction - not just cooking boxes, but expanding the segment and becoming a serious player in online grocery and ready meals market. Factor75 produces healthy premium ready meals in the USA, which can be purchased online. These are also sold on a weekly subscription basis. The special feature here is the fact that the meals are ready-to-eat and no longer need to be cooked.

Note: Factor75 meal plans / Source

HelloFresh GO

HelloFresh GO is also a very exciting development within the HelloFresh brand. Technology, Modern Workplaces and healthy Ready-to-Eat snacks come together and are called HelloFresh GO:

Exchange uninspiring snack boxes and time-consuming food ordering for a high-tech smart vending machine – filled with great meals at affordable prices.

HelloFreshGO combines innovative features and quality materials while being a real eye-catcher in your office. This vending machine can be your new favourite perk – your employees will love the convenience, speed and food variety.

Note: HelloFresh Go / Source

HelloFresh offers HFG Go Boxes, which also contain snacks and are intended for the HomeOffice or smaller office, for example, in addition to the modern food vending machines filled with snacks - you can also see here: HelloFresh adapts quickly and brings new ideas and products from the same segment to the market.

Note: HelloFresh Go / Source

Theme Boxes and Intelligent Upselling

HelloFresh has started upselling its cooking boxes through its technological capabilities, as well as logistical optimization. Thematic boxes were also introduced.

Upselling: In selected markets, customers now have the option of upgrading their cooking box to include extra content, such as premium ingredients or dishes, for a small surcharge - in this way, the customer is individually suggested suitable "products" similar to an advertisement, which make them more satisfied, while HelloFresh earns a golden goose in the process.

Note: HelloFresh Extras/ Source

In addition, HelloFresh now also offers themed / seasonal cooking boxes to match the season or upcoming holiday, such as a turkey for ThanksGiving or the roast for Christmas. These boxes are also extremely well received by customers, as they do not have to shop during the "holiday rush" and are thus supplied by HelloFresh. More ideas from this direction are very likely to be seen in the future.

Note: HelloFresh Theme Boxes / Source

Market Introduction

E-commerce is booming, and not just since the outbreak of the Corona pandemic. In recent years, the market volume in Germany alone has increased from around 18.3 billion euros in 2010 to more than 72 billion euros in 2019. Due to the Corona pandemic, this figure will presumably increase disproportionately once again this year. Sales of food in online retail rose from 618 million euros in 2014 to 1.36 billion euros in 2018. Compared to bricks-and-mortar retail, which turned over 123.1 billion euros in 2018, this is only a small share. However, a trend can be identified on the basis of these figures.

Online trade in the beverage and food sector has also continued to grow globally in recent years. Sales increased from $100 billion in 2017 to over $127 billion in 2018, and the market grew by the same amount again the following year. According to estimates, this year the market will have reached a volume of approximately $236 billion. A steady increase is expected in the coming years as well.

In comparison to the sudden growth in market volume, the number of users has risen very steadily in recent years. While in 2017 about 609 million people ordered groceries online, by the end of this year the number will be about 1,041 million.

Furthermore, the share vis-à-vis brick-and-mortar retail is also gradually increasing. While online retailing still accounted for 1.2% of grocery sales in 2017, this figure will have doubled by the end of 2020. Estimates assume that the share will rise to 3% by 2023. At first glance, this sounds like a niche market. However, it should be noted that the market has a volume of around 10 trillion dollars, and the 3% share therefore corresponds to around 300 billion dollars. In terms of sales, the most important markets are China, Japan, the USA, the UK and South Korea. The latter is also the country with the highest market penetration. Almost 40% of the population uses such services. In the UK, the figure is roughly similar. In Japan, it is still around one in three. These figures give an idea of the potential this market offers a company like HelloFresh and that the growth potential has not yet been exhausted.

Note: Forecasted Online Grocery Market Size by Statista / Source

Outlook

In the short term, the further course of the Covid 19 situation has a major impact on the company's growth. The implementation of lockdown measures and the closure of restaurants in countries such as Germany, the UK or parts of the USA have massively increased customer demand for cooking boxes during this period. How sustainable this development is remains to be seen. The company itself seems very optimistic about this. During the year, for example, they signed leases for two new production facilities. One of them in England and the other in the USA. In addition, the number of employees increased from 6,000 to around 9,000. E-commerce trade, and the food sector in particular, has not just been growing since the outbreak of Covid-19. The trend has merely been accelerated as a result. Another factor will be how much the e-commerce market for groceries develops.

Note: HelloFresh new markets / Source

Recent News and Updates

Increase of Full Year 2020 Guidance (5th time in a FY) plus 2021 Outlook

After HelloFresh has already sharply revised its own forecast for the year upward 4 times in 2020, the company raised its forecast for the fifth time on December 9. It now expects revenue growth of 112% and an EBITDA margin of 13.5%. This is several percentage points above the outdated forecast in each case.

Furthermore, HelloFresh has additionally given a first very conservative outlook for 2021 and expects a growth of 20-25% on the revenue side here. An EBITDA margin of 9-12% is targeted, as well as expansion into 2 new countries. This forecast has not pleased many critics, as they have always assumed that HelloFresh would lose its customers after the Covid pandemic, or that further strong growth would not be possible - HelloFresh sees this very differently.

For additional informations, please take a look at their press release.

Factor75 acquisition

HelloFresh announced on November 23 2020 that it would take over Factor75. Factor75, as described above, is a company from the USA that sells ready-made dishes digitally. Factor75 is expected to generate $100 million in revenue in 2020. There are 3 aspects of the acquisition that are particularly exciting:

- The acquisition was paid entirely in cash, easily out of the operating cash flow - this reflects the enormous strength of HelloFresh's day-to-day business and shows investors that further growth is possible without dilution in the similar segment.

- Factor75 is not a cooking box, no it is a new type of business segment for HelloFresh and the first step to gain a foothold in the digital online food business and ready meals industry.

- It is a punch in the face for all critics of HelloFresh, who often accuse the company of selling only "1" product, which often meets with incomprehension, especially among older people (and older analysts).

For additional informations, please take a look at their press release.

The Read between the lines

Strategy

Last year, the main focus was on increasing market penetration. The company wanted to achieve this on the one hand by acquiring a low-cost brand in the USA, namely Chefs Plate. This was subsequently also introduced in Canada and significantly expanded the addressable markets in both countries. In addition, the main brand is also expected to continue to grow. In 2019, its business segments grew by about 30%. Furthermore, it aims to attract more customers by offering a wider range of products. This is done by, among other things, premium boxes, additional recipes or also seasonal cooking boxes, such as an extra offer for Thanksgiving. In addition, since September 2020, cooking boxes with products from the meat substitute manufacturer Beyond Meat have also been available for U.S. customers to purchase.

In addition, a larger selection of recipes is to be offered. Furthermore, customer feedback will be used to improve personalization and adapt to consumer preference behavior.

Another strategy is to selectively increase distribution. This is to be done primarily in countries where there is a relatively high disposable income. Other criteria are high Internet penetration and a well-developed infrastructure.

In addition, the delivery centers are also to be increasingly automated. This will increase unit economics and also enable a wider selection as well as better personalization of service.

Lastly, financial ratios are to be optimized through economies of scale as well as operational improvement. Firstly, a further increase in efficiency is to be achieved. This is to be achieved by optimizing procurement processes and better menu planning. In the delivery centers, there should be an increase in productivity as well as better fixed cost utilization. All this would increase the contribution margin. Furthermore, a growing customer base will reduce the relative share of marketing expenses. Lastly, G&A expenses are expected to increase slower than overall growth.

The deep Analysis

Financials

Operational History

The company HelloFresh was founded in 2011 by Dominik Richter, Jessica Nilsson and Thomas Griese. In the beginning, they were fiancially supported and advised by the investment company Rocket Internet. However, Rocket later sold its shares again.

At the beginning of 2012, they started delivering cooking bags in Berlin. Later were delivered instead of these cooking boxes. Since September 2012, the company has been delivering throughout Germany. By the end of 2020, the company will be selling its products in 14 countries and expansion into new countries has already been announced. At first, an IPO was planned for 2015. However, this only happend about two years later. Since the 2nd of November 2017, the shares have been traded in the Frankfurt Prime Standard. Currently, the company has a market capitalization of approximately 10 billion euros. Since its founding, the Green Chef, EveryPlate and Chefs Plate brands have been have been acquired and integrated into the company. In November 2020, the US company Factor75 was acquired. Up to $277 million was due for this. Initially, $177 million was paid directly. The remaining $100 million is linked to performance-based components and will be paid upon achievement of certain financial metrics. Factor75 is one of the leading U.S. providers of ready-to-eat, fresh, and healthy and healthy meals. It is intended to strengthen the business in this market and, in addition synergies can possibly also be exploited.

Dividend

The company currently does not pay a dividend.

Share Structure

The shareholder structure is as follows. 8.91% of the company is owned by Insigth which is divided into the shareholdings of HF Main Insight S.à.r.l., HF Del Insight S.à.r.l. and HF Cay S.à.r.l. 6,52 % are owned by BlackRock INC, 11.1 % of the shares are owned by Baillie Gifford & Co, 0.19% are owned by the company and the remaining 73.28% are in free float in free float.

Note: The share structure of HelloFresh / Source

Chart

Valuation of the Stock

The development of the free cash flow is to be assessed as positive. While -73.7 million euros were still on the books as of Dec. 31, 18, this figure was already in positive territory at 3.40 million euros at the end of 2019. In the current year, free cash flow has already increased to 361.3 million euros at the end of the 3rd quarter. This corresponds to a margin of 37.24%. Marley Spoon is heading for an FCF of 1.90 million euros in the current year after an FCF of -34.7 last year. This results in a margin of 0.76%. Nestlé is expected to achieve a margin of 12.25%. Zalando is heading for a figure of 1.99%.

The company has reduced its leverage ratio from 56.98% to 53.27%, in contrast to the previous year's reporting date. In contrast, equity has increased, rising from 43.02% to 46.73%. Expressed in figures, the equity ratio has risen from 245.3 million euros to 518.5 million. Non-current liabilities now amount to 272.1 million euros and current liabilities to 381.9 million. The gearing ratio, i.e. the ratio of debt to equity, has fallen from 132% to 126%.

By comparison, Blue Apron had an equity ratio of only 25.56% at the end of 2019. Nestlé has an equity ratio of 41.31%.

Another way to evaluate a company is the price-earnings ratio. This puts the share price in relation to earnings per share. Since the company made a loss in 2019, this ratio was in negative territory this year.

Based on the 3rd quarter and with the share price as of the reporting date of Nov. 10, 2020, the P/E ratio is 31.21. At the end of the year and with forecast values, the value at the end of the year 2020 is 31.5. Again, a comparison with the direct competition makes little sense since they do not generate a profit. At the end of 2019, Nestlé's P/E ratio was 24.34, Zalando's was 112.19, and Delivery Hero's was 57.8.

Business Model

The company sells so-called cooking boxes. For these, ingredients are portioned and put together with the appropriate recipes. These so-called cooking boxes are then sold via a subscription model and then delivered to customers at a time of their choice. As we all know, subscription means recurring revenues with a good predictability - this leads to a high quality kind of revenue, compared to normal product sales. This is mainly done under the brand name HelloFresh but also under various other brands, such as EveryPlate. The business model breaks with the traditional supply chain model as there are no intermediaries such as distributors or wholesalers. It also works closely with its own network of suppliers as well as numerous local vendors. Key business processes are data and technology driven. The software makes it possible to make efficient purchasing decisions in ingredients procurement. Another important point is product innovation. As part of this, new recipes are constantly added and menu planning is revised. There are also additional products in the most important regions, such as premium boxes, different appetizers, seasonal boxes or even a wine list. Furthermore, there is a flexible ordering system where customers can pause or even cancel deliveries at any time. In addition, the company works closely with producers to offer customers fresh and seasonal products. The company works on the just-in-time principle, as a large part of the goods are perishable and therefore it is possible to operate with low stocks. The storage centers also serve as production sites, from which the cooking boxes are then delivered directly to the customers.

Note: HelloFresh Plans & Pricing

HelloFresh groups their customers into two regional segments - USA and International:

Management

HelloFresh is run by it's co-founders and long time employees. This is a good indicator, because they have some impressive skin in the game, through their ownership. This will lead the managment to always remember that their own money is on the line.

The management consist of:

- Dominik Richter - CEO - Dominik has been CEO since starting HelloFresh in 2011. He is responsible for keeping a general oversight of the business and strategy. Dominik’s an entrepreneur to the core and started his first two businesses while still at university. Dominik graduated from WHU with a degree in International Business in 2009, and from the London School of Economics in 2010 with a Masters in Finance and worked for Goldman Sachs before founding HelloFresh.

- Thomas Griesel - CEO - Thomas is responsible for the international segment at HelloFresh and co-founded the company with Dominik in 2011. Thomas previously worked at OC&C Strategy Consultants and started a range of his own businesses and ideas. He graduated from WHU with a degree in International Business Administration in 2009, and from the London Business School in 2010 with a Masters in Management.

- Christian Gärtner - CFO - Prior to joining HelloFresh, Christian spent 19 years in banking, most recently at Bank of America Merrill Lynch where he ran the Equity Capital Markets business for the German speaking region. Prior to that he was at Goldman Sachs in London and Frankfurt.

- Edward Boyes - CCO - Ed joined HelloFresh back in 2012 and co-founded the company's UK business as CEO of HelloFresh UK. Four years later he was appointed CEO of HelloFresh in the US. In January 2020 Ed joined the HelloFresh Management Board as Chief Commercial Officer. Before joining HelloFresh, Ed worked at Booz & Company. He previously graduated from Oxford University with a degree in Economics and Management in 2010.

Source: HelloFresh

Insiders are holding approximately about $2820 Mio in own shares. This is a huge and impressive amount.

Competition

The cooking box market has shrunk to a market dominated by a few companies after a real "hyper competition" that prevailed in the years 2013-2017. One of the main competitors in recent years, BlueApron, has been losing market share for years and only marginally benefited even from the Corona pandemic. The companies Instacart and freshdirect offer a similar business model and are mainly active in the North American market. Amazon is represented in various countries by its subsidiary Amazon Fresh and sells fresh food via its own website and in its own stores in the USA. In addition, they offer cooking boxes in the USA via their stationary retail chain Wholefoods. However, a comparison with Amazon's figures is not very useful as Amazon only publishes bundled figures for the entire group. Another competitor is Ocado. The company, which originates from Great Britain, is a supermarket that sells its products exclusively online. In addition, there is MarleySpoon, a company from Germany, which is a competitor especially in the Australian market. Finally, I would like to mention the company Freshly. This company sells meals that only need to be heated up. They have a large customer base, especially in the USA. At the beginning of November 2020, they were taken over by Nestlé.

Note: HelloFresh Competitor Martha / Marley Spoon

What to expect in the near future

Acquisitions-Strategy

HelloFresh will make further acquisitions in the near future, which will either further expand the main business of cooking boxes or other new segments, such as that of Factor75. These acquisitions are easily possible due to the good cash position and I also expect them as an investor.

New Market-Strategy

HelloFresh plans to attack new markets - currently 2 new countries per year. In particular, the Asian region leaves a lot of room for dreaming, since the acceptance of food delivery and online food delivery is already much more widespread there. A wealthy target group complements the potential there.

New Product / Product-Segment-Strategy

Most of all, as an investor, I expect expansion and creativity into new product segments in online grocery. A strong expansion of the Factor75 business and HelloFresh GO are just the beginning here - there is plenty of room and space for further growth and more innovations in the coming years.

Conclusion

At the end, it now lends itself to a final verdict on the company.

On the one hand, I find it problematic that it is basically a product that is easy to imitate. The company has a small moat due to its position and large market share, but in my opinion it does not have a unique selling proposition. If a company like Amazon or Nestlé were to decide to open up the market further, there is little that HelloFresh can do to counter this.

In addition, it is also questionable how sustainable the development is that was caused by the current situation. It remains to be seen whether customers can be retained or whether sales will drop sharply after the end of the Corona pandemic.

On the other hand, however, steady growth was already evident in the years before Corona. Among other things, positive EBIT was already achieved in the previous year.

Furthermore, the company has a stable capital structure with a high equity ratio, which has even been increased in recent years. The return on equity, which will be in the region of 70% at the end of the year, is very positive, not only in relation to the value recommended in the specialist literature, but also in comparison with companies in similar fields of business.

The EBIT margin also compares favorably with other companies.

In addition, the free cash flow margin of over 37% is above average. From these funds, any debts can be repaid and the profit can be retained or used to pay dividends. Furthermore, the capital turnover is good and if the expected sales are achieved, the ROI is similar to that of Nestle.

Apart from the figures, there are also positive developments at the company. Already at this stage, steps have been taken for the time after Corona. On the one hand, the company Factor75 in the USA has been acquired, this can strengthen the company's own position in this market. In addition, synergies such as the use of cost allocations or a better analysis of customer preferences through more data can be exploited. With this purchase, the company is also defending itself against Nestlé, which bought up a similar company with Freshly. In addition, the CEO announced that the company will expand into one or two more countries in Europe in the coming year.

It should also be noted that HelloFresh is the only company listed on the stock exchange that generates a positive net income from the sale of cooking boxes.

The valuation on the capital market is also appropriate in my opinion. Compared to other e-commerce companies, the P/E ratio is very low, and even compared to an established company like Nestlé, it is only about 30% higher. The return on sales is also at a good level compared to similar companies.

In addition, the pandemic also led to a relatively strong increase in sales compared to other competitors.

In my opinion, the company is well on the way to further expanding and consolidating its market power as long as new markets can be opened up and its market penetration can be further increased.

Our recommendation: This stock is a clear buy. Use a sell-off for buying in or averaging up and use further price-falls to average up.

Disclaimer & Conflict of interest

The author currently holds a position in the mentioned stock. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Revenue, Contribution Margin and AEBITDA by Quarter

Free Cashflow by Quarter

Customer Metrics by Quarter

Adjusted EBITDA vs. Orders

Region Split by Revenue and AEBITDA

Guidance Increases 2020

Chart

Peers

All the Peers

FlexShopper Inc.

Bullish

Tattooed Chef Inc.

Neutral

Build-a-Bear Workshop Inc.

Outperform

Stamps.com Inc.

Bullish

Redfin Corporation

Bullish

Perion Network Ltd.

Outperform

Upwork Inc.

Bullish

Chegg Inc.

Bullish

Pinterest Inc.

Bullish

urban-gro

Bullish

Wingstop Inc.

Bullish

The Wendy´s Company

Neutral