The Search

Your Search Results

News from us

Newest Symbols

Newest Industries

Click to expand

Advertising

See Stocks

Automotive

See Stocks

E-Commerce

See Stocks

E-Learning

See Stocks

Electricity

See Stocks

Engineering

See Stocks

FlexShopper Inc.

Bullish

Bullish

Tattooed Chef Inc.

Neutral

Neutral

Hellofresh SE

Bullish

Bullish

Build-a-Bear Workshop Inc.

Outperform

Outperform

Stamps.com Inc.

Bullish

Bullish

Redfin Corporation

Bullish

Bullish

Perion Network Ltd.

Outperform

Outperform

Upwork Inc.

Bullish

Bullish

Chegg Inc.

Bullish

Bullish

Pinterest Inc.

Bullish

Bullish

Bluelinx Holdings Inc

Bullish

Bullish

Momentus Inc.

Neutral

Neutral

Mynaric AG

Neutral

Neutral

Virgin Galactic Holdings Inc.

Neutral

Neutral

Maxar Technologies Inc.

Neutral

Neutral

Sunrun Inc.

Bullish

Bullish

Steico SE

Neutral

Neutral

Alfen N.V.

Neutral

Neutral

Research

Content Cards

Swipe

Our Article

Build-a-Bear Workshop Inc. - Article

Research: Build-a-Bear Workshop - Is It to Cute to Resist?

Note: An online exclusive “Swarovski” colloboration-bear / Source

Table of Content:

- Author’s Opinion

- Introduction to the Company

- Why is it so beloved?

- The Read between the lines

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author’s Opinion

Build-a-Bear Workshop is a unique company, the likes of which are rarely found. Children and teens in the US and UK love the company, which is known for its cute and uplifting teddy bears that you get to stuff and dress yourself. Build-a-Bear Workshop sells a well-conceived experience around the teddy bear, rather than just a stuffed animal. Through this ingenious concept, Build-a-Bear Workshop can also sometimes call outrageously high prices for its teddy bears. The many dress-up options or scent and sound upgrades also keep customers coming back to the stores to customize their teddy bear to the latest trends. Strong partnerships with Disney or Harry Potter enable hyped collections like of “Star Wars: The Mandalorian” or “Disney Frozen”. In particular, corporate transformation and Covid-19 greatly accelerated digital transformation and hybrid strategy, make Build-a-Bear an extremely exciting company, what every child and every investor loves.

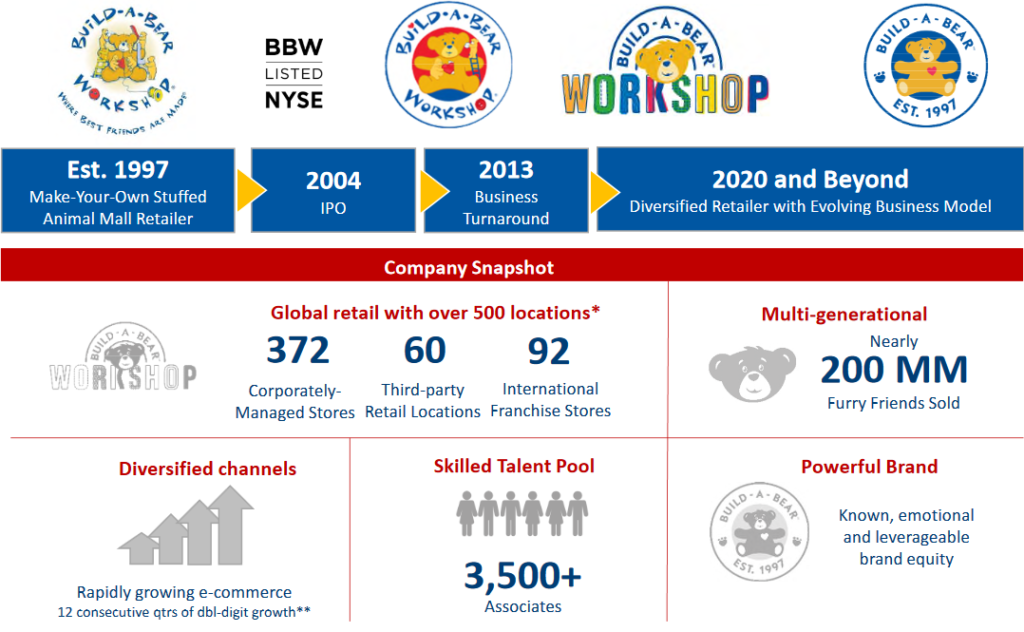

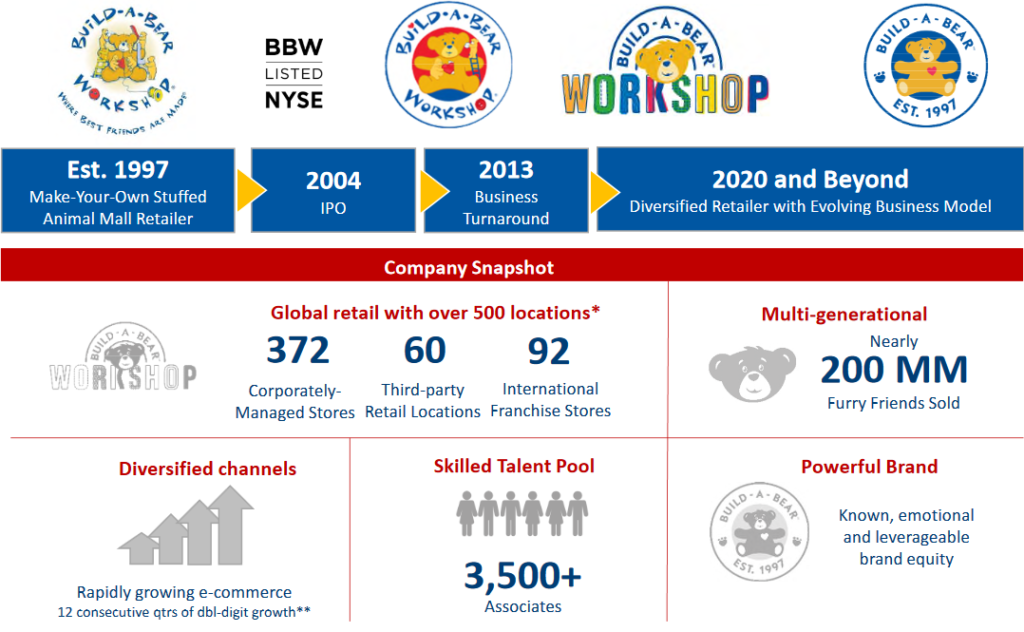

Introduction: Let the company introduce itself

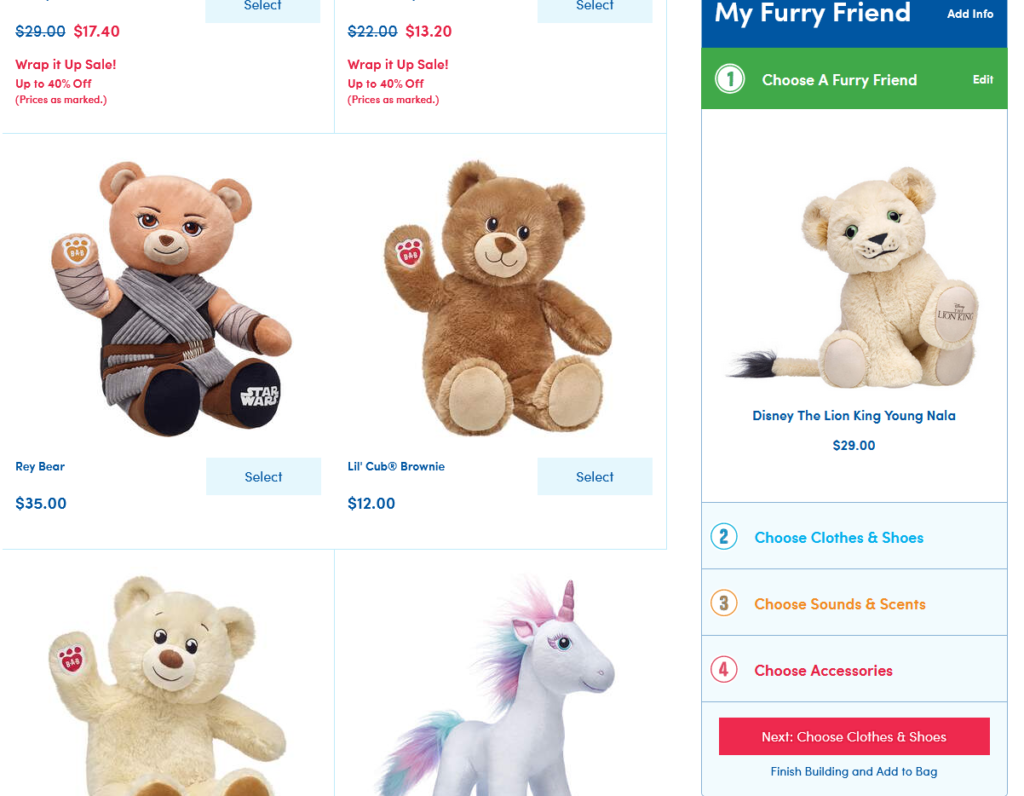

Build-A-Bear is a multi-generational global brand focused on “adding a little more heart to life” appealing to a wide array of consumer groups who enjoy the personal expression in making their own “furry friends” to celebrate and commemorate life moments. The 500+ interactive brick-and-mortar retail locations provide guests of all ages an interactive entertaining experience, which often fosters a lasting and emotional brand connection. The company also offers an engaging e-commerce/digital purchasing activity called the “Bear-Builder” at www.buildabear.com. In addition, the company leverages its brand’s power and equity beyond retail through entertaining content, wholesale products and non-plush consumer product categories via licensing agreements with leading manufacturers. Build-A-Bear Workshop, Inc. (NYSE:BBW) posted total revenue of $338.5 million in fiscal 2019. For more information, visit the Investor Relations section of buildabear.com.

Source: buildabear.com

Note: Build-a-Bear at a glance / Source

Why is Build-a-Bear so beloved?

It’s the Workshop Concept

Build-a-Bear has a unique shop concept: The kids and teens rush into the store and then register themself by an shop assistant, who accompanies the kids through the whole build the bear process. This process of building the plushy friend consist of several steps and takes more than 10 minutes. That’s why the shops are naming themself a ‘workshop’. The process consist of:

- Entering the store

- Registration and welcome by a shop assistant

- Selection of the not yet stuffed plushy animal

- Giving the plush a name and some kissing and wishing for it to come alive

- Choosing of a long lasting scent or some special audios

- Stuffing the animal together with the help of an shop-assistant

- Selecting some clothes and extras for the stuffed friend

- Walking out of the store very happy

So in summary, Build-a-Bear is offering more than just a teddy – going there is a whole experience for the family. To understand this even more, we highly recommend you to watch the following video, where the whole process is very good described.

Note: In this video, little Ryan is experiencing the whole Build-a-Bear entertainment.

Hyped Franchise Deals and Collections

Build-a-Bear has, of course, in addition to their own teddy bears, crocodiles and mythical creatures, well-known “characters” from world-famous franchises. Among them are for example the partly permanently sold out Baby Yoda figures from Star Wars or Harry Potter. Other well-known franchises include Star Wars, Disney’s Frozen, The Lion King, DC, Marvel, Trolls, Pokémon, but also sports clubs from the NFL, NHL, …. .

Build-a-Bear has extremely many of these world-renowned franchise characters and is currently benefiting greatly from them, as they are very well known and downright hyped among children, but also adults. Build-a-Bear knows this by now and launches limited drops of these again and again to further celebrate the hype and promotes this specifically.

In addition to the already very expensive franchise figures, franchise accessories such as laser sabers, wands or Baby Yoda baskets can earn good money, especially if you buy everything in a bundle and thus supposedly save money.

In addition to well-known franchises, Build-a-Bear also has its own collections, some of which are aimed at collectors and no longer at children. An example of this would be the colloboration with Swarovski – these bears sometimes cost over $100.

Note: Lando Calrissian Set from Star Wars franchise / Source

Entertainment focused Hybrid-Model

Build-a-Bear has a dual hybrid model. First, as described earlier, the company aims not to sell a teddy bear as a raw product, but to sell an experience around the personalized teddy bear. This hybrid experience is further enhanced by all the “workshop” activities within the store, as well as the active involvement of children in “building” the bear. Furthermore, the locations of the individual stores are also crucial: for example, the stores are mainly located in malls, but also in hotels, on cruise ships or in “resorts” in order to further tie in with the experience here.

Note: Build-a-Bear 3rd party partners / Source

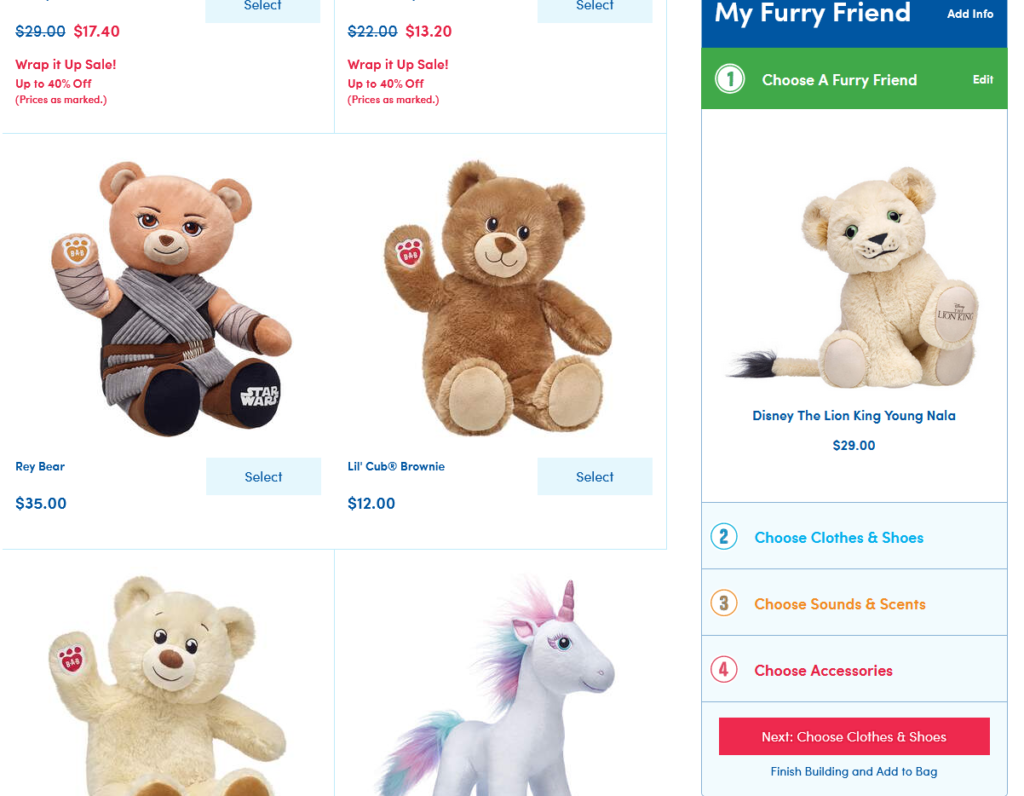

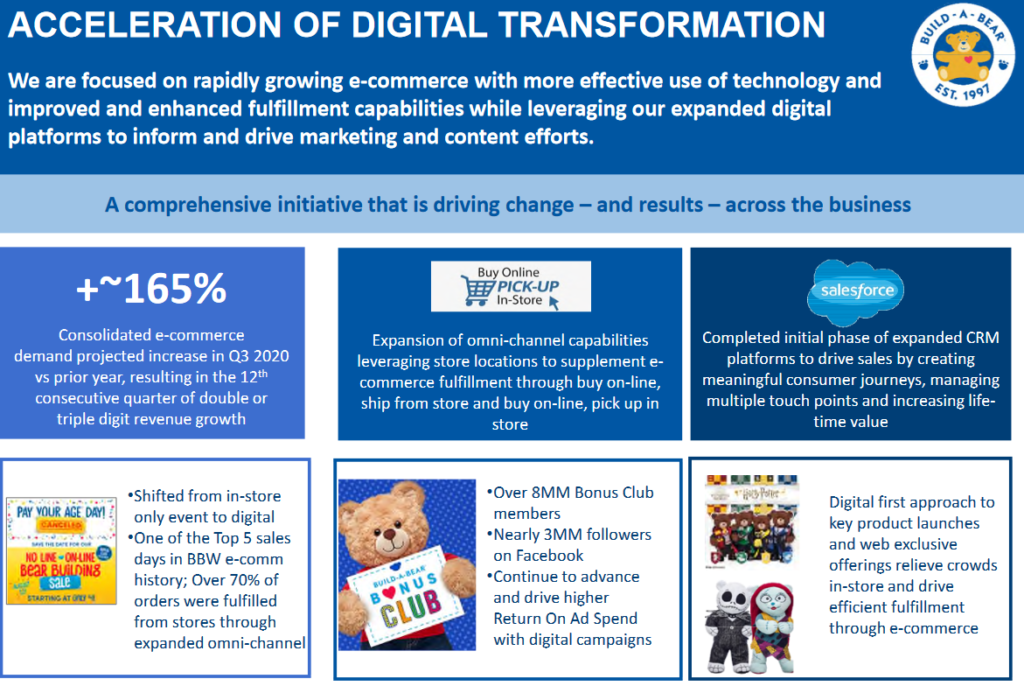

The second hybrid model captures the sales channels – Build-a-Bear is currently developing into an extremely exciting e-commerce hybrid model – somewhat faster than originally planned, involuntarily triggered by the Covid-19 pandemic.

Build-a-Bear, until the Corona crisis, was primarily store-focused, with a rapidly growing online store, which was managed separately. Due to pandemic workshop closures and contact restrictions, that has rapidly changed.

This has now changed and the online store and the stores go hand in hand. This means that the online store is now expanding and replacing the real physical experience of the workshops. It offers the opportunity to explore all the products and do the build-a-bear process yourself. At the end of the process, you have the choice of “simply” having the bear delivered to your home ready to go, or catching up on the main event of the creation process namely stuffing the teddy in a store. So you can have your half-finished bear sent to a store and complete the rest of the experience there. Possibilities are: Buy-online, ship-from-store and buy-online, pick-up-in-store or curbside. An advantage from this is, that customers can be fulfilled from either store-capacities or from warehouses, which means less logistical hurdles.

Online exclusive offers and bundles, as well as store events and a very well-constructed online store with features complete the model.

Note: The Bear-Builder is part of the hybrid concept.

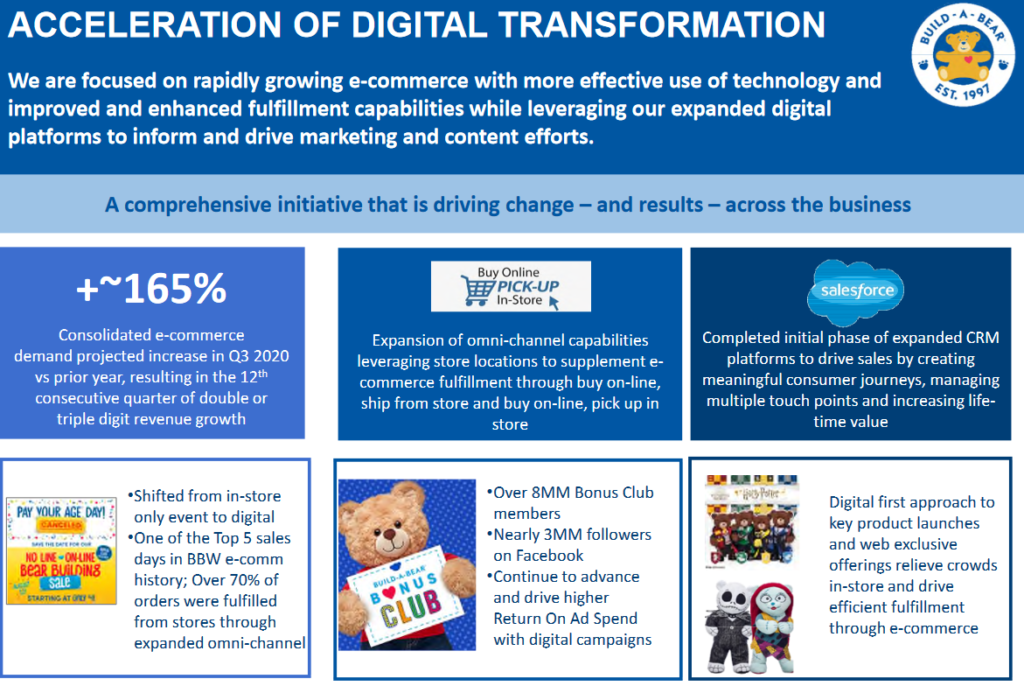

Accelerating E-Commerce at a high pace

Build-a-Bear started building its online store a few years ago – this is now paying off more and more, especially in the hour of the pandemic. For example, in the last quarter, sales via the onlineshop increased by 167% year-over-year – this growth has resulted in Build-a-Bear’s overall sales being slightly positive. This dramatic turnaround alone, that the hybrid online store can now impact the company’s business so strongly, speaks volumes about the future importance and role of the online store.

For this reason, the management has further strengthened the focus on e-commerce. The focus will be much more on digital campaigns in the future, exclusive “online exclusives” will be introduced, as well as improvements to the store, logistics and CRM. This should bring about further strong growth of the online business. As Build-a-Bear already has a good presence in social media, good digital conversions can be achieved here and hypes can be prepared.

The already good digital hybrid model in conjunction with the physical workshops will be further strengthened. In this way, higher margins and sales can be achieved with fewer staff.

Note: Build-a-Bear digital strategy / Source

National Teddy-bear day, Bonus-Club, Cubscription Box, Radio, Parties and #hashtags

As described in the previous chapter, the company is trying to keep its customer base happy with additional digital features and to further expand the digital experience outside the stores.

For example, Build-a-Bear has declared “National Teddy Bear Day” on 9th of september, which is an immense shopping event, similar to “Prime Day” for Amazon.

In addition, Build-A-Bear has launched the Build-A-Bear Bonus Club, a kind of points collecting club for loyal customers, which provides exclusive offers and surprises for loyal customers – such bonus programs have always paid off for companies, regardless of the industry and ensured recurring sales for existing customers – in addition, with such programs you learn a lot of details and data about your customers.

Note: Build-a-Bear Bonus Club is driving recurring revenue from existing customers.

The Cubscription.com box was also recently launched – a similar concept to cooking boxes. These boxes can be subscribed to and contain a teddy bear, Build-a-Bear franchise items and clothes for the bears. The boxes are lavishly presented and uniquely scarce. It remains exciting how the concept will develop.

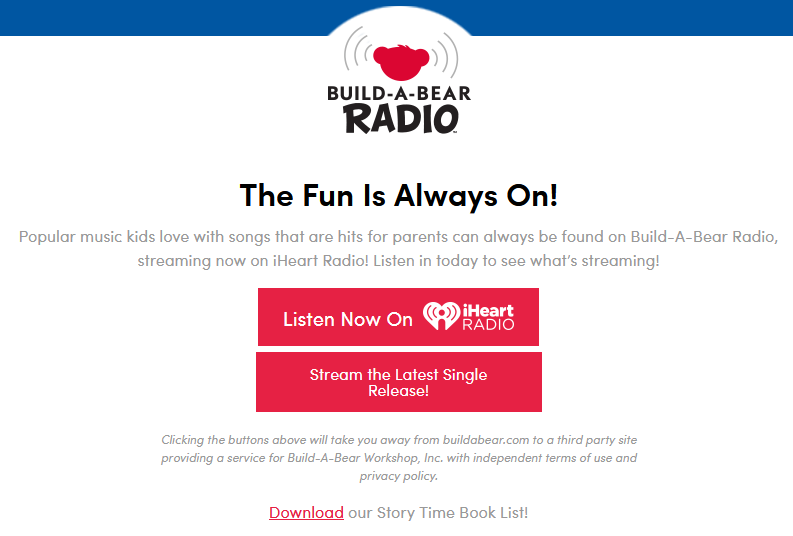

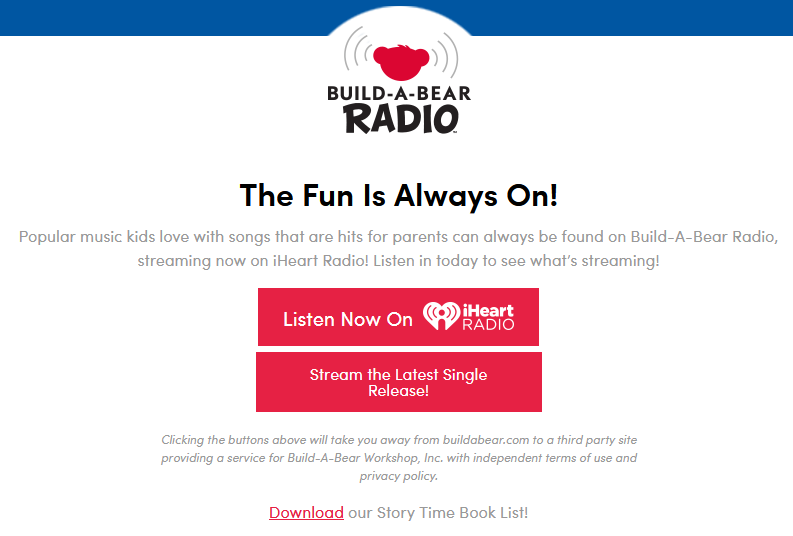

To keep the kids entertained and tuned in to the bears by the minute, there is the Build-a-Bear radio station to be omni present and literally on the kids’ minds. Here, too, the company wants to offer even more in the future and further expand this entertainment option with an advertising factor.

In addition to the radio fun, there is also the possibility to celebrate Build-a-Bear parties, similar to the children’s birthdays at McDonalds – whether the concept will be pursued further in the future is questionable, due to the Corona situation.

The company’s approach to social media, on the other hand, is particularly exciting and innovative – it has its own hashtags, the possibility of sharing its experiences and teddies via the hashtags or via the homepage, and thus maintaining the hype in the community. This is already very good and will be further strengthened in a short time. In summary, Build-a-Bear is currently following the right trends and neglecting old concepts that are no longer current.

Note: Build-a-Bear Radio

Tolerated premium Prices and Margins

With the brand established for years and the entertainment and excitement built around the bear, the company has managed to achieve premium prices and margins on its products. Somewhat comparable to Apple – Build-a-Bear is the Apple of teddy bears – available in masses, but very expensive and in the end with high margins for the company. In the meantime, standard franchise figures cost around 50$ – with clothes or in a bundle over 60$. “Boring” standard teddy bears cost around 20$ – if you dress them up or give them a sound and scent, you’re quickly in the 40$ region.

Especially due to the additional extras, like the above mentioned scents or clothes, which almost every kid buys, their can be generated extra nice dollars and high margins. And also these extras are franchiseable, like The Mandalorian sound theme, Pikachu sounds or Star Wars light Sabers.

In the most recent quarter, the company achieved an impressive 46,5% retail gross margin.

Margin Camparison Q3 2020 Apple, Build-a-Bear, Hasbro and Mattel:

The Turnaround has been successfully initiated

Build-a-Bear has been a twisted success story with some bitter taste. While Build-a-Bear has managed to grow and expand it’s store and location network over the last years, their margins steadily decreased or stagnated, but didn’t really grow. As a result of that, the comapny had rising costs due to the increased headcount for their many stores, but decreasing profits and revenues on a like as like basis. This has resulted in an steady decrease of the comapanie’s stock price. And finally, the Covid-19 pandemic tried to kill the company finally, but failed – due to the successfully launched turnaround strategy in early 2019. The turnaround consists of so many factors and facettes, which most of them were already mentioned above. To name some, most of the turnaround was established by focusing on e-commerce and delivering a solid hybrid model. In addition famous franchise deals, exclusive deals and innovations delivered further growth. Key initatives, which were planned for 2021 are going live now, to fuel even more the sales and margins.

As previously noted, we’ve been able to accelerate key initiatives that were once slated for 2021 and beyond, but are now underway in an aggressive manner with the goal to drive sales, both online and in reopened stores and through additional diversified revenue streams.

Importantly, we are seeing the benefits as we implement these innovative solutions and comprehensive programs that are intended to drive transformative change and results through our entire business and organization.

Source: Sharon Price John, CEO – Q3 2020 Earnings Call

Excellent public Reputation and a high level of Corporate Social Responsibility

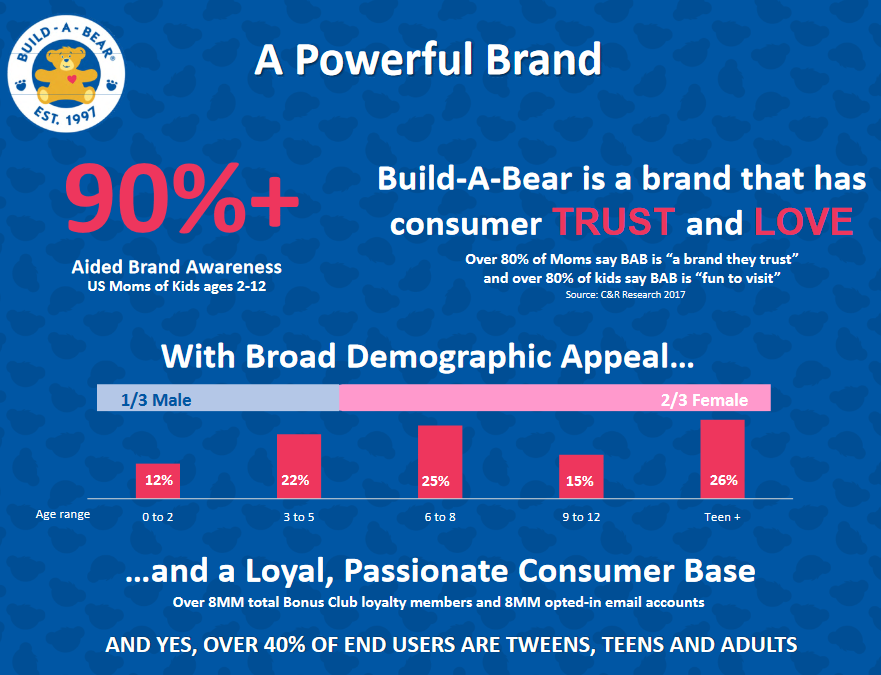

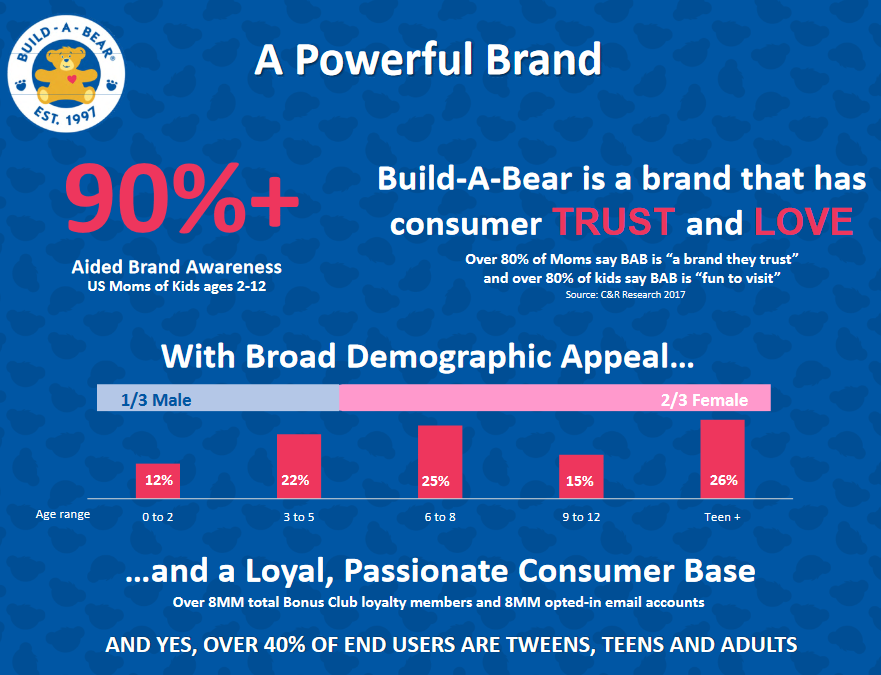

Build-a-Bear has an interesting and unique target group – more than a quarter of the customers are at a teenage or older, which reflects the strenght of the branding. The target group can be seen below:

Note: Build-a-Bear customer base / Source

Build-a-Bear benefits from an extremely positive public image – after all, who doesn’t love cute teddy bears and their “call to life”, which is lovingly dedicated to children?

In addition, the company is committed to the public with its own foundation and also tries to disadvantaged or particularly honorable people to conjure a smile with the bears on the lips.

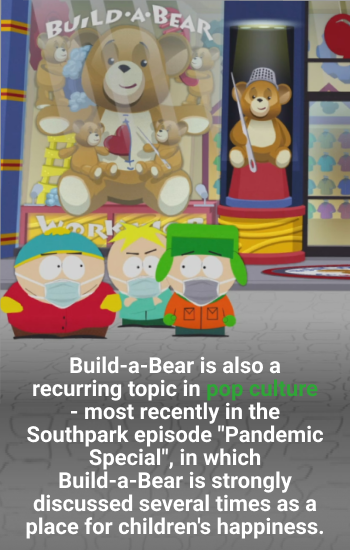

In addition, Build-a-Bear is also a recurring topic in pop culture – most recently, for example, in the latest Southpark episode “Pandemic Special”, in which Build-a-Bear is strongly discussed several times as a place for children’s happiness – such media attention should have an extremely positive effect on the company, considering that the episode reached around 2.3 million viewers on the first day alone.

Note: Build-a-Bear during the South Park Episode “Pandemic Special” / Source

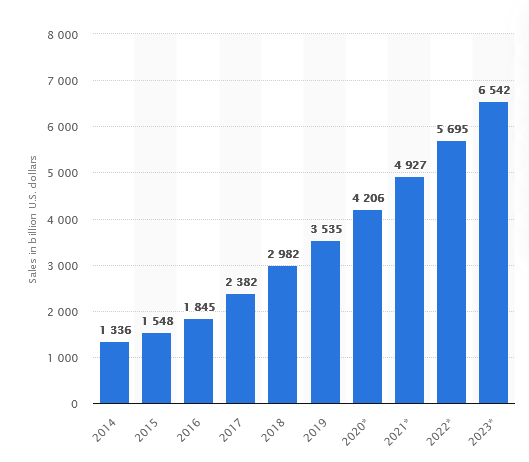

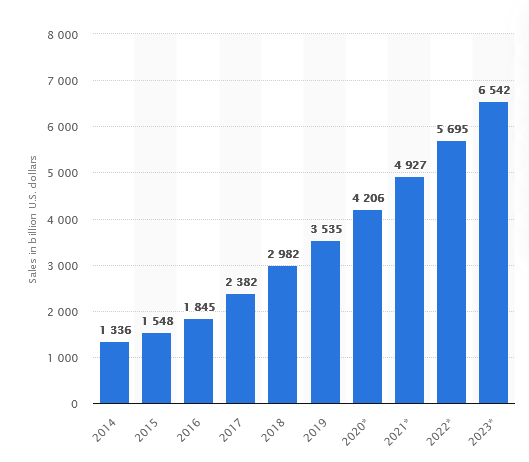

A strong growing market

Build-a-Bear operates in a mixed market – while the market for dolls & stuffed animals is expected to grow only about 1% per year until 2025, the e-commerce sector is experiencing a very strong dynamic, which is shown below. Since the company is focusing very strongly on this market and is strongly expanding the advantages with its hybrid strategy, the company should also benefit from this dynamic for many years to come.

Note: Retail e-commerce sales worldwide from Statista / Source

Recent News and Updates

The Release of the Results for the third Quarter 2020

Build-a-Bear has released it’s latest earnings release on 3rd of December, reflecting a strong rebounce of the business, which has been crushed in the first and second quarter of 2020, due to harsh workshop closures and a not optimal focus on the e-commerce strategy. The newest numbers reflect the ongoing strenght of the digital hybrid strategy, which is highlighted by an 167% increase in digital sales, which has led to an positive year-over-year revenue growth. Most notable is, that even with many stores closed or “defect revenue streams”, like workshops on cruise-ships and a 7% reduction in opening days + a 25% reduction in opening hours, the company was able to outperform last years period and was profitable. This alone speaks a lot for the new strategy and shows, that the initiatives are bearing fruits very fast.

- Total Revenues increased 6.1% Year-over-Year to $74.7 Mio

- EPS (“EPS = Earnings per share”) increased to $0.11 from a loss of 0.40 in 2019

- Retail Gross Margin increased to 46.5% vs. 39.5% the period before

- Due to store closures of unprofitable workshops, the company managed storecount decreased to 358 vs. 371 or 790,310 sqf vs. 799,831 sqf

Build-a-Bear has not published any guidance for the 4th quarter, but revenues should be above $100 Mio, due to the strongest quarter.

In Addition, the company had net cash of about $26 Mio on hand and no debt. The management has also achieved to renegotiate 99% of all rents in north America and 90% in UK.

For additional informations, please have a look at their latest earnings release.

New Collections, Initiatives and Digital Strategy

Build-a-Bear has recently released several press releases, describing new initiatives and features for their digital hybrid-strategy and holiday season – to name some:

- Build-a-Bear celebrates the holidays with gifts for everyone –> focusing on the christmas holiday season

- Build-a-Bear Entertainment announces film premiere of “Deliver by Christmas” –> this is a film by the company to engage with its audience for the holiday season

- Build-a-Bear celebrates the Holiday season with gifts for the whole family –> this focuses on the thanks-giving holiday seasons

- Build-a-Bear celebrates their own National Teddy Bear day with an mega livestreaming event –> reacting creative to engage with the social distancing community

- A Harry Potter-inspired collection is Apparating into Build-a-Bear –> announcing a big franchise collab with the Harry Potter franchise

For additional informations, please have a look at their newsroom.

The Read between the lines – Earnings Call

The aggregated information of the Q3 2020 earningscall can be seperated into three different categories, the three main pillars of Build-a-Bears future strategy: Digital Strategy, Retail Footfprint and Financial Stability:

Digital Strategy:

- Build-a-Bear was able to leverage available store labor and invetory to support the heightened digital demand with buy-online, ship-from-store and buy-online, pick-up-in-store or curbside. Regarding the acceleration of our digital transformation, we remain intent on rapidly growing e-commerce with more effective use of technology and improved and enhanced fulfillment capabilities, while leveraging our expanded digital platform to inform and drive marketing and content efforts. We continue to see robust demand for key licensed products, including new Harry Potter collection, which launched as an online exclusive before expanding to all store distribution. We also had good results with this year’s Halloween collection and we continue to see upticks in sales of gifting products, as consumers seek out creative ways to stay connected, while many remained more home-based than in the past. Finally, we see the creation and digital delivery of content as an important part of the expression of our brand and as a tool to drive further consumer connection that tends to generate incremental sales over time. For example, we’ve created engaging live streaming events with key promotions such as the National Teddy Bear Day and to reveal new product introductions which we plan to expand going forward.

Retail Footprint:

-

Our second initiative is to maintain a profitable real estate portfolio as we continue to evolve our real estate stores in response to macro business and traffic trends. We were pleased with the high level of staff that returned from furlough and the retention levels that were maintained even after we put in a reorganization that eliminated a number of positions. And in addition to the actions taken to lower rent for both the short and longer term, we have been intently focused on reducing operating expenses at the store level.

We had an improvement in gross profit margin of 720 basis points compared to the prior year. This is the result of several initiatives, but there are two that are particularly important to call out. First, as previously reported, over the past several years, we have strategically positioned our retail store portfolio to have high lease optionality and flexibility. And second, following the temporary measures to furloughing associates and reducing salaries for those remaining, we completed a corporate reorganization that was planned prior to the pandemic, with reduced headcount and realigned leadership responsibilities to better support the execution of our current and longer-term strategic initiatives. For the quarter in North America on average, stores recaptured more than 100% of prior year sales following the reopening, inclusive of buy-online and ship-from-store orders while in the UK, e-commerce drove revenue at a higher pace than the brick and mortar stores. Both conversion and transaction value saw a meaningful increase. While similar to other retails, we saw declines in consumer traffic in both geographies. Looking forward, we remain cautious in regards to our expectations and we continue to prioritize digital initiatives given that uncertainty surrounding physical store operations in various communities and jurisdiction.

Note: Build-a-Bear customer base / Source

Financial Stability:

- Securing financial stability with the liquidity needed to support our business with an eye to the long-term positioning, including finalizing a new five-year asset-based credit facility

The deep Analysis

Financials

Operational History

Build-a-Bear has been listed on the New York Stock Exchange since 2004. Since then, the business has developed in a mixed manner. Although the interantional and national retail footprint has continued to grow, the business and numbers have not been convincing, especially in recent years. This has to do with a decline in like-for-like sales and falling margins. This trend can also be observed in the chart. With the onset of the Corona crisis, the business has fallen further into difficulties, but has now been able to recover strongly thanks to the digital hybrid strategy and is well on the way to further explosive positive development.

Dividend

The company currently does not pay a dividend.

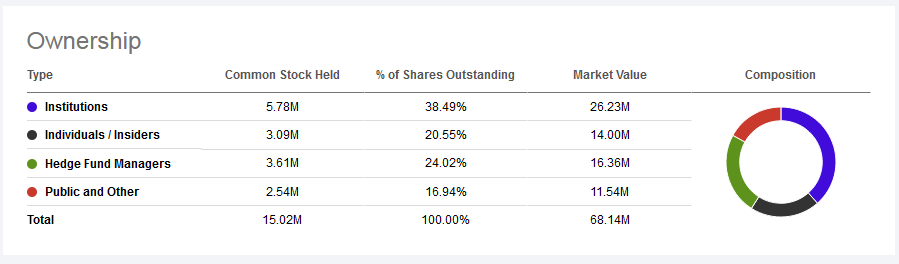

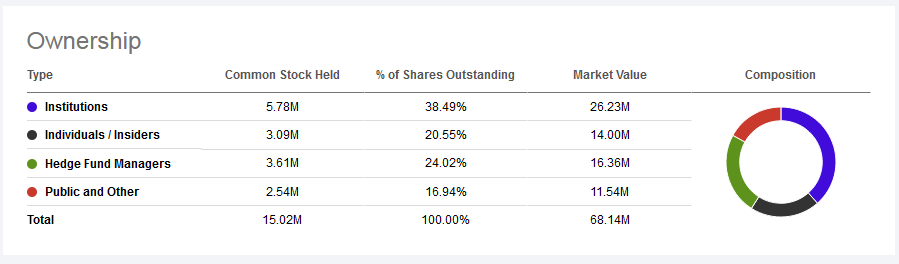

Share Structure

Build-a-Bear uses a one class share system. Most notable is the low public float and the high insider ownership.

Note: The share Structure of Build-a-Bear / Source

Insiders are holding approximately $14 Mio in shares, which is not a very high amount in totals, but an high procentual amount to the market cap. Most notable insiders are the founder, the CEO and other directors.

Chart

Valuation of the Stock

Build-a-Bear is currently low to very low valued. Due to the lack of analyst consensus, there is no real possibility to calculate an one-year forward non-GAAP P/E-Ratio (“P/E-Ratio=Price to Earnings Ratio”). But if we look at the Price/Revenue-Ratio, we have an very low value of about 0.25 for 2020.

The formula is simple: Build-a-Bear has currently the marketcap of its Q3 2020 sales. If the company manages to preserve its Q3 margins and increase sales continously and be profitable, this stock is very undervalued. For comparison, Mattel is currently trading at and Price/Revenue-Ratio of 1.35, which brings above 4x upside potential.

Business Model

Build-a-Bear has an easy to understand business model. More than 97% of the companys revenues come from its Retail Segment, which includes the company operated stores and the onlineshop. The rest of the revenue comes from the Commercial Segment and the Franchising Segment.

Note: Commercial Segment and International Franchsing Segment explained / Source

Build-a-Bear earns it’s money from selling stuffed animals and teddybears and additional extras. The other two segments include royalities fees or franchise fees.

Business Segments and their revenue split by Q3 2020:

- Retail Segment – 97.3%

- Commercial Segment – 1.9%

- International Franchising Segment – 0.8%

Management

Build-a-Bear is run by it’s long time employees, which have built the business, formed it and transformed it. But they have also misled the company to an false path most of the years – but now they can change it.

- Sharon Price John – CEO – Sharon John, 56, was appointed to the Board of Directors on June 3, 2013 in connection with her employment as Chief Executive Officer and Chief President Bear of the Company. From January 2010 through May 2013, Ms. John served as President of Stride Rite Children’s Group LLC, a division of Wolverine World Wide, Inc., which designs and markets footwear for children.

- Voin Todorovic – CFO – Voin Todorovic, 45, joined Build-A-Bear Workshop in September 2014 as Chief Financial Officer. Prior to joining the Company, Mr. Todorovic was employed at Wolverine World Wide, Inc.

- J. Christopher Hurt – COO – J. Christopher Hurt, 54, joined Build-A-Bear Workshop in April 2015 as Chief Operations Officer. Prior to joining the Company, Mr. Hurt was at American Eagle Outfitters, Inc. from 2002 to April 2015 in various senior leadership roles of increasing responsibility.

- Jennifer Kretschmar – CMO – Jennifer Kretchmar, 47, joined Build-A-Bear Workshop in August 2014 as Chief Product Officer and Innovation Bear. Effective March 2016, she now holds the title of Chief Merchandising Officer. Prior to joining the Company, Ms. Kretchmar was Senior Vice President of Product and Brand Management with the Stride Rite Children’s Group of Wolverine World Wide, Inc

Source: Build-a-Bear

Insiders are holding approximately about $14 Mio in own shares.

Competition

Build-a-Bear has no real competition in the North American market and little to no in the UK. That’s because no other company sells teddybears and stuffed animals in the way like Build-a-Bear does, the way of entertainment.

Looking at a broader range, there is of course competition from other companies like Amazon or Disney, who sell their own cheap stuffed animals. There is also competition from other toy comapnies like Hasbro or Mattel, but there is no real match with the business of Build-a-Bear.

What to expect in the near future

Digital-Strategy

As announced in the earnings call, Build-a-Bear will focus on expanding its digital channels and the associated integration into the hybrid model. If the company succeeds in further increasing digital sales, this strategy could provide new strong growth impulses and catapult the company to new heights. This strategy should leverage margins, increase sales and decrease headcount and administrative costs.

Retail-Footprint-Strategy

As also announced in the earnings call, Build-a-Bear will focus on a strong improvement of its retail footprint. This includes the detailed evaluation of profitable locations, the expansion into new territories and a fundamental optimization of the stores in connection with the hybrid connection to the online store. The low store numbers in all markets offer a lot of potential for new openings. The Asian market, which is known for luxury and consumption, is currently still completely untapped – here a lot of further potential is waiting.

Conclusion

Build-a-Bear is a company beloved by all ages that is currently at a very critical inflection point. If the digital transformation, which has been very successful so far, succeeds, Build-a-Bear should rise again to its old heights and glory. Based on the current valuation of the share and the security of the balance sheet, the company is clearly a buy. Nevertheless, one should be very cautious here, as the company is extremely small in terms of market value and is therefore a “plaything” for the market.

Our recommendation: This stock is a buy. Use the current price for buying in or averaging up and use further price-falls to average up.

Disclaimer & Conflict of interest

The author currently holds a position in the mentioned stock. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Build-a-Bear Workshop Inc. - Article

Research: Build-a-Bear Workshop - Is It to Cute to Resist?

Note: An online exclusive "Swarovski" colloboration-bear / Source

Table of Content:

- Author's Opinion

- Introduction to the Company

- Why is it so beloved?

- The Read between the lines

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author's Opinion

Build-a-Bear Workshop is a unique company, the likes of which are rarely found. Children and teens in the US and UK love the company, which is known for its cute and uplifting teddy bears that you get to stuff and dress yourself. Build-a-Bear Workshop sells a well-conceived experience around the teddy bear, rather than just a stuffed animal. Through this ingenious concept, Build-a-Bear Workshop can also sometimes call outrageously high prices for its teddy bears. The many dress-up options or scent and sound upgrades also keep customers coming back to the stores to customize their teddy bear to the latest trends. Strong partnerships with Disney or Harry Potter enable hyped collections like of "Star Wars: The Mandalorian" or "Disney Frozen". In particular, corporate transformation and Covid-19 greatly accelerated digital transformation and hybrid strategy, make Build-a-Bear an extremely exciting company, what every child and every investor loves.

Introduction: Let the company introduce itself

Build-A-Bear is a multi-generational global brand focused on “adding a little more heart to life” appealing to a wide array of consumer groups who enjoy the personal expression in making their own “furry friends” to celebrate and commemorate life moments. The 500+ interactive brick-and-mortar retail locations provide guests of all ages an interactive entertaining experience, which often fosters a lasting and emotional brand connection. The company also offers an engaging e-commerce/digital purchasing activity called the “Bear-Builder” at www.buildabear.com. In addition, the company leverages its brand’s power and equity beyond retail through entertaining content, wholesale products and non-plush consumer product categories via licensing agreements with leading manufacturers. Build-A-Bear Workshop, Inc. (NYSE:BBW) posted total revenue of $338.5 million in fiscal 2019. For more information, visit the Investor Relations section of buildabear.com.

Source: buildabear.com

Note: Build-a-Bear at a glance / Source

Why is Build-a-Bear so beloved?

It's the Workshop Concept

Build-a-Bear has a unique shop concept: The kids and teens rush into the store and then register themself by an shop assistant, who accompanies the kids through the whole build the bear process. This process of building the plushy friend consist of several steps and takes more than 10 minutes. That's why the shops are naming themself a 'workshop'. The process consist of:

- Entering the store

- Registration and welcome by a shop assistant

- Selection of the not yet stuffed plushy animal

- Giving the plush a name and some kissing and wishing for it to come alive

- Choosing of a long lasting scent or some special audios

- Stuffing the animal together with the help of an shop-assistant

- Selecting some clothes and extras for the stuffed friend

- Walking out of the store very happy

So in summary, Build-a-Bear is offering more than just a teddy - going there is a whole experience for the family. To understand this even more, we highly recommend you to watch the following video, where the whole process is very good described.

Note: In this video, little Ryan is experiencing the whole Build-a-Bear entertainment.

Hyped Franchise Deals and Collections

Build-a-Bear has, of course, in addition to their own teddy bears, crocodiles and mythical creatures, well-known "characters" from world-famous franchises. Among them are for example the partly permanently sold out Baby Yoda figures from Star Wars or Harry Potter. Other well-known franchises include Star Wars, Disney's Frozen, The Lion King, DC, Marvel, Trolls, Pokémon, but also sports clubs from the NFL, NHL, .... .

Build-a-Bear has extremely many of these world-renowned franchise characters and is currently benefiting greatly from them, as they are very well known and downright hyped among children, but also adults. Build-a-Bear knows this by now and launches limited drops of these again and again to further celebrate the hype and promotes this specifically.

In addition to the already very expensive franchise figures, franchise accessories such as laser sabers, wands or Baby Yoda baskets can earn good money, especially if you buy everything in a bundle and thus supposedly save money.

In addition to well-known franchises, Build-a-Bear also has its own collections, some of which are aimed at collectors and no longer at children. An example of this would be the colloboration with Swarovski - these bears sometimes cost over $100.

Note: Lando Calrissian Set from Star Wars franchise / Source

Entertainment focused Hybrid-Model

Build-a-Bear has a dual hybrid model. First, as described earlier, the company aims not to sell a teddy bear as a raw product, but to sell an experience around the personalized teddy bear. This hybrid experience is further enhanced by all the "workshop" activities within the store, as well as the active involvement of children in "building" the bear. Furthermore, the locations of the individual stores are also crucial: for example, the stores are mainly located in malls, but also in hotels, on cruise ships or in "resorts" in order to further tie in with the experience here.

Note: Build-a-Bear 3rd party partners / Source

The second hybrid model captures the sales channels - Build-a-Bear is currently developing into an extremely exciting e-commerce hybrid model - somewhat faster than originally planned, involuntarily triggered by the Covid-19 pandemic.

Build-a-Bear, until the Corona crisis, was primarily store-focused, with a rapidly growing online store, which was managed separately. Due to pandemic workshop closures and contact restrictions, that has rapidly changed.

This has now changed and the online store and the stores go hand in hand. This means that the online store is now expanding and replacing the real physical experience of the workshops. It offers the opportunity to explore all the products and do the build-a-bear process yourself. At the end of the process, you have the choice of "simply" having the bear delivered to your home ready to go, or catching up on the main event of the creation process namely stuffing the teddy in a store. So you can have your half-finished bear sent to a store and complete the rest of the experience there. Possibilities are: Buy-online, ship-from-store and buy-online, pick-up-in-store or curbside. An advantage from this is, that customers can be fulfilled from either store-capacities or from warehouses, which means less logistical hurdles.

Online exclusive offers and bundles, as well as store events and a very well-constructed online store with features complete the model.

Note: The Bear-Builder is part of the hybrid concept.

Accelerating E-Commerce at a high pace

Build-a-Bear started building its online store a few years ago - this is now paying off more and more, especially in the hour of the pandemic. For example, in the last quarter, sales via the onlineshop increased by 167% year-over-year - this growth has resulted in Build-a-Bear's overall sales being slightly positive. This dramatic turnaround alone, that the hybrid online store can now impact the company's business so strongly, speaks volumes about the future importance and role of the online store.

For this reason, the management has further strengthened the focus on e-commerce. The focus will be much more on digital campaigns in the future, exclusive "online exclusives" will be introduced, as well as improvements to the store, logistics and CRM. This should bring about further strong growth of the online business. As Build-a-Bear already has a good presence in social media, good digital conversions can be achieved here and hypes can be prepared.

The already good digital hybrid model in conjunction with the physical workshops will be further strengthened. In this way, higher margins and sales can be achieved with fewer staff.

Note: Build-a-Bear digital strategy / Source

National Teddy-bear day, Bonus-Club, Cubscription Box, Radio, Parties and #hashtags

As described in the previous chapter, the company is trying to keep its customer base happy with additional digital features and to further expand the digital experience outside the stores.

For example, Build-a-Bear has declared "National Teddy Bear Day" on 9th of september, which is an immense shopping event, similar to "Prime Day" for Amazon.

In addition, Build-A-Bear has launched the Build-A-Bear Bonus Club, a kind of points collecting club for loyal customers, which provides exclusive offers and surprises for loyal customers - such bonus programs have always paid off for companies, regardless of the industry and ensured recurring sales for existing customers - in addition, with such programs you learn a lot of details and data about your customers.

Note: Build-a-Bear Bonus Club is driving recurring revenue from existing customers.

The Cubscription.com box was also recently launched - a similar concept to cooking boxes. These boxes can be subscribed to and contain a teddy bear, Build-a-Bear franchise items and clothes for the bears. The boxes are lavishly presented and uniquely scarce. It remains exciting how the concept will develop.

To keep the kids entertained and tuned in to the bears by the minute, there is the Build-a-Bear radio station to be omni present and literally on the kids' minds. Here, too, the company wants to offer even more in the future and further expand this entertainment option with an advertising factor.

In addition to the radio fun, there is also the possibility to celebrate Build-a-Bear parties, similar to the children's birthdays at McDonalds - whether the concept will be pursued further in the future is questionable, due to the Corona situation.

The company's approach to social media, on the other hand, is particularly exciting and innovative - it has its own hashtags, the possibility of sharing its experiences and teddies via the hashtags or via the homepage, and thus maintaining the hype in the community. This is already very good and will be further strengthened in a short time. In summary, Build-a-Bear is currently following the right trends and neglecting old concepts that are no longer current.

Note: Build-a-Bear Radio

Tolerated premium Prices and Margins

With the brand established for years and the entertainment and excitement built around the bear, the company has managed to achieve premium prices and margins on its products. Somewhat comparable to Apple - Build-a-Bear is the Apple of teddy bears - available in masses, but very expensive and in the end with high margins for the company. In the meantime, standard franchise figures cost around 50$ - with clothes or in a bundle over 60$. "Boring" standard teddy bears cost around 20$ - if you dress them up or give them a sound and scent, you're quickly in the 40$ region.

Especially due to the additional extras, like the above mentioned scents or clothes, which almost every kid buys, their can be generated extra nice dollars and high margins. And also these extras are franchiseable, like The Mandalorian sound theme, Pikachu sounds or Star Wars light Sabers.

In the most recent quarter, the company achieved an impressive 46,5% retail gross margin.

Margin Camparison Q3 2020 Apple, Build-a-Bear, Hasbro and Mattel:

The Turnaround has been successfully initiated

Build-a-Bear has been a twisted success story with some bitter taste. While Build-a-Bear has managed to grow and expand it's store and location network over the last years, their margins steadily decreased or stagnated, but didn't really grow. As a result of that, the comapny had rising costs due to the increased headcount for their many stores, but decreasing profits and revenues on a like as like basis. This has resulted in an steady decrease of the comapanie's stock price. And finally, the Covid-19 pandemic tried to kill the company finally, but failed - due to the successfully launched turnaround strategy in early 2019. The turnaround consists of so many factors and facettes, which most of them were already mentioned above. To name some, most of the turnaround was established by focusing on e-commerce and delivering a solid hybrid model. In addition famous franchise deals, exclusive deals and innovations delivered further growth. Key initatives, which were planned for 2021 are going live now, to fuel even more the sales and margins.

As previously noted, we've been able to accelerate key initiatives that were once slated for 2021 and beyond, but are now underway in an aggressive manner with the goal to drive sales, both online and in reopened stores and through additional diversified revenue streams.

Importantly, we are seeing the benefits as we implement these innovative solutions and comprehensive programs that are intended to drive transformative change and results through our entire business and organization.

Source: Sharon Price John, CEO - Q3 2020 Earnings Call

Excellent public Reputation and a high level of Corporate Social Responsibility

Build-a-Bear has an interesting and unique target group - more than a quarter of the customers are at a teenage or older, which reflects the strenght of the branding. The target group can be seen below:

Note: Build-a-Bear customer base / Source

Build-a-Bear benefits from an extremely positive public image - after all, who doesn't love cute teddy bears and their "call to life", which is lovingly dedicated to children?

In addition, the company is committed to the public with its own foundation and also tries to disadvantaged or particularly honorable people to conjure a smile with the bears on the lips.

In addition, Build-a-Bear is also a recurring topic in pop culture - most recently, for example, in the latest Southpark episode "Pandemic Special", in which Build-a-Bear is strongly discussed several times as a place for children's happiness - such media attention should have an extremely positive effect on the company, considering that the episode reached around 2.3 million viewers on the first day alone.

Note: Build-a-Bear during the South Park Episode "Pandemic Special" / Source

A strong growing market

Build-a-Bear operates in a mixed market - while the market for dolls & stuffed animals is expected to grow only about 1% per year until 2025, the e-commerce sector is experiencing a very strong dynamic, which is shown below. Since the company is focusing very strongly on this market and is strongly expanding the advantages with its hybrid strategy, the company should also benefit from this dynamic for many years to come.

Note: Retail e-commerce sales worldwide from Statista / Source

Recent News and Updates

The Release of the Results for the third Quarter 2020

Build-a-Bear has released it's latest earnings release on 3rd of December, reflecting a strong rebounce of the business, which has been crushed in the first and second quarter of 2020, due to harsh workshop closures and a not optimal focus on the e-commerce strategy. The newest numbers reflect the ongoing strenght of the digital hybrid strategy, which is highlighted by an 167% increase in digital sales, which has led to an positive year-over-year revenue growth. Most notable is, that even with many stores closed or "defect revenue streams", like workshops on cruise-ships and a 7% reduction in opening days + a 25% reduction in opening hours, the company was able to outperform last years period and was profitable. This alone speaks a lot for the new strategy and shows, that the initiatives are bearing fruits very fast.

- Total Revenues increased 6.1% Year-over-Year to $74.7 Mio

- EPS ("EPS = Earnings per share") increased to $0.11 from a loss of 0.40 in 2019

- Retail Gross Margin increased to 46.5% vs. 39.5% the period before

- Due to store closures of unprofitable workshops, the company managed storecount decreased to 358 vs. 371 or 790,310 sqf vs. 799,831 sqf

Build-a-Bear has not published any guidance for the 4th quarter, but revenues should be above $100 Mio, due to the strongest quarter.

In Addition, the company had net cash of about $26 Mio on hand and no debt. The management has also achieved to renegotiate 99% of all rents in north America and 90% in UK.

For additional informations, please have a look at their latest earnings release.

New Collections, Initiatives and Digital Strategy

Build-a-Bear has recently released several press releases, describing new initiatives and features for their digital hybrid-strategy and holiday season - to name some:

- Build-a-Bear celebrates the holidays with gifts for everyone --> focusing on the christmas holiday season

- Build-a-Bear Entertainment announces film premiere of "Deliver by Christmas" --> this is a film by the company to engage with its audience for the holiday season

- Build-a-Bear celebrates the Holiday season with gifts for the whole family --> this focuses on the thanks-giving holiday seasons

- Build-a-Bear celebrates their own National Teddy Bear day with an mega livestreaming event --> reacting creative to engage with the social distancing community

- A Harry Potter-inspired collection is Apparating into Build-a-Bear --> announcing a big franchise collab with the Harry Potter franchise

For additional informations, please have a look at their newsroom.

The Read between the lines - Earnings Call

The aggregated information of the Q3 2020 earningscall can be seperated into three different categories, the three main pillars of Build-a-Bears future strategy: Digital Strategy, Retail Footfprint and Financial Stability:

Digital Strategy:

- Build-a-Bear was able to leverage available store labor and invetory to support the heightened digital demand with buy-online, ship-from-store and buy-online, pick-up-in-store or curbside. Regarding the acceleration of our digital transformation, we remain intent on rapidly growing e-commerce with more effective use of technology and improved and enhanced fulfillment capabilities, while leveraging our expanded digital platform to inform and drive marketing and content efforts. We continue to see robust demand for key licensed products, including new Harry Potter collection, which launched as an online exclusive before expanding to all store distribution. We also had good results with this year's Halloween collection and we continue to see upticks in sales of gifting products, as consumers seek out creative ways to stay connected, while many remained more home-based than in the past. Finally, we see the creation and digital delivery of content as an important part of the expression of our brand and as a tool to drive further consumer connection that tends to generate incremental sales over time. For example, we've created engaging live streaming events with key promotions such as the National Teddy Bear Day and to reveal new product introductions which we plan to expand going forward.

Retail Footprint:

-

Our second initiative is to maintain a profitable real estate portfolio as we continue to evolve our real estate stores in response to macro business and traffic trends. We were pleased with the high level of staff that returned from furlough and the retention levels that were maintained even after we put in a reorganization that eliminated a number of positions. And in addition to the actions taken to lower rent for both the short and longer term, we have been intently focused on reducing operating expenses at the store level.

We had an improvement in gross profit margin of 720 basis points compared to the prior year. This is the result of several initiatives, but there are two that are particularly important to call out. First, as previously reported, over the past several years, we have strategically positioned our retail store portfolio to have high lease optionality and flexibility. And second, following the temporary measures to furloughing associates and reducing salaries for those remaining, we completed a corporate reorganization that was planned prior to the pandemic, with reduced headcount and realigned leadership responsibilities to better support the execution of our current and longer-term strategic initiatives. For the quarter in North America on average, stores recaptured more than 100% of prior year sales following the reopening, inclusive of buy-online and ship-from-store orders while in the UK, e-commerce drove revenue at a higher pace than the brick and mortar stores. Both conversion and transaction value saw a meaningful increase. While similar to other retails, we saw declines in consumer traffic in both geographies. Looking forward, we remain cautious in regards to our expectations and we continue to prioritize digital initiatives given that uncertainty surrounding physical store operations in various communities and jurisdiction.

Note: Build-a-Bear customer base / Source

Financial Stability:

- Securing financial stability with the liquidity needed to support our business with an eye to the long-term positioning, including finalizing a new five-year asset-based credit facility

The deep Analysis

Financials

Operational History

Build-a-Bear has been listed on the New York Stock Exchange since 2004. Since then, the business has developed in a mixed manner. Although the interantional and national retail footprint has continued to grow, the business and numbers have not been convincing, especially in recent years. This has to do with a decline in like-for-like sales and falling margins. This trend can also be observed in the chart. With the onset of the Corona crisis, the business has fallen further into difficulties, but has now been able to recover strongly thanks to the digital hybrid strategy and is well on the way to further explosive positive development.

Dividend

The company currently does not pay a dividend.

Share Structure

Build-a-Bear uses a one class share system. Most notable is the low public float and the high insider ownership.

Note: The share Structure of Build-a-Bear / Source

Insiders are holding approximately $14 Mio in shares, which is not a very high amount in totals, but an high procentual amount to the market cap. Most notable insiders are the founder, the CEO and other directors.

Chart

Valuation of the Stock

Build-a-Bear is currently low to very low valued. Due to the lack of analyst consensus, there is no real possibility to calculate an one-year forward non-GAAP P/E-Ratio ("P/E-Ratio=Price to Earnings Ratio"). But if we look at the Price/Revenue-Ratio, we have an very low value of about 0.25 for 2020.

The formula is simple: Build-a-Bear has currently the marketcap of its Q3 2020 sales. If the company manages to preserve its Q3 margins and increase sales continously and be profitable, this stock is very undervalued. For comparison, Mattel is currently trading at and Price/Revenue-Ratio of 1.35, which brings above 4x upside potential.

Business Model

Build-a-Bear has an easy to understand business model. More than 97% of the companys revenues come from its Retail Segment, which includes the company operated stores and the onlineshop. The rest of the revenue comes from the Commercial Segment and the Franchising Segment.

Note: Commercial Segment and International Franchsing Segment explained / Source

Build-a-Bear earns it's money from selling stuffed animals and teddybears and additional extras. The other two segments include royalities fees or franchise fees.

Business Segments and their revenue split by Q3 2020:

- Retail Segment - 97.3%

- Commercial Segment - 1.9%

- International Franchising Segment - 0.8%

Management

Build-a-Bear is run by it's long time employees, which have built the business, formed it and transformed it. But they have also misled the company to an false path most of the years - but now they can change it.

- Sharon Price John - CEO - Sharon John, 56, was appointed to the Board of Directors on June 3, 2013 in connection with her employment as Chief Executive Officer and Chief President Bear of the Company. From January 2010 through May 2013, Ms. John served as President of Stride Rite Children’s Group LLC, a division of Wolverine World Wide, Inc., which designs and markets footwear for children.

- Voin Todorovic - CFO - Voin Todorovic, 45, joined Build-A-Bear Workshop in September 2014 as Chief Financial Officer. Prior to joining the Company, Mr. Todorovic was employed at Wolverine World Wide, Inc.

- J. Christopher Hurt - COO - J. Christopher Hurt, 54, joined Build-A-Bear Workshop in April 2015 as Chief Operations Officer. Prior to joining the Company, Mr. Hurt was at American Eagle Outfitters, Inc. from 2002 to April 2015 in various senior leadership roles of increasing responsibility.

- Jennifer Kretschmar - CMO - Jennifer Kretchmar, 47, joined Build-A-Bear Workshop in August 2014 as Chief Product Officer and Innovation Bear. Effective March 2016, she now holds the title of Chief Merchandising Officer. Prior to joining the Company, Ms. Kretchmar was Senior Vice President of Product and Brand Management with the Stride Rite Children’s Group of Wolverine World Wide, Inc

Source: Build-a-Bear

Insiders are holding approximately about $14 Mio in own shares.

Competition

Build-a-Bear has no real competition in the North American market and little to no in the UK. That's because no other company sells teddybears and stuffed animals in the way like Build-a-Bear does, the way of entertainment.

Looking at a broader range, there is of course competition from other companies like Amazon or Disney, who sell their own cheap stuffed animals. There is also competition from other toy comapnies like Hasbro or Mattel, but there is no real match with the business of Build-a-Bear.

What to expect in the near future

Digital-Strategy

As announced in the earnings call, Build-a-Bear will focus on expanding its digital channels and the associated integration into the hybrid model. If the company succeeds in further increasing digital sales, this strategy could provide new strong growth impulses and catapult the company to new heights. This strategy should leverage margins, increase sales and decrease headcount and administrative costs.

Retail-Footprint-Strategy

As also announced in the earnings call, Build-a-Bear will focus on a strong improvement of its retail footprint. This includes the detailed evaluation of profitable locations, the expansion into new territories and a fundamental optimization of the stores in connection with the hybrid connection to the online store. The low store numbers in all markets offer a lot of potential for new openings. The Asian market, which is known for luxury and consumption, is currently still completely untapped - here a lot of further potential is waiting.

Conclusion

Build-a-Bear is a company beloved by all ages that is currently at a very critical inflection point. If the digital transformation, which has been very successful so far, succeeds, Build-a-Bear should rise again to its old heights and glory. Based on the current valuation of the share and the security of the balance sheet, the company is clearly a buy. Nevertheless, one should be very cautious here, as the company is extremely small in terms of market value and is therefore a "plaything" for the market.

Our recommendation: This stock is a buy. Use the current price for buying in or averaging up and use further price-falls to average up.

Disclaimer & Conflict of interest

The author currently holds a position in the mentioned stock. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Revenue and Gross Profit by Quarter

Revenue Mix by Segment

Margin % Comparison

Revenue $ vs. Corporate-managed SQF

Chart

Peers

All the Peers

FlexShopper Inc.

Bullish

Tattooed Chef Inc.

Neutral

Hellofresh SE

Bullish

Stamps.com Inc.

Bullish

Redfin Corporation

Bullish

Perion Network Ltd.

Outperform

Upwork Inc.

Bullish

Chegg Inc.

Bullish

Pinterest Inc.

Bullish

Virgin Galactic Holdings Inc.

Neutral

The One Hospitality Group Inc.

Bullish