The Search

Your Search Results

News from us

Newest Symbols

Newest Industries

Click to expand

Advertising

See Stocks

Automotive

See Stocks

E-Commerce

See Stocks

E-Learning

See Stocks

Electricity

See Stocks

Engineering

See Stocks

FlexShopper Inc.

Bullish

Bullish

Tattooed Chef Inc.

Neutral

Neutral

Hellofresh SE

Bullish

Bullish

Build-a-Bear Workshop Inc.

Outperform

Outperform

Stamps.com Inc.

Bullish

Bullish

Redfin Corporation

Bullish

Bullish

Perion Network Ltd.

Outperform

Outperform

Upwork Inc.

Bullish

Bullish

Chegg Inc.

Bullish

Bullish

Pinterest Inc.

Bullish

Bullish

Bluelinx Holdings Inc

Bullish

Bullish

Momentus Inc.

Neutral

Neutral

Mynaric AG

Neutral

Neutral

Virgin Galactic Holdings Inc.

Neutral

Neutral

Maxar Technologies Inc.

Neutral

Neutral

Sunrun Inc.

Bullish

Bullish

Steico SE

Neutral

Neutral

Alfen N.V.

Neutral

Neutral

Research

Content Cards

Swipe

Our Article

Sunrun Inc. - Article

Research: Sunrun - A Sun-Powered Cashcow Powerplant

Note: Sunrun & Vivint Solar / Source

Note: Sunrun & Vivint Solar / Source

Table of Content:

- Author’s Opinion

- Introduction to the Company

- What makes it so special?

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author’s Opinion

Renewable energy is the future – so what keeps us private individuals from investing in it and using it ourselves? On the one hand, renewable energy is often very expensive to purchase for end users, or the switch from fossil fuels to sustainable energy sources is a deterrent for many homeowners and private individuals – very stressful and expensive.

But what if there is a company that can greatly reduce the stress and the initially high investment costs, making solar energy affordable for almost anyone. But what if this company offers additional energy storage options based on the same principle and thus makes the owners of a solar system independent.

So what then still keeps us from investing in both the energy sources and the Sunrun company?

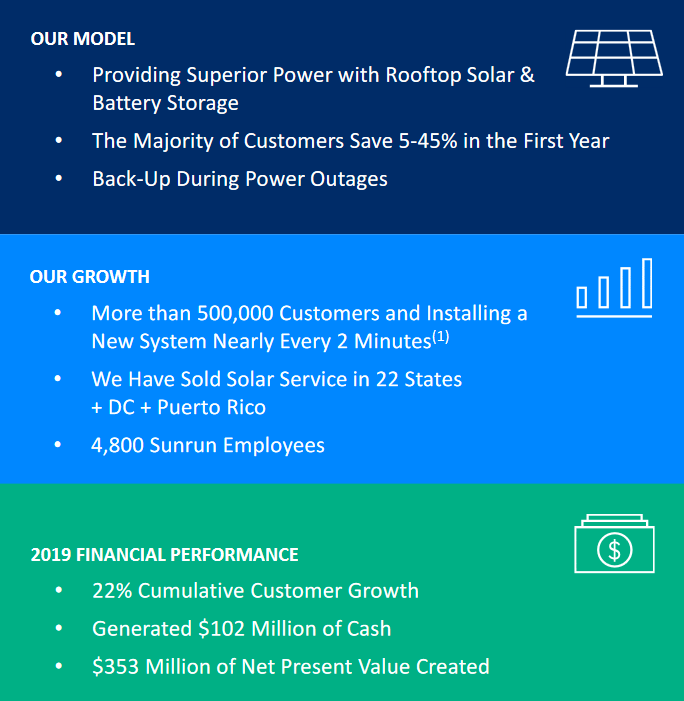

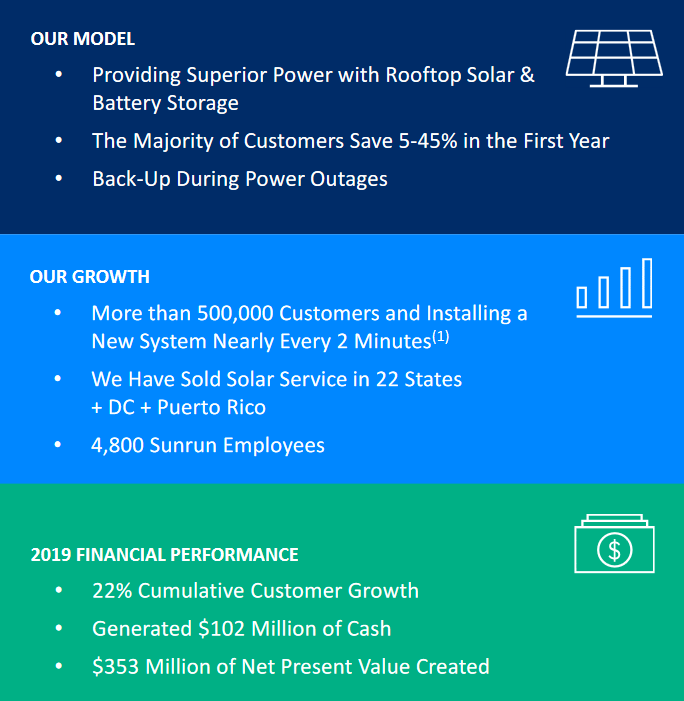

Introduction: Let the company introduce itself

Sunrun Inc. (Nasdaq: RUN) is the nation’s leading home solar, battery storage, and energy services company. Founded in 2007, Sunrun pioneered home solar service plans to make local clean energy more accessible to everyone for little to no upfront cost. Sunrun’s innovative home battery solution, Brightbox, brings families affordable, resilient, and reliable energy. The company can also manage and share stored solar energy from the batteries to provide benefits to households, utilities, and the electric grid while reducing our reliance on polluting energy sources. For more information, please visit www.sunrun.com.

Source: Sunrun

What makes Sunrun so special?

Six reasons that make it special:

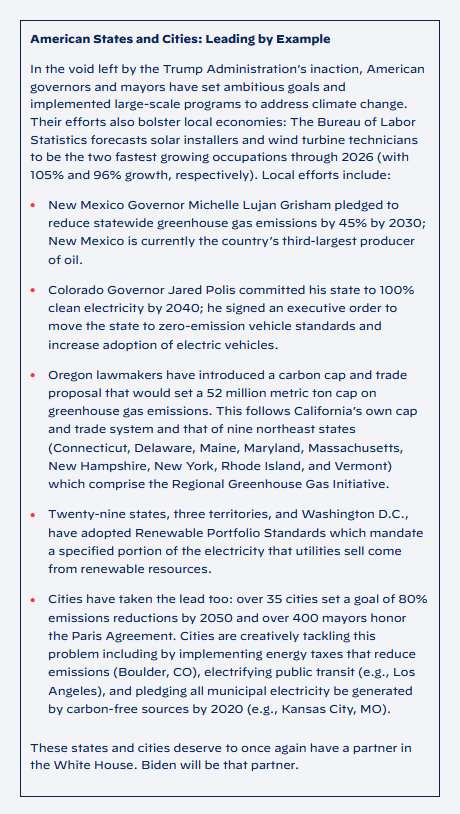

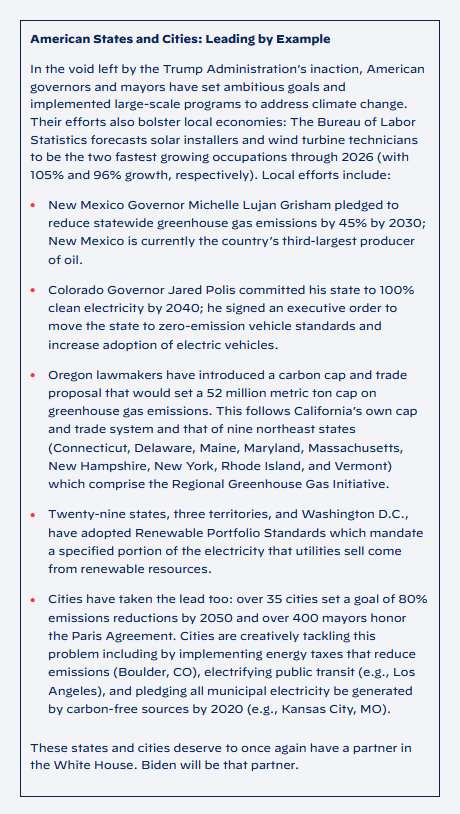

Joe Biden and new awareness for environmental protection

After Joe Biden was elected as the new US President of the USA, companies that focus on renewable energies and environmental protection will benefit greatly. For example, he has published a completely separate “Climate Plan” on his homepage, which shows the way to a more environmentally friendly USA. Here is an excerpt from his plans regarding the field of solar energy. Here he talks about a growth of over 105% until 2026.

Note: An excerpt from Joe Biden’s climate-plan / Source

In addition, the general awareness of the population, especially in progressive cities and states, regarding environmental protection and sustainability is growing, which is why a change is taking place not only in politics, but also in the society that supports this emerging megatrend.

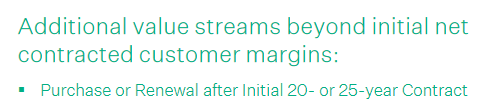

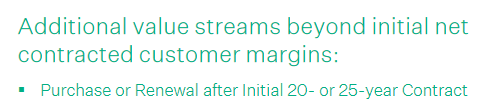

Unique predictability

Due to Sunrun’s unique business model, a large portion of the revenues generated consist of recurring revenues. On average, these contracts last for 20-25 years – Sunrun can therefore calculate stable cash flows of 20-25 years per customer. This represents a unique and extremely rare predictability and calculation possibility of cash flows for the future. Comparable subscription models usually offer a forecast of 2-5 years, with Sunrun it is 20-25 years. After this time, there is often the possibility to extend the contracts or to sell the rented system to the homeowner.

Note: There are additional cashflow options after the initial contract. / Source

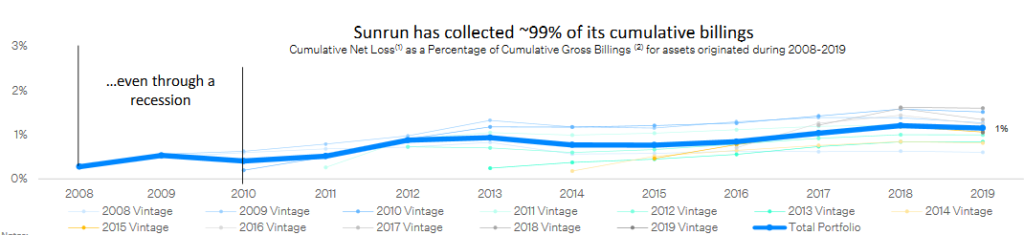

In addition, Sunrun has a historical loss rate of only 1% of its payments during this period – an extremely good and stable value.

Note: Sunrun has a low loss rate. / Source

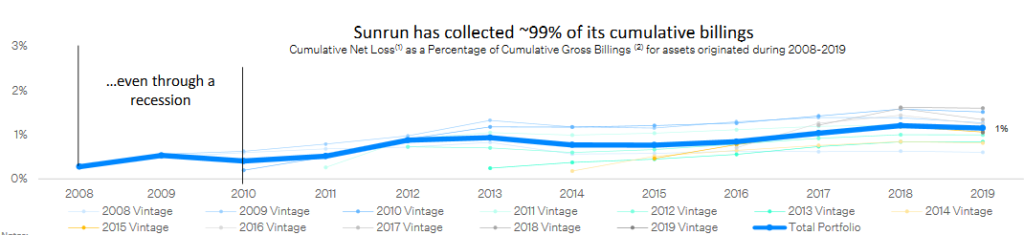

Falling solar costs and rising electricity costs

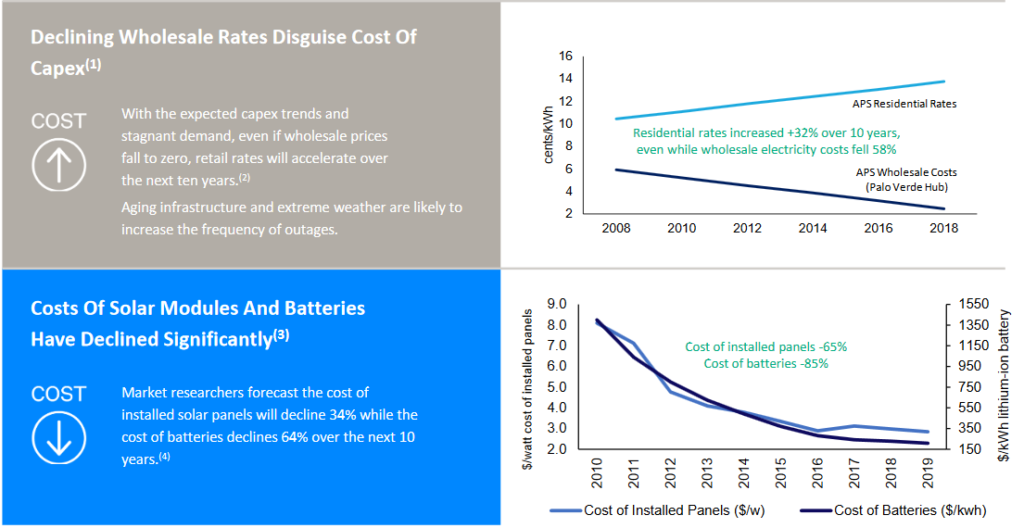

In the long run, Sunrun benefits from two concrete trends – the costs and financing of solar systems are becoming cheaper and cheaper as there are more suppliers and more demand for them, and production processes are becoming simpler. In addition, the cost of electricity for private households is rising almost every year throughout the world – even in the USA. Sunrun benefits from this trend in two ways – Sunrun’s costs per MW (“MW = Megawatt”) are decreasing sharply, but electricity costs for customers are increasing. More and more customers are turning to solar power, and Sunrun can also slightly increase the cost of its customers’ electricity year after year. So Sunrun has with ever decreasing costs, higher income from year to year plus a potential acceleration of new customers.

Note: The long-term trends Sunrun is profiting of. / Source

From financier to power plant operator

Sunrun is not a boring seller and installer of solar power systems. Sunrun is primarily a financier and leasing provider of these systems. Since Sunrun has over 500,000 customers, Sunrun also owns a huge amount of photovoltaic systems, which produce a lot of electricity. To be more precise, it already had a total of 1,969.2 MWh. This amount is produced from a solar plant asset of about $392M, the so-called Contracted Net Earning Assets. This enormous amount makes Sunrun an up-and-coming power producer. Newly concluded contracts with local utilities in the USA, which are to cushion peak power consumption, confirm this evolution of Sunrun once again. Sunrun is increasingly transforming itself from a financier to a gigantic power producer, which no longer operates large power plants, but lets its customers operate their own small power plants in the form of solar plants on their roofs.

Here is an excerpt of the recently released news:

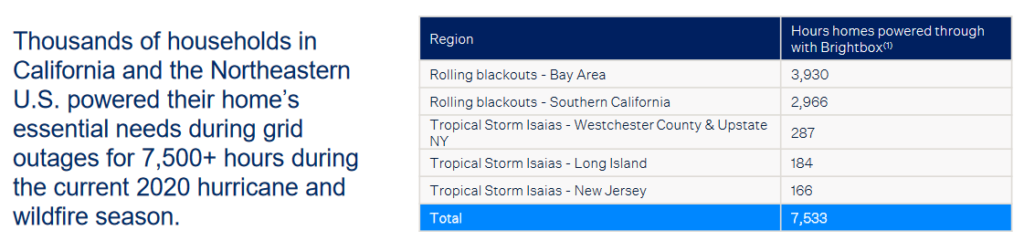

Sunrun (NASDAQ: RUN), the leading provider of residential solar, battery storage and energy services, today announced that it has contracted with one of the largest electric utilities in the United States, Southern California Edison (SCE), to increase grid resilience and lower power costs. SCE will send signals to Sunrun during high-demand events such as extreme heat waves when the energy grid is strained. In response, Sunrun will dispatch energy from thousands of its Brightbox solar-powered battery systems installed in the SCE territory, providing five megawatts (MW) of energy capacity to help support the overall energy system. The same solar-powered home batteries will also provide reliable backup power to these households if the power goes out.

Note: Sunrun’s press release. / Source

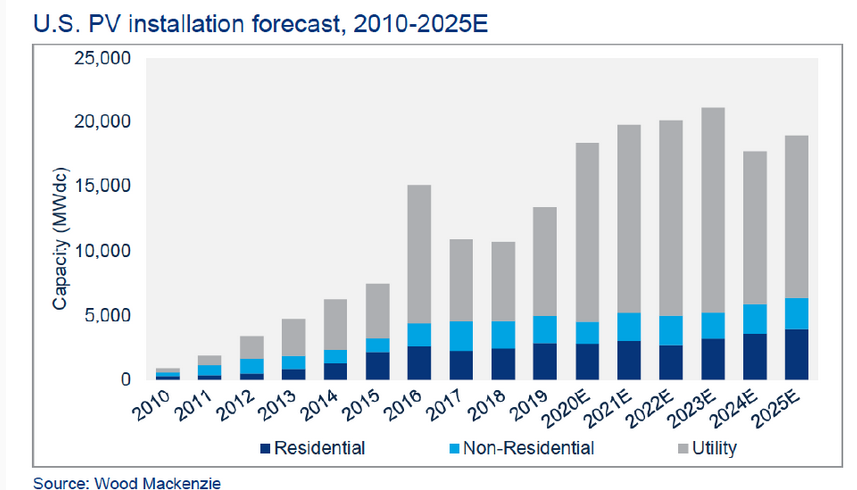

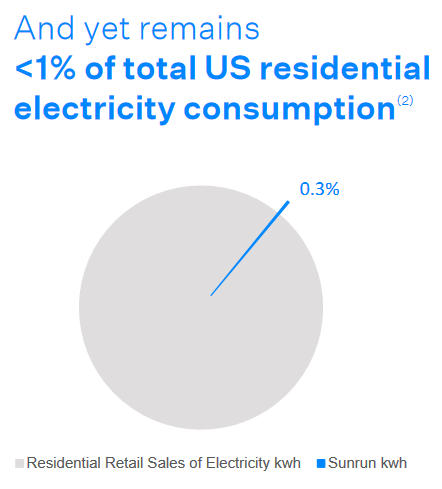

Unique market with enormous growth potential

Sunrun is operating in a rapidly growing market. The forecast for private solar owners is very bright. Due to the partly very bad US power grid and the associated blackouts or the increasing number of natural disasters, more and more private households want a solar system on their roof and thus independence. With the election of Joe Biden and the focus on renewable energies, this trend will accelerate once again.

Note: Sunrun provides independency. / Source

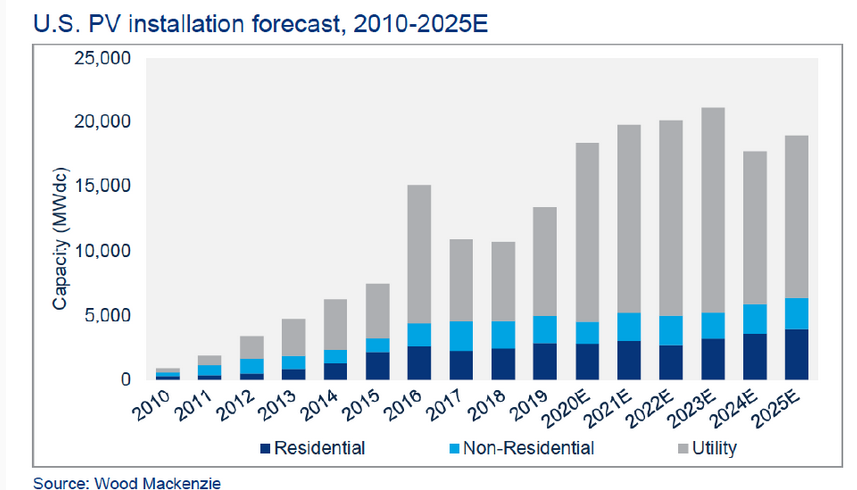

A forecast by Wood Mackenzie shows that the installation of private PV systems will almost double by 2025.

Note: Market outlook for solar energy. / Source

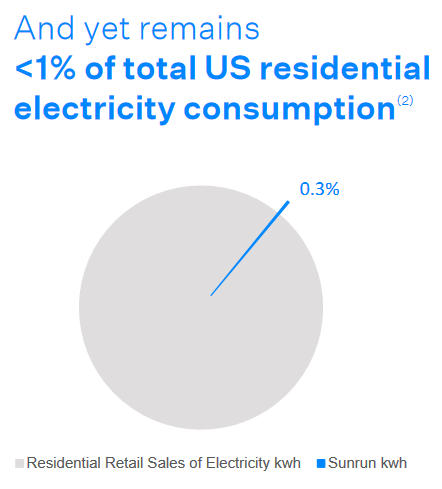

Note: Sunrun’s current markshare. / Source

Growth, growth and more growth with additional products and services

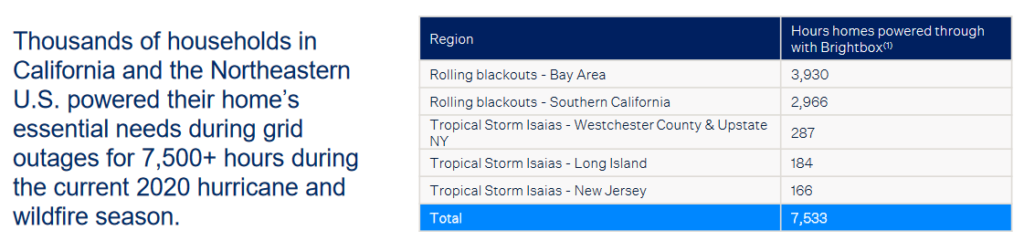

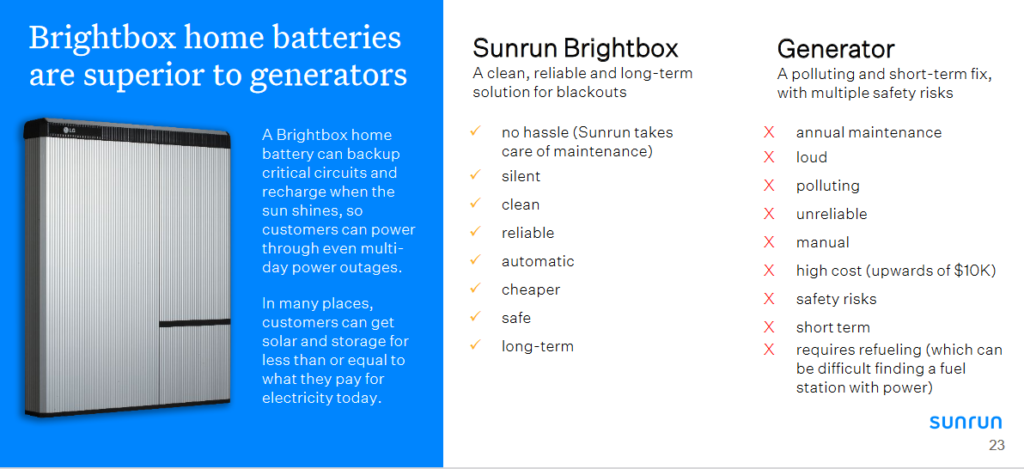

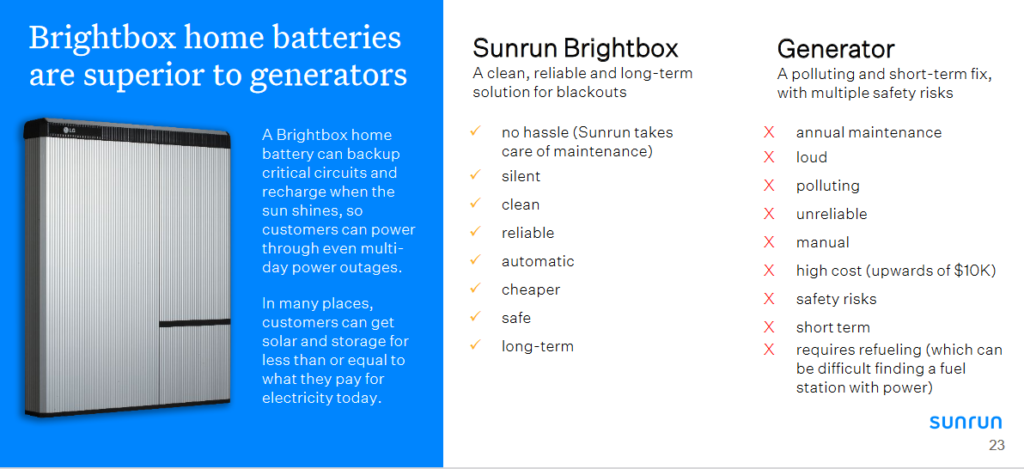

For example, Sunrun offers batteries in addition to the solar systems to keep the generated electricity available at night or during power outages. Sunrun has also integrated this additional product and the associated service very easily into its existing model – Brightbox, the battery division, as Sunrun calls it, can also be conveniently leased.

Note: Sunrun’s Brightbox offer. / Source

In addition, Sunrun continues to place great emphasis on growth. This was recently demonstrated when they took over Vivint Solar, which was also listed on the stock exchange, completely. Vivint Solar made $77.1M in sales in 2019 and offers basically the same services as Sunrun. This means that Sunrun’s sales alone will grow by about 10% with the acquisition of Vivint Solar. The services and activities of Sunrun shown here show that Sunrun does not only want to grow through geographical expansion and the acquisition of new customers, but also through additional services, as well as through acquisitions and the associated synergies.

Recent News and Updates

Sunrun signs Virtual Power Plant Agreement with SCE

Sunrun has signed a virtual power plant agreement with Southern California Edision, a major local power producer. This agreement describes mutual services and the exchange of electricity in case of peak demand. Such an agreement again underscores Sunrun’s strong ambition to be not only a financier and service provider for solar, but a power producer and supplier. The deal also underscores the agile and flexible capabilities of its solar power systems with software and the Brightbox battery system.

Read more.

The Release of the Results for the third Quarter 2020

Sunrun Inc. has announced their latest earnings results on November 5th. One might think that the Corona Pandemic has no influence on solar energy – but it does. Due to the virus, Sunrun was able to increase the number of its customers, but not its revenues. However, profitability has increased.

- Total Revenues decreased 3% Year-over-Year to $209.8Mio

- Customers increased 20% Year-over-Year to 326.000

- 109MW deployed, an increase of 40% Quarter-over-Quarter

- EPS (“EPS = Earnings per share”) were $0.28

Sunrun has also announced other key figures such as its gross profit per customer. This was around $6500, which is a weak figure. The acquisition of Vivint Solar is not yet included in the key figures.

Sunrun expects an increase in MW of 10% in Q4 2020 and to increase gross profit per customer to $8000.

The figures currently represent very weak to even declining growth. For the reasons listed above, growth should be stimulated again.

For additional informations, please have a look at their latest earnings release.

Sunrun to expand Brightbox offering to all markets

Sunrun now offers its Brightbox battery storage system on all markets with the news of November 5th. With it the Cross-Selling possibilities are advanced as extra to the additional solar plants. Likewise a Brightbox can be offered in addition, as stand-alone product.

Beyond backing up home power needs, in some markets, these systems can also share stored power across communities through aggregated, local clean energy networks known as “virtual power plants”. Participating Brightbox users strengthen the electric grid in their neighborhoods, helping decrease blackout events for their entire community.

Source: Sunrun Press Release

Herewith the ambitions and possibilities as a power generator are again further developed and underlined.

Completion of the Vivint Solar Acquisition

On October 8, Sunrun announced the successful and completed acquisition of Vivint Solar. This makes Sunrun 500000 customers heavy and produces over 3 gigawatts of solar power annually. Sunrun expects the acquisition to result in cost savings of over $90M over the next 12-18 months. In addition, all products from both companies will be unified and customers will be offered the best possible product. Vivint Solar will remain a separate company and will continue to operate under the name Vivint Solar.

Vivint Solar shareholders will receive 0.55 Sunrun shares per Vivint Solar share as payment.

The acquisition of Vivint Solar made here reflects several efforts of Sunrun:

On the one hand, Sunrun wants to continue to grow and thus creates a strong partner for itself, in order to increase its customer network, but also its geographical footprint. At the same time, many costs will be saved through common synergies. Furthermore, Sunrun wants to build a moat for itself as the absolute market leader by buying up competitors and integrating them into itself.

The deep Analysis

Financials

Dividend

The company currently does not pay a dividend.

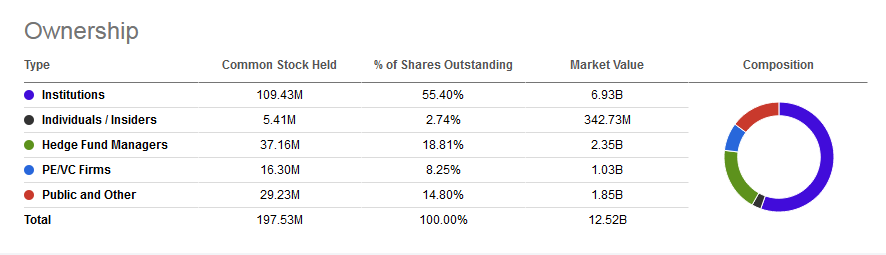

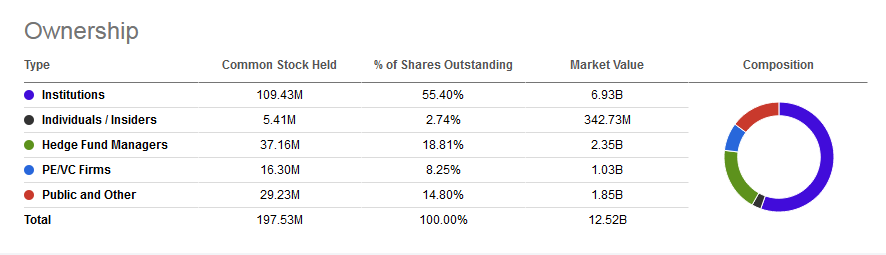

Share Structure

Sunrun uses a one class share system. The current free-float to the public is low.

Note: The share Structure of Sunrun Inc. / Source

Both co-founders hold a combined amount of about $300M. With this amount, the have serious skin in the game, despite their ownership is only about 3% of all outstanding shares.

Chart

Valuation of the Stock

Sunrun is currently very highly valued. We have a one-year forward non-GAAP P/E-Ratio (“P/E-Ratio=Price to Earnings Ratio”) of approximately over 100, which is a very high valuation. On the other we have an very good predictability due to their business model. Their competitors have similiar valuations. If we look at the Price/Revenue-Ratio, we have also a very high value of over 10 for 2020. Since Sunrun is a growth company and plans double digit growth numbers, it can basically grow strong in the next few years, the current valuation is high to very high. This stock is in fact not cheap.

Business Model

Sunrun has an ingenious, but also somewhat more complex business model. Sunrun works closely with small electrical companies that can install solar systems. Private customers, who are interested in a solar system, can purchase it from Sunrun and then have it installed by one of these smaller subcontractors. So far so simple. But Sunrun has built a sophisticated subscription model from the simple sale of the systems, which makes Sunrun a giant solar power producer. The high investment costs / acquisition costs of a solar plant deter many, not wealthy prospective customers. Here Sunrun takes this customer under the arm and finances the plant completely for the customers. In return, they pay off the system in the form of interest and payments for the solar power – on average, such a contract is for 20 years. This way, Sunrun has recurring revenues per customer over 20 years and profits from rising electricity prices, as it sells the electricity to its subscribers. At the same time, the cost of solar power systems decreases. Due to the close cooperation with subcontractors, the model is extremely scalable. Important key figures for Sunrun are the price per kwh, the amount of kwh produced and the number of its customers. Also the amount of solar assets is an important KPI.

Note: Sunrun at a glance / Source

Management

Sunrun is run by it’s two co-founders – both of them had the idea of founding Sunrun, because the process of getting a solar energy system was rather unconfortable and difficult.

- Lynn Jurich – CEO – Lynn is chief executive officer and co-founder of Sunrun (Nasdaq: RUN), the nation’s largest dedicated provider of residential solar, storage and energy services in the United States. With Sunrun co-founder Ed Fenster, Lynn invented the business model “solar as a service” that unlocked consumer demand for clean, affordable energy direct from residential rooftops. Today with more than $3 billion in installed solar systems across 22 states and the District of Columbia, Sunrun is revolutionizing how consumers get electricity.

- Edward Fenster – Chairman – Ed co-founded Sunrun to make solar affordable for American families. He oversees capital raising and legislative and regulatory affairs. Under his leadership, Sunrun has enjoyed uninterrupted access to project finance throughout its history. Ed has worked to shape public and industry policy with the goal of building a sustainable solar industry.

- Tom von Reichbauer – CFO – Tom is responsible for the overall finance, accounting, and technology activities of the company and focuses on developing and executing strategies to grow Sunrun’s long-term value and competitiveness. Tom brings considerable industry experience as a leader at disruptive, mission-driven companies in the consumer energy industry including Google, Nest, and Tesla. Most recently he was a Vice President at Google.

- Chris Dawson – COO – Chris serves as Sunrun’s Chief Operating Officer and leads sales, commercial, operations and lead generation teams, as well as the wholesale and solar mounting solutions business. Chris brings best-in-class experience in sales and operational efficiency to Sunrun with over 25 years of experience working in consumer-facing companies.

Source: Sunrun

Sunrun is still managed by its founders, which is extremely good. Both founders basically invented the Sunrun business model and have great and innovative visions for several years. It is good when the managers have such a clear path and want to achieve this together with their company.

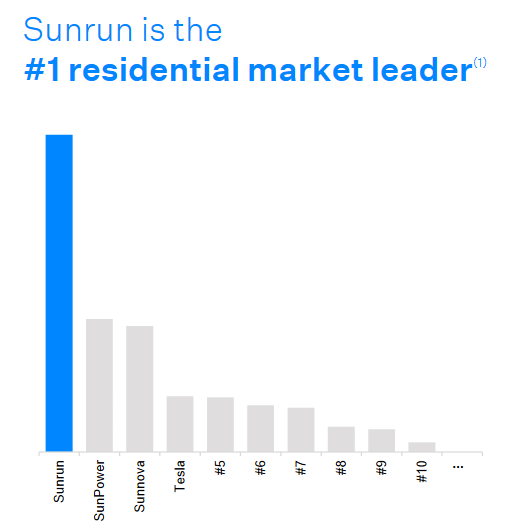

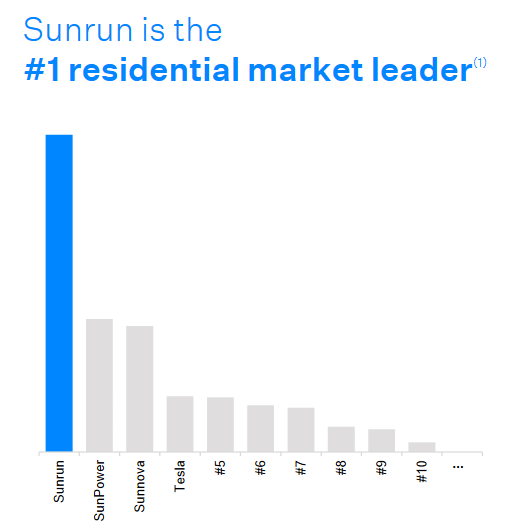

Competition

Sunrun has some very reputable competitors in the very popular and highly competitive market. The best known, but not the biggest competitor is Tesla. Tesla is a very polarizing company, which almost everyone knows by now. There is a concrete danger here, because Tesla likes to focus on some things and then perfect them. From a segment point of view, Tesla is only the 4th biggest competitor. Bigger are SunPower and Sunnova, which all have a similar model as Sunrun.

As you can see on the chart below, Sunrun is still by far the market leader in this field. With the acquisition of Vivint Solar, Sunrun should be able to maintain this position. In addition, strong competition in such a rapidly growing market is rather unproblematic, as any competitor can cut a piece of the ever-growing cake.

Note: Competition in the solar game. / Source

What to expect in the near future

Growth-Strategy

Sunrun will further strengthen its growth strategy in the near future. In doing so, Sunrun will continue to benefit strongly from various factors such as Joe Biden’s environmental protection program or the general trend towards sustainable energy sources.

In addition, Sunrun could make further acquisitions should Vivint Solar’s acquisition prove to be particularly successful and worthwhile. With a stronger focus on additional services and products, Sunrun also has great growth opportunities. Likewise, falling product costs and rising electricity prices continue to play a role in growth.

Transition-Strategy

Sunrun will also continue its transition to a smart, agile and green energy company. Further agreements, as described above, should follow and further underpin Sunrun’s important position. Sunrun will become a growing US wide power producer in the coming years and will benefit from the oligopoly position of a power producer and the resulting increase in electricity prices.

Conclusion

Due to the exobirtant high valuation of Sunrun, it seems irresponsible at first glance to make a buy recommendation here. However, since the opportunities and possibilities, as well as the unique business model, as well as its predictability, make up for all the disadvantages of the high valuation. Sunrun is a unique company with extremely rare potential and enormously good prospects for the coming years – a clear buy.

Our recommendation: This stock is a clear buy. Use the current price for buying in or averaging up and use further price-falls to average up.

Disclaimer & Conflict of interest

The author currently does NOT hold a position in the mentioned stock, but intends to buy shares of the mentioned stock shortly after the release of this article. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Sunrun Inc. - Article

Research: Sunrun - A Sun-Powered Cashcow Powerplant

Note: Sunrun & Vivint Solar / Source

Note: Sunrun & Vivint Solar / Source

Table of Content:

- Author's Opinion

- Introduction to the Company

- What makes it so special?

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author's Opinion

Renewable energy is the future - so what keeps us private individuals from investing in it and using it ourselves? On the one hand, renewable energy is often very expensive to purchase for end users, or the switch from fossil fuels to sustainable energy sources is a deterrent for many homeowners and private individuals - very stressful and expensive.

But what if there is a company that can greatly reduce the stress and the initially high investment costs, making solar energy affordable for almost anyone. But what if this company offers additional energy storage options based on the same principle and thus makes the owners of a solar system independent.

So what then still keeps us from investing in both the energy sources and the Sunrun company?

Introduction: Let the company introduce itself

Sunrun Inc. (Nasdaq: RUN) is the nation’s leading home solar, battery storage, and energy services company. Founded in 2007, Sunrun pioneered home solar service plans to make local clean energy more accessible to everyone for little to no upfront cost. Sunrun’s innovative home battery solution, Brightbox, brings families affordable, resilient, and reliable energy. The company can also manage and share stored solar energy from the batteries to provide benefits to households, utilities, and the electric grid while reducing our reliance on polluting energy sources. For more information, please visit www.sunrun.com.

Source: Sunrun

What makes Sunrun so special?

Six reasons that make it special:

Joe Biden and new awareness for environmental protection

After Joe Biden was elected as the new US President of the USA, companies that focus on renewable energies and environmental protection will benefit greatly. For example, he has published a completely separate "Climate Plan" on his homepage, which shows the way to a more environmentally friendly USA. Here is an excerpt from his plans regarding the field of solar energy. Here he talks about a growth of over 105% until 2026.

Note: An excerpt from Joe Biden's climate-plan / Source

In addition, the general awareness of the population, especially in progressive cities and states, regarding environmental protection and sustainability is growing, which is why a change is taking place not only in politics, but also in the society that supports this emerging megatrend.

Unique predictability

Due to Sunrun's unique business model, a large portion of the revenues generated consist of recurring revenues. On average, these contracts last for 20-25 years - Sunrun can therefore calculate stable cash flows of 20-25 years per customer. This represents a unique and extremely rare predictability and calculation possibility of cash flows for the future. Comparable subscription models usually offer a forecast of 2-5 years, with Sunrun it is 20-25 years. After this time, there is often the possibility to extend the contracts or to sell the rented system to the homeowner.

Note: There are additional cashflow options after the initial contract. / Source

In addition, Sunrun has a historical loss rate of only 1% of its payments during this period - an extremely good and stable value.

Note: Sunrun has a low loss rate. / Source

Falling solar costs and rising electricity costs

In the long run, Sunrun benefits from two concrete trends - the costs and financing of solar systems are becoming cheaper and cheaper as there are more suppliers and more demand for them, and production processes are becoming simpler. In addition, the cost of electricity for private households is rising almost every year throughout the world - even in the USA. Sunrun benefits from this trend in two ways - Sunrun's costs per MW ("MW = Megawatt") are decreasing sharply, but electricity costs for customers are increasing. More and more customers are turning to solar power, and Sunrun can also slightly increase the cost of its customers' electricity year after year. So Sunrun has with ever decreasing costs, higher income from year to year plus a potential acceleration of new customers.

Note: The long-term trends Sunrun is profiting of. / Source

From financier to power plant operator

Sunrun is not a boring seller and installer of solar power systems. Sunrun is primarily a financier and leasing provider of these systems. Since Sunrun has over 500,000 customers, Sunrun also owns a huge amount of photovoltaic systems, which produce a lot of electricity. To be more precise, it already had a total of 1,969.2 MWh. This amount is produced from a solar plant asset of about $392M, the so-called Contracted Net Earning Assets. This enormous amount makes Sunrun an up-and-coming power producer. Newly concluded contracts with local utilities in the USA, which are to cushion peak power consumption, confirm this evolution of Sunrun once again. Sunrun is increasingly transforming itself from a financier to a gigantic power producer, which no longer operates large power plants, but lets its customers operate their own small power plants in the form of solar plants on their roofs.

Here is an excerpt of the recently released news:

Sunrun (NASDAQ: RUN), the leading provider of residential solar, battery storage and energy services, today announced that it has contracted with one of the largest electric utilities in the United States, Southern California Edison (SCE), to increase grid resilience and lower power costs. SCE will send signals to Sunrun during high-demand events such as extreme heat waves when the energy grid is strained. In response, Sunrun will dispatch energy from thousands of its Brightbox solar-powered battery systems installed in the SCE territory, providing five megawatts (MW) of energy capacity to help support the overall energy system. The same solar-powered home batteries will also provide reliable backup power to these households if the power goes out.

Note: Sunrun's press release. / Source

Unique market with enormous growth potential

Sunrun is operating in a rapidly growing market. The forecast for private solar owners is very bright. Due to the partly very bad US power grid and the associated blackouts or the increasing number of natural disasters, more and more private households want a solar system on their roof and thus independence. With the election of Joe Biden and the focus on renewable energies, this trend will accelerate once again.

Note: Sunrun provides independency. / Source

A forecast by Wood Mackenzie shows that the installation of private PV systems will almost double by 2025.

Note: Market outlook for solar energy. / Source

Note: Sunrun's current markshare. / Source

Growth, growth and more growth with additional products and services

For example, Sunrun offers batteries in addition to the solar systems to keep the generated electricity available at night or during power outages. Sunrun has also integrated this additional product and the associated service very easily into its existing model - Brightbox, the battery division, as Sunrun calls it, can also be conveniently leased.

Note: Sunrun's Brightbox offer. / Source

In addition, Sunrun continues to place great emphasis on growth. This was recently demonstrated when they took over Vivint Solar, which was also listed on the stock exchange, completely. Vivint Solar made $77.1M in sales in 2019 and offers basically the same services as Sunrun. This means that Sunrun's sales alone will grow by about 10% with the acquisition of Vivint Solar. The services and activities of Sunrun shown here show that Sunrun does not only want to grow through geographical expansion and the acquisition of new customers, but also through additional services, as well as through acquisitions and the associated synergies.

Recent News and Updates

Sunrun signs Virtual Power Plant Agreement with SCE

Sunrun has signed a virtual power plant agreement with Southern California Edision, a major local power producer. This agreement describes mutual services and the exchange of electricity in case of peak demand. Such an agreement again underscores Sunrun's strong ambition to be not only a financier and service provider for solar, but a power producer and supplier. The deal also underscores the agile and flexible capabilities of its solar power systems with software and the Brightbox battery system.

Read more.

The Release of the Results for the third Quarter 2020

Sunrun Inc. has announced their latest earnings results on November 5th. One might think that the Corona Pandemic has no influence on solar energy - but it does. Due to the virus, Sunrun was able to increase the number of its customers, but not its revenues. However, profitability has increased.

- Total Revenues decreased 3% Year-over-Year to $209.8Mio

- Customers increased 20% Year-over-Year to 326.000

- 109MW deployed, an increase of 40% Quarter-over-Quarter

- EPS ("EPS = Earnings per share") were $0.28

Sunrun has also announced other key figures such as its gross profit per customer. This was around $6500, which is a weak figure. The acquisition of Vivint Solar is not yet included in the key figures.

Sunrun expects an increase in MW of 10% in Q4 2020 and to increase gross profit per customer to $8000.

The figures currently represent very weak to even declining growth. For the reasons listed above, growth should be stimulated again.

For additional informations, please have a look at their latest earnings release.

Sunrun to expand Brightbox offering to all markets

Sunrun now offers its Brightbox battery storage system on all markets with the news of November 5th. With it the Cross-Selling possibilities are advanced as extra to the additional solar plants. Likewise a Brightbox can be offered in addition, as stand-alone product.

Beyond backing up home power needs, in some markets, these systems can also share stored power across communities through aggregated, local clean energy networks known as “virtual power plants”. Participating Brightbox users strengthen the electric grid in their neighborhoods, helping decrease blackout events for their entire community.

Source: Sunrun Press Release

Herewith the ambitions and possibilities as a power generator are again further developed and underlined.

Completion of the Vivint Solar Acquisition

On October 8, Sunrun announced the successful and completed acquisition of Vivint Solar. This makes Sunrun 500000 customers heavy and produces over 3 gigawatts of solar power annually. Sunrun expects the acquisition to result in cost savings of over $90M over the next 12-18 months. In addition, all products from both companies will be unified and customers will be offered the best possible product. Vivint Solar will remain a separate company and will continue to operate under the name Vivint Solar.

Vivint Solar shareholders will receive 0.55 Sunrun shares per Vivint Solar share as payment.

The acquisition of Vivint Solar made here reflects several efforts of Sunrun:

On the one hand, Sunrun wants to continue to grow and thus creates a strong partner for itself, in order to increase its customer network, but also its geographical footprint. At the same time, many costs will be saved through common synergies. Furthermore, Sunrun wants to build a moat for itself as the absolute market leader by buying up competitors and integrating them into itself.

The deep Analysis

Financials

Dividend

The company currently does not pay a dividend.

Share Structure

Sunrun uses a one class share system. The current free-float to the public is low.

Note: The share Structure of Sunrun Inc. / Source

Both co-founders hold a combined amount of about $300M. With this amount, the have serious skin in the game, despite their ownership is only about 3% of all outstanding shares.

Chart

Valuation of the Stock

Sunrun is currently very highly valued. We have a one-year forward non-GAAP P/E-Ratio ("P/E-Ratio=Price to Earnings Ratio") of approximately over 100, which is a very high valuation. On the other we have an very good predictability due to their business model. Their competitors have similiar valuations. If we look at the Price/Revenue-Ratio, we have also a very high value of over 10 for 2020. Since Sunrun is a growth company and plans double digit growth numbers, it can basically grow strong in the next few years, the current valuation is high to very high. This stock is in fact not cheap.

Business Model

Sunrun has an ingenious, but also somewhat more complex business model. Sunrun works closely with small electrical companies that can install solar systems. Private customers, who are interested in a solar system, can purchase it from Sunrun and then have it installed by one of these smaller subcontractors. So far so simple. But Sunrun has built a sophisticated subscription model from the simple sale of the systems, which makes Sunrun a giant solar power producer. The high investment costs / acquisition costs of a solar plant deter many, not wealthy prospective customers. Here Sunrun takes this customer under the arm and finances the plant completely for the customers. In return, they pay off the system in the form of interest and payments for the solar power - on average, such a contract is for 20 years. This way, Sunrun has recurring revenues per customer over 20 years and profits from rising electricity prices, as it sells the electricity to its subscribers. At the same time, the cost of solar power systems decreases. Due to the close cooperation with subcontractors, the model is extremely scalable. Important key figures for Sunrun are the price per kwh, the amount of kwh produced and the number of its customers. Also the amount of solar assets is an important KPI.

Note: Sunrun at a glance / Source

Management

Sunrun is run by it's two co-founders - both of them had the idea of founding Sunrun, because the process of getting a solar energy system was rather unconfortable and difficult.

- Lynn Jurich - CEO - Lynn is chief executive officer and co-founder of Sunrun (Nasdaq: RUN), the nation’s largest dedicated provider of residential solar, storage and energy services in the United States. With Sunrun co-founder Ed Fenster, Lynn invented the business model "solar as a service" that unlocked consumer demand for clean, affordable energy direct from residential rooftops. Today with more than $3 billion in installed solar systems across 22 states and the District of Columbia, Sunrun is revolutionizing how consumers get electricity.

- Edward Fenster - Chairman - Ed co-founded Sunrun to make solar affordable for American families. He oversees capital raising and legislative and regulatory affairs. Under his leadership, Sunrun has enjoyed uninterrupted access to project finance throughout its history. Ed has worked to shape public and industry policy with the goal of building a sustainable solar industry.

- Tom von Reichbauer - CFO - Tom is responsible for the overall finance, accounting, and technology activities of the company and focuses on developing and executing strategies to grow Sunrun’s long-term value and competitiveness. Tom brings considerable industry experience as a leader at disruptive, mission-driven companies in the consumer energy industry including Google, Nest, and Tesla. Most recently he was a Vice President at Google.

- Chris Dawson - COO - Chris serves as Sunrun’s Chief Operating Officer and leads sales, commercial, operations and lead generation teams, as well as the wholesale and solar mounting solutions business. Chris brings best-in-class experience in sales and operational efficiency to Sunrun with over 25 years of experience working in consumer-facing companies.

Source: Sunrun

Sunrun is still managed by its founders, which is extremely good. Both founders basically invented the Sunrun business model and have great and innovative visions for several years. It is good when the managers have such a clear path and want to achieve this together with their company.

Competition

Sunrun has some very reputable competitors in the very popular and highly competitive market. The best known, but not the biggest competitor is Tesla. Tesla is a very polarizing company, which almost everyone knows by now. There is a concrete danger here, because Tesla likes to focus on some things and then perfect them. From a segment point of view, Tesla is only the 4th biggest competitor. Bigger are SunPower and Sunnova, which all have a similar model as Sunrun.

As you can see on the chart below, Sunrun is still by far the market leader in this field. With the acquisition of Vivint Solar, Sunrun should be able to maintain this position. In addition, strong competition in such a rapidly growing market is rather unproblematic, as any competitor can cut a piece of the ever-growing cake.

Note: Competition in the solar game. / Source

What to expect in the near future

Growth-Strategy

Sunrun will further strengthen its growth strategy in the near future. In doing so, Sunrun will continue to benefit strongly from various factors such as Joe Biden's environmental protection program or the general trend towards sustainable energy sources.

In addition, Sunrun could make further acquisitions should Vivint Solar's acquisition prove to be particularly successful and worthwhile. With a stronger focus on additional services and products, Sunrun also has great growth opportunities. Likewise, falling product costs and rising electricity prices continue to play a role in growth.

Transition-Strategy

Sunrun will also continue its transition to a smart, agile and green energy company. Further agreements, as described above, should follow and further underpin Sunrun's important position. Sunrun will become a growing US wide power producer in the coming years and will benefit from the oligopoly position of a power producer and the resulting increase in electricity prices.

Conclusion

Due to the exobirtant high valuation of Sunrun, it seems irresponsible at first glance to make a buy recommendation here. However, since the opportunities and possibilities, as well as the unique business model, as well as its predictability, make up for all the disadvantages of the high valuation. Sunrun is a unique company with extremely rare potential and enormously good prospects for the coming years - a clear buy.

Our recommendation: This stock is a clear buy. Use the current price for buying in or averaging up and use further price-falls to average up.

Disclaimer & Conflict of interest

The author currently does NOT hold a position in the mentioned stock, but intends to buy shares of the mentioned stock shortly after the release of this article. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Revenue by Quarter

Profitability by Quarter

Revenue Mix by Segment and Quarter

Selected KPIs

Chart

Peers

All the Peers

Alfen N.V.

Neutral

Bluelinx Holdings Inc

Bullish

Momentus Inc.

Neutral

Mynaric AG

Neutral

Virgin Galactic Holdings Inc.

Neutral

Maxar Technologies Inc.

Neutral

Steico SE

Neutral