The Search

Your Search Results

News from us

Newest Symbols

Newest Industries

Click to expand

Advertising

See Stocks

Automotive

See Stocks

E-Commerce

See Stocks

E-Learning

See Stocks

Electricity

See Stocks

Engineering

See Stocks

FlexShopper Inc.

Bullish

Bullish

Tattooed Chef Inc.

Neutral

Neutral

Hellofresh SE

Bullish

Bullish

Build-a-Bear Workshop Inc.

Outperform

Outperform

Stamps.com Inc.

Bullish

Bullish

Redfin Corporation

Bullish

Bullish

Perion Network Ltd.

Outperform

Outperform

Upwork Inc.

Bullish

Bullish

Chegg Inc.

Bullish

Bullish

Pinterest Inc.

Bullish

Bullish

Bluelinx Holdings Inc

Bullish

Bullish

Momentus Inc.

Neutral

Neutral

Mynaric AG

Neutral

Neutral

Virgin Galactic Holdings Inc.

Neutral

Neutral

Maxar Technologies Inc.

Neutral

Neutral

Sunrun Inc.

Bullish

Bullish

Steico SE

Neutral

Neutral

Alfen N.V.

Neutral

Neutral

Research

Content Cards

Swipe

Our Article

Upwork Inc. - Article

Research: Upwork - Is the Future Labor Market Remote?

Table of Content:

- What makes UPWORK so special?

- Business

- Management

- Financials

- Future strategy & Outlook

- Competition & Risks

- Valuation

- Conclusion

In the Silicon Valley where the future is imminent and trends are born, the COVID-19 storm is easily weathered. One of those companies´ tools to achieve this, is creating a remote working structure and environment. Square and Twitter CEO Jack Dorsey rephrased it like this:

“We want employees to be able to work where they feel most creative and productive. Moving forward, Squares will be able to work from home permanently, even once offices begin to reopen. Over the past several weeks, we’ve learned a lot about what it takes for people to effectively perform roles outside of an office, and we will continue to learn as we go.”

What makes UPWORK so special?

Labor market disruption

The gig economy gives project managers the chance to easily hire a trained professional for a specialized task. Upwork (UPWK) is the place that delivers superior conditions for both freelancers and clients

Highly educated labor pool

Upwork provides skills from 70+ work categories

Stay at home

In COVID-19 times this means you can evade a dangerous work environment and work in newly defined workspaces. Upwork reports that in Q2 45% of hiring agents have frozen full time hiring and 75% have switched to hiring independent professionals.

Scalable platform

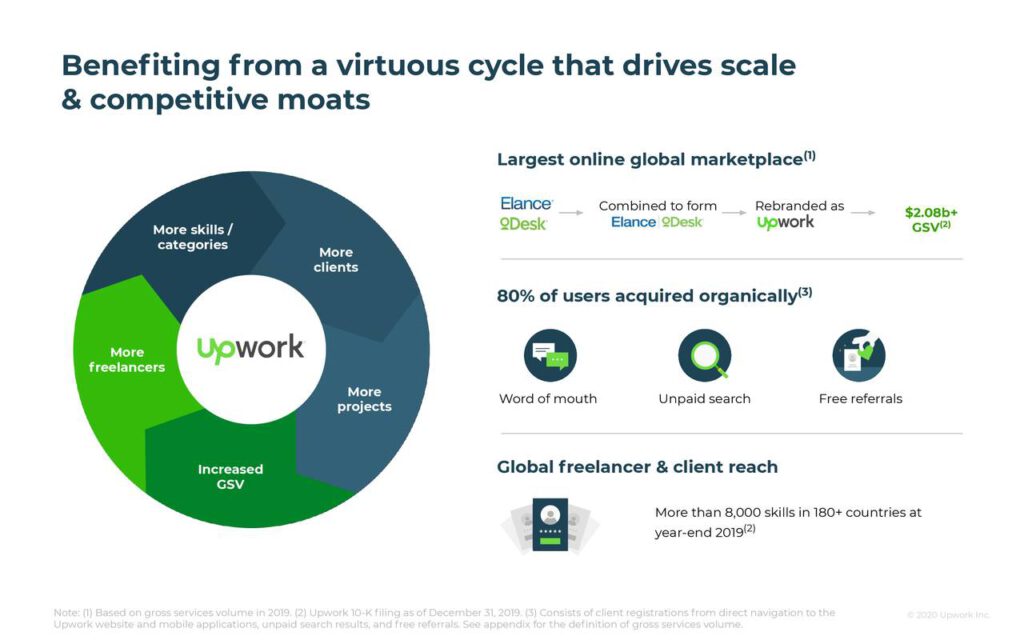

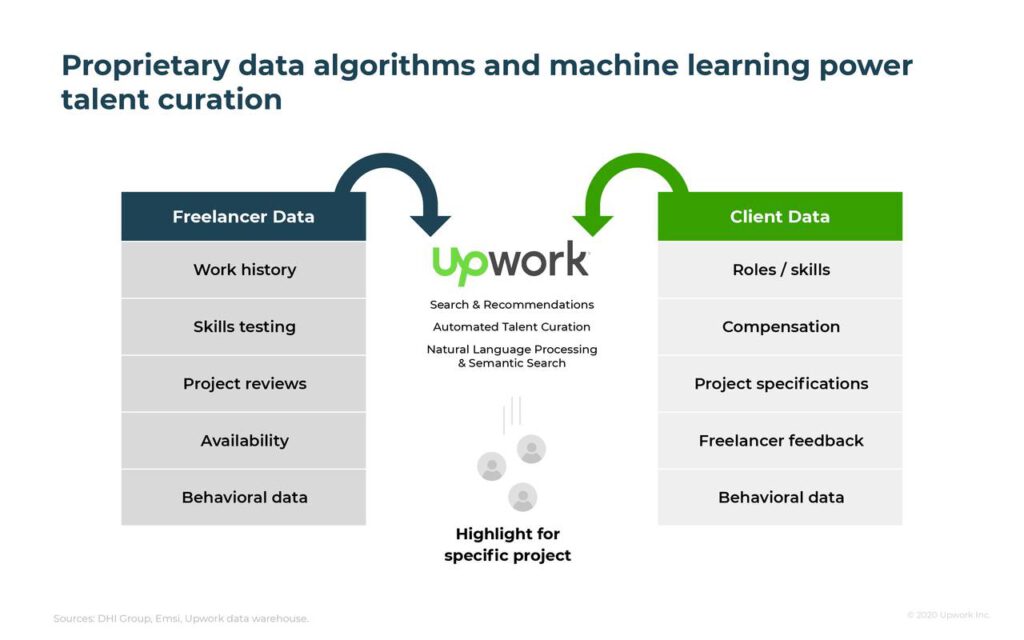

The fully automated UPWK marketplace curates search results and allocates the resources for the best solution.

Software integration

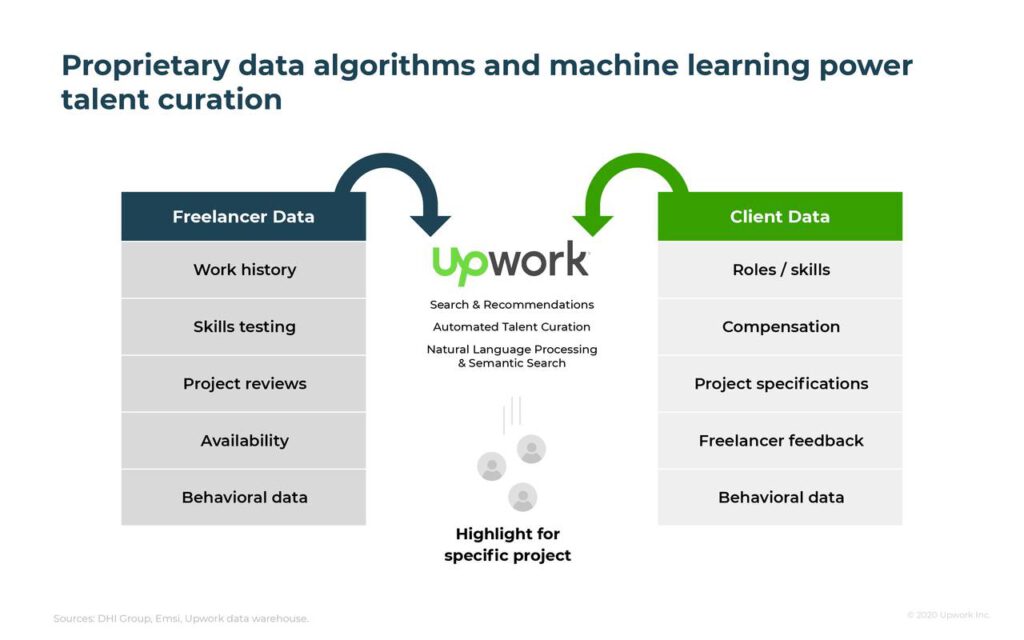

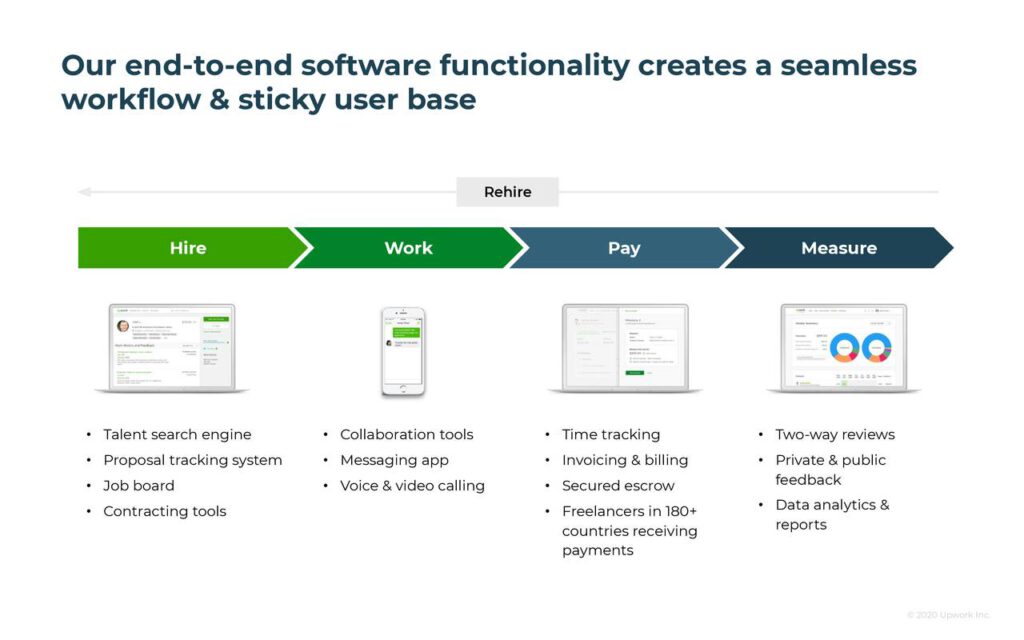

End to end software functionality creates a seamless workflow and a sticky user base.

Business

Upwork is a supply and demand side business case with freelancers on one side and business clients on the other. Upwork provides the marketplace for them to match.

Freelancers

An Upwork commissioned study in 2019 shows that 161M Service jobs globally can be performed remotely. The American Freelancers Union also reports that 53% of GenZs are already freelancers. The Upwork marketplace leverages this fact and provides a highly diverse user base. The platform´s freelancers are based around the globe; they have diverse skill sets and are highly educated. 80% + have a college degree and 34% have a post- graduate degree.

Working for Upwork provides the freelancer with access to high quality and flexible projects even outside their geographic market. The unbounded work environment breaks open living conditions and allows a lifestyle outside of the urban standards. This is especially important because the freelancer can easily escape the extreme living costs of urban centers like the Silicon Valley. With an adequate rooster of skills, the freelancer should easily and quickly get hired. The platform handles the milestone payments so the reliability of the freelancer´s salary is cared for. A portfolio of projects, skills and experiences can be constructed to build up the freelancer´s reputation.

Clients

Most companies already had remote workers in 2018, but this is dramatically boosted by the ongoing pandemic. Upwork´s clients mostly are Small and Medium-sized Businesses (SMBs) with less than 100 employees. They provide 80% of the platform´s gross service volume (GSV). The rest of the revenue is generated by large enterprises like Microsoft, GE, Coty etc.

The platform offers fast access to the talent pool, cost efficiencies for projects, trust and verification of freelancers and an end-to-end suite of workflow tools. Upwork´s horizontal market structure permits clients to effortlessly hire in different categories and for various projects or departments.

Platform

Upwork´s work platform brings key efficiencies to every project.

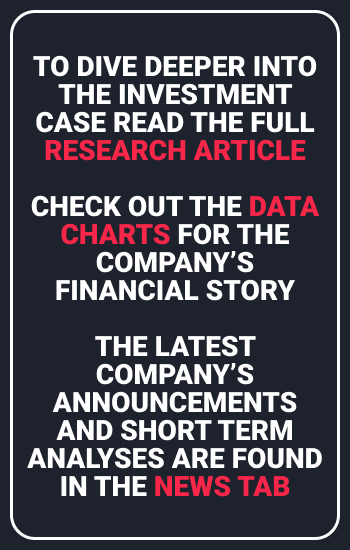

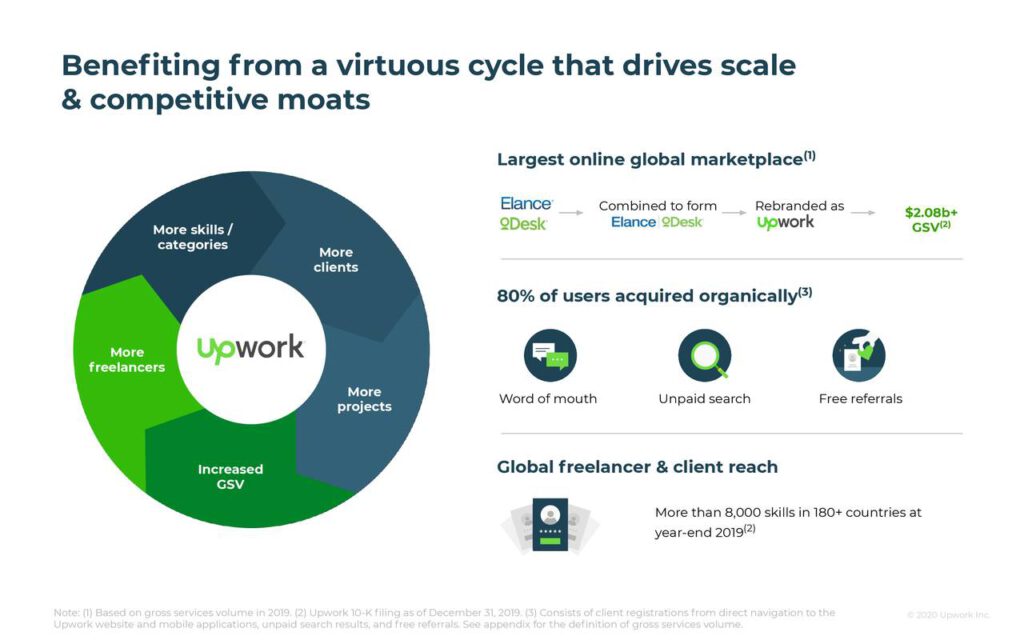

Theoretically every progress on the platform´s offers, benefit other aspects as the following virtuous circle demonstrates.

AI-supported processes support both constituents.

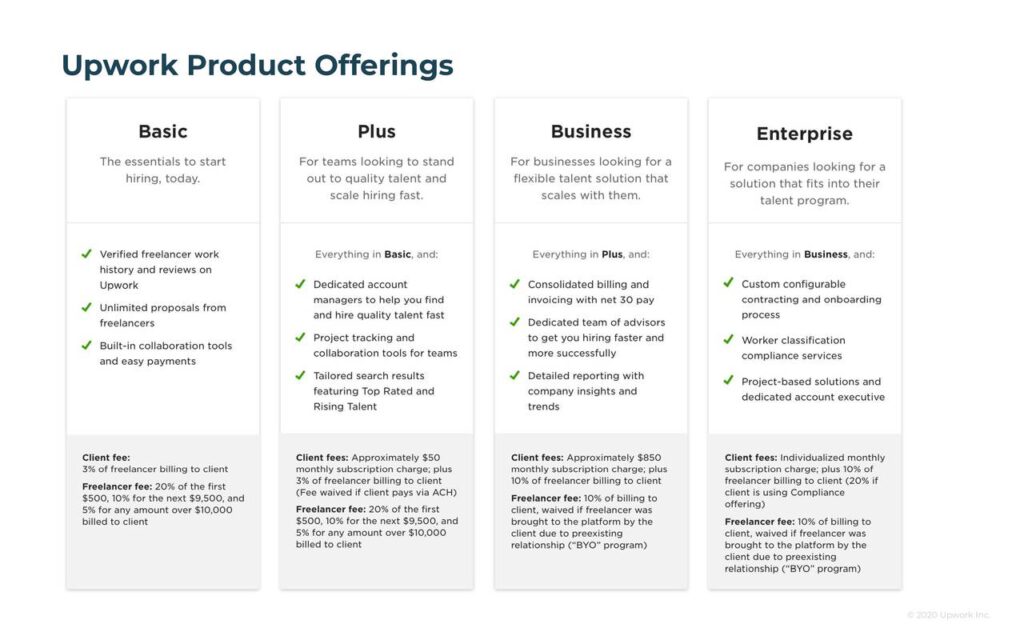

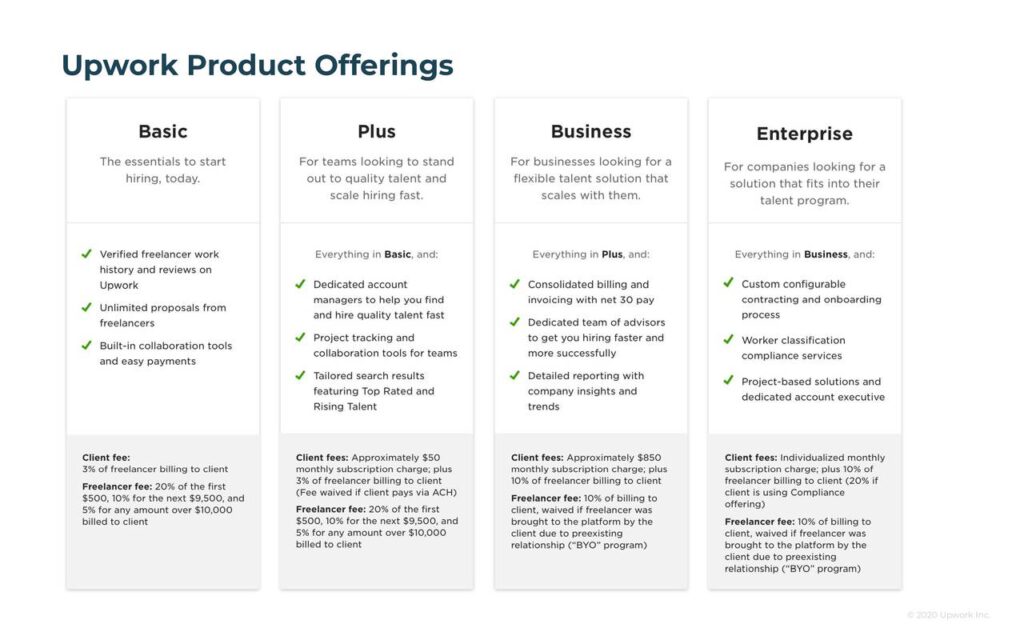

Upwork´s cost structures provide an easy entry and an open up product possibilities.

Management

President and CEO is Hayden Brown. She became CEO after eight years at the company, four of which she led Upwork’s product, design, and marketing teams. Prior to joining Upwork, Hayden was the head of corporate development at Live Person and previously held strategy roles at Microsoft including Director of Corporate Strategy and M&A.

Jeff McCombs is Chief Financial Officer of Upwork. Prior to joining Upwork, he served as the Chief Financial Officer of several organizations, including Doctor On Demand, OpenTable, and Flipboard. Jeff also previously served as the Head of Global Business Operations for Facebook, as well as the Senior Vice President of Business Operations at Yahoo!.

Matt McDonald leads the engineering team at Upwork, where he oversees a distributed technical team of more than 300 people who power the company’s online platform and its innovation. He became SVP of Engineering after four years of leading the Application Engineering teams at Upwork. Matt has 20 plus years of working in the internet industry, mainly in marketplace companies. Prior to joining Upwork, he built and led development teams for eBay’s Mobile and Innovations organizations and spent several years leading eBay’s Local & International Homepages & production teams.

Share structure

Almost 10 % of the company is held by Insiders. The biggest part is held by the director and venture capitalist (VC) Gregory Gretsch (7,7%) followed by the Chairman Thomas Layton (3,6%) and Director Kevi0n Harvey (1,97%). The CEO only has around 0,34%.

Chart

Financials

90% of UPWK´s revenue comes from the marketplace and 10% from their Managed Service.

An important metric in ecommerce marketplaces is the “Take Rate”. It describes the percentage of gross merchandise value of a transaction that is kept by the company. This lever, to increase profits, is bolstered by the strength of the platforms underlying network and tits competitive edge. UPWK´s Q3 take rate was 13,6% and did increase from 13,3% a year ago.

After falling beneath a 20% growth rate in the second quarter and seemingly not being the biggest pandemic profiteer, growth came back in Q3. The stock reacted frenetically after the results were announced and the company guided a steady growth rate in Q4.

After increasing investments in sales & marketing in the beginning of the year, they seem to bear fruit and could even be reduced in Q3. UPWK will continue to drive leverage in G&A as they scale for growth.

This progress is best seen in the net income improvement.

Q3 shows that profitability is imminent in the coming quaters.

Future strategy & Outlook

Growth comes from existing clients and platform / brand improvements. That includes further localization, expanded category offering and more enterprise sales.

30% of the Fortune 500 Companies already use Upwork´s services but they only provide 20% of the GSV, so there is still a long way to go. Attracting more enterprise customers, enabling more spend and making more quality matches are the company´s near-term growth goals.

Upselling will include providing more premium talents, a custom workflow, compliance services, consolidated billings, and premium services.

Personalized Search will be enhanced by a richer taxonomy and asemantic search to better browse through the recommendations.

The first quarters of 2020 have not seen a COVID usage surge which was quite a bummer. That´s because HR departments at first had reduced or even frozen their efforts of recruiting new employees. But not every branch of industry was affected, so recruitment has now reached pre-pandemic levels. With the implementation of remote working measures companies have realized how easily they can expand their teams. So now UPWK can profit from that delayed effect.

Competition & Risks

Fiverr is an online service marketplace for the gig economy. They are concentrated on graphic designs, digital marketing, writing, translation etc. So, compared to UPWK they are more focused on creative works. Fiverr as well has an eLearning platform with lots of creative course offerings to train their users. Until now Fiverr primarily provided smaller gigs rather than Upwork’s longer term enterprise solution. But FVRR just started their business solutions product, which shows that UPWK´s competition is not sleeping.

The shift in the labor market is poised to create a large market with several players. UPWK is the biggest one, but its peers are expanding rigorously. This could result in weakening margins, but the growth in TAM should still be a greater factor.

Valuation

Comparing UPWK trailing twelve months (TTM) price to sales (P/S) ratio of 7 with its peers, it seems outstandingly cheap. FVRR is valued at the ratio almost four times as much, but they offer a somewhat higher gross margin, more than three times the top line growth and at double the take rate.

The comparison shows, if UPWK´s efforts provide as much dynamic as they delivered in Q3, then the path to FVRR´s valuation still gives a good upside potential. But for that, the top line growth must be as steady as guided or even accelerate slightly and the take rate must improve as well. Especially important is the organic part of a UPWK´s growth because this allows them to reduce their expenses on a revenue basis.

Conclusion

Getting a foot into this emerging megatrend is vital for a portfolio build for future success, but as the valuation and their stock price rallyes suggests, both FVRR and UPWK provide a good but not cheap entry point. Discrepancies between their valuation should be closely monitored and could call to action.

Our recommendation: This stock is a clear buy. Use sell-offs or weak market days for buying in or averaging up.

Disclaimer & Conflict of interest

The author currently does NOT hold a position in the mentioned stock, but intends to buy shares of the mentioned stock shortly after the release of this article. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Upwork Inc. - Article

Research: Upwork - Is the Future Labor Market Remote?

Table of Content:

- What makes UPWORK so special?

- Business

- Management

- Financials

- Future strategy & Outlook

- Competition & Risks

- Valuation

- Conclusion

In the Silicon Valley where the future is imminent and trends are born, the COVID-19 storm is easily weathered. One of those companies´ tools to achieve this, is creating a remote working structure and environment. Square and Twitter CEO Jack Dorsey rephrased it like this:

“We want employees to be able to work where they feel most creative and productive. Moving forward, Squares will be able to work from home permanently, even once offices begin to reopen. Over the past several weeks, we’ve learned a lot about what it takes for people to effectively perform roles outside of an office, and we will continue to learn as we go.”

What makes UPWORK so special?

Labor market disruption

The gig economy gives project managers the chance to easily hire a trained professional for a specialized task. Upwork (UPWK) is the place that delivers superior conditions for both freelancers and clients

Highly educated labor pool

Upwork provides skills from 70+ work categories

Stay at home

In COVID-19 times this means you can evade a dangerous work environment and work in newly defined workspaces. Upwork reports that in Q2 45% of hiring agents have frozen full time hiring and 75% have switched to hiring independent professionals.

Scalable platform

The fully automated UPWK marketplace curates search results and allocates the resources for the best solution.

Software integration

End to end software functionality creates a seamless workflow and a sticky user base.

Business

Upwork is a supply and demand side business case with freelancers on one side and business clients on the other. Upwork provides the marketplace for them to match.

Freelancers

An Upwork commissioned study in 2019 shows that 161M Service jobs globally can be performed remotely. The American Freelancers Union also reports that 53% of GenZs are already freelancers. The Upwork marketplace leverages this fact and provides a highly diverse user base. The platform´s freelancers are based around the globe; they have diverse skill sets and are highly educated. 80% + have a college degree and 34% have a post- graduate degree.

Working for Upwork provides the freelancer with access to high quality and flexible projects even outside their geographic market. The unbounded work environment breaks open living conditions and allows a lifestyle outside of the urban standards. This is especially important because the freelancer can easily escape the extreme living costs of urban centers like the Silicon Valley. With an adequate rooster of skills, the freelancer should easily and quickly get hired. The platform handles the milestone payments so the reliability of the freelancer´s salary is cared for. A portfolio of projects, skills and experiences can be constructed to build up the freelancer´s reputation.

Clients

Most companies already had remote workers in 2018, but this is dramatically boosted by the ongoing pandemic. Upwork´s clients mostly are Small and Medium-sized Businesses (SMBs) with less than 100 employees. They provide 80% of the platform´s gross service volume (GSV). The rest of the revenue is generated by large enterprises like Microsoft, GE, Coty etc.

The platform offers fast access to the talent pool, cost efficiencies for projects, trust and verification of freelancers and an end-to-end suite of workflow tools. Upwork´s horizontal market structure permits clients to effortlessly hire in different categories and for various projects or departments.

Platform

Upwork´s work platform brings key efficiencies to every project.

Theoretically every progress on the platform´s offers, benefit other aspects as the following virtuous circle demonstrates.

AI-supported processes support both constituents.

Upwork´s cost structures provide an easy entry and an open up product possibilities.

Management

President and CEO is Hayden Brown. She became CEO after eight years at the company, four of which she led Upwork’s product, design, and marketing teams. Prior to joining Upwork, Hayden was the head of corporate development at Live Person and previously held strategy roles at Microsoft including Director of Corporate Strategy and M&A.

Jeff McCombs is Chief Financial Officer of Upwork. Prior to joining Upwork, he served as the Chief Financial Officer of several organizations, including Doctor On Demand, OpenTable, and Flipboard. Jeff also previously served as the Head of Global Business Operations for Facebook, as well as the Senior Vice President of Business Operations at Yahoo!.

Matt McDonald leads the engineering team at Upwork, where he oversees a distributed technical team of more than 300 people who power the company’s online platform and its innovation. He became SVP of Engineering after four years of leading the Application Engineering teams at Upwork. Matt has 20 plus years of working in the internet industry, mainly in marketplace companies. Prior to joining Upwork, he built and led development teams for eBay’s Mobile and Innovations organizations and spent several years leading eBay’s Local & International Homepages & production teams.

Share structure

Almost 10 % of the company is held by Insiders. The biggest part is held by the director and venture capitalist (VC) Gregory Gretsch (7,7%) followed by the Chairman Thomas Layton (3,6%) and Director Kevi0n Harvey (1,97%). The CEO only has around 0,34%.

Chart

Financials

90% of UPWK´s revenue comes from the marketplace and 10% from their Managed Service.

An important metric in ecommerce marketplaces is the “Take Rate”. It describes the percentage of gross merchandise value of a transaction that is kept by the company. This lever, to increase profits, is bolstered by the strength of the platforms underlying network and tits competitive edge. UPWK´s Q3 take rate was 13,6% and did increase from 13,3% a year ago.

After falling beneath a 20% growth rate in the second quarter and seemingly not being the biggest pandemic profiteer, growth came back in Q3. The stock reacted frenetically after the results were announced and the company guided a steady growth rate in Q4.

After increasing investments in sales & marketing in the beginning of the year, they seem to bear fruit and could even be reduced in Q3. UPWK will continue to drive leverage in G&A as they scale for growth.

This progress is best seen in the net income improvement.

Q3 shows that profitability is imminent in the coming quaters.

Future strategy & Outlook

Growth comes from existing clients and platform / brand improvements. That includes further localization, expanded category offering and more enterprise sales.

30% of the Fortune 500 Companies already use Upwork´s services but they only provide 20% of the GSV, so there is still a long way to go. Attracting more enterprise customers, enabling more spend and making more quality matches are the company´s near-term growth goals.

Upselling will include providing more premium talents, a custom workflow, compliance services, consolidated billings, and premium services.

Personalized Search will be enhanced by a richer taxonomy and asemantic search to better browse through the recommendations.

The first quarters of 2020 have not seen a COVID usage surge which was quite a bummer. That´s because HR departments at first had reduced or even frozen their efforts of recruiting new employees. But not every branch of industry was affected, so recruitment has now reached pre-pandemic levels. With the implementation of remote working measures companies have realized how easily they can expand their teams. So now UPWK can profit from that delayed effect.

Competition & Risks

Fiverr is an online service marketplace for the gig economy. They are concentrated on graphic designs, digital marketing, writing, translation etc. So, compared to UPWK they are more focused on creative works. Fiverr as well has an eLearning platform with lots of creative course offerings to train their users. Until now Fiverr primarily provided smaller gigs rather than Upwork’s longer term enterprise solution. But FVRR just started their business solutions product, which shows that UPWK´s competition is not sleeping.

The shift in the labor market is poised to create a large market with several players. UPWK is the biggest one, but its peers are expanding rigorously. This could result in weakening margins, but the growth in TAM should still be a greater factor.

Valuation

Comparing UPWK trailing twelve months (TTM) price to sales (P/S) ratio of 7 with its peers, it seems outstandingly cheap. FVRR is valued at the ratio almost four times as much, but they offer a somewhat higher gross margin, more than three times the top line growth and at double the take rate.

The comparison shows, if UPWK´s efforts provide as much dynamic as they delivered in Q3, then the path to FVRR´s valuation still gives a good upside potential. But for that, the top line growth must be as steady as guided or even accelerate slightly and the take rate must improve as well. Especially important is the organic part of a UPWK´s growth because this allows them to reduce their expenses on a revenue basis.

Conclusion

Getting a foot into this emerging megatrend is vital for a portfolio build for future success, but as the valuation and their stock price rallyes suggests, both FVRR and UPWK provide a good but not cheap entry point. Discrepancies between their valuation should be closely monitored and could call to action.

Our recommendation: This stock is a clear buy. Use sell-offs or weak market days for buying in or averaging up.

Disclaimer & Conflict of interest

The author currently does NOT hold a position in the mentioned stock, but intends to buy shares of the mentioned stock shortly after the release of this article. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Revenue by Quarter

Profitability by Quarter

Expenditures by Quarter

Chart

Peers

All the Peers

FlexShopper Inc.

Bullish

Tattooed Chef Inc.

Neutral

Hellofresh SE

Bullish

Build-a-Bear Workshop Inc.

Outperform

Stamps.com Inc.

Bullish

Redfin Corporation

Bullish

Perion Network Ltd.

Outperform

Chegg Inc.

Bullish