The Search

Your Search Results

News from us

Newest Symbols

Newest Industries

Click to expand

Advertising

See Stocks

Automotive

See Stocks

E-Commerce

See Stocks

E-Learning

See Stocks

Electricity

See Stocks

Engineering

See Stocks

FlexShopper Inc.

Bullish

Bullish

Tattooed Chef Inc.

Neutral

Neutral

Hellofresh SE

Bullish

Bullish

Build-a-Bear Workshop Inc.

Outperform

Outperform

Stamps.com Inc.

Bullish

Bullish

Redfin Corporation

Bullish

Bullish

Perion Network Ltd.

Outperform

Outperform

Upwork Inc.

Bullish

Bullish

Chegg Inc.

Bullish

Bullish

Pinterest Inc.

Bullish

Bullish

Bluelinx Holdings Inc

Bullish

Bullish

Momentus Inc.

Neutral

Neutral

Mynaric AG

Neutral

Neutral

Virgin Galactic Holdings Inc.

Neutral

Neutral

Maxar Technologies Inc.

Neutral

Neutral

Sunrun Inc.

Bullish

Bullish

Steico SE

Neutral

Neutral

Alfen N.V.

Neutral

Neutral

Research

Content Cards

Swipe

Our Article

Chegg Inc. - Article

Research: Chegg - The Next Netflix in the E-Learning Market?

Note: The Chegg Platform

Table of Content:

- Author’s Opinion

- Introduction to the Company

- What makes it so special?

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author’s Opinion

During the Covid-19 pandemic, only a few companies have delivered and maintained a good image, both from a business and social perspective, like Chegg Inc. Chegg combines the megatrends of e-commerce and subscription models in the rapidly developing e-learning market.

Unlike the government and universities, Chegg has provided its customers, hundreds of thousands of students, with reliable support during the crisis, providing them with education and help in learning. Chegg was reliable and affordable, while others were not. For this reason, Chegg represents a tremendously exciting investment case as the reputation, market and demand for Chegg’s solutions has grown tremendously. This trend will continue and accelerate as it has in recent years and months.

Introduction: Let the company introduce itself

Chegg is a Smarter Way to Student. As the leading direct-to-student learning platform, we strive to improve educational outcomes by putting the student first in all our decisions. We support students on their journey from high school to college and into their career with tools designed to help them pass their test, pass their class, and save money on required materials. Our services are available online, anytime and anywhere, so we can reach students when they need us most. Chegg is a publicly held company based in Santa Clara, California and trades on the NYSE under the symbol CHGG. For more information, visit www.chegg.com.

Source: Chegg

What makes Chegg so special?

One Platform full of different products and services

“Books”

Chegg Books is a service for students, where they can rent or buy books for their studies. They also can access e-papers or e-books their. “Books” is like the early model of Netflix, where they were sending physical DVDs to their customers. The advantage is, that you can stay at home and order your expensive special book for your studies – and don’t have to pay the full price, because you rent it.

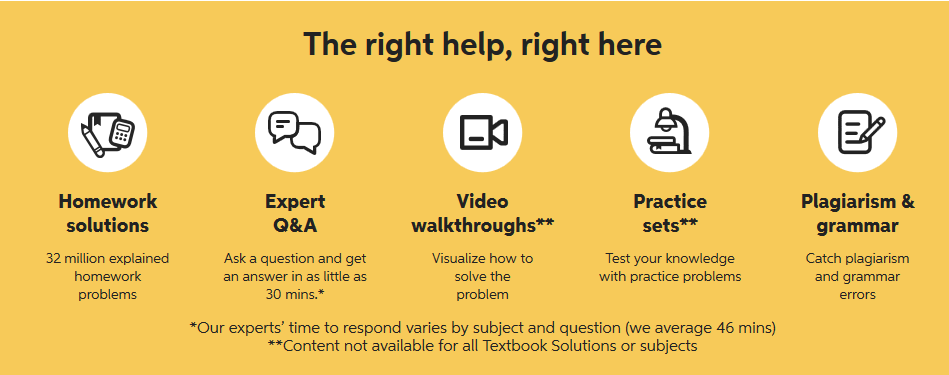

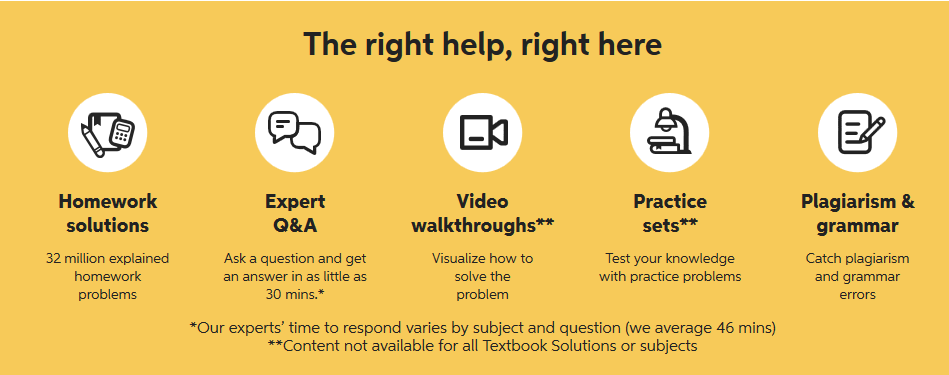

“Study”

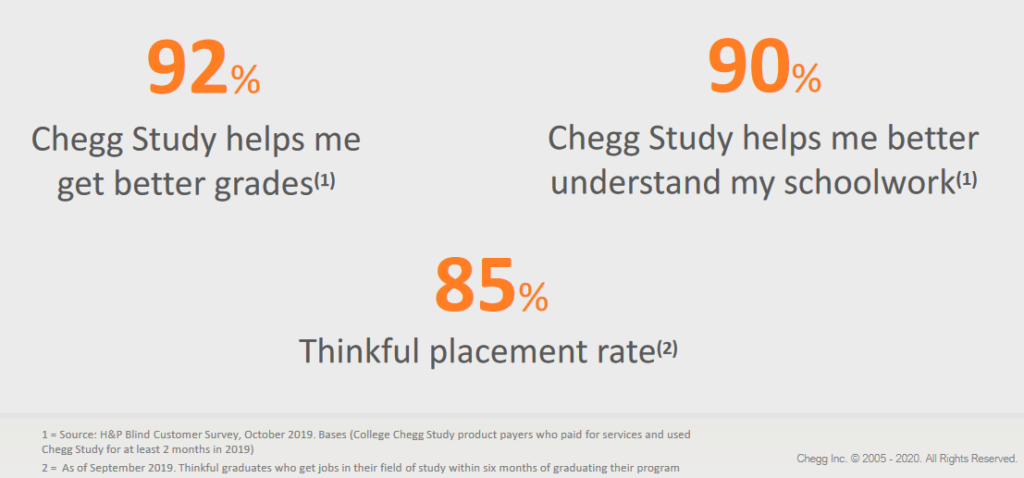

Chegg Study is a monthly subscription service for 15 Bucks $ per month. It includes Textbook Solutions and Expert Q&A. It is an simple and useful subscription for easy results.

Textbook Solutions: With Textbook Solutions you get more than just answers. See step-by-step how to solve tough problems. And learn with guided video walkthroughs & practice sets for thousands of problems.

Expert Q&A: Take a photo of your question and get an answer in as little as 30 mins*. With over 21 million homework solutions, you can also search our library to find similar homework problems & solutions.

Source: Chegg.com

There is also the Chegg Study pack, which is a more costly monthly subscription with additional features and tools like the Math Solver or Chegg Writing.

Note: The Chegg Study Pack

“Writing”

Chegg Writing is also another subscription which costs 10$ per month. It features plagiarism checks, experts reviewing your texts, support for citing and grammar checking.

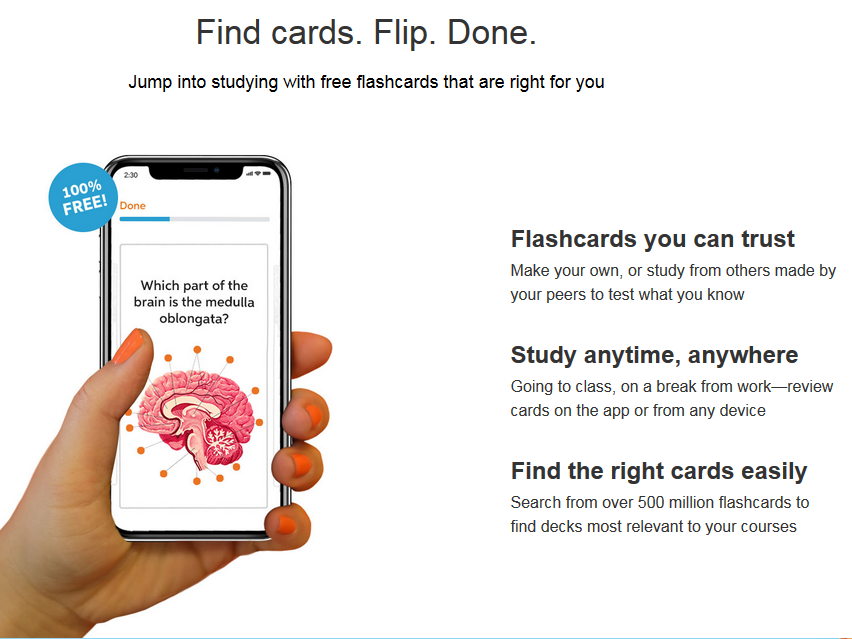

“Flashcards”

Chegg Flashcards is a free app. You can create or use existing flashcards to learn easy and fast new topics. Flashcards is used to attract new students and make them aware for the other Chegg services and products.

Note: The Chegg Flashcards App

“Math Solver”

The Chegg Math Solver is an freemium like (web) app. You can enter your math problems into the calculator and get the solution as an answer. If you want detailed step-by-step solutions and additional explanations, in a graph for example, you have to pay 10$ per month.

Go test it…

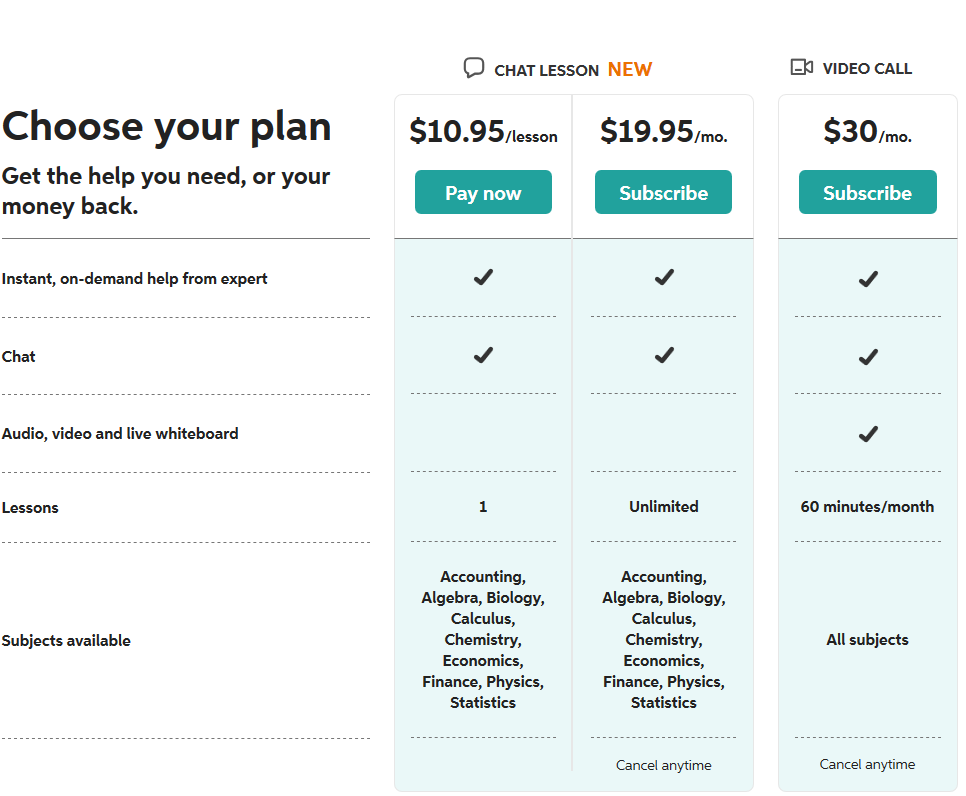

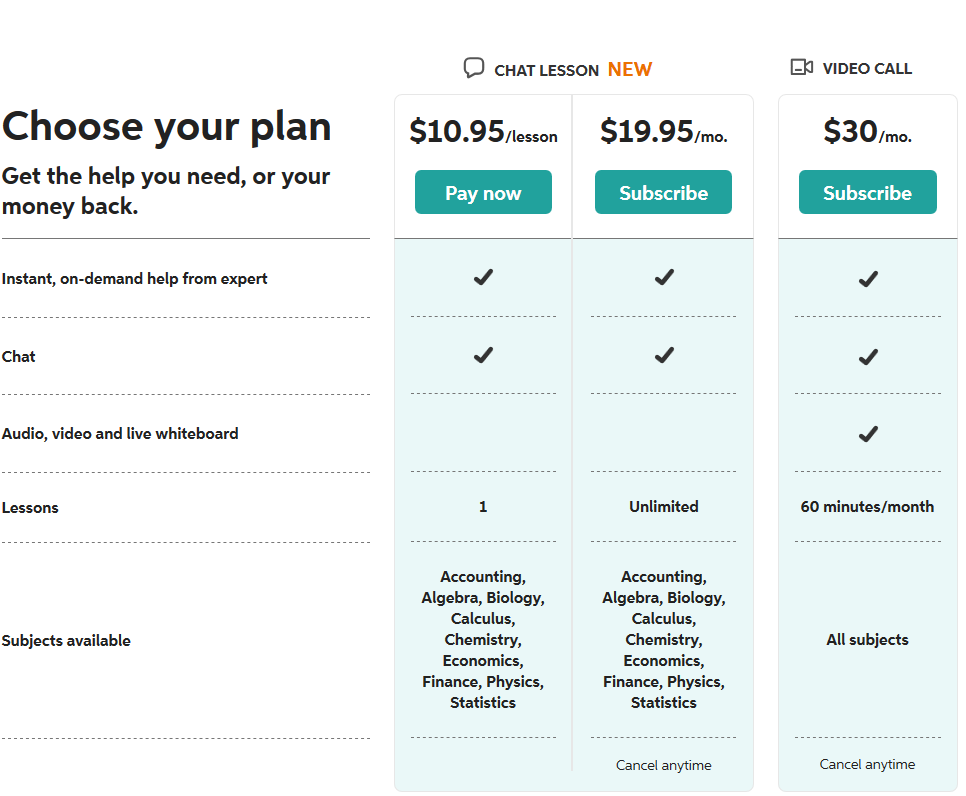

“Tutors”

Did you ever wanted to get help from an experienced tutor asap? Chegg Tutor makes this available – you can chat or speak on video with your tutor and get the help you want. With an positive feedback-ratio of about 96%, Chegg Tutor is a nice product addition and very helpful tool, during the pandemic. Chegg offers different subscription models for their tutor service, which can be seen below:

Note: Plans for Chegg Tutor

“Internships”

Chegg Internships is another product for students, which shows the ambitions from Chegg to fully support students in every part of their studies. Internships is like a career portal, where students can discover internships from known to unknown companies and boost their careers during or after their graduation with an internship.

Find a internship …

“Scholarships”

Chegg Scholarships is similar to Internships – it is a portal full of scholarships. You see the amount and the requirements for that scholarship and you can apply for them. You can also edit your profile, to see only matching scholarships to you profile.

Find a scholarship …

Reliable and affordable in contrast to the officials and universities

The American education system is known for expensive and rather difficult to access education. Due to the partial closure of schools and universities around the world, as well as the cutting off of other educational opportunities such as tutoring or libraries, many students and pupils were left alone and helpless during the Covid-19 pandemic. Many universities or schools did not and do not have proper digital concepts to educate their protégés properly. In addition, many students and households do not accept to invest large amounts of money into their education if they can no longer be delivered physically or even takes place properly.

On the contrary, Chegg has also been able to hold its ground very well and strongly during the pandemic and gained a lot of trust from their students in this segment. Inexpensive, reliable and well-functioning educational opportunities as well as support with homework or complex issues were among the most sought-after services during the pandemic. And Chegg was fully equipped for this at the time and, unlike the public institutions, was able to deliver and further build it’s confidence.

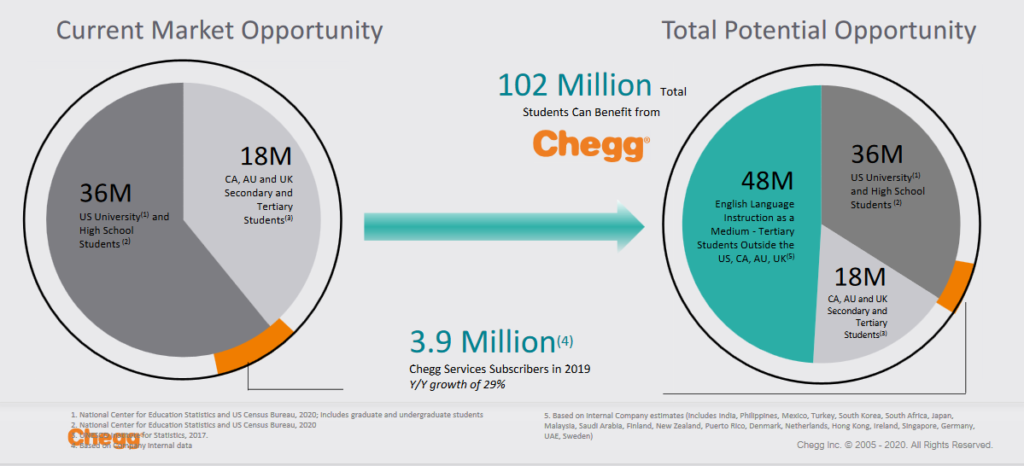

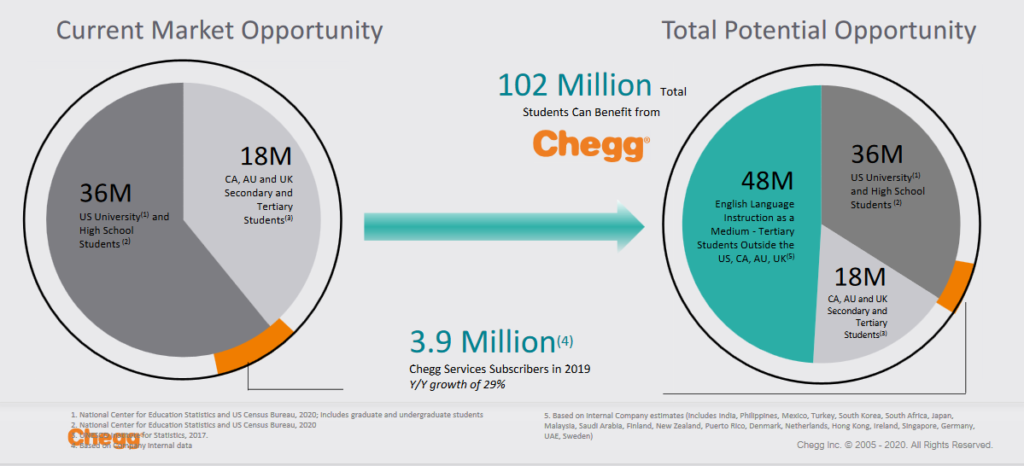

Unique target group and market-opportunity

According to Chegg’s latest earnings slide, there are much more opportunities and momentum in the business segment, in which they are acting. For example, there are more than 100M students, which can profit from Chegg services and products. In relation to that big number, there are currently “only” 3.9Mio Chegg users. To be sure, this big market opportunity will grow each year, especially horizontal on the demand and offer site.

Note: Chegg’s very big Market Opportunity / Source

While many Students face more problems like debt or underemployment, they need ONE platform, to get the help and right education, they need in a digital and affordable way.

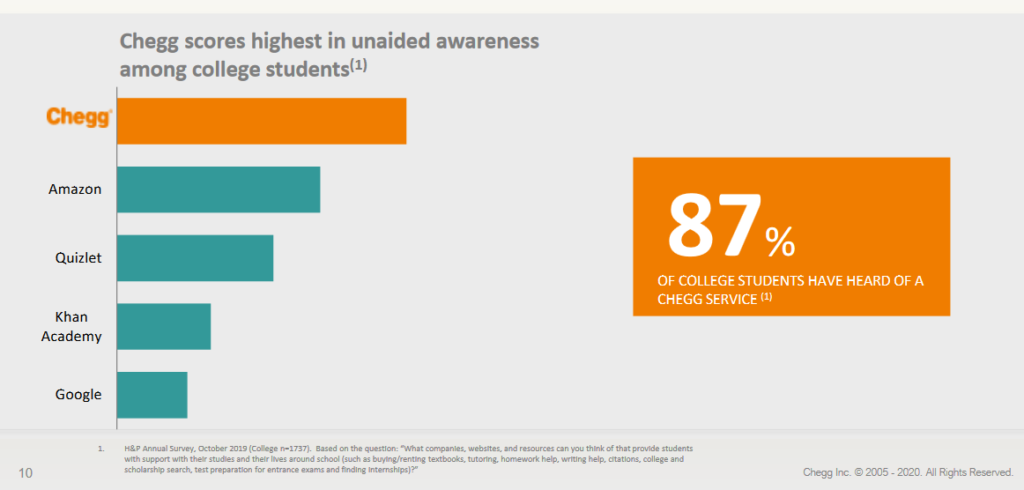

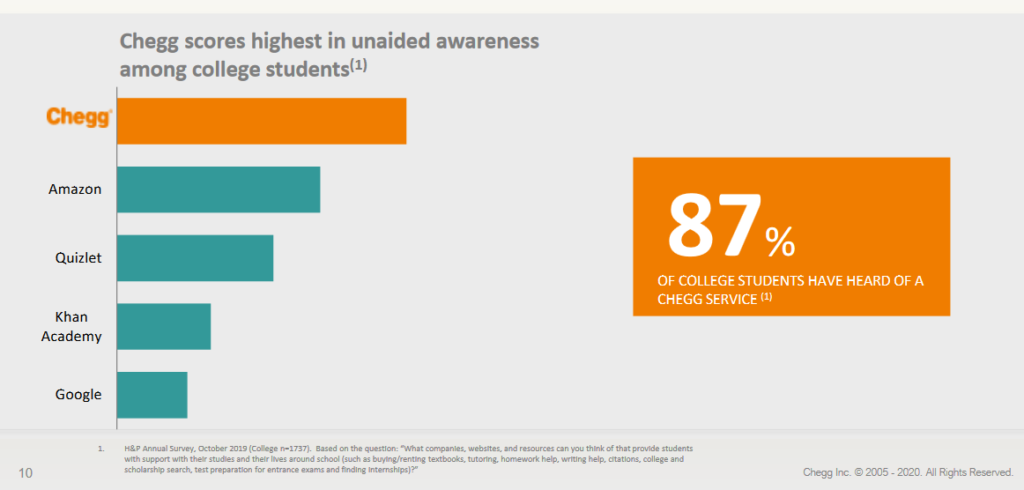

Chegg is also the most recognized brand based on the question: “What companies, websites, and resources can you think of that provide students with support with their studies and their lives around schools?” on US campus.

Note: Chegg is well known on the US campus / Source

Recent News and Updates

The Release of the Results for the third Quarter 2020 and Guidance for 2021

Chegg Inc. has announced their latest earnings results on October 26th. Their earnings soared another quarter, after the pandemic is boosting their business hard. They achieved double digit growth numbers on several KPIs, including:

- Revenues increased 64% Year-over-Year to $154Mio

- Chegg Service Subscribers increased 69% Year-over-Year to M3.7 subscribers – the Service Revenues have also increased 72% – those numbers indicate also an growth in the ARPU. (“ARPU = Average Revenue Per User”).

- Adjusted EBITDA (“Earning Before Interest, Taxes, Deprecations and Amortization”) was $31.9Mio, compared to $23.1Mio one year before. So on an adjusted EBITDA base, and also on the Non-GAAP (“GAAP = General Accepted Accounting Principles”) net income, Chegg is profitable, despite it’s monster growth and expansion.

Chegg also revealed it’s outlook for the 4th quarter of 2020 and for 2021. Chegg expects another brutal revenue increase for their 4th quarter 2020 and also a more than doubling of their Adjusted EBITDA compared to Q3 2020.

- Revenue of about $190Mio and Adjusted EBITDA of about 84$Mio.

- Revenue for fiscal year 2020: Revenues of about $626Mio and Adjusted EBITDA of about $203Mio.

Their 2021 guidance came in a bit low with a revenue guidance of about $775Mio and an Adjusted EBITDA of $260Mio, indicating a growth-rate of about 23%. This “low” growth-rate was punished by investors with a sell-off. If the pandemic last longer than 2020, then this outlook should be increased and updated very fast, while the current outlook is a very cautious one.

For additional information, please have a look at their latest earnings release.

Announcement of $1B Senior Notes Offering

Chegg first announced on 17th of August an Convertible Senior Notes offering with an volume of $750M. This means, that Chegg Inc. is giving notes away, with an fixed interest coupon in order to collect money. After they expire, the investor gets one common stock in exchange or he gets his money back.

On 21th August, they announced the closing of an upsized offering of about $1B. They used the money for the following purposes:

Chegg used $103.4 million of the net proceeds from the offering of the notes to pay the cost of the capped call transactions described below to manage potential dilution. In addition, Chegg used approximately $174.7 million of the net proceeds from the offering to fund the cash consideration (exclusive of accrued interest) and issued approximately 4.2 million shares of Chegg common stock for the remainder of the consideration due in respect of the exchange of approximately $172.0 million aggregate principal amount of its 0.25% Convertible Senior Notes due 2023 (the “2023 notes”). In connection with the exchanges of the 2023 notes, Chegg terminated a corresponding portion of the existing capped call transactions that Chegg entered into when the 2023 notes were issued. Chegg intends to use the remainder of the net proceeds for general corporate purposes, which may include acquisitions or other strategic transactions. The exchanges of the 2023 notes are not part of the $500.0 million securities repurchase program previously announced by Chegg in June 2020.

Source: Chegg Press Release

In short, they used more than half of the money to pay for older convertible notes and the rest of the money is for general corporate purposes and maybe for additional acquisitions, to further boost growth.

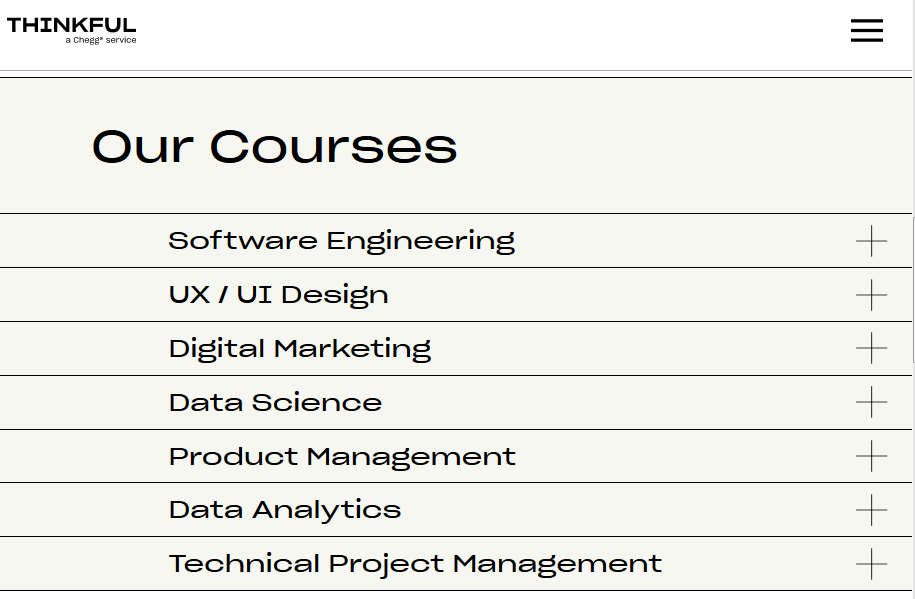

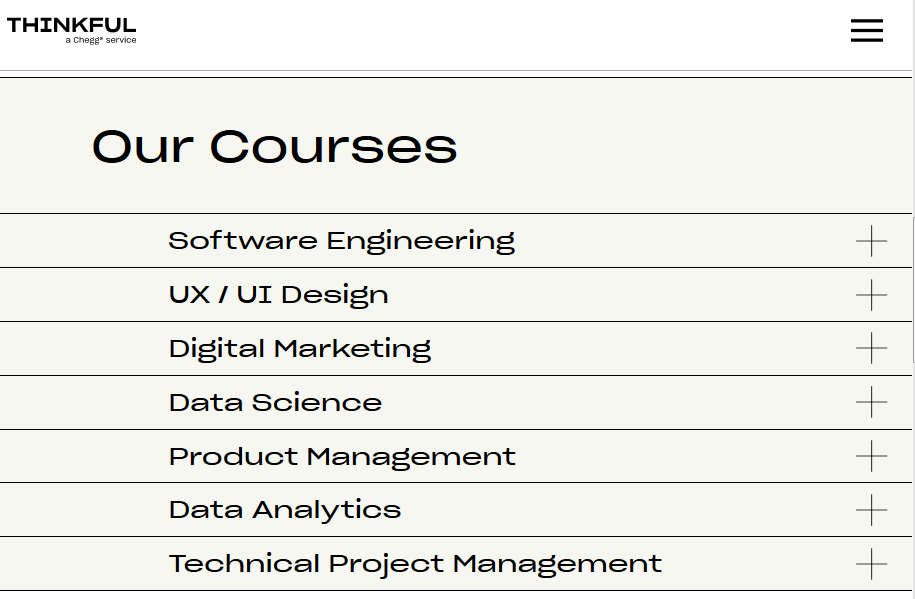

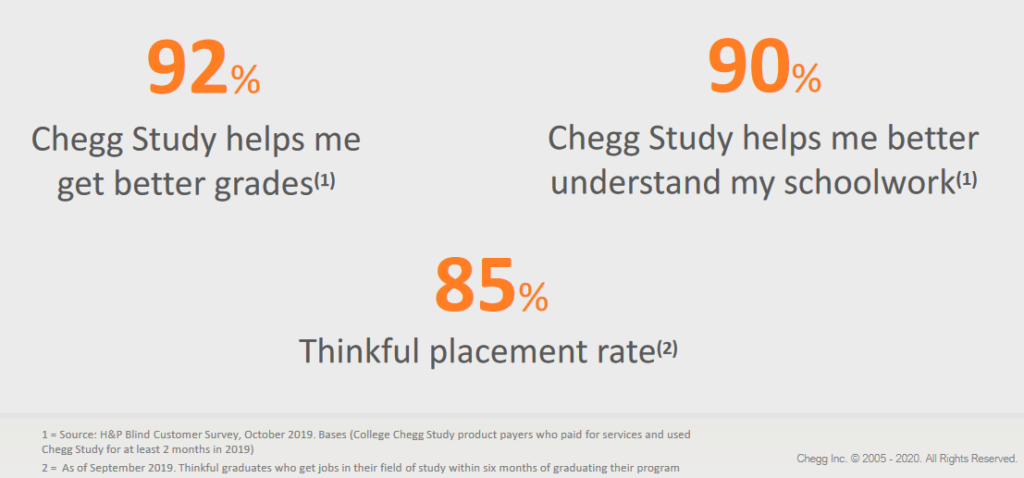

Acquisition of Online Learning Platform Thinkful

Chegg Inc has announced on 4th of September 2019 the acquisition of Thinkful. Thinkful is an online learning platform, which offers skill-based learning courses for students in America. Thinkful is so good, that about 85% of their online graduates get an paid job within 6 months after the successful graduation from the Thinkful platform.

Founded in 2012 by Darrell Silver and Daniel Friedman, Thinkful offers high-quality, online, outcomes-focused curricula, coupled with live experts, to give learners highly sought-after technology skills such as engineering, data science, data analytics and product design.

Source: Chegg Press Release

Chegg wants to expand their customer base with this acquisiton on several sides. First they can cross-sell the chegg study subscriptions and services to all Thinkfull users as an additional service for them. Chegg also expands their customer base with new customers from the Thinkful platform. Second, Chegg is increasing it’s lineup of products and services, to become a real platform full of student services and products. Now Chegg has those little to extra subscription options and services plus on fully good working and digital graduation platform for students.

Note: Thinkful’s current offer of courses

The acquisition costs Chegg about $80M in cash. There maybe an additional $20M payment, depending on performance of Thinkful.

The deep Analysis

Financials

Dividend

The company currently does not pay a dividend.

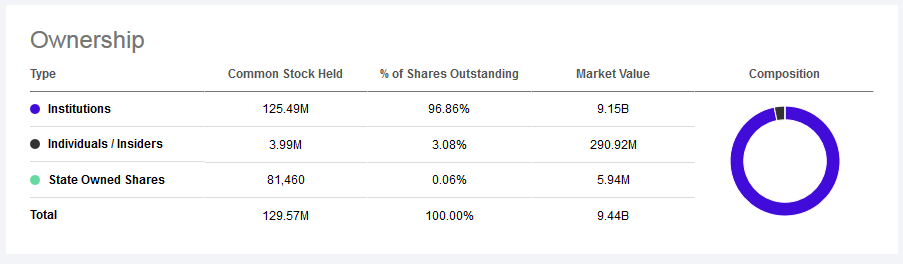

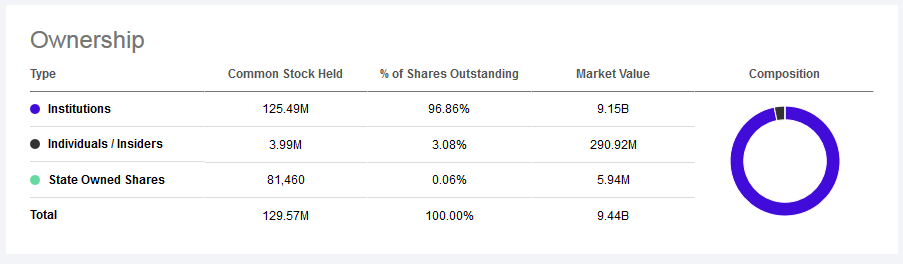

Share Structure

Chegg Inc. uses a one class share system. There are normal mutual fund or institutional holdings.

Note: The share Structure of Chegg Inc. / Source

There is little to no relevant insider or founder with a bigger holding in this stock.

Chart

Valuation of the Stock

The Chegg stock has currently an one year forward P/E-Ratio (“P/E-Ratio = Price/Earnings-Ratio; The higher the ratio, the higher is the valuation”) of about 58 which is in fact high, but fair enough for the growth numbers and opportunities, which lays ahaed for Chegg. Assuming that Chegg can achieve an EPS (“EPS = Earnings per share”) of 2.11$ for the fiscal year 2022, than Chegg would have an P/E-Ratio of about 35, which is low to medium for their growth. Looking on the EBITDA numbers, the valuation is even lower. Since the business is in a phase of strong growth and they are profitable with an positive cashflow, the valuation is pretty fair.

Business Model

Chegg’s business model may seem a bit confusing at first glance, as there are many different products and offers. But in the end there is a very simple and sophisticated model behind it.

Chegg mainly earns his money through monthly subscriptions, which are in the range of 10 to 25$ per month. So Chegg earns more if more customers come to the platform or take out more of these different subscriptions. So the main growth opportunities are mainly through expanding and acquiring new customers and increasing the ARPU by selling more services to existing customers.

In addition, Chegg earns irregular and unpredictable revenue from their book rental business and the training and courses offered by the Thinkful platform.

If you now observe Chegg, you should definitely focus on revenue generated by subscriptions, because these revenues are predictable, scalable and recurring. This kind of revenue has a so much better quality for the business, than non-recurring and unpredictable revenue. The non-recurring revenues are a nice addition, but should be a smaller and smaller part in the coming years.

Operations

Chegg currently operates mainly in the USA and is also focused on this market. Due to the pandemic, the number of international users has risen significantly, which is why a further focus should soon emerge here.

Chegg currently operates the services described above on its platform and also runs Thinkful.

Management

- CEO: Dan Rosensweig – In 2010, Dan Rosensweig joined Chegg with a vision to transform the popular textbook rental service into a leading provider of digital learning services for high school and college students. By leveraging technology, mobility, and connected networks, Chegg now offers a suite of high-quality, low-cost, personalized and on-demand educational resources that help students maximize the return on their investment in education. As Chairman and CEO of Chegg, Dan commits the company to fulfill its mission – “always put students first” – by helping them save time, save money and get smarter. Under Dan’s direction, Chegg has become the always on-demand, connected learning platform so students everywhere have a smarter, faster, more affordable way to achieve their educational and career goals.

- President of Learning Services: Nathan Schultz – As Chegg’s President of Learning Services, Nathan is responsible for student achievement, overseeing all aspects of Chegg’s self-directed learning tools, which includes content development and publisher relations. Nathan has dedicated his career to putting students first and representing their interests within the world of educational publishing, having served at Bowker, Pearson, and Jones & Bartlett prior to joining Chegg.

- CFO: Andrew Brown – As CFO of Chegg, Andy’s goal is to help drive the financial performance of the company. Andy has over 25 years of experience in the financial sector, over 10 of which he’s spent as CFO of three public companies, most recently with Palm, Inc. Andy’s proven ability to help build organizations, impressive track record in high growth environments and significant experience in the consumer technology space make him a great fit for Chegg and will help continue the company’s growth.

- CIO: Mike Osier – Mike Osier serves as Chief Information Officer and Chief Outcomes Officer, responsible for application development, infrastructure, analytics and managing the company’s customer service function, Student Advocacy. Mike’s goal at Chegg is to provide students with a set of tools to discover the right school and career best suited to the outcomes they aim to achieve.

Source: Chegg Inc.

The Chegg Management has a solid track record with relevant business knowledge. The only little negative aspect is, that the whole management team has little to no skin in the game, while they don’t own an relevant amount of shares. However, this disadvantage is made up for by very successful performance and by the long-standing management team. The management is based on longstanding employees and has been able to keep them in the company for more than 10 years, which is a positive sign.

Platform and Product

As described at the beginning of this research note, Chegg operates a large platform of services for students and pupils. The products are all offered on the Chegg platform, Thinkful is an exception as it is currently still operating as a platform in its own right.

Customers can currently access the services via Chegg or separate apps if they have an account or valid subscription.

Image and Reputation

Chegg enjoys a modern and good reputation as a technology company. Thanks to the Covid crisis and the associated closures of universities and public educational institutions, Chegg has been able to strengthen its image and reputation as a reliable and modern provider of educational services, as well as a supporter of students and pupils. The company’s marketing presence on all social media, as well as its advertising measures and campaigns, can be regarded as thoroughly appropriate and contemporary. Chegg is also extremely positively anchored among students, as the following numbers shows.

Note: Chegg has a good reputation among students / Source

Competition

Chegg is clearly operating in a rapidly growing and highly competitive market. Chegg has several listed competitors in the USA alone, who do either the same or similar things to Chegg. There are also many unlisted competitors and of course competition from public institutions that are expanding their digital offerings.

In the following you will find a small selection of listed competitors:

- K12 Inc. (Ticker: LRN; Marketcap: $941Mio): K12 Inc., a technology-based education company, provides proprietary and third-party online curriculum, software systems, and educational services to facilitate individualized learning for students primarily in kindergarten through 12th grade (K-12) in the United States and internationally. The company offers managed public school programs, which offer an integrated package of systems, services, products, and professional services that K12 administers to support an online or blended public school, including administrative support, information technology and provisioning, academic support, curriculum, learning systems, and instructional services. Source: K12 Inc.

- Zovio Inc. (Ticker: ZVO; Marketcap: $114Mio): Zovio Inc operates as an education technology services company in the United States. The company’s academic institutions, Ashford University offer associate’s, bachelor’s, master’s, and doctoral degree programs in the disciplines of business, education, psychology, social sciences, and health sciences. It also operates a Web development school; and offers an online education platform that provides tutoring and online courses. Source: Zovio Inc.

- Strategic Education Inc. (Ticker: STRA; Marketcap: $2B): Strategic Education, Inc., through its subsidiaries, provides a range of post-secondary education and non-degree programs in the United States. The company operates through three segments: Strayer University, Capella University, and Non-Degree Programs. Source: Strategic Education Inc.

Despite the strong competition in the field, Chegg is already a very strong and well-established brand, which can continue to assert itself with its easy subscriptions. Through successful word of mouth their Image and brand awareness should continue to grow. Digital programs and offerings from public universities will come too late and are not to be considered as endangering competition.

What to expect in the near future

Expansion-Strategy

Since the Corona Pandemic, Chegg has also seen increased growth from countries other than the USA. With the market opportunities shown, it is only logical that Chegg will increasingly attack the foreign market in the coming years and spread further, especially in English speaking areas. Of course, Chegg will also continue to increase his popularity in the USA to be considered the Netflix of the students on campus.

Considering the current market opportunities, which Chegg sees only in the English-speaking world, there is enormous growth potential for the next ten years. In addition, the acceptance of the elearning model and services is increasing with the years and the current crisis, which has accelerated the digital change enormously anyway. So Chegg not only has the opportunity to grow geographically, but also on the customer level, keyword ARPU. In addition, the targeted market should grow continuously from year to year.

Platform-Strategy

Chegg has evolved from a boring “textbook lender” to an innovative, fully digital tech platform for students and pupils to meet their modern needs and provide them with products to help them learn and get better grades.

Chegg will clearly continue to focus on new and improved services and products in the coming months and will try to sell them as monthly subscriptions. Currently, Chegg’s offer is still a bit confusing and there are many different, similar sounding subscriptions. It is quite likely that Chegg will bundle all these services and products in “Chegg Study”, or create different high quality subscription bundles, similar to what other software companies are doing today. If Chegg succeeds, Chegg will be as simple and straightforward as a Spotify or Netflix subscription.

By continually adding new features to the platform, the value of the subscription increases for each subscriber to the service, reducing the bounce rate and making a subscription even more attractive to potential customers. In this way, ARPU can be increased and the full-service offer for students and pupils can be intensified.

Acquisition-Strategy

Chegg’s latest acquisition, that of Thinkful, has shown that they can also expand their platform and service offerings through purchases. In the e-learning sector, there should be many more companies that could fit well into Chegg’s portfolio. Acquisitions clearly bring benefits such as a broadened customer base or the opportunity to cross-sell Chegg products to new customers. This theory is further supported by the recent issue of a convertible bond, as there is still some residual money left over which can be used for possible acquisitions.

Conclusion

Chegg is a tremendously exciting company – it couldn’t be better suited to our world than it is now. Chegg supports students with innovative, useful and affordable products and services, and is one of the few companies that is there for them in difficult times. Chegg should profit extremely from the shift to digital education and the big market opportunity that comes with this. Despite the already mentioned high valuation on the stock market, nothing should stand in the way of Chegg’s continued strong growth in the future – Chegg is a premium company that comes with a high price tag, but not with a premium price tag.

Our recommendation: This stock is a clear buy. Use sell-offs or weak market days for buying in or averaging up.

Disclaimer & Conflict of interest

The author currently does NOT hold a position in the mentioned stock, but intends to buy shares of the mentioned stock shortly after the release of this article. The mentioned company does NOT compensate the author or the publisher of this website.

This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.

Chegg Inc. - Article

Research: Chegg - The Next Netflix in the E-Learning Market?

Table of Content:

- Author's Opinion

- Introduction to the Company

- What makes it so special?

- Recent News and Updates

- The deep Analysis

- What to expect in the near Future?

- Conclusion

Author's Opinion

During the Covid-19 pandemic, only a few companies have delivered and maintained a good image, both from a business and social perspective, like Chegg Inc. Chegg combines the megatrends of e-commerce and subscription models in the rapidly developing e-learning market. Unlike the government and universities, Chegg has provided its customers, hundreds of thousands of students, with reliable support during the crisis, providing them with education and help in learning. Chegg was reliable and affordable, while others were not. For this reason, Chegg represents a tremendously exciting investment case as the reputation, market and demand for Chegg's solutions has grown tremendously. This trend will continue and accelerate as it has in recent years and months.Introduction: Let the company introduce itself

Chegg is a Smarter Way to Student. As the leading direct-to-student learning platform, we strive to improve educational outcomes by putting the student first in all our decisions. We support students on their journey from high school to college and into their career with tools designed to help them pass their test, pass their class, and save money on required materials. Our services are available online, anytime and anywhere, so we can reach students when they need us most. Chegg is a publicly held company based in Santa Clara, California and trades on the NYSE under the symbol CHGG. For more information, visit www.chegg.com. Source: Chegg

What makes Chegg so special?

One Platform full of different products and services

"Books"

Chegg Books is a service for students, where they can rent or buy books for their studies. They also can access e-papers or e-books their. "Books" is like the early model of Netflix, where they were sending physical DVDs to their customers. The advantage is, that you can stay at home and order your expensive special book for your studies - and don't have to pay the full price, because you rent it."Study"

Chegg Study is a monthly subscription service for 15 Bucks $ per month. It includes Textbook Solutions and Expert Q&A. It is an simple and useful subscription for easy results.Textbook Solutions: With Textbook Solutions you get more than just answers. See step-by-step how to solve tough problems. And learn with guided video walkthroughs & practice sets for thousands of problems. Expert Q&A: Take a photo of your question and get an answer in as little as 30 mins*. With over 21 million homework solutions, you can also search our library to find similar homework problems & solutions. Source: Chegg.comThere is also the Chegg Study pack, which is a more costly monthly subscription with additional features and tools like the Math Solver or Chegg Writing.

Note: The Chegg Study Pack

Note: The Chegg Study Pack

"Writing"

Chegg Writing is also another subscription which costs 10$ per month. It features plagiarism checks, experts reviewing your texts, support for citing and grammar checking."Flashcards"

Chegg Flashcards is a free app. You can create or use existing flashcards to learn easy and fast new topics. Flashcards is used to attract new students and make them aware for the other Chegg services and products. Note: The Chegg Flashcards App

Note: The Chegg Flashcards App

"Math Solver"

The Chegg Math Solver is an freemium like (web) app. You can enter your math problems into the calculator and get the solution as an answer. If you want detailed step-by-step solutions and additional explanations, in a graph for example, you have to pay 10$ per month. Go test it..."Tutors"

Did you ever wanted to get help from an experienced tutor asap? Chegg Tutor makes this available - you can chat or speak on video with your tutor and get the help you want. With an positive feedback-ratio of about 96%, Chegg Tutor is a nice product addition and very helpful tool, during the pandemic. Chegg offers different subscription models for their tutor service, which can be seen below: Note: Plans for Chegg Tutor

Note: Plans for Chegg Tutor

"Internships"

Chegg Internships is another product for students, which shows the ambitions from Chegg to fully support students in every part of their studies. Internships is like a career portal, where students can discover internships from known to unknown companies and boost their careers during or after their graduation with an internship. Find a internship ..."Scholarships"

Chegg Scholarships is similar to Internships - it is a portal full of scholarships. You see the amount and the requirements for that scholarship and you can apply for them. You can also edit your profile, to see only matching scholarships to you profile. Find a scholarship ...Reliable and affordable in contrast to the officials and universities

The American education system is known for expensive and rather difficult to access education. Due to the partial closure of schools and universities around the world, as well as the cutting off of other educational opportunities such as tutoring or libraries, many students and pupils were left alone and helpless during the Covid-19 pandemic. Many universities or schools did not and do not have proper digital concepts to educate their protégés properly. In addition, many students and households do not accept to invest large amounts of money into their education if they can no longer be delivered physically or even takes place properly. On the contrary, Chegg has also been able to hold its ground very well and strongly during the pandemic and gained a lot of trust from their students in this segment. Inexpensive, reliable and well-functioning educational opportunities as well as support with homework or complex issues were among the most sought-after services during the pandemic. And Chegg was fully equipped for this at the time and, unlike the public institutions, was able to deliver and further build it's confidence.Unique target group and market-opportunity

According to Chegg's latest earnings slide, there are much more opportunities and momentum in the business segment, in which they are acting. For example, there are more than 100M students, which can profit from Chegg services and products. In relation to that big number, there are currently "only" 3.9Mio Chegg users. To be sure, this big market opportunity will grow each year, especially horizontal on the demand and offer site. Note: Chegg's very big Market Opportunity / Source

While many Students face more problems like debt or underemployment, they need ONE platform, to get the help and right education, they need in a digital and affordable way.

Chegg is also the most recognized brand based on the question: "What companies, websites, and resources can you think of that provide students with support with their studies and their lives around schools?" on US campus.

Note: Chegg's very big Market Opportunity / Source

While many Students face more problems like debt or underemployment, they need ONE platform, to get the help and right education, they need in a digital and affordable way.

Chegg is also the most recognized brand based on the question: "What companies, websites, and resources can you think of that provide students with support with their studies and their lives around schools?" on US campus.

Note: Chegg is well known on the US campus / Source

Note: Chegg is well known on the US campus / Source

Recent News and Updates

The Release of the Results for the third Quarter 2020 and Guidance for 2021

Chegg Inc. has announced their latest earnings results on October 26th. Their earnings soared another quarter, after the pandemic is boosting their business hard. They achieved double digit growth numbers on several KPIs, including:- Revenues increased 64% Year-over-Year to $154Mio

- Chegg Service Subscribers increased 69% Year-over-Year to M3.7 subscribers - the Service Revenues have also increased 72% - those numbers indicate also an growth in the ARPU. ("ARPU = Average Revenue Per User").

- Adjusted EBITDA ("Earning Before Interest, Taxes, Deprecations and Amortization") was $31.9Mio, compared to $23.1Mio one year before. So on an adjusted EBITDA base, and also on the Non-GAAP ("GAAP = General Accepted Accounting Principles") net income, Chegg is profitable, despite it's monster growth and expansion.

- Revenue of about $190Mio and Adjusted EBITDA of about 84$Mio.

- Revenue for fiscal year 2020: Revenues of about $626Mio and Adjusted EBITDA of about $203Mio.

Announcement of $1B Senior Notes Offering

Chegg first announced on 17th of August an Convertible Senior Notes offering with an volume of $750M. This means, that Chegg Inc. is giving notes away, with an fixed interest coupon in order to collect money. After they expire, the investor gets one common stock in exchange or he gets his money back. On 21th August, they announced the closing of an upsized offering of about $1B. They used the money for the following purposes:Chegg used $103.4 million of the net proceeds from the offering of the notes to pay the cost of the capped call transactions described below to manage potential dilution. In addition, Chegg used approximately $174.7 million of the net proceeds from the offering to fund the cash consideration (exclusive of accrued interest) and issued approximately 4.2 million shares of Chegg common stock for the remainder of the consideration due in respect of the exchange of approximately $172.0 million aggregate principal amount of its 0.25% Convertible Senior Notes due 2023 (the “2023 notes”). In connection with the exchanges of the 2023 notes, Chegg terminated a corresponding portion of the existing capped call transactions that Chegg entered into when the 2023 notes were issued. Chegg intends to use the remainder of the net proceeds for general corporate purposes, which may include acquisitions or other strategic transactions. The exchanges of the 2023 notes are not part of the $500.0 million securities repurchase program previously announced by Chegg in June 2020. Source: Chegg Press ReleaseIn short, they used more than half of the money to pay for older convertible notes and the rest of the money is for general corporate purposes and maybe for additional acquisitions, to further boost growth.

Acquisition of Online Learning Platform Thinkful

Chegg Inc has announced on 4th of September 2019 the acquisition of Thinkful. Thinkful is an online learning platform, which offers skill-based learning courses for students in America. Thinkful is so good, that about 85% of their online graduates get an paid job within 6 months after the successful graduation from the Thinkful platform.Founded in 2012 by Darrell Silver and Daniel Friedman, Thinkful offers high-quality, online, outcomes-focused curricula, coupled with live experts, to give learners highly sought-after technology skills such as engineering, data science, data analytics and product design. Source: Chegg Press ReleaseChegg wants to expand their customer base with this acquisiton on several sides. First they can cross-sell the chegg study subscriptions and services to all Thinkfull users as an additional service for them. Chegg also expands their customer base with new customers from the Thinkful platform. Second, Chegg is increasing it's lineup of products and services, to become a real platform full of student services and products. Now Chegg has those little to extra subscription options and services plus on fully good working and digital graduation platform for students.

Note: Thinkful's current offer of courses

The acquisition costs Chegg about $80M in cash. There maybe an additional $20M payment, depending on performance of Thinkful.

Note: Thinkful's current offer of courses

The acquisition costs Chegg about $80M in cash. There maybe an additional $20M payment, depending on performance of Thinkful.

The deep Analysis

Financials

Dividend

The company currently does not pay a dividend.Share Structure

Chegg Inc. uses a one class share system. There are normal mutual fund or institutional holdings. Note: The share Structure of Chegg Inc. / Source

There is little to no relevant insider or founder with a bigger holding in this stock.

Note: The share Structure of Chegg Inc. / Source

There is little to no relevant insider or founder with a bigger holding in this stock.

Chart

Valuation of the Stock

The Chegg stock has currently an one year forward P/E-Ratio ("P/E-Ratio = Price/Earnings-Ratio; The higher the ratio, the higher is the valuation") of about 58 which is in fact high, but fair enough for the growth numbers and opportunities, which lays ahaed for Chegg. Assuming that Chegg can achieve an EPS ("EPS = Earnings per share") of 2.11$ for the fiscal year 2022, than Chegg would have an P/E-Ratio of about 35, which is low to medium for their growth. Looking on the EBITDA numbers, the valuation is even lower. Since the business is in a phase of strong growth and they are profitable with an positive cashflow, the valuation is pretty fair.Business Model

Chegg's business model may seem a bit confusing at first glance, as there are many different products and offers. But in the end there is a very simple and sophisticated model behind it. Chegg mainly earns his money through monthly subscriptions, which are in the range of 10 to 25$ per month. So Chegg earns more if more customers come to the platform or take out more of these different subscriptions. So the main growth opportunities are mainly through expanding and acquiring new customers and increasing the ARPU by selling more services to existing customers. In addition, Chegg earns irregular and unpredictable revenue from their book rental business and the training and courses offered by the Thinkful platform. If you now observe Chegg, you should definitely focus on revenue generated by subscriptions, because these revenues are predictable, scalable and recurring. This kind of revenue has a so much better quality for the business, than non-recurring and unpredictable revenue. The non-recurring revenues are a nice addition, but should be a smaller and smaller part in the coming years.Operations

Chegg currently operates mainly in the USA and is also focused on this market. Due to the pandemic, the number of international users has risen significantly, which is why a further focus should soon emerge here. Chegg currently operates the services described above on its platform and also runs Thinkful.Management

- CEO: Dan Rosensweig - In 2010, Dan Rosensweig joined Chegg with a vision to transform the popular textbook rental service into a leading provider of digital learning services for high school and college students. By leveraging technology, mobility, and connected networks, Chegg now offers a suite of high-quality, low-cost, personalized and on-demand educational resources that help students maximize the return on their investment in education. As Chairman and CEO of Chegg, Dan commits the company to fulfill its mission - "always put students first" - by helping them save time, save money and get smarter. Under Dan’s direction, Chegg has become the always on-demand, connected learning platform so students everywhere have a smarter, faster, more affordable way to achieve their educational and career goals.

- President of Learning Services: Nathan Schultz - As Chegg’s President of Learning Services, Nathan is responsible for student achievement, overseeing all aspects of Chegg’s self-directed learning tools, which includes content development and publisher relations. Nathan has dedicated his career to putting students first and representing their interests within the world of educational publishing, having served at Bowker, Pearson, and Jones & Bartlett prior to joining Chegg.

- CFO: Andrew Brown - As CFO of Chegg, Andy’s goal is to help drive the financial performance of the company. Andy has over 25 years of experience in the financial sector, over 10 of which he’s spent as CFO of three public companies, most recently with Palm, Inc. Andy’s proven ability to help build organizations, impressive track record in high growth environments and significant experience in the consumer technology space make him a great fit for Chegg and will help continue the company’s growth.

- CIO: Mike Osier - Mike Osier serves as Chief Information Officer and Chief Outcomes Officer, responsible for application development, infrastructure, analytics and managing the company's customer service function, Student Advocacy. Mike’s goal at Chegg is to provide students with a set of tools to discover the right school and career best suited to the outcomes they aim to achieve.

Platform and Product

As described at the beginning of this research note, Chegg operates a large platform of services for students and pupils. The products are all offered on the Chegg platform, Thinkful is an exception as it is currently still operating as a platform in its own right. Customers can currently access the services via Chegg or separate apps if they have an account or valid subscription.Image and Reputation

Chegg enjoys a modern and good reputation as a technology company. Thanks to the Covid crisis and the associated closures of universities and public educational institutions, Chegg has been able to strengthen its image and reputation as a reliable and modern provider of educational services, as well as a supporter of students and pupils. The company's marketing presence on all social media, as well as its advertising measures and campaigns, can be regarded as thoroughly appropriate and contemporary. Chegg is also extremely positively anchored among students, as the following numbers shows. Note: Chegg has a good reputation among students / Source

Note: Chegg has a good reputation among students / Source

Competition

Chegg is clearly operating in a rapidly growing and highly competitive market. Chegg has several listed competitors in the USA alone, who do either the same or similar things to Chegg. There are also many unlisted competitors and of course competition from public institutions that are expanding their digital offerings. In the following you will find a small selection of listed competitors:- K12 Inc. (Ticker: LRN; Marketcap: $941Mio): K12 Inc., a technology-based education company, provides proprietary and third-party online curriculum, software systems, and educational services to facilitate individualized learning for students primarily in kindergarten through 12th grade (K-12) in the United States and internationally. The company offers managed public school programs, which offer an integrated package of systems, services, products, and professional services that K12 administers to support an online or blended public school, including administrative support, information technology and provisioning, academic support, curriculum, learning systems, and instructional services. Source: K12 Inc.

- Zovio Inc. (Ticker: ZVO; Marketcap: $114Mio): Zovio Inc operates as an education technology services company in the United States. The company's academic institutions, Ashford University offer associate's, bachelor's, master's, and doctoral degree programs in the disciplines of business, education, psychology, social sciences, and health sciences. It also operates a Web development school; and offers an online education platform that provides tutoring and online courses. Source: Zovio Inc.

- Strategic Education Inc. (Ticker: STRA; Marketcap: $2B): Strategic Education, Inc., through its subsidiaries, provides a range of post-secondary education and non-degree programs in the United States. The company operates through three segments: Strayer University, Capella University, and Non-Degree Programs. Source: Strategic Education Inc.

What to expect in the near future

Expansion-Strategy

Since the Corona Pandemic, Chegg has also seen increased growth from countries other than the USA. With the market opportunities shown, it is only logical that Chegg will increasingly attack the foreign market in the coming years and spread further, especially in English speaking areas. Of course, Chegg will also continue to increase his popularity in the USA to be considered the Netflix of the students on campus. Considering the current market opportunities, which Chegg sees only in the English-speaking world, there is enormous growth potential for the next ten years. In addition, the acceptance of the elearning model and services is increasing with the years and the current crisis, which has accelerated the digital change enormously anyway. So Chegg not only has the opportunity to grow geographically, but also on the customer level, keyword ARPU. In addition, the targeted market should grow continuously from year to year.Platform-Strategy

Chegg has evolved from a boring "textbook lender" to an innovative, fully digital tech platform for students and pupils to meet their modern needs and provide them with products to help them learn and get better grades. Chegg will clearly continue to focus on new and improved services and products in the coming months and will try to sell them as monthly subscriptions. Currently, Chegg's offer is still a bit confusing and there are many different, similar sounding subscriptions. It is quite likely that Chegg will bundle all these services and products in "Chegg Study", or create different high quality subscription bundles, similar to what other software companies are doing today. If Chegg succeeds, Chegg will be as simple and straightforward as a Spotify or Netflix subscription. By continually adding new features to the platform, the value of the subscription increases for each subscriber to the service, reducing the bounce rate and making a subscription even more attractive to potential customers. In this way, ARPU can be increased and the full-service offer for students and pupils can be intensified.Acquisition-Strategy

Chegg's latest acquisition, that of Thinkful, has shown that they can also expand their platform and service offerings through purchases. In the e-learning sector, there should be many more companies that could fit well into Chegg's portfolio. Acquisitions clearly bring benefits such as a broadened customer base or the opportunity to cross-sell Chegg products to new customers. This theory is further supported by the recent issue of a convertible bond, as there is still some residual money left over which can be used for possible acquisitions.Conclusion

Chegg is a tremendously exciting company - it couldn't be better suited to our world than it is now. Chegg supports students with innovative, useful and affordable products and services, and is one of the few companies that is there for them in difficult times. Chegg should profit extremely from the shift to digital education and the big market opportunity that comes with this. Despite the already mentioned high valuation on the stock market, nothing should stand in the way of Chegg's continued strong growth in the future - Chegg is a premium company that comes with a high price tag, but not with a premium price tag. Our recommendation: This stock is a clear buy. Use sell-offs or weak market days for buying in or averaging up.Disclaimer & Conflict of interest

The author currently does NOT hold a position in the mentioned stock, but intends to buy shares of the mentioned stock shortly after the release of this article. The mentioned company does NOT compensate the author or the publisher of this website. This post is not an investment advice and should not be treated as one. Please contact your local bank or broker for financial advice.Revenue by Quarter

Profitability by Quarter

Revenue Mix by Segment

Service Subscribers (Subscription Users)

Chart

Peers

All the Peers

FlexShopper Inc.

Bullish

Tattooed Chef Inc.

Neutral

Hellofresh SE

Bullish

Build-a-Bear Workshop Inc.

Outperform

Stamps.com Inc.

Bullish

Redfin Corporation

Bullish

Perion Network Ltd.

Outperform

Upwork Inc.

Bullish

Pinterest Inc.

Bullish

Sprout Social Inc.

Bullish

Lang & Schwarz AG

Outperform